BOSTON–PropertyShark released its annual most expensive zip codes of 2021. New England is home to 11 of the priciest U.S. zip codes, including #2 with Boston’s Back Bay. The full list is included towards the end in this article.

Key Takeaways:

- At nearly $7.5 million, Atherton, Calif.’s 94027 remains #1 most expensive zip code for fifth consecutive year

- Record $5.5 million median sale price gives Boston’s 02199 #2 spot

- Top 10 most expensive zip codes in 2021 all surpass $4 million mark — a historic first

- 33109 in Miami jumps 66% Y-o-Y, becomes #5 priciest in U.S.

- Nationally, 30 zips feature median sale prices higher than $3 million, more than double the number of areas in 2020

- Country’s 100 most expensive zip codes located in 10 states, with 70% from California

- Bay Area claims 47 of nation’s most exclusive zip codes

- Los Angeles County remains priciest county with 21 entries

- Once again, San Francisco boasts highest concentration of pricey zip codes, while NYC drops out of top 20

- Gibson Island’s 97% Y-o-Y price surge claims Maryland’s highest position yet at #23

- Exclusive Lake Tahoe enclaves rule Nevada real estate, Paradise Valley returns Arizona for 3rdconsecutive year

Ranking the Priciest U.S. Zip Codes by Closed Home Sales

Even as another uniquely challenging year — marked by the efforts of tackling the pandemic and boosting the economy — is coming to an end, the U.S. residential market continues to experience vertical price trends. And, that picture is clearly visible in our 2021 edition of the 100 most expensive zip codes in the U.S. — which, for the first time ever, includes 127 zip codes due to multiple ties.

Compiled by calculating median home sale prices as opposed to listing prices to ensure an accurate picture of market conditions as opposed to selling prices that reflect sellers’ wishes, this year’s edition highlights the ever-increasingly competitive residential markets of economically vital urban centers.

The Bay Area, Los Angeles County, and New York City yet again have a heavy presence, joined by exclusive pockets of affluence scattered across the country, like Arizona’s Paradise Valley, Washington state’s Medina and Connecticut’s Fairfield County. What’s more, 2021’s competitive residential landscape is further evidenced by the country’s 10 most expensive zip codes — all of which surpassed the $4 million threshold, marking a new record.

For the full ranking of 2021’s 100 most expensive zip codes, scroll to the bottom of the page. For an even more detailed picture, explore last year’s rankings.

California Claims Overwhelming Majority of Expensive Zips Yet Again, Alongside New York & 8 Other States

Unsurprisingly, California continued to provide the bulk of the country’s most expensive zip codes: The Golden State originated 70% of all of the zip codes on this list, including six of the top 10 priciest. And, as usual, New York came in second, providing 17 zip codes in our ranking.

Unsurprisingly, California continued to provide the bulk of the country’s most expensive zip codes: The Golden State originated 70% of all of the zip codes on this list, including six of the top 10 priciest. And, as usual, New York came in second, providing 17 zip codes in our ranking.

Notably, New York logged three fewer than last year — demonstrating California’s more vertical price trends, as well as the pricing slowdown in NYC’s top markets. In fact, while 2020 marked the first time that no NYC zips ranked among the country’s 10 most expensive, 2021 brought another historic first for the East Coast giant: No NYC zip codes ranked among the 20 priciest in the U.S. this year, with the state represented only by the Hamptons at the top of our ranking.

The East Coast made its presence further known with Massachusetts, home to seven of the top 100 zips in the U.S., up from last year’s four. Not only that, but as sales activity improved in Boston’s Back Bay area, Massachusetts claimed the #2 most expensive zip code in the country with 02199’s $5.5 million median sale price, which was only surpassed by California’s Atherton at more than $7 million.

To the south, Connecticut’s presence also improved compared to previous years: For the first time since 2018, it contributed four zips to the country’s priciest, most of which ranked in the bottom half of our list — similar to the three zips provided by New Jersey. Out west, Nevada and Washington added two zips each, with Washington state claiming #10 with Medina’s ever pricey 98039.

Additionally, Arizona, Florida and Maryland each contributed one zip code. Florida claimed the #5 most expensive zip code with Miami Beach’s 33109 — the highest-ranking for the Sunshine State since 2017. Meanwhile, New Hampshire missed the top 100 this year, having secured a presence during the last two years with Rye Beach.

Maryland Claims Sharpest Price Gain at 97%, While NYC’s Upper West Side Contracts 39%

The U.S. residential market’s vertical price trends were evident among the country’s top zip codes as well, with 92 zips registering price gains — including 23 where the median surged by more than 25%. Conversely, only 12 locations among the priciest registered drops in their medians this year – by comparison, 2020 brought median increases to 78 zips and drops to 23 locations.

The U.S. residential market’s vertical price trends were evident among the country’s top zip codes as well, with 92 zips registering price gains — including 23 where the median surged by more than 25%. Conversely, only 12 locations among the priciest registered drops in their medians this year – by comparison, 2020 brought median increases to 78 zips and drops to 23 locations.

At the same time, a record 30 zip codes posted median sale prices of $3 million and above — more than double those in 2020 — with the top 10 most expensive zips coming in at $4 million and higher. Moreover, the last zip code to enter our ranking — San Francisco’s 94122 — did so with a 12% year-over-year (Y-o-Y) increase in its median sale price, managing to hold onto its #100 position from last year.

The sharpest price gain was claimed by 21056 in Maryland’s Gibson Island, which nearly doubled its median sale price, surging 97% Y-o-Y to hit $3,195,000. Gibson Island was followed by 89402 in Nevada’s Crystal Bay, which swelled 68% to reach #39 with a $2.5 million median. The third-sharpest gain was claimed by 33109 in Miami Beach, which rose 66% to a $4,475,00 median sale price to become the #5 most expensive zip code in 2021.

The sharpest price contraction was registered in NYC’s Upper West Side, where zip 10069 contracted 39% Y-o-Y to stabilize at $1,663,000. As a result, the Upper West Side zip dropped from last year’s #22 to #93 this year. Notably, this zip code was actually the leader of price growth in 2020, when its median shot up 42% Y-o-Y.

Across the country, the second-sharpest price drop was registered by 94904 in Greenbrae, Calif., which contracted 12% Y-o-Y. It was followed by Bridgehampton, N.Y.’s 11932, down 11% Y-o-Y. Located in the famously pricey Hamptons, 11932’s price contraction meant that this zip — which was the #7 most expensive in 2020 — came in at #31 this year, its lowest position in three years.

Unshakeable Atherton Maintains #1 Spot for 5th Consecutive Year, Boston Grabs #2 with Record $5.5M Median

A record-setting year for the most expensive zip codes in the U.S., the 10 priciest zip codes in the country now sport median sale prices of $4 million and above. All in all, the 10 most expensive zip codes in the U.S. were provided by five states (as opposed to last year’s three): California claimed six of the top 10 and was joined by Massachusetts, Florida and Washington, as well as New York, which was solely represented by the Hamptons.

Reaching a new record median sale price at $7,475,000, Atherton’s 94027 remains the #1 most expensive zip code in the U.S. for the fifth consecutive year — nearly $2 million ahead of the runner-up. Not only that, but the billionaire favorite also saw its median rise 7% Y-o-Y, suggesting that this exclusive enclave may continue to retain its leading position in the future.

Meanwhile, on the opposite coast, Boston’s 02199 was conspicuously absent last year due to depressed sales activity during the onset of the pandemic — despite that it historically features one of the highest median sale prices in the U.S. However, the Prudential Center area of Back Bay returned in 2021 with a $5.5 million median sale price — its highest figure yet. Consequently, Boston’s 02199 became the #2 most expensive zip code nationwide, outpacing even ultra-exclusive Hamptons enclaves.

Similarly, another well-established presence among the priciest zip codes in the country, Sagaponack’s 11962 was this year’s #3 most expensive zip code, dropping from the runner-up slot it held for three consecutive years, despite a 29% Y-o-Y price uptick that raised its median sale price from $3,875,000 to $5 million. It was also the only zip from New York state to rank in the top 10, as NYC lost further pricing ground, failing to rank a single zip among even the top 20.

In Ross, Calif., 94957 retained its previous year’s position at #4 with a $4,583,000 median sale price, the result of a 27% Y-o-Y increase. A favorite of Silicon Valley executives and celebrities, this marked the first time that Ross surpassed the $4 million pricing mark.

Conversely, Miami Beach’s 33109 may have ventured into the $4 million and over category back in 2017, but this exclusive Florida enclave reached new pricing heights in 2021: 33109 on exclusive Fisher Island stabilized at $4,475,000 to become the #5 most expensive zip code after a staggering 66% Y-o-Y price jump.

Bay Area Still the Priciest Metro with 47 of the Top U.S. Zip Codes

As has increasingly been the case in recent years, greater Los Angeles, the vast New York metropolitan area and the Bay Area remained the leading metros for pricey zip codes. In particular, the Bay Area was yet again the uncontested leader, contributing 47 zip codes to our list — including three of the top 10 zips — while the greater Los Angeles was represented by 30 Orange and L.A. County zips.

The New York metro was represented by 22 zip codes, with only six of those from NYC proper and the rest located in the Hamptons, Nassau County and Westchester, as well as Connecticut’s Fairfield County and New Jersey’s Bergen and Monmouth counties.

L.A. County Remains Most Expensive, Santa Clara & San Mateo Form Pricey Zip Supercluster

Clearly, not even the tech dollars of Silicon Valley could unseat Los Angeles County, which again was the hottest county in the country for expensive real estate with 21 of the priciest zips in the U.S. Its most expensive zip was Beverly Hills’ famed 90210, a veteran of our yearly rankings and the #6 nationally with a $4,125,000 median sale price.

Not to be outdone, the Bay Area’s Santa Clara and San Mateo counties contributed 15 and 10 zips, respectively, to our ranking as the second- and third-most expensive counties in the U.S. As a result, they form a nearly contiguous supercluster of ultra-expensive zip codes that cover high-profile tech centers such as Menlo Park, Mountain View, Palo Alto, San Jose and Sunnyvale. And, while San Mateo’s top zip was overall leader 94027 in Atherton, Santa Clara’s highest-ranking zip was 94022 in Los Altos, which landed at #9 with a $4,052,000 median sale price.

A special note goes to Santa Barbara County, which increased its presence from just one zip code in 2020 to five in 2021. Its top zip code was 93108 in Santa Barbara’s exclusive enclave of Montecito — home to the likes of Oprah and former royals Prince Harry and Meghan Markle — which claimed #7 overall with a $4,103,000 median, following a 40% Y-o-Y pricing jump.

San Francisco, Los Angeles & New York City Hold Highest Concentrations of Exclusive Zips

For the fifth year in a row, San Francisco had the highest concentration of expensive zip codes of any city, ranking seven among the top 10. It was followed by Los Angeles and NYC, with six zips each. However, while San Francisco led the way, most of its zip codes were actually in the bottom half of our ranking: Its priciest zip (94123) placed at #46 — down 10 positions compared to 2020, despite a 7% uptick in its median. Covering the iconic Marina District, 94123 featured a $2,307,000 median sale price.

Of L.A.’s six zips that ranked nationally, its top three — 90272, 90077 and 90049 — form an uninterrupted cluster of pricey real estate with medians greater than $2 million. The trio was led by Pacific Palisades’ 90272 at #21 with a $3.25 million median sale price after an 18% Y-o-Y increase. Covering Bel Air, Holmby Hills and areas of Beverly Glenn, 90077 was #42 nationally with a $2.46 million median, while Brentwood’s 90049 grabbed #52 at $2,165,000.

