In December 2022, when the agitation of the fish workers at Vizhinjam in Kerala was at its peak, I wrote an open letter to Gautam Adani, head of the Adani Group, to include the cost of rehabilitation of those who lost their houses and were living in a miserable condition, in the project cost and win their confidence.

Let me quote from the letter published in this magazine, “If the rehabilitation of the fish workers would cost, say, Rs 50 crore or Rs 100 crore, please include it in the project cost. Nobody would object. If each displaced farmer gets a plot of land where he can build a permanent house, not far from the sea, he would be more than happy to withdraw the agitation”.

Around the same time, I heard a spokesman of the Adani Group claim that whatever they could do was done to mitigate the hardship of the people affected and nothing more could be done. He specifically mentioned the number of laptops distributed under the company’s Corporate Social Responsibility (CSR) program.

When I heard him, I remembered the video of a mother standing before an open toilet to let her daughter have some privacy as she eased herself. Could the laptop have given her privacy? I concluded my letter requesting him to be generous to the poor fish workers of Vizhinjam.

Before that, I also warned him of what could happen. Let me quote the letter again: “The great Malayalam poet Poonthanam’s Jnanappana (The fountain of wisdom) written in the 16th century has these thought-provoking lines: “If God wishes, the people we see now or are with us now, may disappear or be dead in the next moment. Or, if He wishes, in a few days, a healthy man may be paraded to his funeral pyre.

“If God wishes, the king living in a palace today may lose everything and end up carrying a dirty bag on his shoulders and walk around homeless”. He reminds us about the fleeting nature of wealth.

Adani did not send a reply, let alone loosen his purse strings to settle the problem. Instead, with the help of the police, he allowed the agitation to be suppressed.

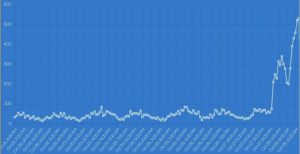

Not even two months have passed since I wrote that letter. At that time, Gautam Adani was the richest man in India, nay Asia. He was the third richest person in the world. He used to create wealth at the rate of Rs 1,612 crore per day to outpace Jeff Bezoz of Amazon.

