Former UN ambassador Nikki Haley’s tenacious battle for the presidency of the US is a symbol of Indian American women’s emergence as a powerhouse in politics and society even though she dropped her Sisyphean quest two days before International Women’s Day.

On the other side of the political divide, US Vice President Kamala Harris is set for another run for the vice presidency alongside President Joe Biden, having notched the record of the first woman elected to the position that is just a heartbeat away from the world’s most powerful job.

While the two women have the highest profiles in politics, many Indian American women shine across the spectrum of politics, government, business and beyond.

They have soared into space, headed multinational corporations, led universities, and showing their versatility, served undercover for the Central Intelligence Agency (CIA) and even took the Miss America crown.

Although overrun by former President Donald Trump, Nikki Haley made her mark by standing up to him while other competitors folded and she struck out a line of Republican politics that could have a wider appeal.

She put her stamp on politics by getting a significant chunk of votes – estimated at about 25 per cent of those cast in the Republican primaries till she quit – winning in one state, Vermont, and in Washington, the federal District of Columbia.

She also has the distinction of being elected twice as the governor of South Carolina, the first woman and the first non-White person to head the state, and the first Indian American to be a member of the US cabinet when she was the permanent representative to the United Nations, a post with cabinet rank.

Kamala Harris made her mark as California’s attorney general lofting her to the Senate where her work got her national recognition, paving the way to the second most powerful job in the US, the vice president.

She is the first woman to become vice president and she was also the first person of Indian descent elected to the US Senate.

Pramila Jayapal, who heads the Progressive Caucus in the House of Representatives, is the other politically powerful Indian American woman.

What helps them shatter glass ceilings despite their being women and, on top of that, women of color with immigrant backgrounds is a society that values merit as it steadily tries to bring down barriers to women’s advancement.

And they are not dynasts or nepobabies, either, and they got to where they are through their own merit.

As Nikki Haley said on Wednesday while announcing she was ending her race, “Just last week, my mother, a first-generation immigrant, got to vote for her daughter for president – only in America”.

In business, Indra Nooyi created a legend of her own as the CEO of Pepsico, a multinational corporation with over 300,000 employees operating in over 200 countries having a revenue of $62 billion in her final year heading it.

By the time she left in 2018 after 12 years as CEO, she boosted its annual profits from $2.5 billion to $6.7 billion as she chartered a new, more diversified course for the company.

Revathi Advaithi is the CEO of Flex, a global diversified company that is the third-largest globally in electronics manufacturing services.

She also serves on the US government’s Advisory Committee for Trade Policy and Negotiations.

Padmasree Warrior, who blazed a trail as chief technology officer for marquee technology companies Motorola and Cisco and as the US CEO of the Chinese electric vehicle company Nio, is now the CEO of a startup Fable.

In academia, there are scores of Indian American Women heading departments and schools.

Among them are heads of large universities, Neeli Bendapudi, the president of Pennsylvania State University and Renu Khator, the chancellor of the University of Houston System.

Asha Rangappa, a former Federal Bureau of Investigation agent-turned-academic, has served as an associate dean of Yale University Law School.

Indian American women have soared into space as astronauts.

Kalpana Chawla, a mission specialist and robotic arms operator, was killed on her second mission when the space shuttle Columbia broke up as it reentered the earth’s atmosphere in 2003.

Sunita Williams has done a stint as the commander of the International Space Station (ISS), on one of her four missions at the multinational orbiting research facility.

The Bhagwad Gita and the Upanishad went to space with Williams, who said that for inspiration she took them along to the ISS, from where she conducted spacewalks.

On Earth as a Navy officer, Sunita Williams was deployed during the first Gulf War and later she became a test pilot.

While the other two were on NASA space missions, aeronautical engineer Sirisha Bandla went up on a spacecraft of the private venture by Virgin Galactic, where she is a vice president.

Geeta Gopinath is the first managing director of the International Monetary Fund, having made her mark as an economist in the Ivy League and as the organization’s chief economist.

In the US judiciary, there are several Indian American women, among them Neomi Rao, a judge of the US Court of Appeals for the District of Columbia Circuit, which is considered the most influential court below the Supreme Court.

The Biden administration has deployed Indian American Women in senior positions across government.

The most visible of them on media after Kamala Harris is Defense Department’s Deputy Spokesperson Sabrina Singh who often conducts the Pentagon’s media briefings laying out the administration’s strategic positions.

