The Russian-Ukrainian war of 2022 is not just a major geopolitical event but also a geoeconomic turning point. Western sanctions are the toughest measures ever imposed against a state of Russia’s size and power.

In the space of less than three weeks, the United States and its allies have cut major Russian banks off from the global financial system; blocked the export of high-tech components in unison with Asian allies; seized the overseas assets of hundreds of wealthy oligarchs; revoked trade treaties with Moscow; banned Russian airlines from North Atlantic airspace: restricted Russian oil sales to the United States and United Kingdom; blocked all foreign investment in the Russian economy from their jurisdiction; and frozen $403 billion out of the $630 billion in foreign assets of the Central Bank of Russia.

The overall effect has been unprecedented, and a few weeks ago would have seemed unimaginable even to most experts: in all but its most vital products, the world’s eleventh-largest economy has now been decoupled from twenty-first-century globalization.

How will these historic measures play out? Economic sanctions rarely succeed at achieving their goals. Western policymakers frequently assume that failures stem from weaknesses in sanctions design.

How will these historic measures play out? Economic sanctions rarely succeed at achieving their goals. Western policymakers frequently assume that failures stem from weaknesses in sanctions design.

Indeed, sanctions can be plagued by loopholes, lack of political will to implement them, or insufficient diplomatic agreement concerning enforcement. The implicit assumption is that stronger sanctions stand a better chance of succeeding.

Yet the Western economic containment of Russia is different. This is an unprecedented campaign to isolate a G-20 economy with a large hydrocarbon sector, a sophisticated military-industrial complex, and a diversified basket of commodity exports. As a result, Western sanctions face a different kind of problem.

The sanctions, in this case, could fail not because of their weakness but because of their great and unpredictable strength. Having grown accustomed to using sanctions against smaller countries at low cost, Western policymakers have only limited experience and understanding of the effects of truly severe measures against a major, globally connected economy. Existing fragilities in the world’s economic and financial structure mean that such sanctions have the potential to cause grave political and material fallout.

THE REAL SHOCK AND AWE

Just how severe the current sanctions against Russia are can be seen from their effects across the world. The immediate shock to the Russian economy is the most obvious. Economists expect Russian GDP to contract by at least 9–15 percent this year, but the damage could well become much more severe.

The ruble has fallen more than a third since the beginning of January. An exodus of skilled Russian professionals is underway, while the capacity to import consumer goods and valuable technology has fallen drastically. As Russian political scientist Ilya Matveev has put it, “30 years of economic development thrown into the bin.”

The ramifications of the Western sanctions go far beyond these effects on Russia itself. There are at least four different kinds of broader effects: spillover effects into adjacent countries and markets; multiplier effects through private-sector divestment; escalation effects in the form of Russian responses; and systemic effects on the global economy.

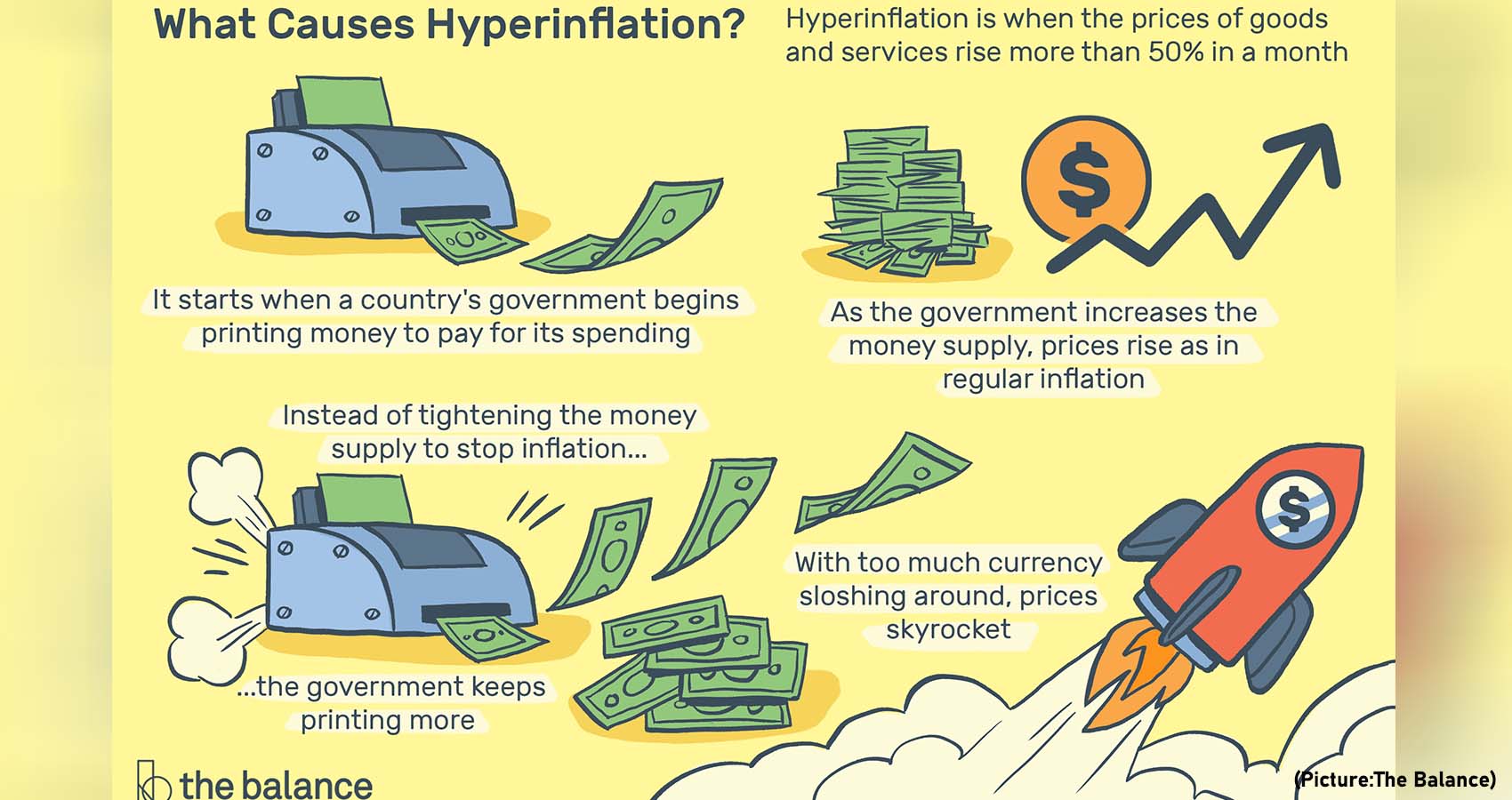

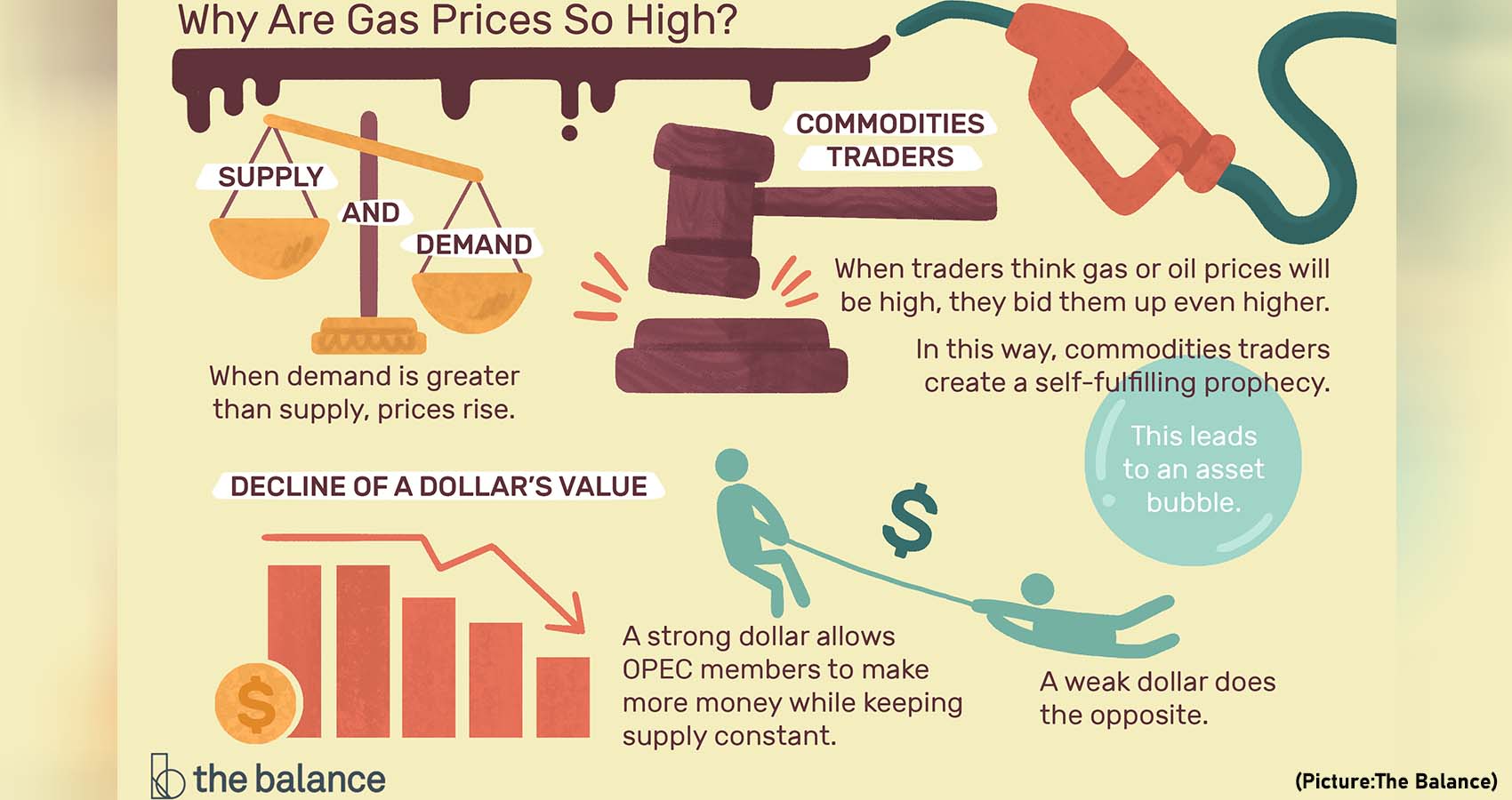

Spillover effects have already caused turmoil in international commodities markets. A generalized panic erupted among traders after the second Western sanctions package—including the SWIFT cutoff and the freezing of central bank reserves—was announced on February 26.

