President Biden went big in his $6.8 trillion annual budget proposal to Congress by calling for $5 trillion in tax increases over the next decade, more than what lawmakers expected after the president downplayed his tax agenda in earlier meetings. It’s a risky move for the president as he heads into a tough reelection campaign in 2024.

Senate Democrats will have to defend 23 seats next year, including in Republican-leaning states such as Ohio, Montana and West Virginia, and Americans are concerned about inflation and the direction of the economy.

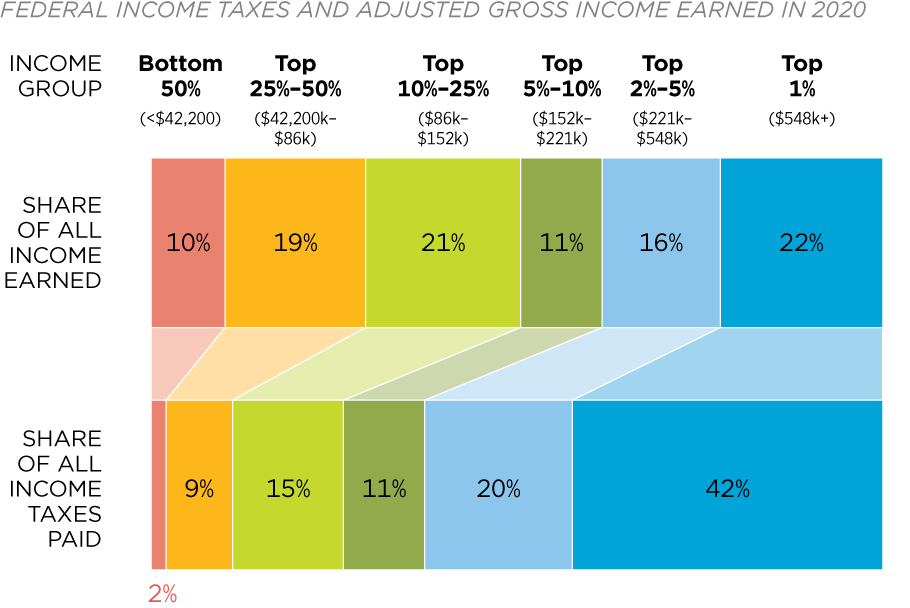

Republicans say Biden’s budget plan marks the return of tax-and-spend liberal politics; they warn higher taxes on corporations and the wealthy will hurt the economy. Biden, however, thinks he can win the debate by pledging that he won’t raise taxes on anyone who earns less than $400,000 a year.

Sen. Mike Crapo (R-Idaho), the ranking member of the Senate Finance Committee, called Biden’s ambitious tax plan “jaw-dropping.”

“This is exactly the wrong approach to solving our fiscal problems,” he said of the $5 trillion aggregate total of proposed tax hikes. “I think this sets a new record, by far.”

Grover Norquist, the president of Americans for Tax Reform, a group that advocates for lower taxes, said “in dollar terms, it’s the largest tax increase in American history.”

A surprise and a ‘negotiating position’

Many lawmakers were expecting Biden to propose between $2 trillion and $2.5 trillion in tax increases, based on what he said in his State of the Union address on Feb. 7 and on what media outlets reported in the days before the White House unveiled its budget plan.

The $5 trillion in new tax revenues is more than what the president called for last year, when Democrats controlled the House and Senate.

In October of 2021, when Biden was trying to nail down a deal with Sen. Joe Manchin (D-W.Va.) on the Build Back Better agenda, he proposed a more modest $2 trillion in tax increases.

The headline number even surprised some Democratic policy experts, though they agree the federal government needs to collect more revenue.

“I didn’t expect to see a number that big, but I’m not alarmed by it. I think it’s a negotiating position,” said Jim Kessler, the executive vice president for policy at Third Way, a centrist Democratic think tank.

Biden told lawmakers at his State of the Union address that his budget plan would lower the deficit by $2 trillion and that he would “pay for the ideas I’ve talked about tonight by making the wealthy and big corporations begin to pay their fair share.”

The president then surprised lawmakers with a budget proposal to cut $3 trillion from deficit over the next decade and to do it almost entirely by raising tax revenues.