Also at that department, Radha Iyengar Plumb is the deputy under-secretary of defense.

At the White House, Neera Tanden, a veteran of Democratic Party campaigns, is an assistant to the president and domestic policy advisor.

Arati Prabhakar is the assistant to the President for Science and Technology and Science Advisor while heading the White House Office of Science and Technology Policy and to the President.

Shanthi Kalathil is a deputy assistant to the President and the National Security Council’s coordinator for democracy and human rights.

At the State Department, Uzra Zeya is the under-secretary of state for civilian security, democracy, and human rights, and Rao Gupta is the ambassador-at-Large for Global Women’s Issues.

And, in the other party, Harmeet Dhillon is a member Republican National Committee who ran an unsuccessful insurgent campaign to replace the chair, Ronna McDaniel. She is a co-chair of Women for Trump and Lawyers for Trump, groups that advocate for Trump.

In an unusual occupation was Sabrina De Souza who had served in a senior role as an undercover Central Intelligence Agency agent.

Unfortunately, her cover was blown while she was on an anti-terrorism mission in Italy and that country has tried to prosecute her for capturing a terrorist who was taken to the US.

On the other side, showing the diversity of political views, Gitanjali S. Gutierrez worked as a lawyer defending an alleged terrorist held by the US detention center on Guantanamo Bay.

On the trade unions front, Bhairavi Desai is the executive director of the Taxi Drivers’ Alliance, and Saru Jayaraman has organized restaurant workers in New York City.

In entertainment, Vera Mindy Chokalingam, better known as Mindy Kaling, made her mark with the sitcom, The Mindy Kaling Project, which she created, produced and starred in.

Biden awarded her the National Medal of the Arts in 2022. And, further into the unexpected venues, Nina Davuluri was crowned Miss America in 2014. (IANS)