Prices of crude oil, natural gas, wheat, copper, nickel, aluminum, fertilizers, and gold have soared. Because the war has closed Ukrainian ports and international firms are shunning Russian commodity exports, a grain and metals shortage now looms over the global economy.

Although oil prices have since dropped in anticipation of additional output from Gulf producers, the price shock to energy and commodities across the board will push global inflation higher. African and Asian countries reliant on food and energy imports are already experiencing difficulties.

Economists expect Russian GDP to contract by at least 9 to 15 percent this year.

Central Asia’s economies are also caught up in the sanctions shock. These former Soviet states are strongly connected to the Russian economy through trade and outward labor migration. The collapse of the ruble has caused serious financial distress in the region.

Kazakhstan has imposed exchange controls after the tenge, its currency, fell by 20 percent in the wake of the Western sanctions against Moscow; Tajikistan’s somoni has undergone a similarly steep depreciation. Russia’s impending impoverishment will force millions of Central Asian migrant workers to seek employment elsewhere and dry up the flow of remittances to their home countries.

The impact of the sanctions goes beyond decisions taken by G-7 and EU governments. The official sanctions packages have had a catalyzing effect on international businesses operating in Russia. Virtually overnight, Russia’s impending isolation has set in motion a massive corporate flight.

In what amounts to a vast private sector boycott, hundreds of major Western firms in the technology, oil and gas, aerospace, car, manufacturing, consumer goods, food and beverage, accounting and financial, and transport industries are pulling out of the country.

It is noteworthy that these departures are in many cases not required by sanctions. Instead, they are driven by moral condemnation, reputational concerns, and outright panic. As a result, the business retreat is deepening the economic shock to Russia by multiplying the negative economic effects of official state sanctions.

The Russian government has responded to the sanctions in several ways. It has undertaken emergency stabilization policies to protect foreign exchange earnings and shore up the ruble. Foreign portfolio capital is being locked into the country.

While the stock market has remained closed, the assets of many Western firms that have departed may soon face confiscation. The Ministry of Economic Development has prepared a law that grants the Russian state six months to take over businesses in case of an “ungrounded” liquidation or bankruptcy.

The potential nationalization of Western capital is not the only escalatory effect of the sanctions. On March 9, Putin signed an order restricting Russian commodity exports. Although the full array of items to be withheld under the ban is not yet clear, the threat of its use will continue to hang over international trade.

Russian restrictions on fertilizer exports imposed in early February have already put pressure on global food production. Russia could retaliate by restricting exports of important minerals such as nickel, palladium, and industrial sapphires. These are crucial inputs for the production of electrical batteries, catalytic converters, phones, ball bearings, light tubes, and microchips.

In the globalized assemblage system, even small changes in materials prices can massively raise the production costs faced by final users downstream in the production chain. A Russian embargo or large export reduction of palladium, nickel, or sapphires would hit car and semiconductor manufacturers, a $3.4 trillion global industry.

If the economic war between the West and Russia continues further into 2022 at this intensity, it is very possible that the world will slide into a sanctions-induced recession.

MANAGING THE FALLOUT

The combination of spillover effects, negative multiplier effects, and escalation effects means that the sanctions against Russia will have an effect on the world economy like few previous sanctions regimes in history. Why was this great upheaval not anticipated?

One reason is that over the last few decades, U.S. policymakers have usually deployed sanctions against economies that were sufficiently modest in size for any significant adverse effects to be contained. The degree of integration into the world economy of North Korea, Syria, Venezuela, Myanmar, and Belarus was relatively modest and one-dimensional. Only the rollout of U.S. sanctions against Iran required special care to avoid upsetting the oil market.

In general, however, the assumption held that sanctions use was economically almost costless to the United States. This has meant that the macroeconomic and macrofinancial consequences of global sanctions are insufficiently understood.

To better grasp the choices to be made in the current economic sanctions against Russia, it is instructive to examine sanctions use in the 1930s, when democracies similarly attempted to use them to stop the aggression of large-sized autocratic economies such as Fascist Italy, imperial Japan, and Nazi Germany.

The crucial backdrop to these efforts was the Great Depression, which had weakened economies and inflamed nationalism around the world. When Italian dictator Benito Mussolini invaded Ethiopia in October 1935, the League of Nations implemented an international sanctions regime enforced by 52 countries. It was an impressive united response, similar to that on display in reaction to Russia’s invasion of Ukraine.

But the league sanctions came with real tradeoffs. Economic containment of Fascist Italy limited democracies’ ability to use sanctions against an aggressor who was more threatening still: Adolf Hitler.

As a major engine of export demand for smaller European economies, Germany was too large an economy to be isolated without severe commercial loss to the whole of Europe. Amid the fragile recovery from the Depression, simultaneously placing sanctions on both Italy and Germany—then the fourth- and seventh-largest economies in the world—was too costly for most democracies.

Hitler exploited this fear of overstretch and the international focus on Ethiopia by moving German troops into the demilitarized Rhineland in March 1936, advancing further toward war. German officials were aware of their commercial power, which they used to maneuver central European and Balkan economies into their political orbit.

The result was the creation of a continental, river-based bloc of vassal economies whose trade with Germany was harder for Western states to block with sanctions or a naval blockade.

The sanctions dilemmas of the 1930s show that aggressors should be confronted when they disrupt the international order. But it equally drives home the fact that the viability of sanctions, and the chances of their success, are always dependent on the global economic situation.

In unstable commercial and financial conditions, it will be necessary to prioritize among competing objectives and prepare thoroughly for unintended effects of all kinds. Using sanctions against very large economies will simply not be possible without compensatory policies that support the sanctioners’ economies and the rest of the world.

More intensive sanctions will inflict further damage to the world economy.

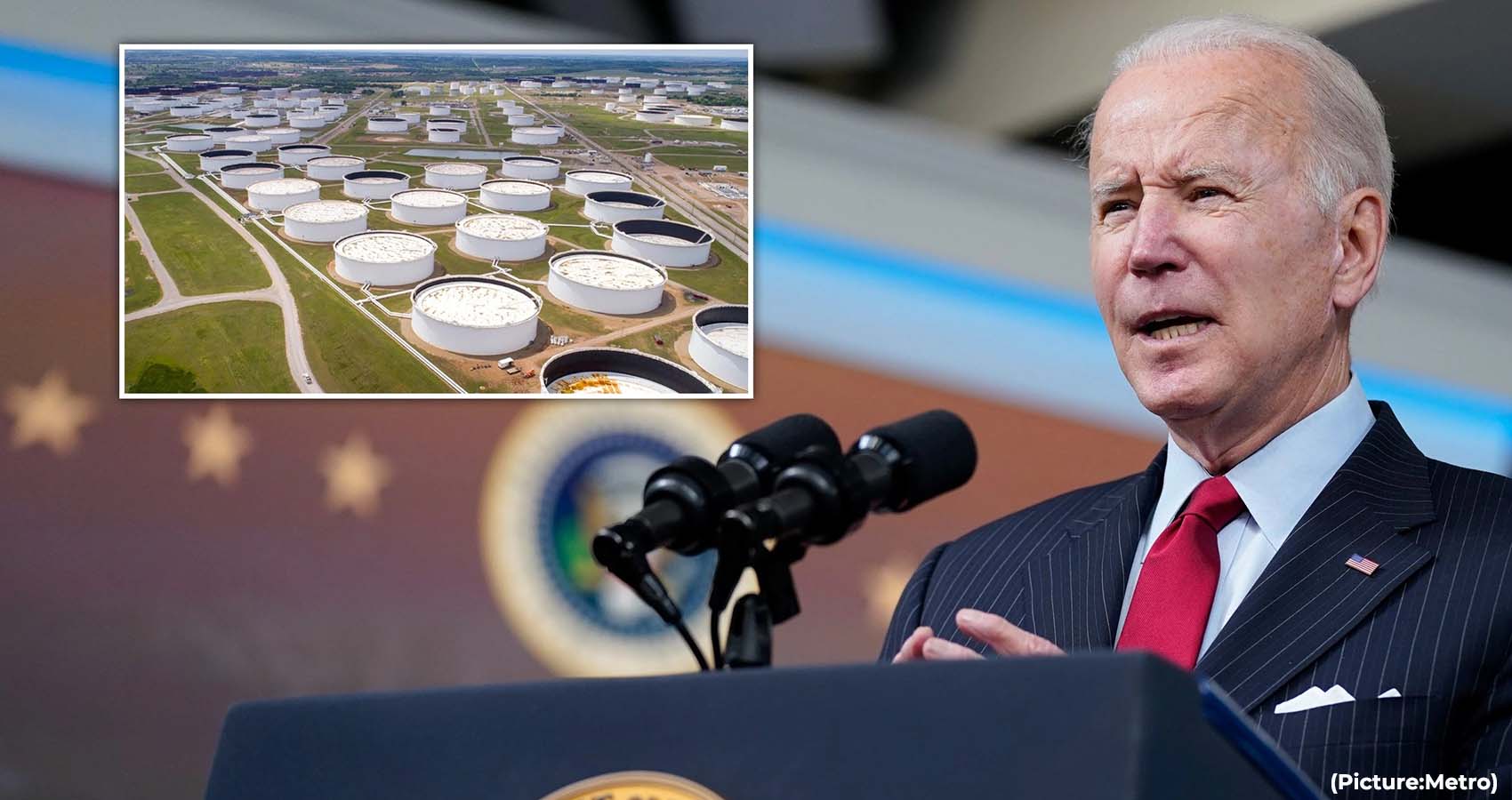

The Biden administration is aware of this problem, but its actions so far are inadequate to the scale of the problem. Washington has attempted to reduce strains in the oil market by a partial reconciliation with Iran and Venezuela.

Countering the spillover effects of sanctions against one leading petrostate may now require lifting sanctions on two smaller petrostates. But this oil diplomacy is insufficient to meet the challenge posed by the Russia sanctions, the effects of which are aggravating preexisting economic woes.

Supply chain issues and pandemic-era bottlenecks in global transport and production networks predated the war in Ukraine. The unprecedented use of sanctions in these already troubled conditions has made an already difficult situation worse.