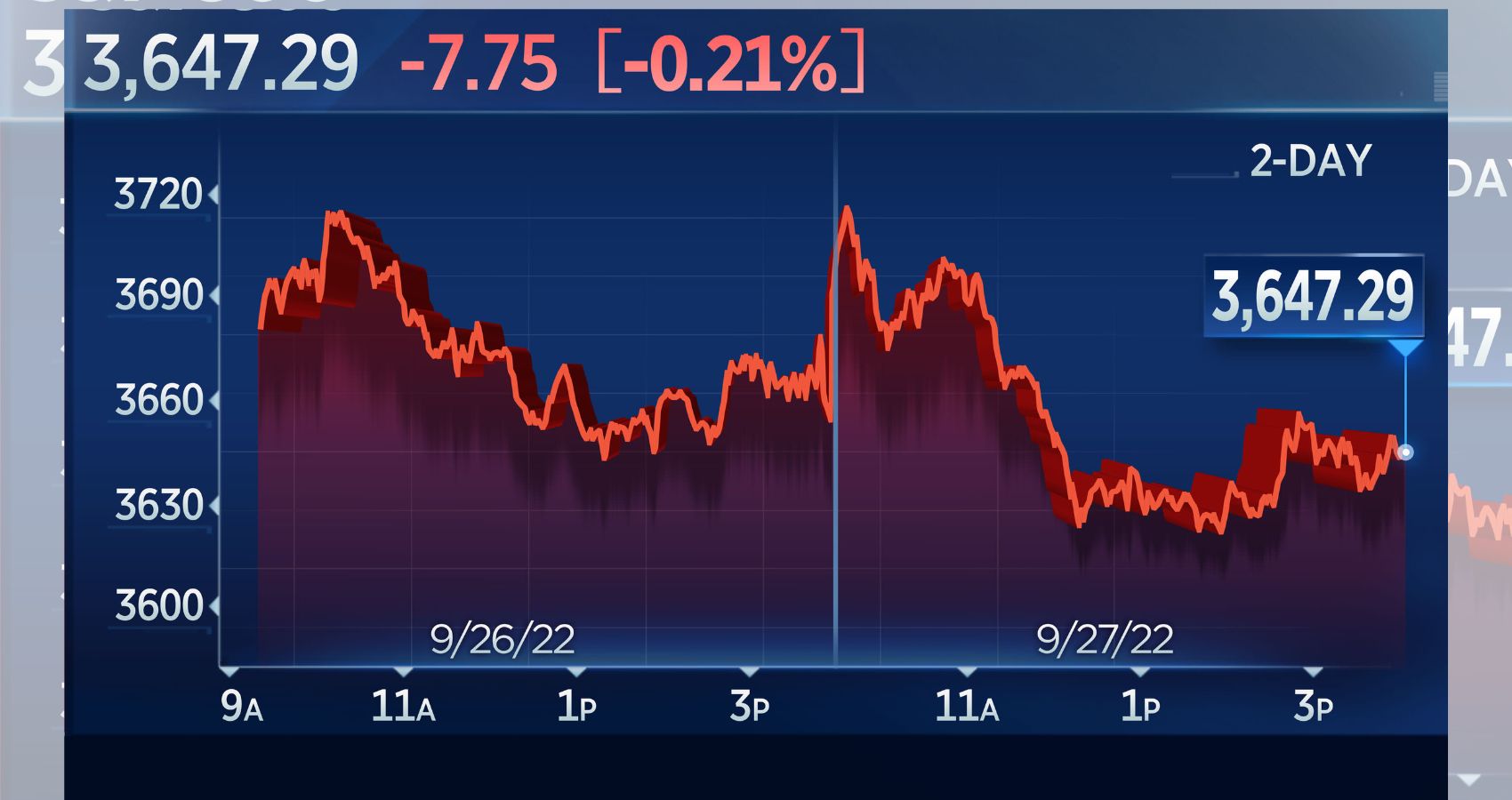

During the last few days, Adani has lost billions of rupees. At the rate at which the value of the shares of Adani Enterprises and other Adani companies has been plummeting, one really wonders whether it is the beginning of the end of the Adani business saga. After all, it was a small boy David who felled the giant Goliath.

What pricked the bubble of Adani is a report published by Hindenburg Research, a small company in the US. When the report was released, the mainstream media in India did not think it merited detailed coverage. Adani, who believed that money could cover up his “sins”, produced multiple-page advertisements in major Indian newspapers to suggest that everything was hunky-dory with his companies.

Any sensible and sensitive person would have called off the Rs 20,000-crore Follow on Public Offer (FPO), given the doubts created in the public mind by the Hindenburg Research (HR). The strategy now in vogue in the political and business fields is to counter truth with greater and greater falsehood.

The voluminous rejoinder the Adani Group produced to counter the HR report was like the 5,000-page chargesheet filed against Siddiqui Kappan, which reminded me of Shakespeare’s famous line, “sound and fury signify nothing”. Adani was confident that with the support of the business empire he has created and with the help of those in power, he would be able to brazen out. That is why he persisted with the FPO.

The public relations team was at its best when it claimed that the FPO was oversubscribed. Yes, institutional investors did not disappoint him. But retail investors for whom half the FPO shares were earmarked did not show any interest. Only 11 percent of the earmarked shares were lifted by them. Nearly 50 percent of the shares earmarked for the employees also remained unsold. They knew the company better!

In other words, it was a flop show. And that is why the company was forced to declare that it would return the money of all those who invested in the FPO. It is a major setback to the whole Adani Group.

What the Hindenburg Research said was that Adani built his empire using all devious means. Let me explain it in simple terms. Suppose I buy an acre of land for Rs 1 lakh. After that, I spread the news that there are gold deposits in the land. Nobody can check the land as tight security is arranged. Then I decide to sell 60 cents of the land at Rs 1 lakh each. I get Rs 60 lakh which is 60 times my investment, while 40 cents of land still remain with me. I use Rs 60 lakh to rope in more investors and my asset doubles, triples and quadruples.

Adani became famous in 2014 when he made available his fully-fuelled helicopter at the service of Narendra Modi. Every day, the chopper would take off from Ahmedabad carrying Modi and his tiffin to one of the states where he would campaign that day. He would return home the same day.