Back in the Empire State, NYC’s presence weakened yet again: While 2020 marked the first time ever that no NYC zip codes were among the country’s 10 most expensive, in 2021, NYC came in below the top 20, too. More precisely, its most expensive zip — 10013 — just missed out, landing at #22 with a $3,212,000 median sale price, followed by 10007 at #25 with a median of $3,125,000.

Next up, Newport Beach had the the third-highest concentration of pricey zips in a city, with five entries, followed by Santa Barbara with four. Specifically, the most expensive Newport Beach zip — Balboa’s 92662 — grabbed #15 with a $3,577,000, while Santa Barbara’s top zip — 93108 in the exclusive community of Montecito — was #7 nationally.

Sagaponack Finishes as #3 Priciest Nationally, NYC Drops Out of Top 20

Usually one of the strongest presences in the 100 most expensive zip codes in the U.S. (second only to California), New York state retained its position in 2021 — although with a weakened presence. Specifically, the state recorded just 17 zip codes, only six of which were in NYC. Historically speaking, the East Coast powerhouse has had a strong presence in the uppermost levels of our ranking, but only two New York state zips were among the 20 most expensive in 2021 — none of which were in New York City proper.

Rather, the Hamptons’ 11962 in Sagaponack was the #3 most expensive zip code in the U.S. And, although its median sale price of $5 million was up 29% Y-o-Y, Boston’s Back Bay pushed it down one position, ending Sagaponack’s three-year reign as runner-up to the priciest zip code in the country.

The next-highest New York zip code was fellow Hamptons zip 11976 in Water Mill, which came in at #13 with a $3,745,000 median sale price, up an impressive 51% Y-o-Y. At the same time, last year’s #7 nationally — 11932 in Bridgehampton— dropped to #31 after an 11% Y-o-Y price contraction suppressed its median to $2,963,000.

Other zip codes outside of NYC included four more Hamptons locations: The pricey North Shore’s 11568 in Old Westbury which climbed to #62 with a $1.95 million median, as well as two Westchester zip codes. The latter included top 100 veteran 10580 in Rye at #72, plus newcomer 10577 in Purchase, which placed 88th with a $1.7 million median sale price.

Of NYC’s famously expensive real estate, only six zip codes ranked nationally in 2021. And, as a historic first, not one of them placed among the country’s 20 most expensive. Overall, NYC’s top two zips were Manhattan’s 10013 and 10007, claiming #22 and #25, respectively.

To be precise, 10013 — which covers parts of TriBeCa, SoHo, Little Italy and Hudson Square — posted a $3,212,000 median sale price, up 7% Y-o-Y, but still reeling from the 19% price crunch it experienced in 2020. Likewise, Downtown Manhattan, TriBeCa and SoHo’s 10007 posted a $3,125,000 median sale price, dropping 14 spots Y-o-Y. They were followed by Battery Park City’s 10282 with its $2,725,000 median at #35.

And, while Brooklyn made waves in 2019 with zip 11231’s break into the top 100, the Red Hook and Carroll Gardens zip code departed the top 100 in 2021 after a two-year stint, outpaced by sharper price gains in dozens of other zip codes nationwide.

At $2M Median, Alpine’s 07620 Leads New Jersey Real Estate for 5th Consecutive Year

While the Mid-Atlantic region was, as expected, dominated by exclusive New York locations, three New Jersey zip codes also represented the region — the highest number New Jersey has ever contributed to our list. Just 15 miles from Midtown Manhattan and with a $2 million median sale price, 07620 in Bergen County’s Alpine was the most expensive New Jersey zip code. Landing at #58 nationally, Alpine’s median was up 38% Y-o-Y, but, nonetheless, fell short of its 2018 pricing high of $2.2 million.

Alpine was joined by two beach communities, with 08750 in Monmouth County’s Sea Girt placing #70 nationally with a $1,892,000 median sale price, and 08202 in Cape May County’s Avalon landing at #92 with a $1.67 million median. Notably, both zip codes ranked among the 100 most expensive zip codes in the country for the first time.

New England Home to 11 of the Priciest U.S. Zip Codes, Including #2 with Boston’s Back Bay

Further north, New England originated 11 of the most expensive zip codes in the country — the highest figure yet for the region — with Massachusetts contributing seven zips and Connecticut adding four. What’s more, New England also provided the #2 most expensive zip code in the U.S. with Boston’s ultra-pricey 02199.

Zip 02199, which covers the Prudential Center area of Back Bay, usually ranks among the country’s most expensive areas, but was conspicuously absent in 2020 due to depressed sales activity. However, in 2021, zip 02199 returned not only to its highest position yet at #2 nationally, but also reached a new pricing record with a $5.5 million median sale price.

Meanwhile, Nantucket’s 02554 was Massachusetts’ next most expensive zip code, with its $2 million median sale price placing it #58 nationally and marking a new median peak for the exclusive island. It was followed by Weston’s 02493 at $1.85 million,as well as Wellesley Hills’ 02481, Waban’s 02468 and Chilmark’s 02535. Boston also ranked a second time with Beacon Hill and Downtown Boston’s zip 02108, which was the 91st most expensive in the U.S. at $1,673,000.

Connecticut was represented by four Fairfield County zip codes that regularly post some of the highest median sale prices in the country: Greenwich’s perennial representative, 06830, reached its highest median sale price yet at $2.05 million — up 36% Y-o-Y. It was joined by another Greenwich zip code, newcomer 06831, which claimed the #94 spot with a $1,653,000 median.

Notably, last year’s most expensive New England zip — Riverside, Conn.’s 06878 — was only the 4th priciest in the region this year, despite reaching a new median sale price high at $1.98 million. Finally, Connecticut’s contributions were rounded out by 06870 in Old Greenwich, which returned to national rankings after last year’s absence with a $1,807,000 median in 2021 — its highest pricing point yet.

Miami Beach Returns to Top 10 Nationally, Maryland’s Gibson Island Hits Historic $3M Mark

Down south, Florida’s perennially pricey 33109 zip in Miami Beach’s Fisher Island was on the upswing compared to last year, climbing all the way from #23 to #5 nationally. And, although it wasn’t the highest position yet for the popular celebrity location (having been the #3 most expensive in the U.S. in 2017), the exclusive 33109 zip nevertheless reached a new pricing peak in 2021 with its $4,475,000 median. That came as the result of a 66% Y-o-Y price surge — the third-sharpest increase among the country’s 100 leading zip codes.

In Maryland, Gibson Island’s 21056 was among the most expensive zip codes in the U.S. yet again and marked the sixth consecutive year that it has led the state in terms of pricing. However, while 21056 usually ranked in the bottom half of our list (even ranking at #100 in 2019), the Chesapeake Bay community reached its highest position yet this year, placing #23 nationally. That was the result of a whopping 97% Y-o-Y surge — by far the sharpest gain among the country’s top zips. Not only that, but by nearly doubling its median year-over-year, Gibson Island also reached a $3,195,000 median sale price — nearly double its previous record from 2016.

Arizona & Nevada’s Most Expensive Communities Enter Top 50 for 1st Time

Across the country, the Mountain States were again led by three high-income enclaves — Nevada’s Glenbrook and Crystal Bay on the shores of Lake Tahoe, as well as Arizona’s Paradise Valley — marking the first time that all three landed in the upper half of our ranking.

Specifically, 85253 in Arizona’s Paradise Valley claimed #50 after a 41% Y-o-Y price jump raised its median to $2,175,000. A favorite of some of the highest-profile rock stars in the world, the Maricopa County zip finally broke into the country’s most expensive zip codes in 2019, although it had already been the leader of pricey Arizona real estate for years.

Nevada was represented by two zip codes — 89413 and 89402 — for the third consecutive year, with both Lake Tahoe enclaves reaching their highest positions and pricing points to date. In particular, Glenbrook’s 89413 placed in the upper third of our ranking, landing at #29 with a record $3 million median sale price, the result of a 38% Y-o-Y price jump.

The Douglas County zip was joined by 89402 in Washoe County’s Crystal Bay at #39 with a record $2.5 million median sale price. Up 56 positions compared to last year, 89402 logged a staggering 68% median sale price surge, the second-sharpest price increase among the country’s top 100 zips.

Exclusive King County Enclaves Lead Pacific Northwest’s Priciest Real Estate

About 1,000 miles further north, the Pacific Northwest was, once again, represented not by Seattle or Portland, but by the high-income enclaves of Medina and Mercer Island in Washington state.

Specifically, Medina’s 98039 reached its highest pricing point with a $4 million median. This was the result of a 24% Y-o-Y increase that helped the tech-billionaire favorite remain among the most exclusive zip codes in the U.S., ranking as the #10 priciest. It’s also worth noting that 2021 marked the sixth consecutive year that Medina’s 98039 was the undisputed leader of expensive real estate in the Pacific Northwest.

And, returning to our list after its 2019 debut, fellow King County zip 98040 landed at #82. Also a favorite of tech executives, high-profile sports figures and media personalities, the Mercer Island zip code posted a $1,795,000 median sale price.