The problem of managing the fallout of economic war is greater still in Europe. This is not only because the European Union has much stronger trade and energy links with Russia. It is also the result of the political economy of the eurozone as it has taken shape over the last two decades: with the exception of France, most of its economies follow a heavily trade-reliant, export-focused growth strategy.

This economic model requires foreign demand for exports while repressing wages and domestic demand. It is a structure that is very ill suited to the prolonged imposition of trade-reducing sanctions. Increasing EU-wide renewable energy investment and expanding public control in the energy sector, as French President Emmanuel Macron has announced, is one way to absorb this shock.

But there is also a need for income-boosting measures for consumer goods and price-dampening interventions in producer goods markets, from strategic reserve management to the excess profits taxes that are being rolled out in Spain and Italy.

Then there are the consequences of sanctions cause for the world economy at large, especially in the “global South.” Addressing these problems will pose a major macroeconomic challenge. It is therefore imperative for the G-7, the European Union, and the United States’ Asian partners to launch bold and coordinated action to stabilize global markets.

This can be done through targeted investment to clear up supply bottlenecks, generous international grants and loans to developing countries struggling to secure adequate food and energy supplies, and large-scale government funding for renewable energy capacity.

It will also have to involve subsidies, and perhaps even rationing and price controls, to protect the poorest from the destructive effects of surging food, energy, and commodity prices.

Such state intervention is the price to be paid for engaging in economic war. Inflicting material damage at the scale levelled against Russia simply cannot be pursued without an international policymaking shift that extends economic support to those affected by sanctions. Unless the material well-being of households is protected, political support for sanctions will crumble over time.

THE NEW INTERVENTIONISTS

Western policymakers thus face a serious decision. They must decide whether to uphold sanctions against Russia at their current strength or to impose further economic punishment on Putin. If the goal of the sanctions is to exert maximum pressure on Russia with minimal disruption to their own economies—and thus a manageable risk of domestic political backlash—then current levels of pressure may be the most that is politically feasible now.

At the moment, simply maintaining existing sanctions will require active compensatory policies. For Europe especially, neither laissez-faire economic policies nor fiscal fragmentation will be sustainable if the economic war persists. But if the West decides to step up the economic pressure on Russia further still, far-reaching economic interventions will become an absolute necessity.

More intensive sanctions will inflict further damage, not just to the sanctioners themselves but to the world economy at large. No matter how strong and justified the West’s resolve to stop Putin’s aggression is, policymakers must accept the material reality that an all-out economic offensive will introduce considerable new strains into the world economy.

An intensification of sanctions will cause a cascade of material shocks that will demand far-reaching stabilization efforts.And even with such rescue measures, the economic damage may well be serious, and the risks of strategic escalation willremain high.

For all these reasons, it remains vital to pursue diplomatic and economic paths that can end the conflict. Whatever the results of the war, the economic offensive against Russia has already exposed one important new reality: the era of costless, risk-free, and predictable sanctions is well and truly over.

Amazon’s market capitalisation increased by 61 per cent in the year to March 2021, supported by the growing “stay-at-home economy” seen throughout 2020 and into 2021, although Amazon did not move up from fourth position.

Amazon’s market capitalisation increased by 61 per cent in the year to March 2021, supported by the growing “stay-at-home economy” seen throughout 2020 and into 2021, although Amazon did not move up from fourth position.

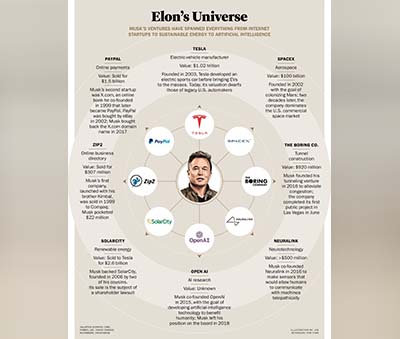

Meanwhile, Twitter Inc said on Friday last week that the waiting period under the HSR Act for Elon Musk’s $44-billion acquisition of the social media firm has expired. Completion of the deal is now subject to remaining customary closing conditions, including approval by Twitter stockholders and the receipt of applicable regulatory approvals, Twitter said.

Meanwhile, Twitter Inc said on Friday last week that the waiting period under the HSR Act for Elon Musk’s $44-billion acquisition of the social media firm has expired. Completion of the deal is now subject to remaining customary closing conditions, including approval by Twitter stockholders and the receipt of applicable regulatory approvals, Twitter said.

In recent years, major alcohol companies including

In recent years, major alcohol companies including

In 2019, Zurich Airport International AG won the bid to develop the airport. The Uttar Pradesh government signed the concession agreement with Yamuna International Airport Private Limited on October 7, 2020, to commence the development of the Noida International Airport.

In 2019, Zurich Airport International AG won the bid to develop the airport. The Uttar Pradesh government signed the concession agreement with Yamuna International Airport Private Limited on October 7, 2020, to commence the development of the Noida International Airport.

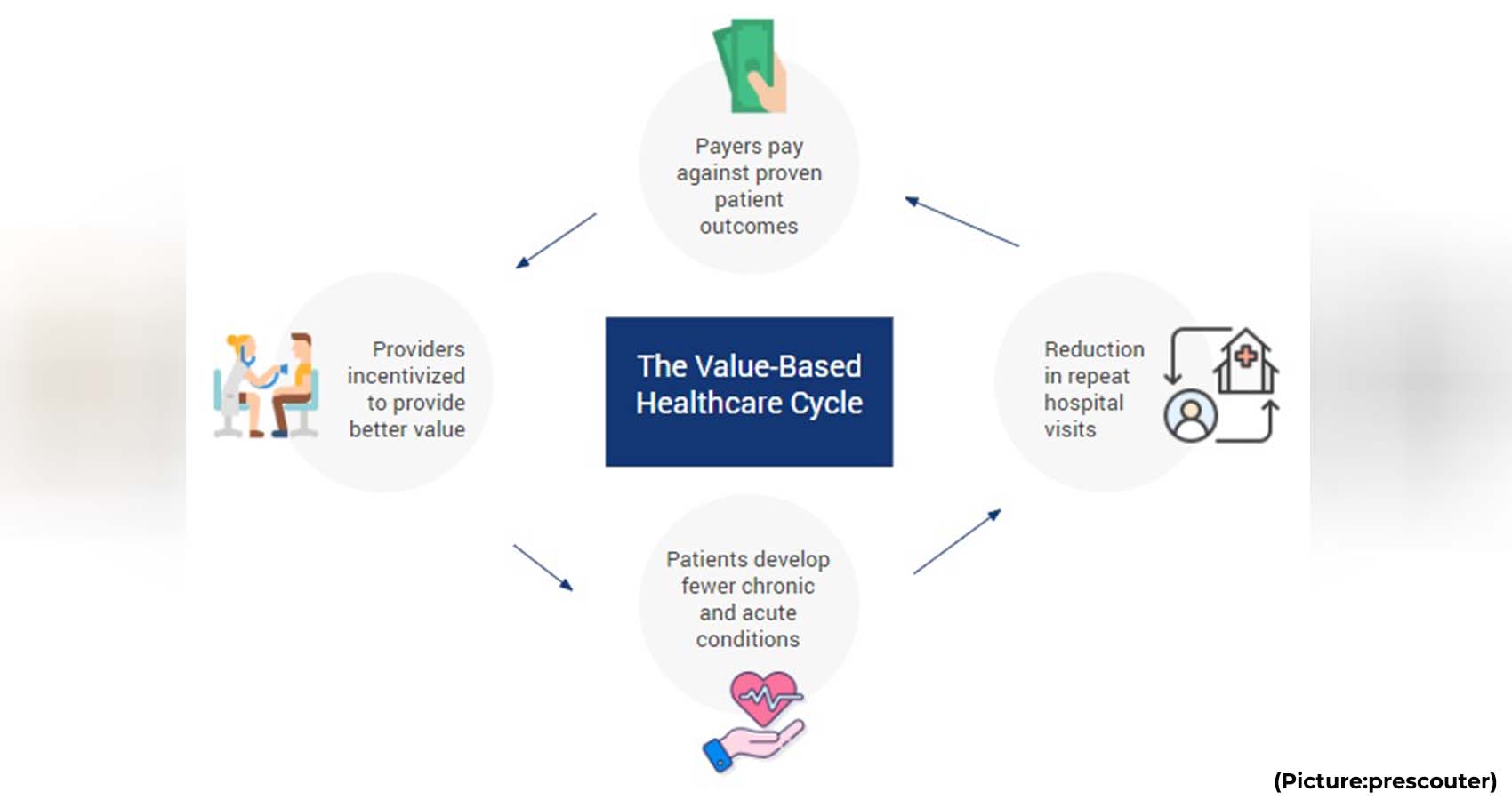

Conceived and developed by Dr. Joseph M. Chalil and Mr. Bob Miglani, and building on the successful experiences of the past several years of the popular CEO Forum at the 40th edition of AAPI’s annual Convention, to be attended by world renowned healthcare leaders will address: “The Future of Healthcare: Technology, Transformation and Beyond.”

Conceived and developed by Dr. Joseph M. Chalil and Mr. Bob Miglani, and building on the successful experiences of the past several years of the popular CEO Forum at the 40th edition of AAPI’s annual Convention, to be attended by world renowned healthcare leaders will address: “The Future of Healthcare: Technology, Transformation and Beyond.” “The 2022 AAPI Annual Convention & Scientific Assembly offers the participants at the convention a rare platform to interact with and listen to leading physicians, healthcare professionals, academicians, scientists, and leaders of the hospitals, technology , medical device and pharmaceutical companies,” said Dr. Anjana Samadder, Vice President of AAPI.

“The 2022 AAPI Annual Convention & Scientific Assembly offers the participants at the convention a rare platform to interact with and listen to leading physicians, healthcare professionals, academicians, scientists, and leaders of the hospitals, technology , medical device and pharmaceutical companies,” said Dr. Anjana Samadder, Vice President of AAPI.