It was in Adani’s aircraft that Modi came to Delhi to be sworn in as the Prime Minister of India. Adani accompanied Modi whenever he went on a foreign trip. Everybody who mattered in the country knew his close connections with the Prime Minister, which came to his help as he expanded his business network both within and without the country. Soon, he got mega projects like seaports and airports.

When the world’s largest consignment of drugs passed through his port in Gujarat, nobody blamed the owners of the port. It was also revealed that a similar consignment had already been cleared. Nobody knows who funded the import of such a large quantity of drugs. The point is that they remain at large.

Was Adani a great entrepreneur? Take the case of Steve Jobs, who founded Apple Incorporated. He developed a prototype of a computer and set up a company to manufacture it. Later, he added new products like iPhone, iPad, iPod to make his company the world’s most valuable. Similarly, Jeff Bezos found a new way of selling books. He also introduced a device called Kindle.

Soon, Bezos became an industrialist and acquired the skills to operate at a global level. Ford was America’s greatest-ever industrialist. He developed a car and began selling it to become the world’s greatest industrialist. In the case of Adani, nothing of the sort happened.

He did not even complete his college education and went to Mumbai. There, he became a trader, who would buy something for Rs 100 and sell it for Rs 400 to earn Rs 300. He realised that he was successful when he made his first Rs 1 lakh. Thereafter, there was nothing to stop him. He was essentially a trader, who stepped into the manufacturing sector. By then, he had learnt how to manipulate the share market.

Why single out Adani? I have read BM Birla’s biography where it is mentioned that when he turned 18, he was given a gift of Rs 1000 by his father GD Birla. He did not spend the money on clothes or other items. Instead, he used it for speculation and made another Rs 1000. In fact, almost all the Indian industrialists are not entrepreneurs but traders who cannot succeed except by bluffing the government.

What Hindenburg Research accused Adani of doing is what an American company Enron did. The American investigative and legal system acted swiftly without caring for the company and the persons involved. Before its bankruptcy in late 2001, it employed around 21,000 people and was one of the world’s leading electricity, natural gas, pulp and paper and communication companies with a claimed revenue of $111 billion in 2000. Fortune named Enron “America’s most innovative company” for six consecutive years.

It achieved infamy at the end of 2001 when it was revealed that its reported financial condition was sustained mostly by institutionalized, systematic and creatively planned accounting fraud. Enron has since become a popular symbol of willful corporate fraud and corruption. Kenneth Lay, its former chairman, died of a heart attack while he was on trial and Jeffrey Skilling, its chief operating officer, was given 24 years of imprisonment. It also led to the collapse of World.com, a bigger firm than Enron.

The American government followed the principle, emanating from the Malayalam saying, that those who eat salt should drink water. In other words, the more severe the crime, the more severe the punishment.

Recently, India lost a great lawyer in the death of Shanti Bhushan, who was also a Union Minister. He wrote the Foreword for the book titled ‘Reliance, The Real Natwar’ by Arun K. Agrawal (Manas). Let me quote a few lines from the author’s Preface:

“The plain truth of the matter is that Reliance has become the largest company in India and its owner the richest man in the country the old-fashioned way: Financial engineering involving the conversion of debt into equity, the propping up of its own shares to public institutions, issuing shares of new companies at premium to the public and then merging the companies, allotting shares to the promoters to increase their stake, avoiding taxes, managing a company-friendly tax regime and, of course, the oil bonanza handed over to it by the government.

“Inevitably, in just 30 years, its turnover has grown from approximately Rs.100 crore to over Rs 1 lakh crore”. This book was published in 2008 but what it says about Reliance reads like a summary of the Hindenburg Research report about the Adani Group.

One cartoon that became viral on social media showed Adani approaching the State Bank of India for a loan to purchase the bank. When the Vizhinjam port in Kerala was successfully bid by Adani, many would have thought that he would pump in his own money. The fact of the matter is that no Indian businessman sinks his own money in any project. It is all public money that is sunk. But once the profits start flowing, the owners do not part with it.