| # |

Zip Code |

Location |

County |

State |

Median Sale Price 2021 |

| 1 |

94027 |

Atherton |

San Mateo County |

CA |

$7,475,000 |

| 2 |

2199 |

Boston |

Suffolk County |

MA |

$5,500,000 |

| 3 |

11962 |

Sagaponack |

Suffolk County |

NY |

$5,000,000 |

| 4 |

94957 |

Ross |

Marin County |

CA |

$4,583,000 |

| 5 |

33109 |

Miami Beach |

Miami-Dade County |

FL |

$4,475,000 |

| 6 |

90210 |

Beverly Hills |

Los Angeles County |

CA |

$4,125,000 |

| 7 |

93108 |

Santa Barbara |

Santa Barbara County |

CA |

$4,103,000 |

| 8 |

90402 |

Santa Monica |

Los Angeles County |

CA |

$4,058,000 |

| 9 |

94022 |

Los Altos |

Santa Clara County |

CA |

$4,052,000 |

| 10 |

98039 |

Medina |

King County |

WA |

$4,000,000 |

| 11 |

94024 |

Los Altos |

Santa Clara County |

CA |

$3,856,000 |

| 12 |

94301 |

Palo Alto |

Santa Clara County |

CA |

$3,800,000 |

| 13 |

11976 |

Water Mill |

Suffolk County |

NY |

$3,745,000 |

| 14 |

90742 |

Huntington Beach |

Orange County |

CA |

$3,625,000 |

| 15 |

92662 |

Newport Beach |

Orange County |

CA |

$3,577,000 |

| 16 |

94970 |

Stinson Beach |

Marin County |

CA |

$3,500,000 |

| 17 |

94028 |

Portola Valley |

San Mateo County |

CA |

$3,400,000 |

| 18 |

92067 |

Rancho Santa Fe |

San Diego County |

CA |

$3,399,000 |

| 19 |

92657 |

Newport Beach |

Orange County |

CA |

$3,365,000 |

| 20 |

92661 |

Newport Beach |

Orange County |

CA |

$3,293,000 |

| 21 |

90265 |

Malibu |

Los Angeles County |

CA |

$3,250,000 |

| 21 |

90272 |

Los Angeles |

Los Angeles County |

CA |

$3,250,000 |

| 22 |

10013 |

New York |

New York County |

NY |

$3,212,000 |

| 23 |

21056 |

Gibson Island |

Anne Arundel County |

MD |

$3,195,000 |

| 24 |

95070 |

Saratoga |

Santa Clara County |

CA |

$3,150,000 |

| 25 |

10007 |

New York |

New York County |

NY |

$3,125,000 |

| 26 |

94528 |

Diablo |

Contra Costa County |

CA |

$3,100,000 |

| 27 |

94010 |

Hillsborough/Burlingame |

San Mateo County |

CA |

$3,075,000 |

| 28 |

94920 |

Belvedere Tiburon |

Marin County |

CA |

$3,050,000 |

| 29 |

89413 |

Glenbrook |

Douglas County |

NV |

$3,000,000 |

| 30 |

95030 |

Los Gatos |

Santa Clara County |

CA |

$2,995,000 |

| 31 |

11932 |

Bridgehampton |

Suffolk County |

NY |

$2,963,000 |

| 32 |

90266 |

Manhattan Beach |

Los Angeles County |

CA |

$2,910,000 |

| 33 |

94306 |

Palo Alto |

Santa Clara County |

CA |

$2,810,000 |

| 34 |

93953 |

Pebble Beach |

Monterey County |

CA |

$2,750,000 |

| 34 |

11975 |

Wainscott |

Suffolk County |

NY |

$2,750,000 |

| 35 |

10282 |

New York |

New York County |

NY |

$2,725,000 |

| 36 |

92625 |

Corona Del Mar |

Orange County |

CA |

$2,695,000 |

| 37 |

11930 |

Amagansett |

Suffolk County |

NY |

$2,645,000 |

| 38 |

11959 |

Quogue |

Suffolk County |

NY |

$2,593,000 |

| 39 |

94025 |

Menlo Park |

San Mateo County |

CA |

$2,500,000 |

| 39 |

94062 |

Redwood City |

San Mateo County |

CA |

$2,500,000 |

| 39 |

89402 |

Crystal Bay |

Washoe County |

NV |

$2,500,000 |

| 40 |

91108 |

San Marino |

Los Angeles County |

CA |

$2,490,000 |

| 41 |

92651 |

Laguna Beach |

Orange County |

CA |

$2,475,000 |

| 42 |

90077 |

Los Angeles |

Los Angeles County |

CA |

$2,460,000 |

| 43 |

90212 |

Beverly Hills |

Los Angeles County |

CA |

$2,429,000 |

| 44 |

94507 |

Alamo |

Contra Costa County |

CA |

$2,400,000 |

| 45 |

95014 |

Cupertino |

Santa Clara County |

CA |

$2,310,000 |

| 46 |

94123 |

San Francisco |

San Francisco County |

CA |

$2,307,000 |

| 47 |

93921 |

Carmel By The Sea |

Monterey County |

CA |

$2,300,000 |

| 48 |

93067 |

Summerland |

Santa Barbara County |

CA |

$2,190,000 |

| 49 |

94087 |

Sunnyvale |

Santa Clara County |

CA |

$2,180,000 |

| 50 |

85253 |

Paradise Valley |

Maricopa County |

AZ |

$2,175,000 |

| 51 |

10001 |

New York |

New York County |

NY |

$2,171,000 |

| 52 |

90049 |

Los Angeles |

Los Angeles County |

CA |

$2,165,000 |

| 53 |

90274 |

Rolling Hills |

Los Angeles County |

CA |

$2,118,000 |

| 54 |

92660 |

Newport Beach |

Orange County |

CA |

$2,111,000 |

| 55 |

94040 |

Mountain View |

Santa Clara County |

CA |

$2,100,000 |

| 55 |

93920 |

Big Sur |

Monterey County |

CA |

$2,100,000 |

| 56 |

94070 |

San Carlos |

San Mateo County |

CA |

$2,055,000 |

| 57 |

6830 |

Greenwich |

Fairfield County |

CT |

$2,050,000 |

| 58 |

2554 |

Nantucket |

Nantucket County |

MA |

$2,000,000 |

| 58 |

94127 |

San Francisco |

San Francisco County |

CA |

$2,000,000 |

| 58 |

7620 |

Alpine |

Bergen County |

NJ |

$2,000,000 |

| 58 |

91008 |

Bradbury |

Los Angeles County |

CA |

$2,000,000 |

| 59 |

90048 |

Los Angeles |

Los Angeles County |

CA |

$1,985,000 |

| 59 |

94041 |

Mountain View |

Santa Clara County |

CA |

$1,985,000 |

| 59 |

91436 |

Encino |

Los Angeles County |

CA |

$1,985,000 |

| 60 |

90254 |

Hermosa Beach |

Los Angeles County |

CA |

$1,980,000 |

| 60 |

6878 |

Riverside |

Fairfield County |

CT |

$1,980,000 |

| 61 |

94402 |

San Mateo |

San Mateo County |

CA |

$1,968,000 |

| 62 |

11568 |

Old Westbury |

Nassau County |

NY |

$1,950,000 |

| 62 |

94002 |

Belmont |

San Mateo County |

CA |

$1,950,000 |

| 63 |

92118 |

Coronado |

San Diego County |

CA |

$1,940,000 |

| 64 |

10012 |

New York |

New York County |

NY |

$1,935,000 |

| 65 |

91302 |

Calabasas |

Los Angeles County |

CA |

$1,925,000 |

| 66 |

94705 |

Berkeley |

Alameda County |

CA |

$1,913,000 |

| 67 |

95032 |

Los Gatos |

Santa Clara County |

CA |

$1,911,000 |

| 68 |

90291 |

Venice |

Los Angeles County |

CA |

$1,907,000 |

| 69 |

95129 |

San Jose |

Santa Clara County |

CA |

$1,900,000 |

| 69 |

94563 |

Orinda |

Contra Costa County |

CA |

$1,900,000 |

| 69 |

91011 |

La Canada Flintridge |

Los Angeles County |

CA |

$1,900,000 |

| 69 |

90036 |

Los Angeles |

Los Angeles County |

CA |

$1,900,000 |

| 69 |

11963 |

Sag Harbor |

Suffolk County |

NY |

$1,900,000 |

| 70 |

8750 |

Sea Girt |

Monmouth County |

NJ |

$1,892,000 |

| 71 |

94118 |

San Francisco |

San Francisco County |

CA |

$1,868,000 |

| 72 |

10580 |

Rye |

Westchester County |

NY |

$1,861,000 |

| 73 |

94506 |

Danville |

Contra Costa County |

CA |

$1,860,000 |

| 73 |

94939 |

Larkspur |

Marin County |

CA |

$1,860,000 |

| 74 |

90211 |

Beverly Hills |

Los Angeles County |

CA |

$1,850,000 |

| 74 |

95120 |

San Jose |

Santa Clara County |

CA |

$1,850,000 |

| 74 |

2493 |

Weston |

Middlesex County |

MA |

$1,850,000 |

| 74 |

92014 |

Del Mar |

San Diego County |

CA |

$1,850,000 |

| 75 |

94904 |

Greenbrae |

Marin County |

CA |

$1,849,000 |

| 76 |

92663 |

Newport Beach |

Orange County |

CA |

$1,845,000 |

| 77 |

94030 |

Millbrae |

San Mateo County |

CA |

$1,840,000 |

| 78 |

94114 |

San Francisco |

San Francisco County |

CA |

$1,830,000 |

| 79 |

90232 |

Culver City |

Los Angeles County |

CA |

$1,819,000 |

| 80 |

6870 |

Old Greenwich |

Fairfield County |

CT |

$1,807,000 |

|

|

|

|

|

|

|

|

| 81 |

93109 |

Santa Barbara |

Santa Barbara County |

CA |

$1,805,000 |

| 82 |

98040 |

Mercer Island |

King County |

WA |

$1,795,000 |

| 83 |

94549 |

Lafayette |

Contra Costa County |

CA |

$1,775,000 |

| 84 |

94061 |

Redwood City |

San Mateo County |

CA |

$1,773,000 |

| 85 |

94941 |

Mill Valley |

Marin County |

CA |

$1,758,000 |

| 86 |

2481 |

Wellesley Hills |

Norfolk County |

MA |

$1,756,000 |

| 87 |

94121 |

San Francisco |

San Francisco County |

CA |

$1,701,000 |

| 88 |

95130 |

San Jose |

Santa Clara County |

CA |

$1,700,000 |

| 88 |

10577 |

Purchase |

Westchester County |

NY |

$1,700,000 |

| 89 |

2468 |

Waban |

Middlesex County |

MA |

$1,695,000 |

| 90 |

93103 |

Santa Barbara |

Santa Barbara County |

CA |

$1,682,000 |

| 91 |

93923 |

Carmel |

Monterey County |

CA |

$1,665,000 |

| 91 |

2108 |

Boston |

Suffolk County |

MA |

$1,673,000 |

| 92 |

8202 |

Avalon |

Cape May County |

NJ |

$1,670,000 |

| 93 |

2535 |

Chilmark |

Dukes County |

MA |

$1,663,000 |

| 93 |

10069 |

New York |

New York County |

NY |

$1,663,000 |

| 94 |

6831 |

Greenwich |

Fairfield County |

CT |

$1,653,000 |

| 95 |

93110 |

Santa Barbara |

Santa Barbara County |

CA |

$1,650,000 |

| 95 |

94131 |

San Francisco |

San Francisco County |

CA |

$1,650,000 |

| 95 |

94574 |

Saint Helena |

Napa County |

CA |

$1,650,000 |

| 95 |

92861 |

Villa Park |

Orange County |

CA |

$1,650,000 |

| 95 |

94707 |

Berkeley |

Alameda County |

CA |

$1,650,000 |

| 96 |

11030 |

Manhasset |

Nassau County |

NY |

$1,647,000 |

| 97 |

94960 |

San Anselmo |

Marin County |

CA |

$1,645,000 |

| 98 |

90027 |

Los Angeles |

Los Angeles County |

CA |

$1,640,000 |

| 99 |

94303 |

Palo Alto |

Santa Clara County |

CA |

$1,633,000 |

| 100 |

94122 |

San Francisco |

San Francisco County |

CA |

$1,627,000 |

Make sure to explore 2020’s rankings as well.

Methodology

To determine the most expensive zip codes in the U.S., we looked at residential transactions closed between January 1, 2021, and October 22, 2021, taking into account condos, co-ops, and single- and two-family homes. All package deals were excluded.

For an accurate representation, we considered only zip codes that registered a minimum of three residential transactions. Due to a number of ties, 127 zips made it onto our list of the 100 most expensive zip codes in 2021.

2020 and 2021 median sale prices were rounded to the nearest $1,000.

The Bay Area was defined as Alameda, Contra Costa, Marin, Napa, Santa Clara, San Francisco, San Mateo, Sonoma and Solano counties; the Los Angeles metropolitan area was defined as Los Angeles County and Orange County; and the 23-county New York metropolitan area was defined as New York City, Long Island, the Mid- and Lower Hudson Valley, Central and Northern New Jersey, Western Connecticut and Pike County, Penn

The president also wants Congress to impose financial penalties on oil and gas companies that lease public lands but are not producing. He said he will invoke the Defense Production Act to encourage the mining of critical minerals for batteries in electric vehicles, part of a broader push to shift toward cleaner energy sources and reduce the use of fossil fuels. The actions show that oil remains a vulnerability for the U.S. Higher prices have hurt Biden’s approval domestically and added billions of oil-export dollars to the Russian government as it wages war on Ukraine.