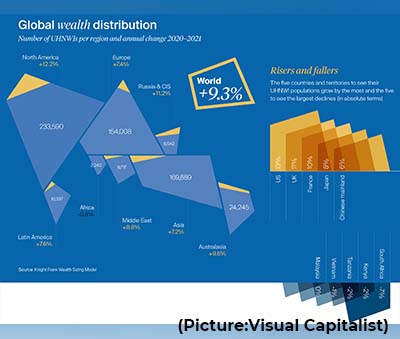

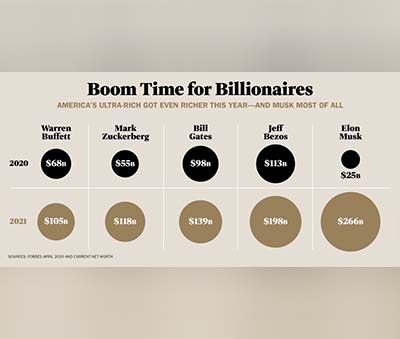

Billionaires have seen their total

Billionaires have seen their total

‘Social partnerships’ have also been important in Austria and Sweden. A series of political understandings – or ‘bargains’ – between successive governments and major interest groups enabled national wage agreements from 1952 until the mid-1970s.

‘Social partnerships’ have also been important in Austria and Sweden. A series of political understandings – or ‘bargains’ – between successive governments and major interest groups enabled national wage agreements from 1952 until the mid-1970s.

India’s trade deficit with China continued to grow, from $44 billion in 2020-21 to $72.91 billion in 2021-22. The US is, however, one of the few countries with which India has a trade surplus. In 2021-22, India recorded a positive trade balance of $32.8 billion with the US.

India’s trade deficit with China continued to grow, from $44 billion in 2020-21 to $72.91 billion in 2021-22. The US is, however, one of the few countries with which India has a trade surplus. In 2021-22, India recorded a positive trade balance of $32.8 billion with the US.

The fortunes of food and energy billionaires have risen by $453 billion in the last two years, equivalent to $1 billion every two days, says Oxfam.

The fortunes of food and energy billionaires have risen by $453 billion in the last two years, equivalent to $1 billion every two days, says Oxfam.

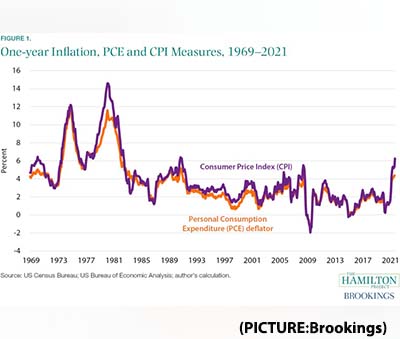

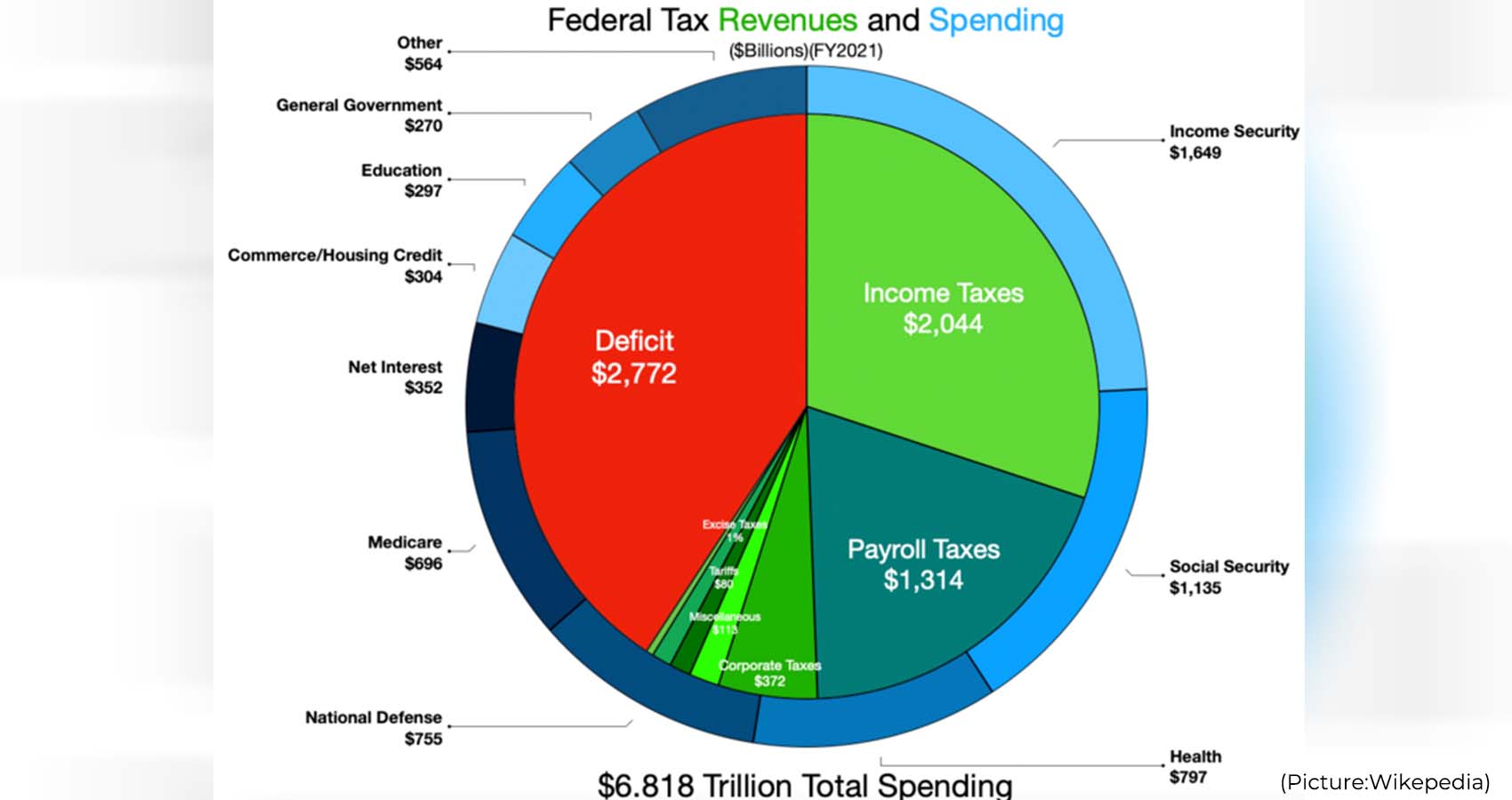

The BEA noted that government assistance payments in the form of forgivable loans to businesses, grants to state and local governments, and social benefits to households “all decreased as provisions of several federal programs expired or tapered off”.

The BEA noted that government assistance payments in the form of forgivable loans to businesses, grants to state and local governments, and social benefits to households “all decreased as provisions of several federal programs expired or tapered off”.

Toyota is aligning its own green targets with India’s ambitions of becoming a manufacturing hub though the switch to clean transport in the South Asian nation is slower than other countries such as China and the U.S. Expensive price tags, lack of options in electric models and insufficient charging stations have led to sluggish adoption of battery vehicles in India.

Toyota is aligning its own green targets with India’s ambitions of becoming a manufacturing hub though the switch to clean transport in the South Asian nation is slower than other countries such as China and the U.S. Expensive price tags, lack of options in electric models and insufficient charging stations have led to sluggish adoption of battery vehicles in India.

One winner of an ownership change could be former President Donald Trump. Right now, Twitter has imposed a

One winner of an ownership change could be former President Donald Trump. Right now, Twitter has imposed a

Central to bitcoin’s technology is the process through which transactions are verified and then recorded on what’s known as the blockchain. Computers connected to the bitcoin network race to solve complex mathematical calculations that verify the transactions, with the winner earning newly minted bitcoins as a reward. Currently, when a machine solves the puzzle, its owner is rewarded with 6.25 bitcoins — worth about $260,000 total. The system is calibrated to release 6.25 bitcoins every 10 minutes.

Central to bitcoin’s technology is the process through which transactions are verified and then recorded on what’s known as the blockchain. Computers connected to the bitcoin network race to solve complex mathematical calculations that verify the transactions, with the winner earning newly minted bitcoins as a reward. Currently, when a machine solves the puzzle, its owner is rewarded with 6.25 bitcoins — worth about $260,000 total. The system is calibrated to release 6.25 bitcoins every 10 minutes.

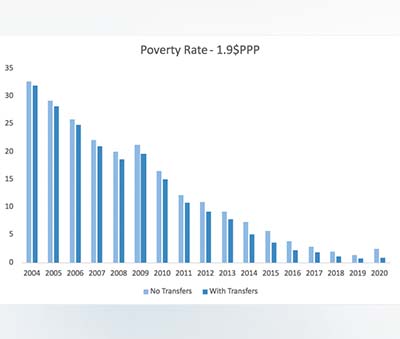

Source: NSS 2011-12 MMRP data; Private Final Consumption Expenditure (PFCE) growth rates for estimates of monthly per capita consumption; authors’ calculations.

Source: NSS 2011-12 MMRP data; Private Final Consumption Expenditure (PFCE) growth rates for estimates of monthly per capita consumption; authors’ calculations. Our paper presents a consistent time series of poverty and (real) inequality in India for each of the years 2004-2020. Our estimate of real inequality (Figure 3) shows that consumption inequality has also declined, and in 2020 is very close to the lowest historical level of 0.28. Poverty and inequality trends can be emotive, controversial, and confusing. Consumption inequality is lower than income inequality, which itself is lower than wealth inequality. And each can show different trends. The levels and trends are different, and intermingled use should carry a warning about this when discussing “inequality.”

Our paper presents a consistent time series of poverty and (real) inequality in India for each of the years 2004-2020. Our estimate of real inequality (Figure 3) shows that consumption inequality has also declined, and in 2020 is very close to the lowest historical level of 0.28. Poverty and inequality trends can be emotive, controversial, and confusing. Consumption inequality is lower than income inequality, which itself is lower than wealth inequality. And each can show different trends. The levels and trends are different, and intermingled use should carry a warning about this when discussing “inequality.”

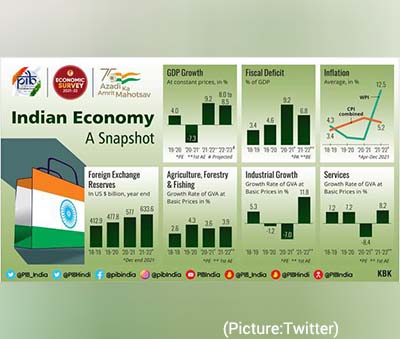

The international lender lowered its growth estimate for India, the region’s largest economy, to 8% from 8.7% for the current fiscal year to March, 2023 and cut by a full percentage point the growth outlook for South Asia, excluding Afghanistan, to 6.6%.

The international lender lowered its growth estimate for India, the region’s largest economy, to 8% from 8.7% for the current fiscal year to March, 2023 and cut by a full percentage point the growth outlook for South Asia, excluding Afghanistan, to 6.6%.