Today, Reliance makes most of its money from petroleum. It is believed that all the wealth under the earth belongs to the people of India. Then, how did Reliance get the oil wells? It was the late Captain Satish Sharma who, as the Petroleum Minister, handed over the oil fields to receive pecuniary benefits, as found out by the CBI.

Most corporates in India believe in the theory, as propounded by Lord Byron in a poem, that everybody has a price. The poet concludes his poem in these words, “The most by ready cash — but all have prices, from crowns to kicks, according to their vices”.

Small wonder that a wisecrack said that if Gautam Adani knew that Hindenburg Research could hit him so hard, he would have offered a price and bought it like NDTV he bought, certainly not for the profit it made but to end a nuisance. Even now it is not too late for him to remember the seven deadly sins identified by Mahatma Gandhi — wealth without work, pleasure without conscience, knowledge without character, science without humanity, religion without sacrifice and politics without principles. (Courtesy: Indian Currents) [email protected]

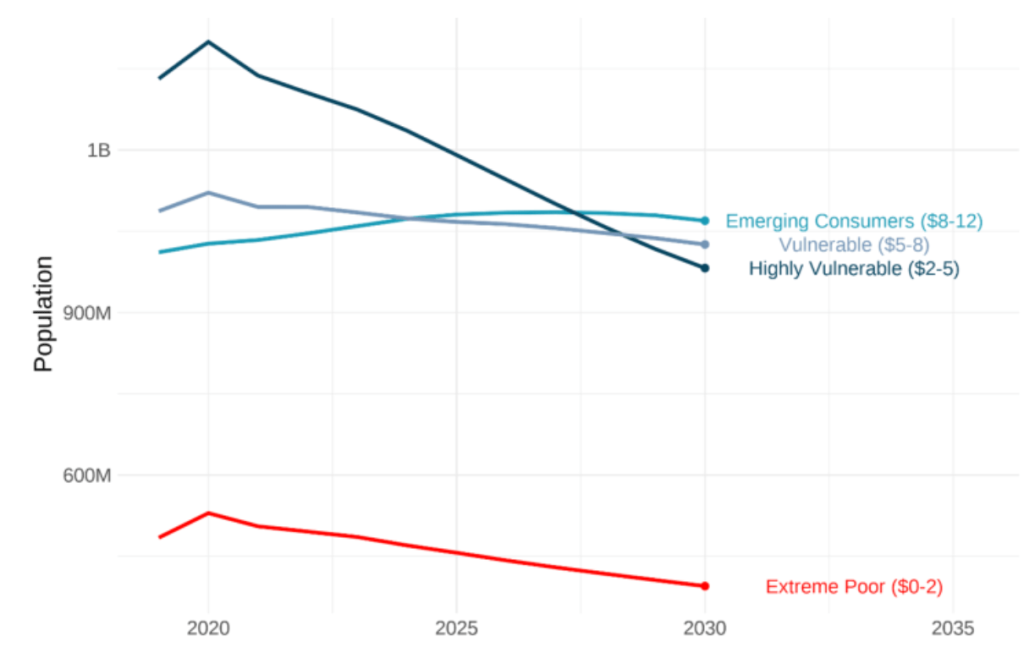

However, there are only 4.6 billion people in these three groups out of the 8 billion people on the planet. There are 3.4 billion people who are seemingly forgotten, not extremely poor, not part of the middle class, and not rich. Who are they?

However, there are only 4.6 billion people in these three groups out of the 8 billion people on the planet. There are 3.4 billion people who are seemingly forgotten, not extremely poor, not part of the middle class, and not rich. Who are they?