Biden has called for a 25 percent tax on the nation’s wealthiest 0.01 percent of families. He has proposed raising the corporate tax rate from 21 percent to 28 percent and the top marginal income tax rate from 37 percent to 39.6 percent. He wants to quadruple the 1 percent tax on stock buybacks. He has proposed taxing capital gains at 39.6 percent for people with income of more than $1 million.

Kessler noted that Biden’s budget doesn’t include significant spending cuts nor does it reform Social Security, despite Biden’s pledge during the 2020 election to reduce the program’s imbalance. Kessler defended the president’s strategy of focusing instead on taxing wealthy individuals and corporations.

“The amount of unrealized wealth that people have at the top dwarfs anything that we’ve ever seen in the past,” he said. “These are opening bids” ahead of the negotiations between Biden and Speaker Kevin McCarthy (R-Calif.) to raise the debt limit.

Senate Republicans are trying to chip away at Biden’s argument that his tax policy will only hit wealthy individuals and companies. “It’s probably not good for the economy. Last time I checked, most tax increases on the business side are passed on to consumers, and I think we need to control spending more than adding $5 trillion in new taxes,” said Sen. Lindsey Graham (R-S.C.).

Norquist, the conservative anti-tax activist, warned that if enacted, raising the corporate tax rate would reverberate throughout the economy. “The corporate income tax, 70 percent of that is paid by workers and lower wages,” he said.

He said raising the top marginal tax rate and capital gains tax rate would hit small businesses that file under subchapter S of the tax code. “When you raise the top individual rate, you’re raising taxes on millions of smaller businesses in the United States,” he said. “Their employees end up paying that because that’s money they don’t have in the business anymore.”

How does Biden compare to predecessors?

Norquist noted that Obama and Clinton both cut taxes during their administrations, citing Clinton’s role in cutting the capital gains rate and Obama’s role in making many of the Bush-era tax cuts permanent. “Both of them ran a more moderate campaign. This guy is going Bernie Sanders,” he said of Biden, comparing him to the liberal independent senator from Vermont.

Biden’s budget is a significant departure from the approach then-President Obama took 12 years ago, when he also faced a standoff with a GOP-controlled House over the debt.

In his first year working with a House GOP majority, Obama in his fiscal 2012 budget proposed cutting the deficit by $1.1 trillion, of which he said two-thirds should come from spending cuts and one-third from tax increases. Obama later ramped up his proposal in the fall of 2011 by floating a plan to cut the deficit by $3.6 trillion over a decade and raise taxes by $1.6 trillion during that span.

Concerning for some Democrats

Republican strategists say they’ll use Biden’s proposed tax increases as ammunition against Democratic incumbents up for reelection next year. National Republican Senatorial Committee Chairman Steve Daines (Mont.) said Biden’s budget provides “a contrast” ahead of the election.

Sen. Jon Tester (D-Mont.), who faces a tough re-election in a state that former President Trump with 57 percent of the vote, said he’s leery about trillions of dollars in new taxes.

Asked last week if he’s worried about how Montanans might react to Biden’s proposed tax increases, Tester replied: “For sure. I got to make sure that will work. I just got to see what he’s doing.”

McCaul says Jan. 6 tapes not going to show ‘tourism at the Capitol’ Porter on Silicon Valley Bank collapse: ‘You can’t bet on’ interest rates staying low forever

Manchin, who is up for reelection in another red state, has called on his fellow Democrats to focus more on how the federal budget has swelled from $3.8 trillion in 2013 to $6.7 trillion today.

“Can we just see if we can go back to normal? Where were we before COVID? What was our trajectory before that?” he asked in a CNN interview Thursday. “How did it grow so quickly? How do we have so many things that are so necessary that weren’t before?” he said of the federal budget and debt.

The White House branded the House Freedom Caucus’ deficit plan as “tax breaks for the super wealthy and wasteful spending for special interests,” as the two sides continued to trade jabs amid an escalating debt ceiling battle.

“MAGA House Republicans are proposing, if spread evenly across affected discretionary programs, at least a 20 [percent] across the board cut,” White House Communications Director Ben LaBolt said in an initial analysis of the proposal.

LaBolt pointed to several typically Republican issue areas that would be impacted by such cuts, including law enforcement, border security, education and manufacturing.

“The one thing MAGA Republicans do want to protect are tax cuts for the super-wealthy,” he added. “This means that their plan, with all of the sacrifices they are asking of working-class Americans, will reduce the deficit by…$0.”