Low rates fueled the revival of the U.S. housing market after the Great Recession and have helped drive home prices to record levels. But after two years of hovering at historical lows, rates have been on a tear: In January, the 30-year fixed average was 3.22 percent. It was 3.04 percent a year ago. And while mortgage rates had been expected to rise, they’ve done so more quickly than many economists predicted.

Low rates fueled the revival of the U.S. housing market after the Great Recession and have helped drive home prices to record levels. But after two years of hovering at historical lows, rates have been on a tear: In January, the 30-year fixed average was 3.22 percent. It was 3.04 percent a year ago. And while mortgage rates had been expected to rise, they’ve done so more quickly than many economists predicted.

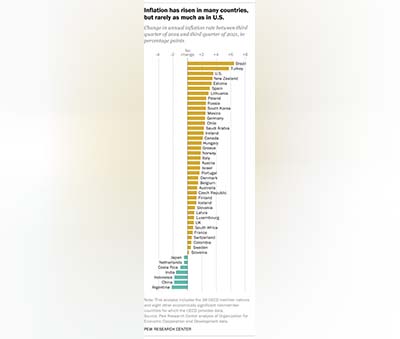

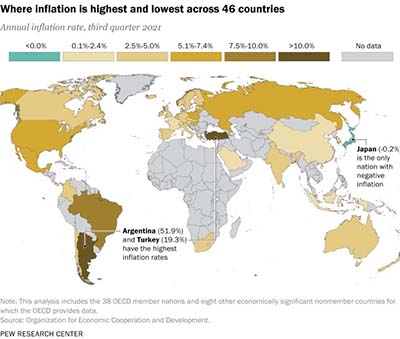

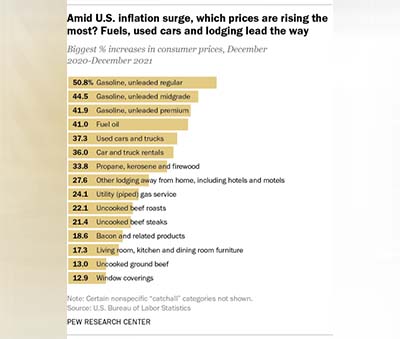

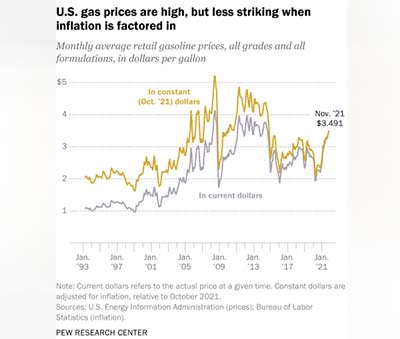

At least one thing is clear: A resurgent inflation rate is by no means solely a U.S. concern. A Pew Research Center analysis of data from 46 nations finds that the third-quarter 2021 inflation rate was higher in most of them (39) than in the pre-pandemic third quarter of 2019. In 16 of these countries, including the U.S., the inflation rate was more than 2 percentage points higher last quarter than in the same period of 2019. (For this analysis, we used data from the Organization for Economic Cooperation and Development, a group of mostly highly developed, democratic countries. The data covers the 38 OECD member nations, plus eight other economically significant countries.)

At least one thing is clear: A resurgent inflation rate is by no means solely a U.S. concern. A Pew Research Center analysis of data from 46 nations finds that the third-quarter 2021 inflation rate was higher in most of them (39) than in the pre-pandemic third quarter of 2019. In 16 of these countries, including the U.S., the inflation rate was more than 2 percentage points higher last quarter than in the same period of 2019. (For this analysis, we used data from the Organization for Economic Cooperation and Development, a group of mostly highly developed, democratic countries. The data covers the 38 OECD member nations, plus eight other economically significant countries.) For most countries in this analysis, 2021 has marked a sharp break from what had been an unusually long period of low-to-moderate inflation. In fact, during the decade leading up to the pandemic, 34 of the 46 countries in the analysis averaged changes in inflation rates of 2.6% or lower. In 27 of these countries, inflation rates averaged less than 2%. The biggest exception was Argentina, whose economy has been plagued by

For most countries in this analysis, 2021 has marked a sharp break from what had been an unusually long period of low-to-moderate inflation. In fact, during the decade leading up to the pandemic, 34 of the 46 countries in the analysis averaged changes in inflation rates of 2.6% or lower. In 27 of these countries, inflation rates averaged less than 2%. The biggest exception was Argentina, whose economy has been plagued by

Studying China’s loan arrangements for 13,427 projects in 165 countries over 18 years,

Studying China’s loan arrangements for 13,427 projects in 165 countries over 18 years,

Rama Rao invited the companies to set up their research and development, digital and manufacturing operations in Hyderabad.

Rama Rao invited the companies to set up their research and development, digital and manufacturing operations in Hyderabad.

Specifically, the Special Task Force identified and considered 12 potential elements of value, including 2 core elements (net costs and quality-adjusted life years), 2 common but inconsistently used elements (productivity and adherence-improvement) and 8 potentially novel ones (reduction in uncertainty, fear of contagion, value of insurance, severity of disease, value of hope, real option value, equity, and scientific spillovers). These 12 elements came to be known as the “ISPOR Value Flower.” In the past few years, the value flower, with its petals highlighting elements that may be overlooked or underappreciated in conventional drug value assessments, has been discussed and debated widely.

Specifically, the Special Task Force identified and considered 12 potential elements of value, including 2 core elements (net costs and quality-adjusted life years), 2 common but inconsistently used elements (productivity and adherence-improvement) and 8 potentially novel ones (reduction in uncertainty, fear of contagion, value of insurance, severity of disease, value of hope, real option value, equity, and scientific spillovers). These 12 elements came to be known as the “ISPOR Value Flower.” In the past few years, the value flower, with its petals highlighting elements that may be overlooked or underappreciated in conventional drug value assessments, has been discussed and debated widely.

Murthy is said to own a 0.9 per cent stake in Infosys, which has been calculated as being worth 500 million pounds. Annual dividends from this holding is estimated to be 11.6 million pounds. On Thursday, it emerged she pays just 30,000 pounds a year in the UK on the British income.

Murthy is said to own a 0.9 per cent stake in Infosys, which has been calculated as being worth 500 million pounds. Annual dividends from this holding is estimated to be 11.6 million pounds. On Thursday, it emerged she pays just 30,000 pounds a year in the UK on the British income.

The deal, first announced last May, is a climactic moment for Zaslav and his longtime deputies at Discovery, best known for brands like Animal Planet, TLC and HGTV. The merger adds HBO, CNN, TNT, Turner Sports, the Warner Bros. movie studio, and a huge raft of other media assets to the company.

The deal, first announced last May, is a climactic moment for Zaslav and his longtime deputies at Discovery, best known for brands like Animal Planet, TLC and HGTV. The merger adds HBO, CNN, TNT, Turner Sports, the Warner Bros. movie studio, and a huge raft of other media assets to the company.

“Expectation is that inflation could remain elevated following the recent rise in energy and food prices. On the other hand, industrial production could grow at a slower pace in January and could further weigh on the currency.”

“Expectation is that inflation could remain elevated following the recent rise in energy and food prices. On the other hand, industrial production could grow at a slower pace in January and could further weigh on the currency.”

Nonrevolving credit, such as student or car loans, grew by 8.4% to $3.4 trillion, also outpacing a smaller January gain.

Nonrevolving credit, such as student or car loans, grew by 8.4% to $3.4 trillion, also outpacing a smaller January gain.

The president also wants Congress to impose financial penalties on oil and gas companies that lease public lands but are not producing. He said he will invoke the Defense Production Act to encourage the mining of critical minerals for batteries in electric vehicles, part of a broader push to shift toward cleaner energy sources and reduce the use of fossil fuels. The actions show that oil remains a vulnerability for the U.S. Higher prices have hurt Biden’s approval domestically and added billions of oil-export dollars to the Russian government as it wages war on Ukraine.

The president also wants Congress to impose financial penalties on oil and gas companies that lease public lands but are not producing. He said he will invoke the Defense Production Act to encourage the mining of critical minerals for batteries in electric vehicles, part of a broader push to shift toward cleaner energy sources and reduce the use of fossil fuels. The actions show that oil remains a vulnerability for the U.S. Higher prices have hurt Biden’s approval domestically and added billions of oil-export dollars to the Russian government as it wages war on Ukraine.

As per figures released by Immigration, Refugees and Citizenship Canada (IRCC), it also issued 450,000 study permit applications. As of December 31, 2021, of the approximately 622,000 foreign students in Canada, Indians number as high as 217,410.

As per figures released by Immigration, Refugees and Citizenship Canada (IRCC), it also issued 450,000 study permit applications. As of December 31, 2021, of the approximately 622,000 foreign students in Canada, Indians number as high as 217,410.

In fact, the southbound leg of the historic new route will become the fourth-longest flight in the world, with a flight time clocking in at 17 hours and 35 minutes. The route will also be the first-ever nonstop from the

In fact, the southbound leg of the historic new route will become the fourth-longest flight in the world, with a flight time clocking in at 17 hours and 35 minutes. The route will also be the first-ever nonstop from the

Canada’s Post-Graduation Work Permit Program (PGWPP), America’s Optional Training Program (OPT) and Britain’s New Graduate Pathway (GR) offer opportunities for good placements after postgraduation which are a major attraction among Indian students to advance their career.

Canada’s Post-Graduation Work Permit Program (PGWPP), America’s Optional Training Program (OPT) and Britain’s New Graduate Pathway (GR) offer opportunities for good placements after postgraduation which are a major attraction among Indian students to advance their career.

How will these historic measures play out? Economic sanctions rarely succeed at achieving their goals. Western policymakers frequently assume that failures stem from weaknesses in sanctions design.

How will these historic measures play out? Economic sanctions rarely succeed at achieving their goals. Western policymakers frequently assume that failures stem from weaknesses in sanctions design.

India’s domestic and international air travel market is expected to grow 6.2% per year over the next 20 years, outpacing average global growth of about 3.9%, McBratney said.

India’s domestic and international air travel market is expected to grow 6.2% per year over the next 20 years, outpacing average global growth of about 3.9%, McBratney said.

Withdrawal of major Western transnational companies – such as Shell, McDonald’s and Apple – will undoubtedly hurt many Russians – not only oligarchs, their ostensible target.