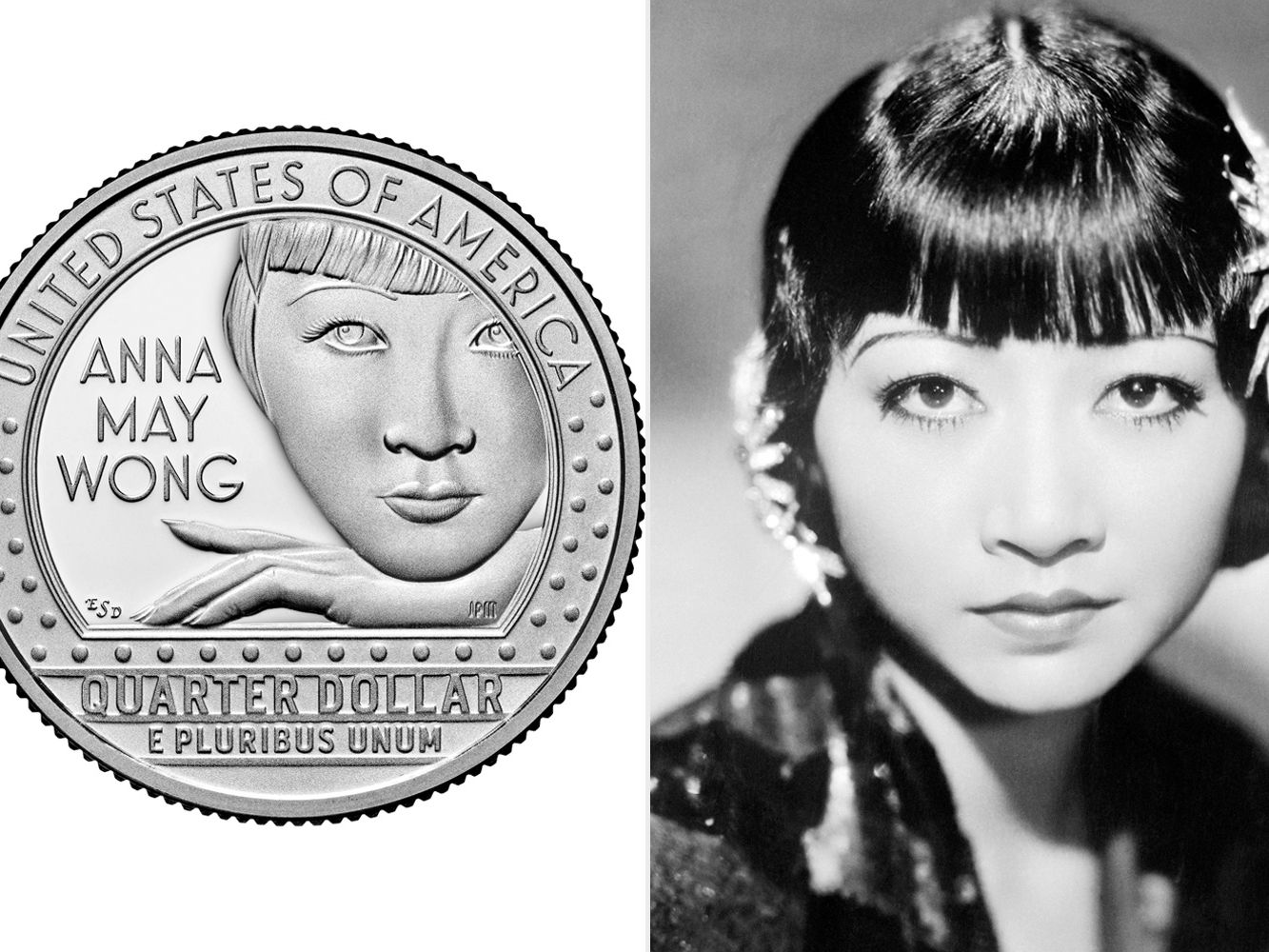

Born in Los Angeles, she began acting at 14 and took a lead role in “The Toll of the Sea” three years later, in 1922. She went on to appear in dozens of movies but faced deeply entrenched racism in Hollywood, where she struggled to break from stereotypical roles.

Born in Los Angeles, she began acting at 14 and took a lead role in “The Toll of the Sea” three years later, in 1922. She went on to appear in dozens of movies but faced deeply entrenched racism in Hollywood, where she struggled to break from stereotypical roles.