The president also wants Congress to impose financial penalties on oil and gas companies that lease public lands but are not producing. He said he will invoke the Defense Production Act to encourage the mining of critical minerals for batteries in electric vehicles, part of a broader push to shift toward cleaner energy sources and reduce the use of fossil fuels. The actions show that oil remains a vulnerability for the U.S. Higher prices have hurt Biden’s approval domestically and added billions of oil-export dollars to the Russian government as it wages war on Ukraine.

As per figures released by Immigration, Refugees and Citizenship Canada (IRCC), it also issued 450,000 study permit applications. As of December 31, 2021, of the approximately 622,000 foreign students in Canada, Indians number as high as 217,410.

As per figures released by Immigration, Refugees and Citizenship Canada (IRCC), it also issued 450,000 study permit applications. As of December 31, 2021, of the approximately 622,000 foreign students in Canada, Indians number as high as 217,410.

Canada’s Post-Graduation Work Permit Program (PGWPP), America’s Optional Training Program (OPT) and Britain’s New Graduate Pathway (GR) offer opportunities for good placements after postgraduation which are a major attraction among Indian students to advance their career.

Canada’s Post-Graduation Work Permit Program (PGWPP), America’s Optional Training Program (OPT) and Britain’s New Graduate Pathway (GR) offer opportunities for good placements after postgraduation which are a major attraction among Indian students to advance their career.

How will these historic measures play out? Economic sanctions rarely succeed at achieving their goals. Western policymakers frequently assume that failures stem from weaknesses in sanctions design.

How will these historic measures play out? Economic sanctions rarely succeed at achieving their goals. Western policymakers frequently assume that failures stem from weaknesses in sanctions design.

Withdrawal of major Western transnational companies – such as Shell, McDonald’s and Apple – will undoubtedly hurt many Russians – not only oligarchs, their ostensible target.

Withdrawal of major Western transnational companies – such as Shell, McDonald’s and Apple – will undoubtedly hurt many Russians – not only oligarchs, their ostensible target.

The majority of parents reported concerns regarding child(ren)’s development, including social life or development (73%), academic development (71%) and emotional health or development (71%). More than two-thirds of parents reported concern about the pandemic’s impact on their child’s cognitive development (68%) and their physical health/development (68%).

The majority of parents reported concerns regarding child(ren)’s development, including social life or development (73%), academic development (71%) and emotional health or development (71%). More than two-thirds of parents reported concern about the pandemic’s impact on their child’s cognitive development (68%) and their physical health/development (68%).

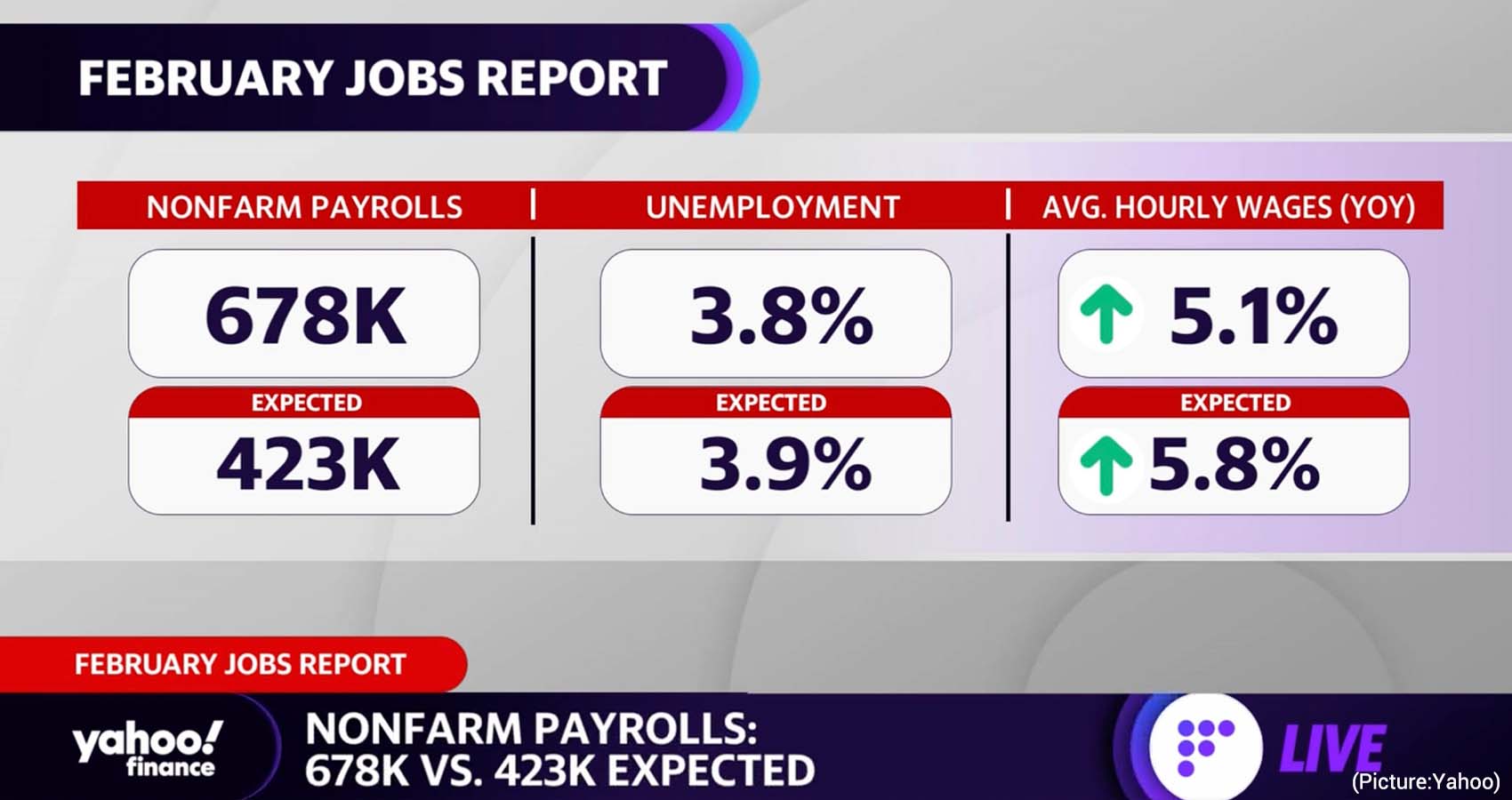

“If we see more numbers like this moving forward, we can be optimistic about this year. Employment is growing at a strong rate and joblessness is getting closer and closer to pre-pandemic levels,” said Nick Bunker, economic research director at Indeed.

“If we see more numbers like this moving forward, we can be optimistic about this year. Employment is growing at a strong rate and joblessness is getting closer and closer to pre-pandemic levels,” said Nick Bunker, economic research director at Indeed.

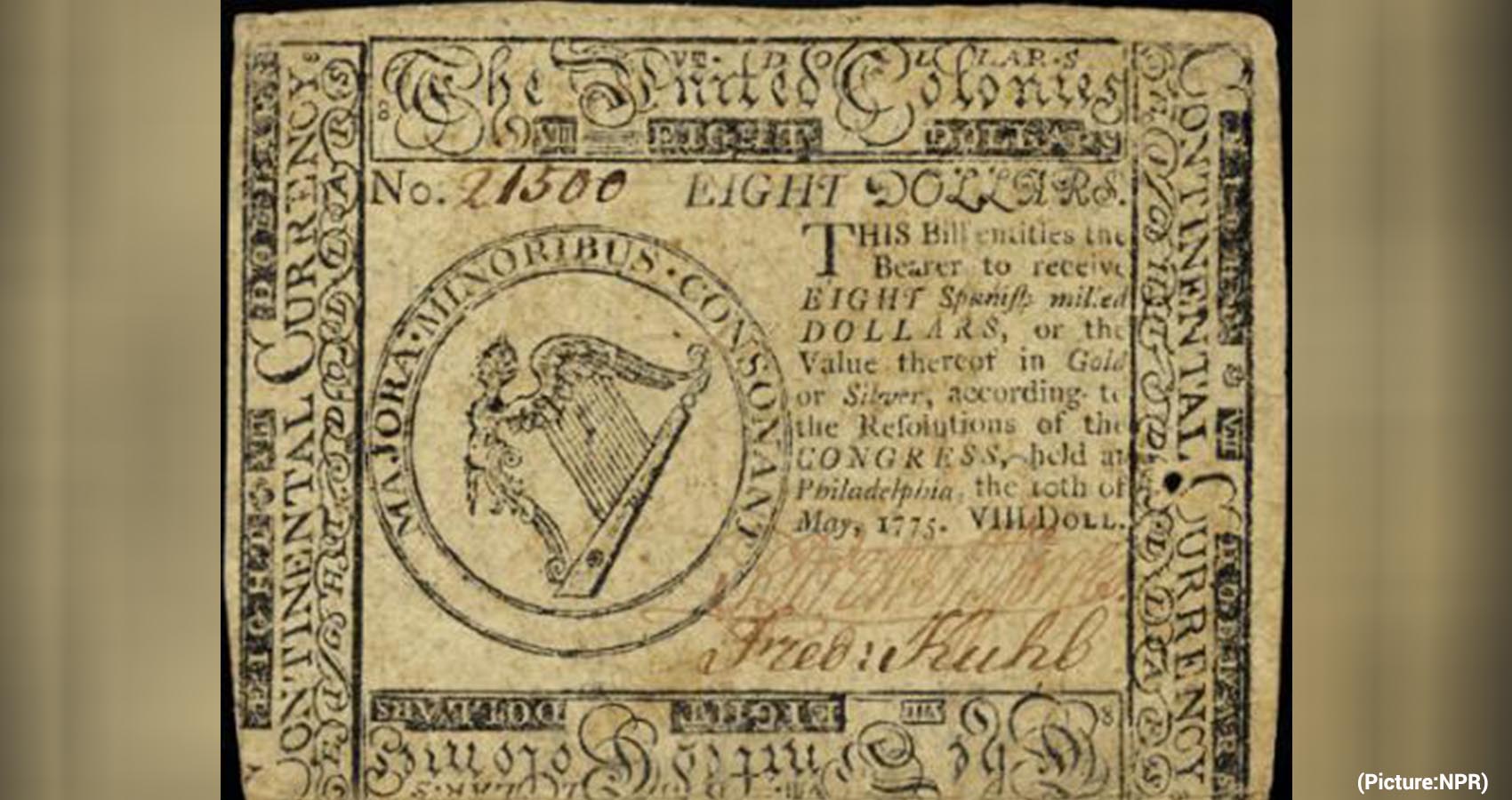

Policymakers stress these are early days yet, and there is a lot that needs to be hammered out. All in all, the transactions conducted with digital dollars probably wouldn’t seem too different from existing private alternatives that allow us to pay for things by bringing our smartphones next to digital readers.

Policymakers stress these are early days yet, and there is a lot that needs to be hammered out. All in all, the transactions conducted with digital dollars probably wouldn’t seem too different from existing private alternatives that allow us to pay for things by bringing our smartphones next to digital readers.

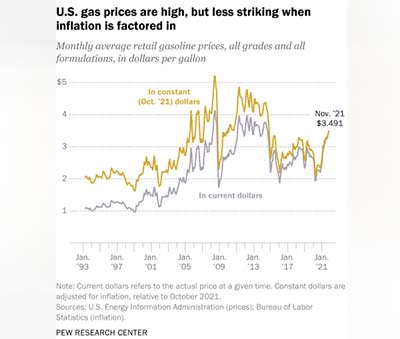

Oil has surged by 37% since closing at a recent low of $65.57 a barrel on December 1 amid Omicron fears and the fallout from the US-led intervention into energy markets.