Withdrawal of major Western transnational companies – such as Shell, McDonald’s and Apple – will undoubtedly hurt many Russians – not only oligarchs, their ostensible target.

“In the U.S., it takes as long as three days for a patient to get diagnostic test results. During that time, informed decision making comes to a standstill, even while costs mount,” said Boditech Med co-founder and CEO Eui-Yul Choi, Ph.D. “At Boditech, we develop and manufacture point-of-care tests that deliver actionable results in 12 to 15 minutes. Our goal in the U.S. is to flip the diagnostic industry on its head so that patients get timely, quality care while the healthcare system minimizes waste.”

“In the U.S., it takes as long as three days for a patient to get diagnostic test results. During that time, informed decision making comes to a standstill, even while costs mount,” said Boditech Med co-founder and CEO Eui-Yul Choi, Ph.D. “At Boditech, we develop and manufacture point-of-care tests that deliver actionable results in 12 to 15 minutes. Our goal in the U.S. is to flip the diagnostic industry on its head so that patients get timely, quality care while the healthcare system minimizes waste.” Boditech is currently seeking approvals from the U.S. Food and Drug Administration for several diagnostic solutions in cardiac, cancer, hormone, infectious disease, and other therapeutic areas. Timelines and precise locations remain in the works. Boditech intends to hire hundreds of Americans to support its efforts.

Boditech is currently seeking approvals from the U.S. Food and Drug Administration for several diagnostic solutions in cardiac, cancer, hormone, infectious disease, and other therapeutic areas. Timelines and precise locations remain in the works. Boditech intends to hire hundreds of Americans to support its efforts.

The majority of parents reported concerns regarding child(ren)’s development, including social life or development (73%), academic development (71%) and emotional health or development (71%). More than two-thirds of parents reported concern about the pandemic’s impact on their child’s cognitive development (68%) and their physical health/development (68%).

The majority of parents reported concerns regarding child(ren)’s development, including social life or development (73%), academic development (71%) and emotional health or development (71%). More than two-thirds of parents reported concern about the pandemic’s impact on their child’s cognitive development (68%) and their physical health/development (68%).

The Hyderabad data centre region is another addition to the existing network of 3 regions in India across Pune, Mumbai, and Chennai, which have been operational for more than five years.

The Hyderabad data centre region is another addition to the existing network of 3 regions in India across Pune, Mumbai, and Chennai, which have been operational for more than five years.

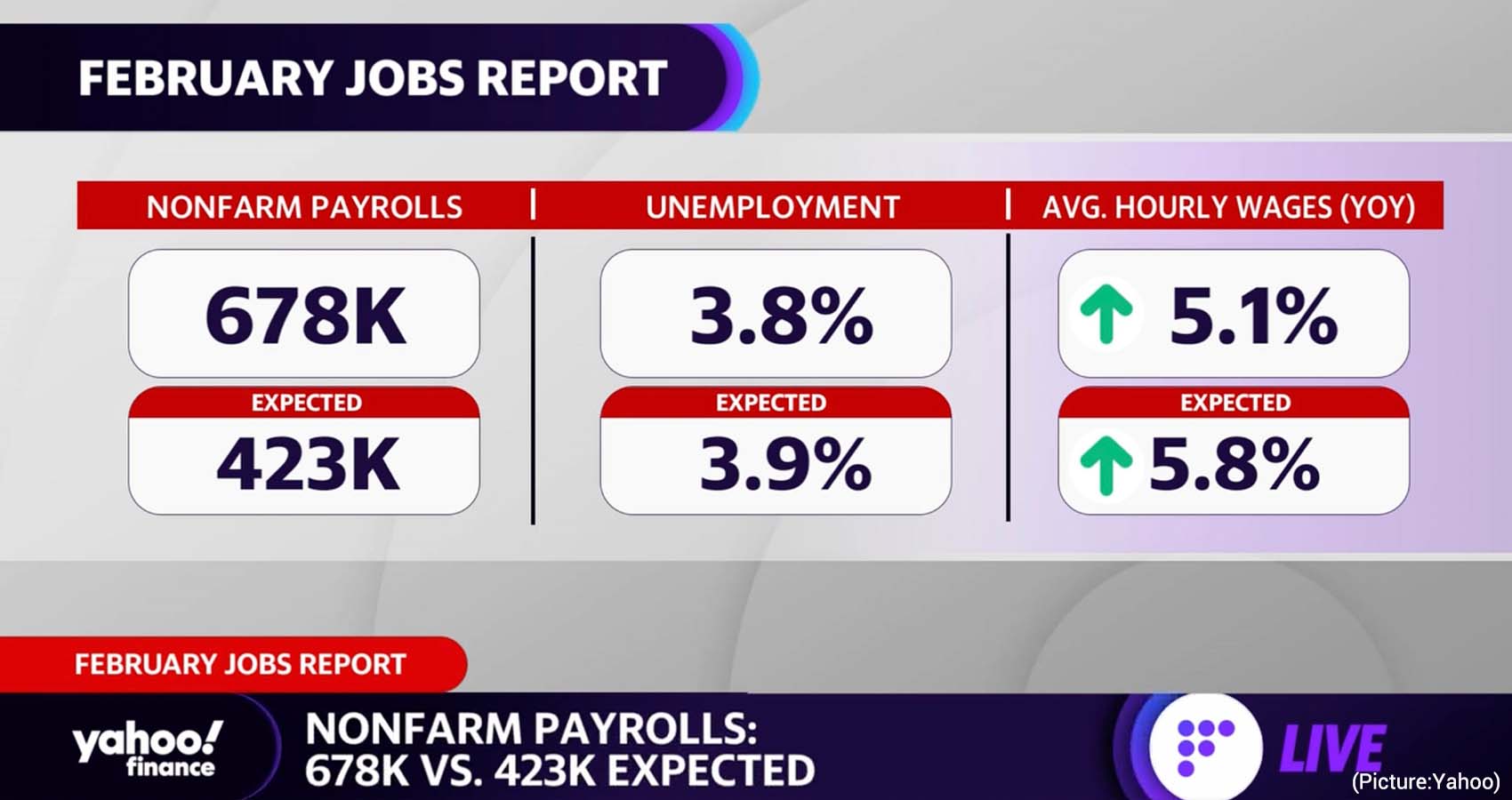

“If we see more numbers like this moving forward, we can be optimistic about this year. Employment is growing at a strong rate and joblessness is getting closer and closer to pre-pandemic levels,” said Nick Bunker, economic research director at Indeed.

“If we see more numbers like this moving forward, we can be optimistic about this year. Employment is growing at a strong rate and joblessness is getting closer and closer to pre-pandemic levels,” said Nick Bunker, economic research director at Indeed.

What started as TiE Atlantic in February 1997 as the dream of 13 Founding Members and only the second TiE Chapter worldwide, has now grown into an unparalleled network of successful, serial entrepreneurs who are deeply engaged and committed to giving back to the community by providing mentorship, tactical advice, and expertise to rising entrepreneurs.

What started as TiE Atlantic in February 1997 as the dream of 13 Founding Members and only the second TiE Chapter worldwide, has now grown into an unparalleled network of successful, serial entrepreneurs who are deeply engaged and committed to giving back to the community by providing mentorship, tactical advice, and expertise to rising entrepreneurs.

Policymakers stress these are early days yet, and there is a lot that needs to be hammered out. All in all, the transactions conducted with digital dollars probably wouldn’t seem too different from existing private alternatives that allow us to pay for things by bringing our smartphones next to digital readers.

Policymakers stress these are early days yet, and there is a lot that needs to be hammered out. All in all, the transactions conducted with digital dollars probably wouldn’t seem too different from existing private alternatives that allow us to pay for things by bringing our smartphones next to digital readers.

Oil has surged by 37% since closing at a recent low of $65.57 a barrel on December 1 amid Omicron fears and the fallout from the US-led intervention into energy markets.

Oil has surged by 37% since closing at a recent low of $65.57 a barrel on December 1 amid Omicron fears and the fallout from the US-led intervention into energy markets.

The RBI has already been keenly watching the performance of major economies worldwide and their respective central banks for CBDC schemes. As a result, the central bank has almost decided on the issue of official digital currency. While the Reserve Bank mentions the need for central banking digital currency (CBDC), it also makes it clear that the government is concerned about the risks surrounding other cryptocurrencies. Why has the government not yet officially banned such currencies? Why did the Supreme Court overturn the ban on banks operating cryptocurrencies? The questions are numerous.

The RBI has already been keenly watching the performance of major economies worldwide and their respective central banks for CBDC schemes. As a result, the central bank has almost decided on the issue of official digital currency. While the Reserve Bank mentions the need for central banking digital currency (CBDC), it also makes it clear that the government is concerned about the risks surrounding other cryptocurrencies. Why has the government not yet officially banned such currencies? Why did the Supreme Court overturn the ban on banks operating cryptocurrencies? The questions are numerous.

These trends point to the emergence of a very different poverty landscape. Whereas in 1990, poverty was concentrated in low-income, Asian countries, today’s (and tomorrow’s) poverty is largely found in sub-Saharan Africa and fragile and conflict-affected states. By 2030, sub-Saharan African countries will account for 9 of the top 10 countries by poverty headcount. Sixty percent of the global poor will live in fragile and conflict-affected states. Many of the top poverty destinations in the next decade will fall into both of these categories: Nigeria, Democratic Republic of the Congo, Mozambique and Somalia. Global efforts to achieve the SDGs by 2030, including eliminating extreme poverty, will be complicated by the concentration of poverty in these fragile and hard-to-reach contexts.

These trends point to the emergence of a very different poverty landscape. Whereas in 1990, poverty was concentrated in low-income, Asian countries, today’s (and tomorrow’s) poverty is largely found in sub-Saharan Africa and fragile and conflict-affected states. By 2030, sub-Saharan African countries will account for 9 of the top 10 countries by poverty headcount. Sixty percent of the global poor will live in fragile and conflict-affected states. Many of the top poverty destinations in the next decade will fall into both of these categories: Nigeria, Democratic Republic of the Congo, Mozambique and Somalia. Global efforts to achieve the SDGs by 2030, including eliminating extreme poverty, will be complicated by the concentration of poverty in these fragile and hard-to-reach contexts.