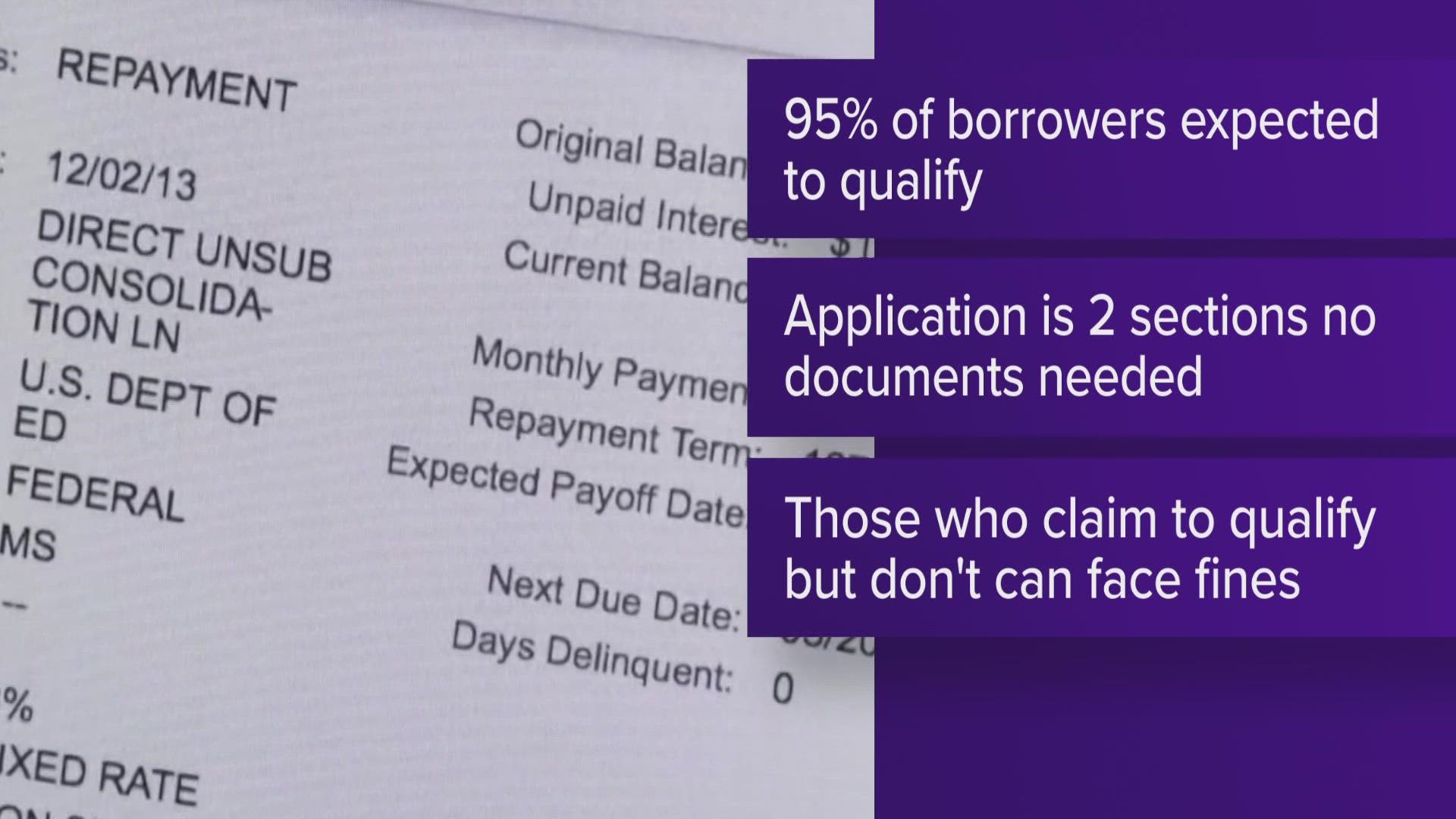

The Education Department’s technical team will be responding to potential issues in real-time, and although the application itself won’t change, the team may make changes to the website if faced with any glitches.

The Education Department’s technical team will be responding to potential issues in real-time, and although the application itself won’t change, the team may make changes to the website if faced with any glitches.

India’s GHI score has decreased from a 2000 GHI score of 38.8 points, considered alarming, to a 2022 GHI score of 29.1, considered serious. India’s proportion of undernourished in the population is considered to be at a medium level, and its under-five child mortality rate is considered low.

India’s GHI score has decreased from a 2000 GHI score of 38.8 points, considered alarming, to a 2022 GHI score of 29.1, considered serious. India’s proportion of undernourished in the population is considered to be at a medium level, and its under-five child mortality rate is considered low.