Oil has surged by 37% since closing at a recent low of $65.57 a barrel on December 1 amid Omicron fears and the fallout from the US-led intervention into energy markets.

The RBI has already been keenly watching the performance of major economies worldwide and their respective central banks for CBDC schemes. As a result, the central bank has almost decided on the issue of official digital currency. While the Reserve Bank mentions the need for central banking digital currency (CBDC), it also makes it clear that the government is concerned about the risks surrounding other cryptocurrencies. Why has the government not yet officially banned such currencies? Why did the Supreme Court overturn the ban on banks operating cryptocurrencies? The questions are numerous.

The RBI has already been keenly watching the performance of major economies worldwide and their respective central banks for CBDC schemes. As a result, the central bank has almost decided on the issue of official digital currency. While the Reserve Bank mentions the need for central banking digital currency (CBDC), it also makes it clear that the government is concerned about the risks surrounding other cryptocurrencies. Why has the government not yet officially banned such currencies? Why did the Supreme Court overturn the ban on banks operating cryptocurrencies? The questions are numerous.

These trends point to the emergence of a very different poverty landscape. Whereas in 1990, poverty was concentrated in low-income, Asian countries, today’s (and tomorrow’s) poverty is largely found in sub-Saharan Africa and fragile and conflict-affected states. By 2030, sub-Saharan African countries will account for 9 of the top 10 countries by poverty headcount. Sixty percent of the global poor will live in fragile and conflict-affected states. Many of the top poverty destinations in the next decade will fall into both of these categories: Nigeria, Democratic Republic of the Congo, Mozambique and Somalia. Global efforts to achieve the SDGs by 2030, including eliminating extreme poverty, will be complicated by the concentration of poverty in these fragile and hard-to-reach contexts.

These trends point to the emergence of a very different poverty landscape. Whereas in 1990, poverty was concentrated in low-income, Asian countries, today’s (and tomorrow’s) poverty is largely found in sub-Saharan Africa and fragile and conflict-affected states. By 2030, sub-Saharan African countries will account for 9 of the top 10 countries by poverty headcount. Sixty percent of the global poor will live in fragile and conflict-affected states. Many of the top poverty destinations in the next decade will fall into both of these categories: Nigeria, Democratic Republic of the Congo, Mozambique and Somalia. Global efforts to achieve the SDGs by 2030, including eliminating extreme poverty, will be complicated by the concentration of poverty in these fragile and hard-to-reach contexts.

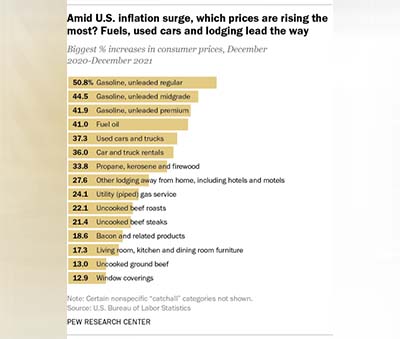

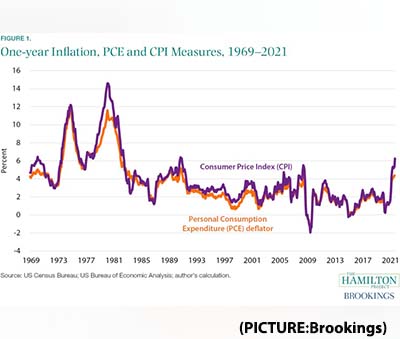

The Bureau of Labor Statistics (BLS), which is responsible for the CPI, starts by collecting price data for hundreds of discrete goods and services – the so-called “market basket” – from around 8,000 housing units and 23,000 retailers, service providers and online outlets in 75 urban areas around the country. Data on rents is gathered from some 50,000 landlords and tenants. The items sampled, and their weights in the overall index, are determined by the

The Bureau of Labor Statistics (BLS), which is responsible for the CPI, starts by collecting price data for hundreds of discrete goods and services – the so-called “market basket” – from around 8,000 housing units and 23,000 retailers, service providers and online outlets in 75 urban areas around the country. Data on rents is gathered from some 50,000 landlords and tenants. The items sampled, and their weights in the overall index, are determined by the

India’s Finance Minister

India’s Finance Minister

It advocates a one per cent surcharge on the richest 10 per cent of the Indian population to fund inequality combating measures such as higher investments in school education, universal healthcare, and social security benefits like maternity leaves, paid leaves and pension for all Indians.

It advocates a one per cent surcharge on the richest 10 per cent of the Indian population to fund inequality combating measures such as higher investments in school education, universal healthcare, and social security benefits like maternity leaves, paid leaves and pension for all Indians.

Wednesday’s report from the Labor Department showed signs that some of the pressures may be easing. The cost of energy dropped 0.4% from November to December – its first decline since April. But over 12 months energy costs are up by nearly 30% and have returned to their upward trend in recent days.

Wednesday’s report from the Labor Department showed signs that some of the pressures may be easing. The cost of energy dropped 0.4% from November to December – its first decline since April. But over 12 months energy costs are up by nearly 30% and have returned to their upward trend in recent days.

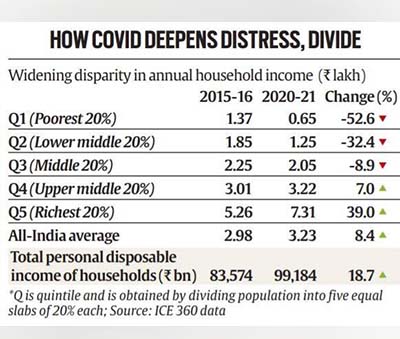

The report also noted that the Covid-19 pandemic has raised global income inequality, partly reversing the decline that was achieved over the previous two decades, Xinhua news agency reported.

The report also noted that the Covid-19 pandemic has raised global income inequality, partly reversing the decline that was achieved over the previous two decades, Xinhua news agency reported.

“That is the way forward here,” said Ben Ritz, director of the Center for Funding America’s Future at the Progressive Policy Institute, who has advocated for a bill with fewer items. “Most of the party is starting to come around to that,” Ritz added. Some Democrats think their party made a mistake in going too large in the first place.

“That is the way forward here,” said Ben Ritz, director of the Center for Funding America’s Future at the Progressive Policy Institute, who has advocated for a bill with fewer items. “Most of the party is starting to come around to that,” Ritz added. Some Democrats think their party made a mistake in going too large in the first place.

As we prepare for the return to repayment in May, we will continue to provide tools and supports to borrowers so they can enter into the repayment plan that is responsive to their financial situation, such as an income-driven repayment plan. Students and borrowers will always be at the center of our work at the Department, and we are committed to not only ensuring a smooth return to repayment, but also increasing accountability and stronger customer service from our loan servicers as borrowers prepare for repayment.”

As we prepare for the return to repayment in May, we will continue to provide tools and supports to borrowers so they can enter into the repayment plan that is responsive to their financial situation, such as an income-driven repayment plan. Students and borrowers will always be at the center of our work at the Department, and we are committed to not only ensuring a smooth return to repayment, but also increasing accountability and stronger customer service from our loan servicers as borrowers prepare for repayment.”

According to India Tourism Statistics 2019, a government of India publication, in 2017, Goa had 68,95,234 domestic and 8,42,220 foreign tourists while in 2018, the respective number of 70,81,559 and 9,33,841 showing a growth rate of 2.70 per cent and 10.88 per cent, respectively. Of course, the pandemic changed the situation, and the tourism sector was the hardest hit. In 2021, even when the domestic sector has picked up slowly, foreign tourists’ numbers are no match.

According to India Tourism Statistics 2019, a government of India publication, in 2017, Goa had 68,95,234 domestic and 8,42,220 foreign tourists while in 2018, the respective number of 70,81,559 and 9,33,841 showing a growth rate of 2.70 per cent and 10.88 per cent, respectively. Of course, the pandemic changed the situation, and the tourism sector was the hardest hit. In 2021, even when the domestic sector has picked up slowly, foreign tourists’ numbers are no match.

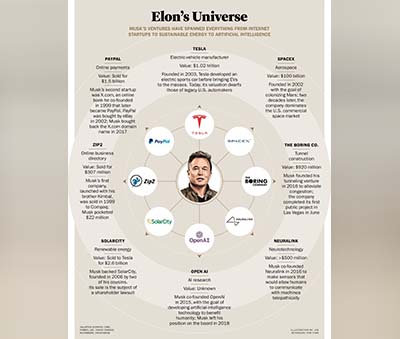

But by then, Musk was already on to his next venture. Driving with him in the McLaren the day of the wreck was Peter Thiel, co-founder of a payments startup called Confinity. (Thiel and Musk weren’t injured in the crash).

But by then, Musk was already on to his next venture. Driving with him in the McLaren the day of the wreck was Peter Thiel, co-founder of a payments startup called Confinity. (Thiel and Musk weren’t injured in the crash). Rich Morgan

Rich Morgan

Supply chain bottlenecks, with COVID-19-related worker absences at factories and ports still high, are also leading to low supplies and higher prices for consumer electronics, appliances and many other products.

Supply chain bottlenecks, with COVID-19-related worker absences at factories and ports still high, are also leading to low supplies and higher prices for consumer electronics, appliances and many other products.

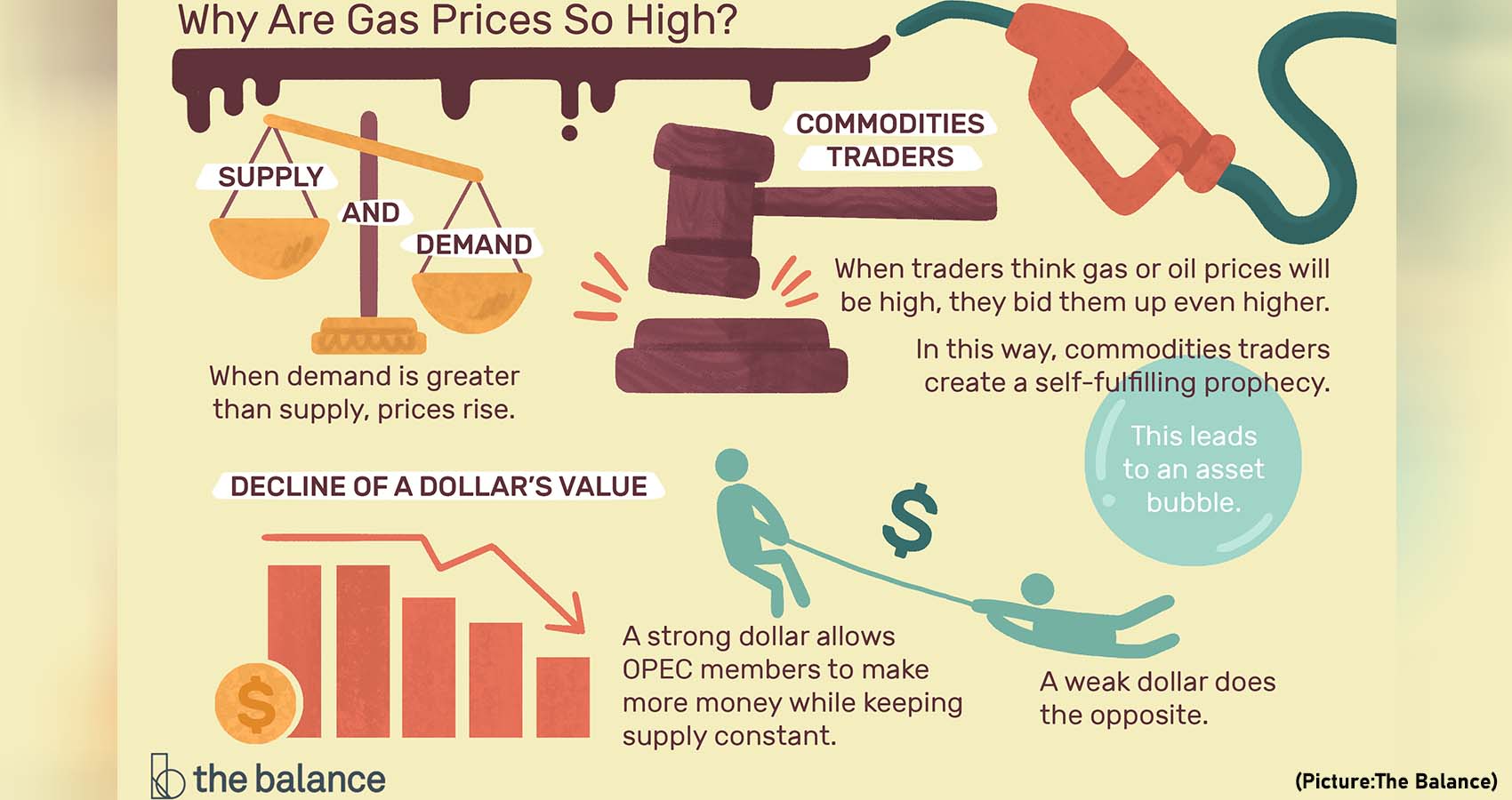

Also, the volatility of gas prices means they can go down as sharply and as suddenly as they go up. In the spring of 2020, as the