The Bureau of Labor Statistics (BLS), which is responsible for the CPI, starts by collecting price data for hundreds of discrete goods and services – the so-called “market basket” – from around 8,000 housing units and 23,000 retailers, service providers and online outlets in 75 urban areas around the country. Data on rents is gathered from some 50,000 landlords and tenants. The items sampled, and their weights in the overall index, are determined by the

The Bureau of Labor Statistics (BLS), which is responsible for the CPI, starts by collecting price data for hundreds of discrete goods and services – the so-called “market basket” – from around 8,000 housing units and 23,000 retailers, service providers and online outlets in 75 urban areas around the country. Data on rents is gathered from some 50,000 landlords and tenants. The items sampled, and their weights in the overall index, are determined by the

Brand guardians from these two countries head up a number of key sectors: Jianjun Wei of Great Wall in Automobiles at 3, Patricia Griffith of Progressive Insurance at 11, Xiongjun Ding of Moutai Spirits at 12, and Baoan Xin of State Grid Utilities at 13.

Brand guardians from these two countries head up a number of key sectors: Jianjun Wei of Great Wall in Automobiles at 3, Patricia Griffith of Progressive Insurance at 11, Xiongjun Ding of Moutai Spirits at 12, and Baoan Xin of State Grid Utilities at 13.

India’s Finance Minister

India’s Finance Minister

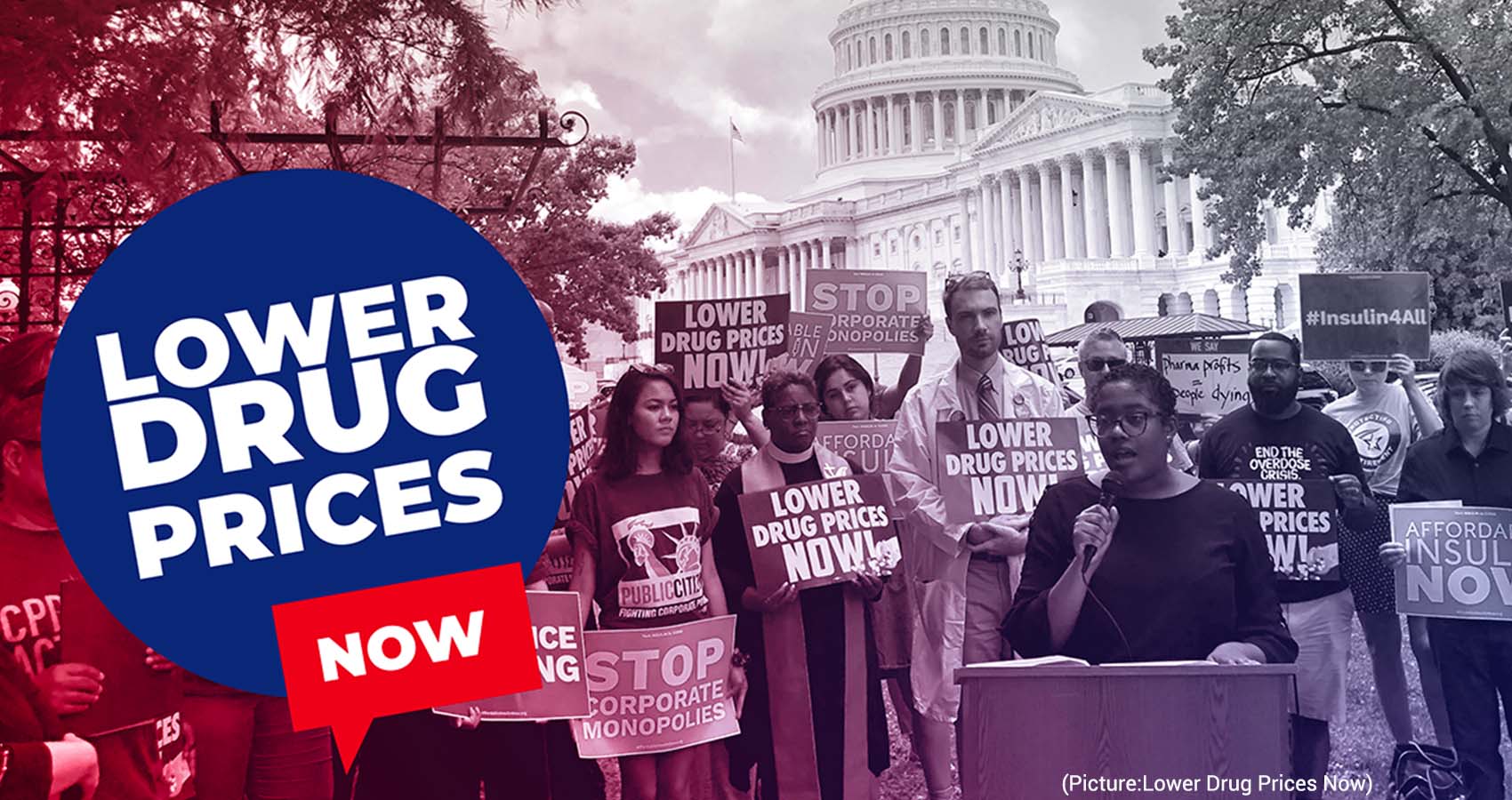

“We write today urging you to take legislative action as swiftly as possible to lower drug prices,” the Democrats, many of whom represent competitive seats,

“We write today urging you to take legislative action as swiftly as possible to lower drug prices,” the Democrats, many of whom represent competitive seats,

“Today is the beginning of a new chapter. The entire nation’s eyes are on us, waiting to see what we will achieve together. To build the airline our country needs, we need to look to the future,” it added. Notably, the purpose of the letter was to welcome the employees into the Tata Group “family”.

“Today is the beginning of a new chapter. The entire nation’s eyes are on us, waiting to see what we will achieve together. To build the airline our country needs, we need to look to the future,” it added. Notably, the purpose of the letter was to welcome the employees into the Tata Group “family”.

In a communication to the airline’s employees on Monday, Air India’s Director, Finance, Vinod Hejmadi wrote: “The disinvestment of Air India is now decided to be on the 27th January, 2022. The closing balance sheet as on 20th January has to be provided today, 24th January, so that it can be reviewed by Tatas and any changes can be effected on Wednesday”.

In a communication to the airline’s employees on Monday, Air India’s Director, Finance, Vinod Hejmadi wrote: “The disinvestment of Air India is now decided to be on the 27th January, 2022. The closing balance sheet as on 20th January has to be provided today, 24th January, so that it can be reviewed by Tatas and any changes can be effected on Wednesday”. Headquartered in

Headquartered in

It advocates a one per cent surcharge on the richest 10 per cent of the Indian population to fund inequality combating measures such as higher investments in school education, universal healthcare, and social security benefits like maternity leaves, paid leaves and pension for all Indians.

It advocates a one per cent surcharge on the richest 10 per cent of the Indian population to fund inequality combating measures such as higher investments in school education, universal healthcare, and social security benefits like maternity leaves, paid leaves and pension for all Indians.

“There has been possibly no bigger obstacle, but also no better opportunity to learn and sharpen your skillset as an event executive,” Patel said. When AAHOA was forced to reschedule its 2021 annual convention no less than five times within the calendar year, “every day presented itself with new challenges, whether it be COVID-related, financial challenges, or contractual challenges,” Patel said, “but we were determined that the show must go on.”

“There has been possibly no bigger obstacle, but also no better opportunity to learn and sharpen your skillset as an event executive,” Patel said. When AAHOA was forced to reschedule its 2021 annual convention no less than five times within the calendar year, “every day presented itself with new challenges, whether it be COVID-related, financial challenges, or contractual challenges,” Patel said, “but we were determined that the show must go on.”

During the much anticipated CEOs Forum, a panel of healthcare experts, health industry leaders, opinion makers, and community organizers discussed the significance of promoting Preventive healthcare in India.

During the much anticipated CEOs Forum, a panel of healthcare experts, health industry leaders, opinion makers, and community organizers discussed the significance of promoting Preventive healthcare in India. Analyzing and assimilating the diverse and expert views expressed by the renowned speakers at the CEO Forum regarding the current state of healthcare in India, the CEO Forum provided a great stage to interact with a varied and distinct group of individuals and corporations, and comprehend the complex dynamics of the commerce of health care enterprise.

Analyzing and assimilating the diverse and expert views expressed by the renowned speakers at the CEO Forum regarding the current state of healthcare in India, the CEO Forum provided a great stage to interact with a varied and distinct group of individuals and corporations, and comprehend the complex dynamics of the commerce of health care enterprise. Urging the Government of India to encourage private hospitals and insurance companies to provide Annual Physical exams, or Telehealth visits at an affordable cost to patients, the CEO Forum members stated, “many routine lab tests, vaccinations, blood pressure checks, and some cancer screenings like self-breast examination can be done remotely and even at patients’ homes with the help of Asha

Urging the Government of India to encourage private hospitals and insurance companies to provide Annual Physical exams, or Telehealth visits at an affordable cost to patients, the CEO Forum members stated, “many routine lab tests, vaccinations, blood pressure checks, and some cancer screenings like self-breast examination can be done remotely and even at patients’ homes with the help of Asha

Wednesday’s report from the Labor Department showed signs that some of the pressures may be easing. The cost of energy dropped 0.4% from November to December – its first decline since April. But over 12 months energy costs are up by nearly 30% and have returned to their upward trend in recent days.

Wednesday’s report from the Labor Department showed signs that some of the pressures may be easing. The cost of energy dropped 0.4% from November to December – its first decline since April. But over 12 months energy costs are up by nearly 30% and have returned to their upward trend in recent days.

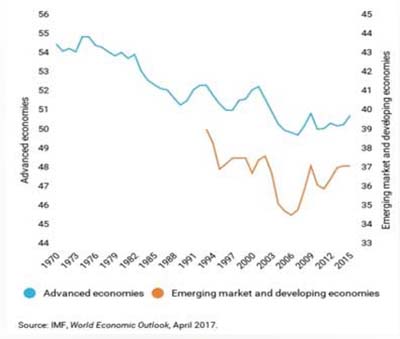

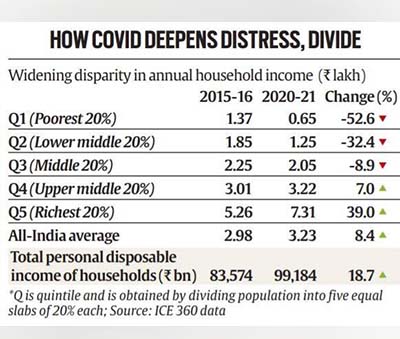

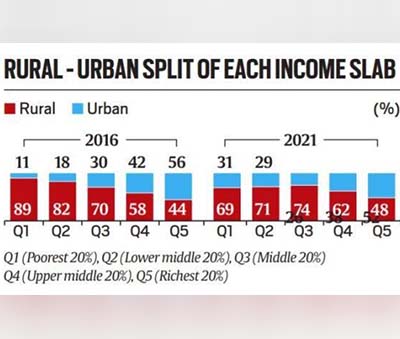

The report also noted that the Covid-19 pandemic has raised global income inequality, partly reversing the decline that was achieved over the previous two decades, Xinhua news agency reported.