Monday’s UNCTAD report disparaged comparisons to the last period of high inflation in the global economy, saying that today’s economic conditions are inherently different from those in the 1970s and that drawing parallels between them was tantamount to “sifting through the economic entrails of a bygone era.”

Monday’s UNCTAD report disparaged comparisons to the last period of high inflation in the global economy, saying that today’s economic conditions are inherently different from those in the 1970s and that drawing parallels between them was tantamount to “sifting through the economic entrails of a bygone era.”

The dollar is also soaring in destinations like Thailand, India and South Korea — countries with ample tourism interest from Americans and relatively weaker economic growth than the U.S.

The dollar is also soaring in destinations like Thailand, India and South Korea — countries with ample tourism interest from Americans and relatively weaker economic growth than the U.S.

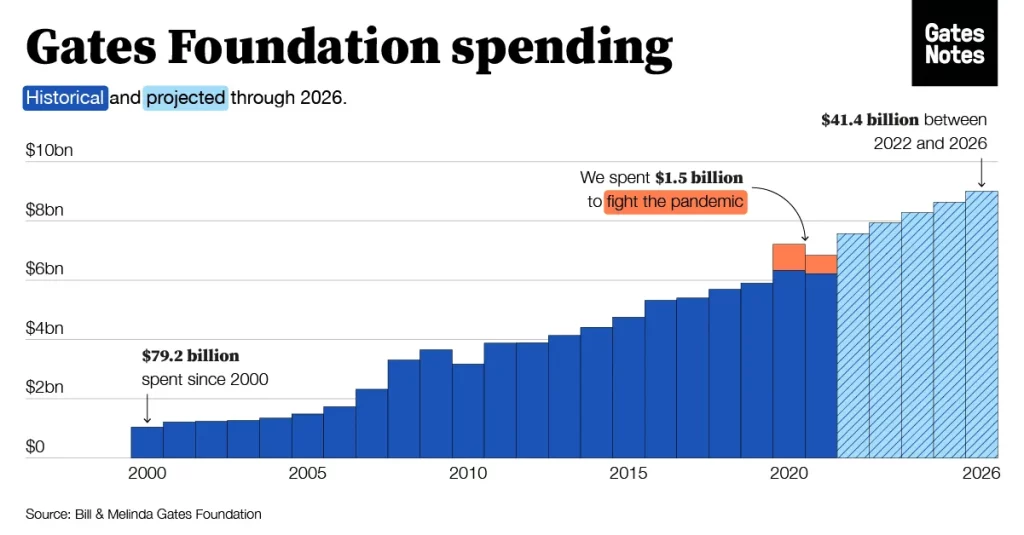

Bill Gates is moving $20 billion of his wealth into the endowment of the Bill and Melinda Gates Foundation, which is ramping up its spending in the face of global challenges, including the pandemic and the war in Ukraine, media reports said.

Bill Gates is moving $20 billion of his wealth into the endowment of the Bill and Melinda Gates Foundation, which is ramping up its spending in the face of global challenges, including the pandemic and the war in Ukraine, media reports said.

Many immigrants with well-paying jobs in these overseas nations help their relatives, parents, and near and dear ones by sending them money for assistance. Even students who study in developed nations return home with great knowledge and expertise. They even impart their expertise and aid in medicine, engineering, technology, and other professions.

Many immigrants with well-paying jobs in these overseas nations help their relatives, parents, and near and dear ones by sending them money for assistance. Even students who study in developed nations return home with great knowledge and expertise. They even impart their expertise and aid in medicine, engineering, technology, and other professions.

Lower-income and Black and Hispanic American have been hit especially hard, since a disproportionate share of their income goes toward essentials such as transportation, housing and food. But with the cost of many goods and services rising faster than average incomes, a vast majority of Americans are feeling the pinch in their daily routines.

Lower-income and Black and Hispanic American have been hit especially hard, since a disproportionate share of their income goes toward essentials such as transportation, housing and food. But with the cost of many goods and services rising faster than average incomes, a vast majority of Americans are feeling the pinch in their daily routines.