Also, the volatility of gas prices means they can go down as sharply and as suddenly as they go up. In the spring of 2020, as the  Where you buy gas also matters. Much of the U.S. petroleum industry is concentrated along the Gulf Coast, making it perhaps unsurprising that gas tends to be cheapest there. The average price in that region was $3.072 a gallon in late November, and in Texas it was also a hairsbreadth above $3.

Where you buy gas also matters. Much of the U.S. petroleum industry is concentrated along the Gulf Coast, making it perhaps unsurprising that gas tends to be cheapest there. The average price in that region was $3.072 a gallon in late November, and in Texas it was also a hairsbreadth above $3.

The growing pools of cash are meant to entice young workers and hold on to existing staff at a time

The growing pools of cash are meant to entice young workers and hold on to existing staff at a time

Some common examples of Medicare fraud include billing for services that were not provided, over billing, billing unnecessary services, misrepresenting dates of service or providers of service, and paying kickbacks for patient referrals.

Some common examples of Medicare fraud include billing for services that were not provided, over billing, billing unnecessary services, misrepresenting dates of service or providers of service, and paying kickbacks for patient referrals.

The country performs best in the future resources measure, where it finishes behind only the US and China. However, lost growth potential for Asia’s third largest economy due largely to the impact of the coronavirus pandemic has led to a diminished economic forecast for 2030, Lowy Institute said.

The country performs best in the future resources measure, where it finishes behind only the US and China. However, lost growth potential for Asia’s third largest economy due largely to the impact of the coronavirus pandemic has led to a diminished economic forecast for 2030, Lowy Institute said.

Mastercard Inc has raised similar concerns privately with the USTR. Reuters reported in 2018 that the company had lodged a protest with the USTR that Modi was using nationalism to promote the local network.

Mastercard Inc has raised similar concerns privately with the USTR. Reuters reported in 2018 that the company had lodged a protest with the USTR that Modi was using nationalism to promote the local network.

But the CBDC is the official cryptocurrency issued by the Central Bank of India. This is the main difference between other cryptocurrencies and CDBC. The CBDC (Central Bank Digital Currency) will also be marketed through the blockchain technology as done by other virtual currencies . It is likely to be a digital token or electronic form of the current currency. The Reserve Bank of India will be in charge of supervising and monitoring the official crypto of the Indian government. Digital money cannot be withdrawn as we usually withdraw from banks and ATMs. Their transactions will be through digital platforms. It is not yet clear whether it will be listed on other crypto exchanges.

But the CBDC is the official cryptocurrency issued by the Central Bank of India. This is the main difference between other cryptocurrencies and CDBC. The CBDC (Central Bank Digital Currency) will also be marketed through the blockchain technology as done by other virtual currencies . It is likely to be a digital token or electronic form of the current currency. The Reserve Bank of India will be in charge of supervising and monitoring the official crypto of the Indian government. Digital money cannot be withdrawn as we usually withdraw from banks and ATMs. Their transactions will be through digital platforms. It is not yet clear whether it will be listed on other crypto exchanges.

On honoring him his new crown, CM Stalin praised Rangaswami for his achievements in the US.

On honoring him his new crown, CM Stalin praised Rangaswami for his achievements in the US.

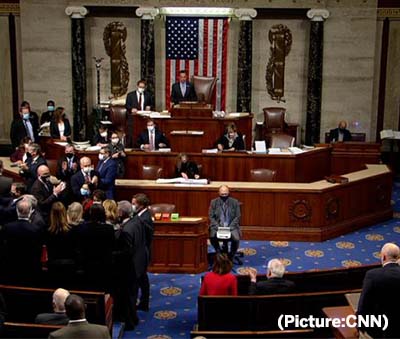

The sweeping economic legislation stands as a key pillar of Biden’s domestic agenda. It would deliver on longstanding Democratic priorities by dramatically expanding social services for Americans, working to mitigate the climate crisis, increasing access to health care and delivering aid to families and children.

The sweeping economic legislation stands as a key pillar of Biden’s domestic agenda. It would deliver on longstanding Democratic priorities by dramatically expanding social services for Americans, working to mitigate the climate crisis, increasing access to health care and delivering aid to families and children.

The Build Back Better Act includes long-term work permits and protections for seven million hardworking immigrant essential workers that will help prevent family separation, stabilize our workforce, boost our economy, and create jobs,” said Congressional Hispanic Caucus (CHC) Chair Raúl Ruiz (D-Calif.).

The Build Back Better Act includes long-term work permits and protections for seven million hardworking immigrant essential workers that will help prevent family separation, stabilize our workforce, boost our economy, and create jobs,” said Congressional Hispanic Caucus (CHC) Chair Raúl Ruiz (D-Calif.).

India is followed by China, Mexico, the Philippines, and Egypt, the report said. In India, remittances are projected to grow 3% in 2022 to $89.6 billion, reflecting a drop in overall migrant stock, as a large proportion of returnees from the Arab countries await return, it said.

India is followed by China, Mexico, the Philippines, and Egypt, the report said. In India, remittances are projected to grow 3% in 2022 to $89.6 billion, reflecting a drop in overall migrant stock, as a large proportion of returnees from the Arab countries await return, it said.

“For H-4 spouses who have lawful status and merely need to renew their employment authorization, they will now enjoy an automatic extension of their authorization for 180 days after expiration should the agency fail to process their timely-filed applications,” said Bless.

“For H-4 spouses who have lawful status and merely need to renew their employment authorization, they will now enjoy an automatic extension of their authorization for 180 days after expiration should the agency fail to process their timely-filed applications,” said Bless.

Dr. Vasundhara Kalasapudi, who is the founder of India Home nonprofit organization and a current board member of NIAASC hosted the conference, which was informative and entertaining with vegan breakfast and lunch served. Dr. Bhavani Srinivasan, Vice president – NIAASC was the coordinator of the conference and coordinated the event effectively and flawlessly.

Dr. Vasundhara Kalasapudi, who is the founder of India Home nonprofit organization and a current board member of NIAASC hosted the conference, which was informative and entertaining with vegan breakfast and lunch served. Dr. Bhavani Srinivasan, Vice president – NIAASC was the coordinator of the conference and coordinated the event effectively and flawlessly. The main speaker was Dr. Vikas Malik, a board-certified medical professional in both Child-Adolescent Psychiatry and Adult Psychiatry and his PowerPoint presentation on Mental Health in light of COVID-19 captivated the audience of roughly 70 physical attendees and 30 virtual attendees, who appreciated the information and knowledge that was succinctly explained. His presentation was followed by Dr. Swaminathan Giridharan, a Geriatric specialist, who spoke about COVID-19 Vaccination. The conference also focused on physical health and a presentation by Mrs. Suman Munjal, president of World Vegan Vision, who discussed the health benefits pertaining to a vegan diet.

The main speaker was Dr. Vikas Malik, a board-certified medical professional in both Child-Adolescent Psychiatry and Adult Psychiatry and his PowerPoint presentation on Mental Health in light of COVID-19 captivated the audience of roughly 70 physical attendees and 30 virtual attendees, who appreciated the information and knowledge that was succinctly explained. His presentation was followed by Dr. Swaminathan Giridharan, a Geriatric specialist, who spoke about COVID-19 Vaccination. The conference also focused on physical health and a presentation by Mrs. Suman Munjal, president of World Vegan Vision, who discussed the health benefits pertaining to a vegan diet. Lunch was followed by Diwali cultural program that was presented by Ms. Jyoti Gupta and her team consisted of several singers, Dr.Jag Kalra, Kul Bhooshan Sharma, Gautam Chopra and Raj Dhingra. The group entertained and regaled the audience with lively Bollywood songs. Music program was followed by Diwali Felicitation by Nilima Madan.

Lunch was followed by Diwali cultural program that was presented by Ms. Jyoti Gupta and her team consisted of several singers, Dr.Jag Kalra, Kul Bhooshan Sharma, Gautam Chopra and Raj Dhingra. The group entertained and regaled the audience with lively Bollywood songs. Music program was followed by Diwali Felicitation by Nilima Madan.

Inflation is when the average price of virtually everything consumers buy goes up. Food, houses, cars, clothes, toys, etc. To afford those necessities, wages have to rise too.

Inflation is when the average price of virtually everything consumers buy goes up. Food, houses, cars, clothes, toys, etc. To afford those necessities, wages have to rise too.

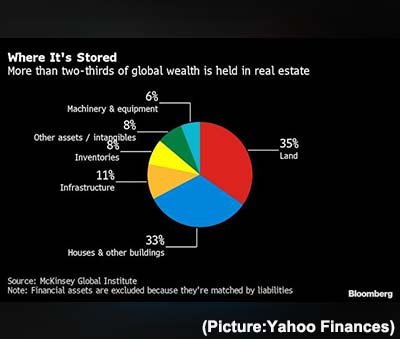

The U.S., held back by more muted increases in property prices, saw its net worth more than double over the period, to $90 trillion.

The U.S., held back by more muted increases in property prices, saw its net worth more than double over the period, to $90 trillion.

Now the administration has agreed to provide automatic work authorization permits to the spouses of H-1B visa holders, most of whom are Indian IT professionals.

Now the administration has agreed to provide automatic work authorization permits to the spouses of H-1B visa holders, most of whom are Indian IT professionals.

Unsurprisingly, California continued to provide the bulk of the country’s most expensive zip codes: The Golden State originated 70% of all of the zip codes on this list, including six of the top 10 priciest. And, as usual, New York came in second, providing 17 zip codes in our ranking.

Unsurprisingly, California continued to provide the bulk of the country’s most expensive zip codes: The Golden State originated 70% of all of the zip codes on this list, including six of the top 10 priciest. And, as usual, New York came in second, providing 17 zip codes in our ranking. The U.S. residential market’s vertical price trends were evident among the country’s top zip codes as well, with 92 zips registering price gains — including 23 where the median surged by more than 25%. Conversely, only 12 locations among the priciest registered drops in their medians this year – by comparison, 2020 brought median increases to 78 zips and drops to 23 locations.