The report also noted that the Covid-19 pandemic has raised global income inequality, partly reversing the decline that was achieved over the previous two decades, Xinhua news agency reported.

Founder/Principal Mitch Patel of Patel Spirits Inc., brings over 20 years of expertise and knowledge in the retail spirits industry to Patel Spirits Inc. He has used his knowledge from developing and executing actionable retail sales plans in Central Florida for some of the biggest brands in the industry. These brands include Bacardi flavors, Three Olives flavors, Southern Comfort, Proper 12, Jack Daniel’s Honey and many more.

Founder/Principal Mitch Patel of Patel Spirits Inc., brings over 20 years of expertise and knowledge in the retail spirits industry to Patel Spirits Inc. He has used his knowledge from developing and executing actionable retail sales plans in Central Florida for some of the biggest brands in the industry. These brands include Bacardi flavors, Three Olives flavors, Southern Comfort, Proper 12, Jack Daniel’s Honey and many more.

“That is the way forward here,” said Ben Ritz, director of the Center for Funding America’s Future at the Progressive Policy Institute, who has advocated for a bill with fewer items. “Most of the party is starting to come around to that,” Ritz added. Some Democrats think their party made a mistake in going too large in the first place.

“That is the way forward here,” said Ben Ritz, director of the Center for Funding America’s Future at the Progressive Policy Institute, who has advocated for a bill with fewer items. “Most of the party is starting to come around to that,” Ritz added. Some Democrats think their party made a mistake in going too large in the first place.

As we prepare for the return to repayment in May, we will continue to provide tools and supports to borrowers so they can enter into the repayment plan that is responsive to their financial situation, such as an income-driven repayment plan. Students and borrowers will always be at the center of our work at the Department, and we are committed to not only ensuring a smooth return to repayment, but also increasing accountability and stronger customer service from our loan servicers as borrowers prepare for repayment.”

As we prepare for the return to repayment in May, we will continue to provide tools and supports to borrowers so they can enter into the repayment plan that is responsive to their financial situation, such as an income-driven repayment plan. Students and borrowers will always be at the center of our work at the Department, and we are committed to not only ensuring a smooth return to repayment, but also increasing accountability and stronger customer service from our loan servicers as borrowers prepare for repayment.”

According to India Tourism Statistics 2019, a government of India publication, in 2017, Goa had 68,95,234 domestic and 8,42,220 foreign tourists while in 2018, the respective number of 70,81,559 and 9,33,841 showing a growth rate of 2.70 per cent and 10.88 per cent, respectively. Of course, the pandemic changed the situation, and the tourism sector was the hardest hit. In 2021, even when the domestic sector has picked up slowly, foreign tourists’ numbers are no match.

According to India Tourism Statistics 2019, a government of India publication, in 2017, Goa had 68,95,234 domestic and 8,42,220 foreign tourists while in 2018, the respective number of 70,81,559 and 9,33,841 showing a growth rate of 2.70 per cent and 10.88 per cent, respectively. Of course, the pandemic changed the situation, and the tourism sector was the hardest hit. In 2021, even when the domestic sector has picked up slowly, foreign tourists’ numbers are no match.

But by then, Musk was already on to his next venture. Driving with him in the McLaren the day of the wreck was Peter Thiel, co-founder of a payments startup called Confinity. (Thiel and Musk weren’t injured in the crash).

But by then, Musk was already on to his next venture. Driving with him in the McLaren the day of the wreck was Peter Thiel, co-founder of a payments startup called Confinity. (Thiel and Musk weren’t injured in the crash). Rich Morgan

Rich Morgan

Supply chain bottlenecks, with COVID-19-related worker absences at factories and ports still high, are also leading to low supplies and higher prices for consumer electronics, appliances and many other products.

Supply chain bottlenecks, with COVID-19-related worker absences at factories and ports still high, are also leading to low supplies and higher prices for consumer electronics, appliances and many other products.

Also, the volatility of gas prices means they can go down as sharply and as suddenly as they go up. In the spring of 2020, as the

Also, the volatility of gas prices means they can go down as sharply and as suddenly as they go up. In the spring of 2020, as the  Where you buy gas also matters. Much of the U.S. petroleum industry is concentrated along the Gulf Coast, making it perhaps unsurprising that gas tends to be cheapest there. The average price in that region was $3.072 a gallon in late November, and in Texas it was also a hairsbreadth above $3.

Where you buy gas also matters. Much of the U.S. petroleum industry is concentrated along the Gulf Coast, making it perhaps unsurprising that gas tends to be cheapest there. The average price in that region was $3.072 a gallon in late November, and in Texas it was also a hairsbreadth above $3.

The growing pools of cash are meant to entice young workers and hold on to existing staff at a time

The growing pools of cash are meant to entice young workers and hold on to existing staff at a time

“No other nation in the world ‘trains’ so many citizens in such a gladiatorial manner as India does,” says R Gopalakrishnan, former executive director of Tata Sons and co-author of The Made in India Manager.

“No other nation in the world ‘trains’ so many citizens in such a gladiatorial manner as India does,” says R Gopalakrishnan, former executive director of Tata Sons and co-author of The Made in India Manager.

Some common examples of Medicare fraud include billing for services that were not provided, over billing, billing unnecessary services, misrepresenting dates of service or providers of service, and paying kickbacks for patient referrals.

Some common examples of Medicare fraud include billing for services that were not provided, over billing, billing unnecessary services, misrepresenting dates of service or providers of service, and paying kickbacks for patient referrals.

The country performs best in the future resources measure, where it finishes behind only the US and China. However, lost growth potential for Asia’s third largest economy due largely to the impact of the coronavirus pandemic has led to a diminished economic forecast for 2030, Lowy Institute said.

The country performs best in the future resources measure, where it finishes behind only the US and China. However, lost growth potential for Asia’s third largest economy due largely to the impact of the coronavirus pandemic has led to a diminished economic forecast for 2030, Lowy Institute said.

Mastercard Inc has raised similar concerns privately with the USTR. Reuters reported in 2018 that the company had lodged a protest with the USTR that Modi was using nationalism to promote the local network.

Mastercard Inc has raised similar concerns privately with the USTR. Reuters reported in 2018 that the company had lodged a protest with the USTR that Modi was using nationalism to promote the local network.

“The reaction that we saw of the Jet Airways brand coming back was motivation in itself,” 37-year old Jalan, who’s leading the consortium’s airline venture, said from the old offices of Jet Airways just outside of New Delhi on Wednesday evening. “That’s exactly why Jet is coming back; to serve the loyal fan base, to serve the people who miss Jet.”

“The reaction that we saw of the Jet Airways brand coming back was motivation in itself,” 37-year old Jalan, who’s leading the consortium’s airline venture, said from the old offices of Jet Airways just outside of New Delhi on Wednesday evening. “That’s exactly why Jet is coming back; to serve the loyal fan base, to serve the people who miss Jet.”

But the CBDC is the official cryptocurrency issued by the Central Bank of India. This is the main difference between other cryptocurrencies and CDBC. The CBDC (Central Bank Digital Currency) will also be marketed through the blockchain technology as done by other virtual currencies . It is likely to be a digital token or electronic form of the current currency. The Reserve Bank of India will be in charge of supervising and monitoring the official crypto of the Indian government. Digital money cannot be withdrawn as we usually withdraw from banks and ATMs. Their transactions will be through digital platforms. It is not yet clear whether it will be listed on other crypto exchanges.

But the CBDC is the official cryptocurrency issued by the Central Bank of India. This is the main difference between other cryptocurrencies and CDBC. The CBDC (Central Bank Digital Currency) will also be marketed through the blockchain technology as done by other virtual currencies . It is likely to be a digital token or electronic form of the current currency. The Reserve Bank of India will be in charge of supervising and monitoring the official crypto of the Indian government. Digital money cannot be withdrawn as we usually withdraw from banks and ATMs. Their transactions will be through digital platforms. It is not yet clear whether it will be listed on other crypto exchanges.

Speaking on the occasion of the foundation laying stone ceremony of Noida International Airport here, PM Modi said, “Tourism of land-locked states like Uttar Pradesh will greatly benefit from the Noida International Airport. Now, pilgrims will be able to easily travel to temples and shrines in Uttar Pradesh.”

Speaking on the occasion of the foundation laying stone ceremony of Noida International Airport here, PM Modi said, “Tourism of land-locked states like Uttar Pradesh will greatly benefit from the Noida International Airport. Now, pilgrims will be able to easily travel to temples and shrines in Uttar Pradesh.”

Planned in collaboration between project’s designer, OCEANIX and the UN Human Settlement Programme (UN-Habitat), the

Planned in collaboration between project’s designer, OCEANIX and the UN Human Settlement Programme (UN-Habitat), the

On honoring him his new crown, CM Stalin praised Rangaswami for his achievements in the US.

On honoring him his new crown, CM Stalin praised Rangaswami for his achievements in the US.

The sweeping economic legislation stands as a key pillar of Biden’s domestic agenda. It would deliver on longstanding Democratic priorities by dramatically expanding social services for Americans, working to mitigate the climate crisis, increasing access to health care and delivering aid to families and children.

The sweeping economic legislation stands as a key pillar of Biden’s domestic agenda. It would deliver on longstanding Democratic priorities by dramatically expanding social services for Americans, working to mitigate the climate crisis, increasing access to health care and delivering aid to families and children.

The Build Back Better Act includes long-term work permits and protections for seven million hardworking immigrant essential workers that will help prevent family separation, stabilize our workforce, boost our economy, and create jobs,” said Congressional Hispanic Caucus (CHC) Chair Raúl Ruiz (D-Calif.).

The Build Back Better Act includes long-term work permits and protections for seven million hardworking immigrant essential workers that will help prevent family separation, stabilize our workforce, boost our economy, and create jobs,” said Congressional Hispanic Caucus (CHC) Chair Raúl Ruiz (D-Calif.).