The Freedom Caucus on Friday unveiled its initial spending demands for a possible debt ceiling increase, as the potential for default looms this summer. The proposal would cap discretionary spending at fiscal 2022 levels for 10 years, resulting in a $131 billion cut from current levels. Defense spending would be maintained at current levels.

LaBolt claimed that the proposal would also defund police and make the border less secure, turning around two accusations that Republicans have frequently lobbed at the Biden administration.

Such spending cuts would, according to LaBolt’s analysis, eliminate funding for 400 state, local and tribal police officers and several thousand FBI agents and personnel and “deny the men and women of Customs and Border Protection the resources they need to secure our borders.”

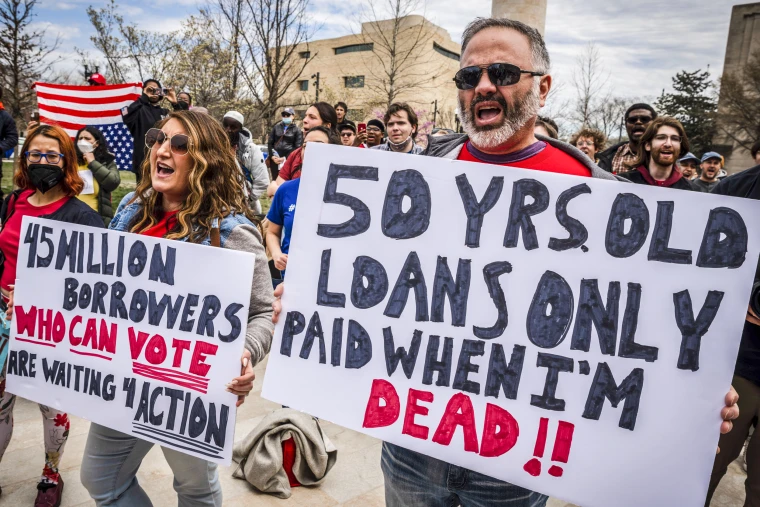

He also criticized the Freedom Caucus’s calls to end President Biden’s student loan forgiveness plan and to rescind unspent COVID-19 and Inflation Reduction Act funds, claiming they would increase prescription drug and energy costs and ship manufacturing jobs overseas.

The analysis also accused the group of hard-line conservatives of making plans that would actually increase the federal deficit by $114 billion, and allow “the wealthy and big corporations to continue to cheat on their taxes.” Biden’s $6.8 trillion budget released on Thursday included tax hikes on the wealthy.

LaBolt’s 20 percent number represents a slight adjustment from Biden’s claim on Friday that the plan would require a 25 percent cut in discretionary spending across the board.

“If what they say they mean, they’re going to keep the tax cuts from the last president … no additional taxes on the wealthy — matter of fact reducing taxes — and in addition to that, on top of that, they’re going to say we have to cut 25 percent of every program across the broad,” Biden said during remarks on the economy. “I don’t know what there’s much to negotiate on.”

House Freedom Caucus Chairman Scott Perry (R-Pa.) hit back at the president on Friday, accusing him of misrepresenting their proposal. “For him to mention things like firefighters, police officers and health care — obviously, either he didn’t watch the press conference, he can’t read, or someone is, you know, got their hand up his back and they’re speaking for him, because those are just abject lies,” Perry told The Hill. “It’s the same old, you know, smear-and-fear campaign by the Biden administration.” (Courtesy: CNN)

The House of Representatives and the Senate

The House of Representatives and the Senate

Luxury Jewelry is well-known for its sophisticated designs and utilization of the most precious and uncommon unrefined substances. The Luxury Jewelry Market is vigorous and quickly developing. It’s also exceptionally divided and determined by buyer conduct and style. In the nearing years, huge market development is normal, from increasing extra cash and amplifying buyer consumption of extravagant merchandise. Assimilating the luxury gems industry with diversion and allure businesses has set new open doors for the market.

Luxury Jewelry is well-known for its sophisticated designs and utilization of the most precious and uncommon unrefined substances. The Luxury Jewelry Market is vigorous and quickly developing. It’s also exceptionally divided and determined by buyer conduct and style. In the nearing years, huge market development is normal, from increasing extra cash and amplifying buyer consumption of extravagant merchandise. Assimilating the luxury gems industry with diversion and allure businesses has set new open doors for the market.