The U.S. residential market’s vertical price trends were evident among the country’s top zip codes as well, with 92 zips registering price gains — including 23 where the median surged by more than 25%. Conversely, only 12 locations among the priciest registered drops in their medians this year – by comparison, 2020 brought median increases to 78 zips and drops to 23 locations.

The business community has rallied behind the infrastructure package, which makes huge investments in roads, bridges, broadband internet, drinking water, rail and public transit without raising taxes on corporations. Business groups say that Biden should sign the bill as soon as possible so transportation officials can get started on construction projects.

The business community has rallied behind the infrastructure package, which makes huge investments in roads, bridges, broadband internet, drinking water, rail and public transit without raising taxes on corporations. Business groups say that Biden should sign the bill as soon as possible so transportation officials can get started on construction projects.

Building on the enduring relationship and cultural connections between the UK and India, it is the first time that Gandhi has been commemorated on an official UK coin with the final design chosen by Sunak, who is the Master of the Mint.

Building on the enduring relationship and cultural connections between the UK and India, it is the first time that Gandhi has been commemorated on an official UK coin with the final design chosen by Sunak, who is the Master of the Mint.

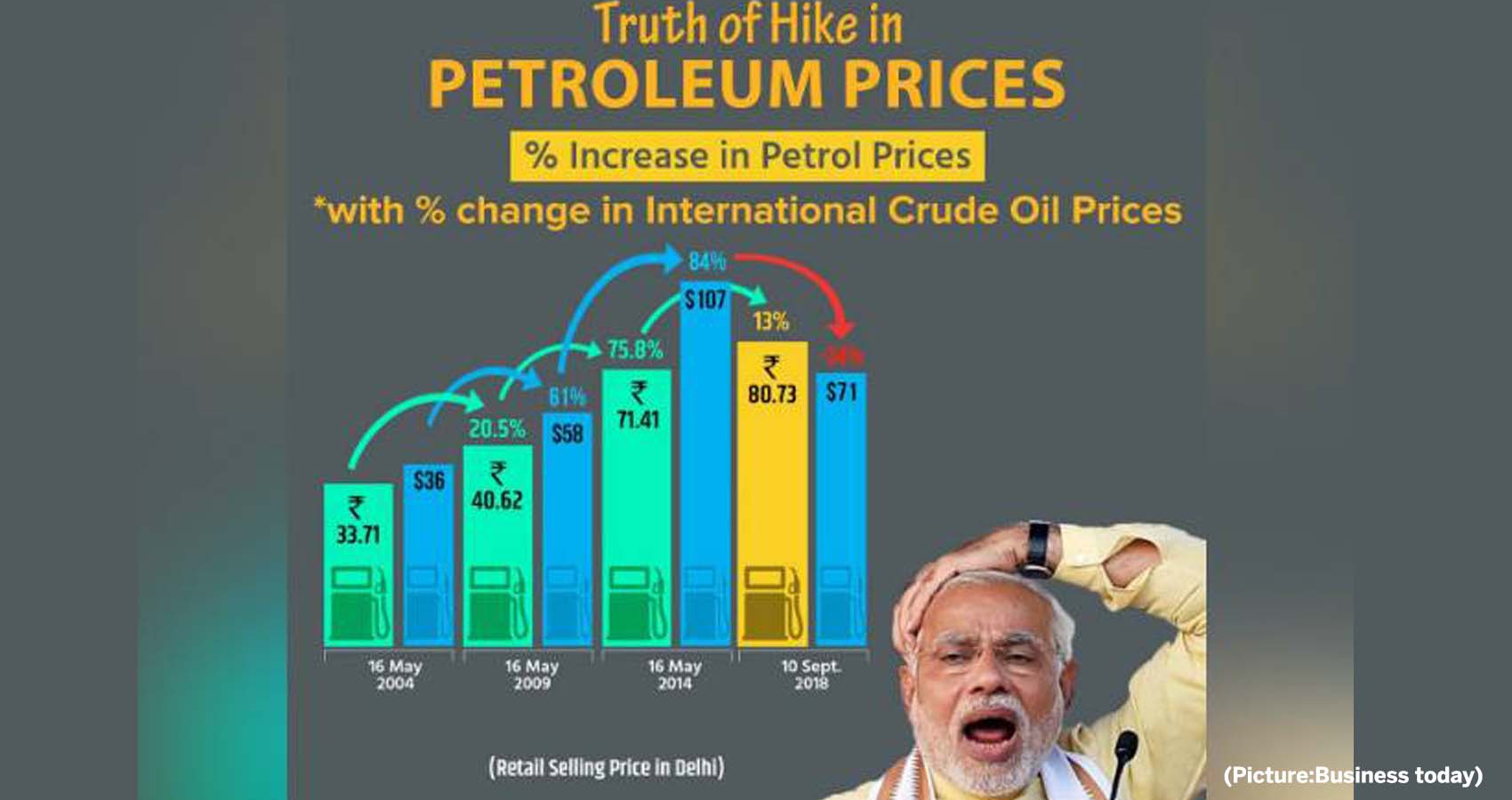

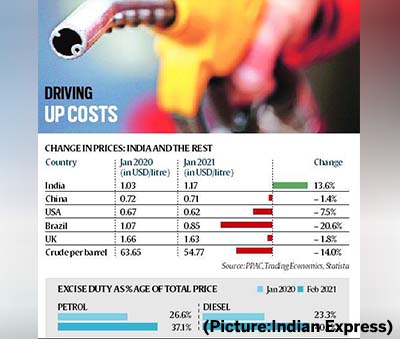

According to Indian Oil Corporation, the country’s largest fuel retailer, in the national capital, petrol is retailing at Rs 103.97 per litre and diesel is available at Rs 86.67 per litre. The rate of petrol stands at Rs 109.98 in Mumbai and diesel costs Rs 94.14 per litre. The prices of petrol and diesel are the highest in India’s financial hub, Mumbai, among all the four metro cities.

According to Indian Oil Corporation, the country’s largest fuel retailer, in the national capital, petrol is retailing at Rs 103.97 per litre and diesel is available at Rs 86.67 per litre. The rate of petrol stands at Rs 109.98 in Mumbai and diesel costs Rs 94.14 per litre. The prices of petrol and diesel are the highest in India’s financial hub, Mumbai, among all the four metro cities.

Despite the fact that the

Despite the fact that the According to analysts, Methane emission reductions from oil and gas production are the low-hanging fruit of the climate crisis: easy to fix with existing technology, and easy to track. Methane is the principal component of the natural gas used for cooking, heating and energy generation.

According to analysts, Methane emission reductions from oil and gas production are the low-hanging fruit of the climate crisis: easy to fix with existing technology, and easy to track. Methane is the principal component of the natural gas used for cooking, heating and energy generation.

Party leaders have announced a hard-fought agreement on a proposal to rein in prescription drug costs — which stood among the last stubborn divisions between liberals and party moderates — and lawmakers said they were also nearing a deal on a new tax cut for those living in high-income regions of the country, which was demanded by centrists.

Party leaders have announced a hard-fought agreement on a proposal to rein in prescription drug costs — which stood among the last stubborn divisions between liberals and party moderates — and lawmakers said they were also nearing a deal on a new tax cut for those living in high-income regions of the country, which was demanded by centrists.

Jes Staley stepped down from Barclays, which is Britain’s third-biggest bank by market value, after a probe into his relationship with financier and sex offender Jeffrey Epstein. The bank said Staley will get a 2.5 million pound ($3.5 million) payout and receive other benefits for a year.

Jes Staley stepped down from Barclays, which is Britain’s third-biggest bank by market value, after a probe into his relationship with financier and sex offender Jeffrey Epstein. The bank said Staley will get a 2.5 million pound ($3.5 million) payout and receive other benefits for a year.

The latter is found mostly in Eastern Himalayas and China and used in naturopathy and certain food preparations like meat dishes, stews and barbecue sauces, owing to its bolder flavor. And, it is now one of the much soiught after spices India exports around the world.

The latter is found mostly in Eastern Himalayas and China and used in naturopathy and certain food preparations like meat dishes, stews and barbecue sauces, owing to its bolder flavor. And, it is now one of the much soiught after spices India exports around the world.

Half its original size, President Joe Biden’s big domestic policy plan is being pulled apart and reconfigured as Democrats edge closer to

Half its original size, President Joe Biden’s big domestic policy plan is being pulled apart and reconfigured as Democrats edge closer to

“I do think I’ll get a deal,” Biden told CNN’s Anderson Cooper on Thursday night during a Town Hall Meeting, strongly signaling his belief that progressives and moderates, two wings of the Democratic caucus that have been at odds with one another, are reaching an accord on the Build Back Better bill, a sweeping bill that aims to expand the social safety net.

“I do think I’ll get a deal,” Biden told CNN’s Anderson Cooper on Thursday night during a Town Hall Meeting, strongly signaling his belief that progressives and moderates, two wings of the Democratic caucus that have been at odds with one another, are reaching an accord on the Build Back Better bill, a sweeping bill that aims to expand the social safety net.

Most recently, Mehta served as the senior vice president at Mastercard, where he led the company’s efforts to advance sustainable and equitable economic growth around the world as executive director of the company’s Center for Inclusive Growth. In that role, he led a global team of professionals dedicated to ensuring that the benefits of economic growth are broadly shared and who work to leverage the core competencies and assets of Mastercard to achieve the same.

Most recently, Mehta served as the senior vice president at Mastercard, where he led the company’s efforts to advance sustainable and equitable economic growth around the world as executive director of the company’s Center for Inclusive Growth. In that role, he led a global team of professionals dedicated to ensuring that the benefits of economic growth are broadly shared and who work to leverage the core competencies and assets of Mastercard to achieve the same.

The increases in house prices relative to incomes makes housing unaffordable to many segments of the population, as highlighted in the Fund’s recent study of housing affordability in Europe. The post-pandemic working arrangements could also exacerbate inequality concerns as high-earners in tele-workable jobs bid for larger homes, making homes less affordable for less affluent residents, IMF researchers said.

The increases in house prices relative to incomes makes housing unaffordable to many segments of the population, as highlighted in the Fund’s recent study of housing affordability in Europe. The post-pandemic working arrangements could also exacerbate inequality concerns as high-earners in tele-workable jobs bid for larger homes, making homes less affordable for less affluent residents, IMF researchers said.

“The President is proposing making better use of our current infrastructure by increasing working hours and spreading business more evenly throughout the day,” says Dresner, professor and chair of the logistics, business and public policy department at the University of Maryland’s Robert H. Smith School of Business.

“The President is proposing making better use of our current infrastructure by increasing working hours and spreading business more evenly throughout the day,” says Dresner, professor and chair of the logistics, business and public policy department at the University of Maryland’s Robert H. Smith School of Business.

Her discussions with Sleyster revolved around the reforms towards capital bond market, investor charter and other initiatives.

Her discussions with Sleyster revolved around the reforms towards capital bond market, investor charter and other initiatives.