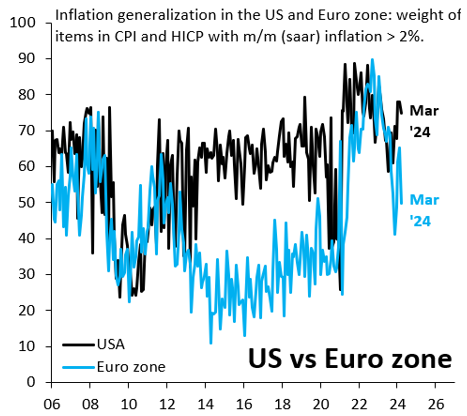

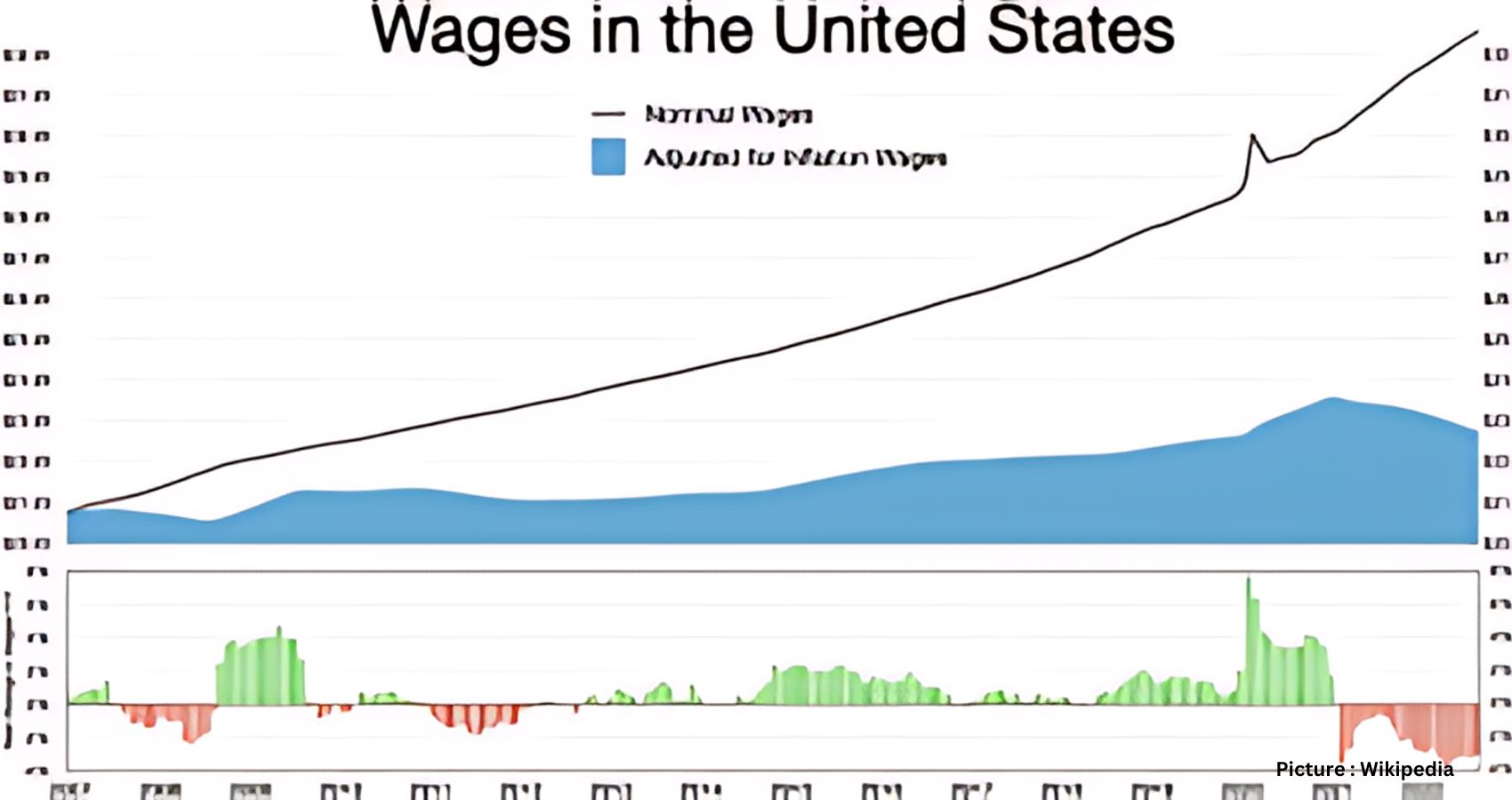

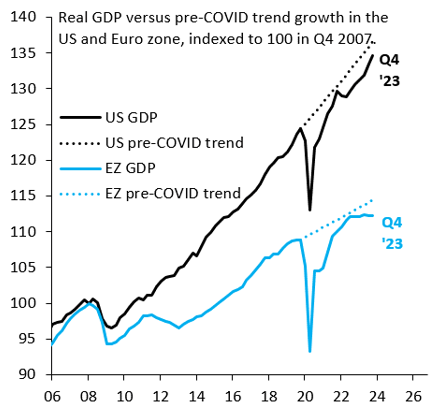

A stylized fact following the 2008 crisis is that U.S. growth substantially outperformed the rest of the advanced world. This again looks to be true in the aftermath of COVID-19 (Figure 1), with lots of debate on the underlying drivers. Some argue that this outperformance reflects loose fiscal policy and rapid immigration, while others see a productivity boom linked to tight labor markets. Whatever the source, cyclical outperformance may keep U.S. inflation stickier than elsewhere. There are some signs of this. Figure 2 shows the combined weight of items in the U.S. consumer price index (CPI) with month-over-month inflation above 2% (on a seasonally adjusted, annualized basis), alongside the same measure for the eurozone’s harmonized index of consumer prices (HICP). This metric is noisier than if we used year-over-year inflation, but it has the advantage of focusing on recent inflation dynamics, since there are no base effects to muddy the picture. Elevated inflation remains relatively broad-based in the U.S., consistent with strong growth, while inflation momentum is clearly fading in the eurozone.

A stylized fact following the 2008 crisis is that U.S. growth substantially outperformed the rest of the advanced world. This again looks to be true in the aftermath of COVID-19 (Figure 1), with lots of debate on the underlying drivers. Some argue that this outperformance reflects loose fiscal policy and rapid immigration, while others see a productivity boom linked to tight labor markets. Whatever the source, cyclical outperformance may keep U.S. inflation stickier than elsewhere. There are some signs of this. Figure 2 shows the combined weight of items in the U.S. consumer price index (CPI) with month-over-month inflation above 2% (on a seasonally adjusted, annualized basis), alongside the same measure for the eurozone’s harmonized index of consumer prices (HICP). This metric is noisier than if we used year-over-year inflation, but it has the advantage of focusing on recent inflation dynamics, since there are no base effects to muddy the picture. Elevated inflation remains relatively broad-based in the U.S., consistent with strong growth, while inflation momentum is clearly fading in the eurozone.