It’s a sharp departure from the previous two years, when the fortunes of the ultra-rich swelled as governments and central banks unleashed unprecedented stimulus measures in the wake of the Covid-19 pandemic, juicing the value of everything from tech companies to cryptocurrencies.

It’s a sharp departure from the previous two years, when the fortunes of the ultra-rich swelled as governments and central banks unleashed unprecedented stimulus measures in the wake of the Covid-19 pandemic, juicing the value of everything from tech companies to cryptocurrencies.

At least at first,

At least at first,

“After holding their breath for nearly a week awaiting the US CPI report for May, investors exhaled in exasperation as inflation came in hotter than expected,” Sam Stovall, chief investment strategist at CFRA, said in a note to clients Monday morning.

“After holding their breath for nearly a week awaiting the US CPI report for May, investors exhaled in exasperation as inflation came in hotter than expected,” Sam Stovall, chief investment strategist at CFRA, said in a note to clients Monday morning.

He said that when Berkshire’s stock fell, there was nothing wrong with the company. He said that the mind of the investor should be right. Otherwise, your life will be spent in buying and selling shares at the wrong time and you will continue to cry for loss. Investors take decisions on the advice of others when prices fluctuate.

He said that when Berkshire’s stock fell, there was nothing wrong with the company. He said that the mind of the investor should be right. Otherwise, your life will be spent in buying and selling shares at the wrong time and you will continue to cry for loss. Investors take decisions on the advice of others when prices fluctuate.

Amazon’s market capitalisation increased by 61 per cent in the year to March 2021, supported by the growing “stay-at-home economy” seen throughout 2020 and into 2021, although Amazon did not move up from fourth position.

Amazon’s market capitalisation increased by 61 per cent in the year to March 2021, supported by the growing “stay-at-home economy” seen throughout 2020 and into 2021, although Amazon did not move up from fourth position.

Meanwhile, Twitter Inc said on Friday last week that the waiting period under the HSR Act for Elon Musk’s $44-billion acquisition of the social media firm has expired. Completion of the deal is now subject to remaining customary closing conditions, including approval by Twitter stockholders and the receipt of applicable regulatory approvals, Twitter said.

Meanwhile, Twitter Inc said on Friday last week that the waiting period under the HSR Act for Elon Musk’s $44-billion acquisition of the social media firm has expired. Completion of the deal is now subject to remaining customary closing conditions, including approval by Twitter stockholders and the receipt of applicable regulatory approvals, Twitter said.

In recent years, major alcohol companies including

In recent years, major alcohol companies including

In 2019, Zurich Airport International AG won the bid to develop the airport. The Uttar Pradesh government signed the concession agreement with Yamuna International Airport Private Limited on October 7, 2020, to commence the development of the Noida International Airport.

In 2019, Zurich Airport International AG won the bid to develop the airport. The Uttar Pradesh government signed the concession agreement with Yamuna International Airport Private Limited on October 7, 2020, to commence the development of the Noida International Airport.

Conceived and developed by Dr. Joseph M. Chalil and Mr. Bob Miglani, and building on the successful experiences of the past several years of the popular CEO Forum at the 40th edition of AAPI’s annual Convention, to be attended by world renowned healthcare leaders will address: “The Future of Healthcare: Technology, Transformation and Beyond.”

Conceived and developed by Dr. Joseph M. Chalil and Mr. Bob Miglani, and building on the successful experiences of the past several years of the popular CEO Forum at the 40th edition of AAPI’s annual Convention, to be attended by world renowned healthcare leaders will address: “The Future of Healthcare: Technology, Transformation and Beyond.” “The 2022 AAPI Annual Convention & Scientific Assembly offers the participants at the convention a rare platform to interact with and listen to leading physicians, healthcare professionals, academicians, scientists, and leaders of the hospitals, technology , medical device and pharmaceutical companies,” said Dr. Anjana Samadder, Vice President of AAPI.

“The 2022 AAPI Annual Convention & Scientific Assembly offers the participants at the convention a rare platform to interact with and listen to leading physicians, healthcare professionals, academicians, scientists, and leaders of the hospitals, technology , medical device and pharmaceutical companies,” said Dr. Anjana Samadder, Vice President of AAPI.

Billionaires have seen their total

Billionaires have seen their total