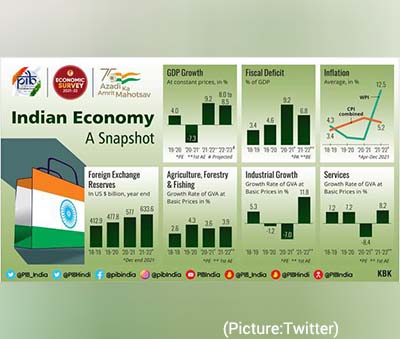

According to the Update issued ahead of the Bank’s annual meeting next week, India’ gross domestic product (GDP) — which shrank by 7.3 per cent (that is, a minus 7.3 per cent) under the onslaught of the pandemic last fiscal year — is expected to record the 8.3 per cent growth this fiscal year, which will moderate to 7.5 per cent next year and 6.5 per cent in 2023-24. Of the major economies, China is ahead with its economy expected to grow by 8.5 per cent during the current calendar year after the Bank revised it upwards from the 8.1 per cent projection in April.

According to the Update issued ahead of the Bank’s annual meeting next week, India’ gross domestic product (GDP) — which shrank by 7.3 per cent (that is, a minus 7.3 per cent) under the onslaught of the pandemic last fiscal year — is expected to record the 8.3 per cent growth this fiscal year, which will moderate to 7.5 per cent next year and 6.5 per cent in 2023-24. Of the major economies, China is ahead with its economy expected to grow by 8.5 per cent during the current calendar year after the Bank revised it upwards from the 8.1 per cent projection in April.

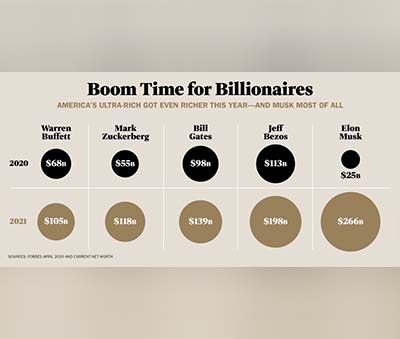

In this bumper year, more than 80 per cent of the listees saw their fortunes increase, with 61 adding $1 billion or more. At the top of the list is Mukesh Ambani, India’s richest person since 2008, with a net worth of $92.7 billion. Ambani recently outlined plans to pivot into renewable energy with a $10 billion investment by his Reliance Industries. Close to a fifth of the increase in the collective wealth of India’s 100 richest came from infrastructure tycoon Gautam Adani, who ranks No. 2 for the third year in a row. Adani, who is the biggest gainer in both percentage and dollar terms, nearly tripled his fortune to $74.8 billion from $25.2 billion previously, as shares of all his listed companies soared.

In this bumper year, more than 80 per cent of the listees saw their fortunes increase, with 61 adding $1 billion or more. At the top of the list is Mukesh Ambani, India’s richest person since 2008, with a net worth of $92.7 billion. Ambani recently outlined plans to pivot into renewable energy with a $10 billion investment by his Reliance Industries. Close to a fifth of the increase in the collective wealth of India’s 100 richest came from infrastructure tycoon Gautam Adani, who ranks No. 2 for the third year in a row. Adani, who is the biggest gainer in both percentage and dollar terms, nearly tripled his fortune to $74.8 billion from $25.2 billion previously, as shares of all his listed companies soared.

Tata Group and SpiceJet chairman

Tata Group and SpiceJet chairman

The International Consortium of Investigative Journalists, a Washington, D.C.-based network of reporters and media organizations, said the files are linked to about 35 current and former national leaders, and more than 330 politicians and public officials in 91 countries and territories. It did not say how the files were obtained, and Reuters could not independently verify the allegations or documents detailed by the consortium.

The International Consortium of Investigative Journalists, a Washington, D.C.-based network of reporters and media organizations, said the files are linked to about 35 current and former national leaders, and more than 330 politicians and public officials in 91 countries and territories. It did not say how the files were obtained, and Reuters could not independently verify the allegations or documents detailed by the consortium.

Currently, India has 237 billionaires, up 58 compared to last year. “While ‘Chemicals’ and ‘Software’ sectors added the greatest number of new entrants to the list, Pharma is still at number one and has contributed 130 entrants to the list. The youngest in the list is aged 23, three years younger than the youngest last year.” Furthermore, the list report pointed out that Reliance Industries’ Chairman and Managing Director Mukesh Ambani continued to be the richest man in India for the 10th consecutive year with a wealth of Rs 718,000 crore.

Currently, India has 237 billionaires, up 58 compared to last year. “While ‘Chemicals’ and ‘Software’ sectors added the greatest number of new entrants to the list, Pharma is still at number one and has contributed 130 entrants to the list. The youngest in the list is aged 23, three years younger than the youngest last year.” Furthermore, the list report pointed out that Reliance Industries’ Chairman and Managing Director Mukesh Ambani continued to be the richest man in India for the 10th consecutive year with a wealth of Rs 718,000 crore.

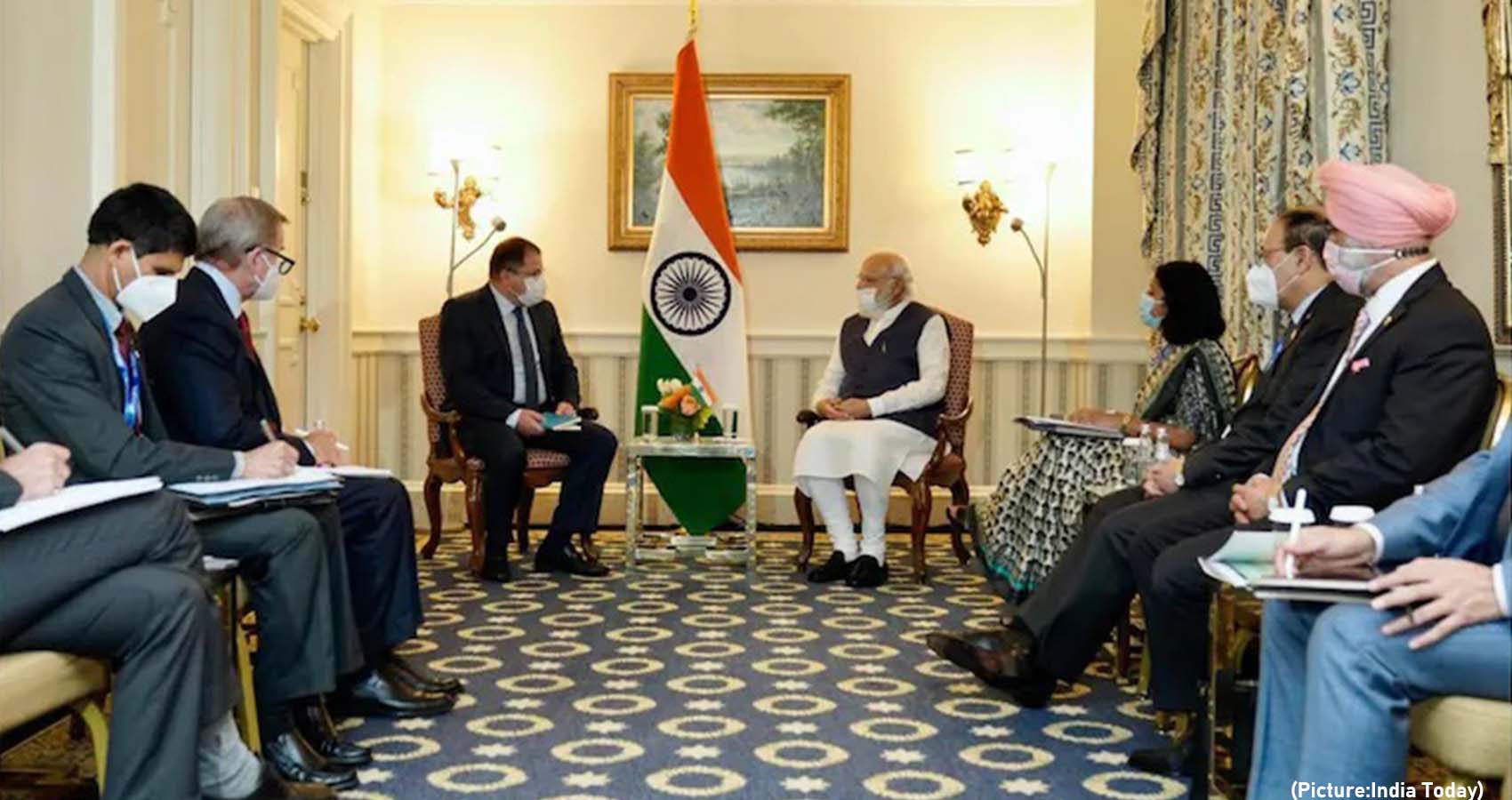

India has great potential for attracting investments and manufacturing under the various programs introduced by Prime Minister Narendra Modi as companies try to diversify their global footprints, according to hi-tech CEOs who met him. “Because of the necessity to diversify and build a very resilient supply chain for semiconductors, we believe India could be an important destination for manufacturing,” Qualcomm CEO Cristiano Amon told reporters in Washington after his meeting with Prime Minister Modi on Thursday.

India has great potential for attracting investments and manufacturing under the various programs introduced by Prime Minister Narendra Modi as companies try to diversify their global footprints, according to hi-tech CEOs who met him. “Because of the necessity to diversify and build a very resilient supply chain for semiconductors, we believe India could be an important destination for manufacturing,” Qualcomm CEO Cristiano Amon told reporters in Washington after his meeting with Prime Minister Modi on Thursday.

The U.S., by contrast, is having trouble even concluding its multi-year exploration into the possibility of an e-dollar. In fact, an upcoming Federal Reserve paper on a potential U.S. digital currency won’t take a position on whether the central bank of the United States will, or even should, create one. Instead, Federal Reserve Chair Jerome Powell said in recent testimony to Congress, this paper will “begin a major public consultation on central bank digital currencies…” (Once planned for July, the paper’s release has since been moved to September.)

The U.S., by contrast, is having trouble even concluding its multi-year exploration into the possibility of an e-dollar. In fact, an upcoming Federal Reserve paper on a potential U.S. digital currency won’t take a position on whether the central bank of the United States will, or even should, create one. Instead, Federal Reserve Chair Jerome Powell said in recent testimony to Congress, this paper will “begin a major public consultation on central bank digital currencies…” (Once planned for July, the paper’s release has since been moved to September.)

The

The

The U.S. Federal Reserve, by contrast, has largely stayed on the sidelines. This could be a lost opportunity. The United States should develop a digital dollar, not because of what other countries are doing, but because the benefits of a digital currency far outweigh the costs. One benefit is security. Cash is vulnerable to loss and theft, a problem for both individuals and businesses, whereas digital currencies are relatively secure. Electronic hacking does pose a risk, but one that can be managed with new technologies. (As it happens, offshoots of Bitcoin’s technology

The U.S. Federal Reserve, by contrast, has largely stayed on the sidelines. This could be a lost opportunity. The United States should develop a digital dollar, not because of what other countries are doing, but because the benefits of a digital currency far outweigh the costs. One benefit is security. Cash is vulnerable to loss and theft, a problem for both individuals and businesses, whereas digital currencies are relatively secure. Electronic hacking does pose a risk, but one that can be managed with new technologies. (As it happens, offshoots of Bitcoin’s technology

This is the first such attempt in the state where expatriates, and returnees, of a village have come together and mobilized capital for a business enterprise of this kind. The total investment of Rs 18 crore was raised from 207 people. Of these, 147 invested only Rs 1 lakh each. The price of a share was fixed at Rs 50,000, and an individual had to invest in at least two shares. There was a cap on the maximum investment as well – Rs 40 lakh per person. “The major highlight of the venture is that a large section of investors are ordinary people who have some small savings, a few lakh rupees, after years of toil in the Gulf. But for an initiative of this type, they would not have been able to be a part of a professional business venture,” said GTF Steels Chairman Mohammed Basheer Nadammal.