Tamil Nadu Chief Minister M.K. Stalin, currently on a 17-day visit to the United States, has successfully signed several significant Memorandums of Understanding (MoUs) with major companies in San Francisco, aiming to bolster investments in the state. The Chief Minister’s trip, which began on August 27 and will conclude on September 14, has already yielded multiple agreements that promise to enhance Tamil Nadu’s technological and industrial landscape.

A statement from the Office of the Chief Minister highlighted that one of the key MoUs was signed with Nokia. This agreement will facilitate the establishment of a new Nokia Research and Development (R&D) center at SIPCOT, Siruseri in Chengalpattu. The center is set to be the largest Fixed Network test bed globally, focusing on innovations in 10G, 25G, 50G, and 100G Passive Optical Networks (PON). The project comes with an investment of Rs 450 crore and is expected to create 100 jobs.

Another notable agreement was signed with PayPal, a leader in the digital payments space. This MoU will lead to the creation of an Advanced Development Centre in Chennai, primarily focused on Artificial Intelligence. This center is expected to provide employment to 1,000 individuals.

Further expanding Tamil Nadu’s presence in the semiconductor industry, CM Stalin signed an MoU with Yield Engineering Systems. This agreement will lead to the development of a product development and manufacturing facility for semiconductor equipment in Sulur, Coimbatore. The project, estimated to cost Rs 150 crore, will generate approximately 300 jobs.

The Chief Minister also secured an MoU with Microchip Technology Inc., a prominent player in the semiconductor sector. This MoU will result in the establishment of an R&D center in Semiconductor technology at Semmancherry, Chennai. The project, with an estimated investment of Rs 250 crore, is expected to generate 1,500 jobs.

In addition to these, an agreement and MoU were signed with Applied Materials, a leading company in the semiconductor manufacturing and equipment sector. This collaboration will lead to the creation of an Advanced AI-enabled Technology Development Centre in Tharamani, Chennai. The project is anticipated to generate 500 jobs.

In Madurai district, a new Technology and Global Delivery Centre will be set up at ELCOT, Vadapalanji, as part of an agreement signed with Infinx. The project, which involves an investment of Rs 50 crore, is expected to create 700 jobs.

Another significant MoU was signed with Ohmium, focusing on the renewable energy sector. This agreement will lead to the establishment of a manufacturing facility for components related to electrolysis and hydrogen solutions systems in Chengalpattu. The project, worth Rs 400 crore, is expected to generate 500 jobs.

Further solidifying the state’s IT infrastructure, CM Stalin signed an MoU with GeakMinds. This agreement will result in the establishment of an IT & Analytics Services Centre in Chennai, which is projected to create 500 jobs.

CM Stalin’s delegation includes his wife, Durga Stalin, Tamil Nadu Industries Minister T.R.B. Raaja, and several senior officials. The trip is a part of the state’s broader strategy to attract international investments and strengthen its position as a leading industrial and technological hub in India.

This U.S. visit comes eight months after the Tamil Nadu government secured MoUs worth over Rs 6 lakh crore during the third edition of the Global Investors Meet, further underlining the state’s commitment to economic growth and development.

The Chief Minister is also expected to visit several prominent technology companies, which is indicative of Tamil Nadu’s focus on adopting cutting-edge technologies and fostering a conducive ecosystem for R&D and high-tech manufacturing.

The statement from the Chief Minister’s office added that the proposals and agreements signed during this U.S. trip would be documented and detailed upon his return to Chennai.

Since taking office in May 2021, CM Stalin has undertaken several international trips, including visits to the UAE, Singapore, Japan, and Spain, all aimed at attracting investment proposals for Tamil Nadu. These efforts have positioned the state as a leading destination for industrial and technological investments in India.

Tamil Nadu has already become a key hub for iPhone manufacturing in India, with three major suppliers—Foxconn, Pegatron, and Tata Electronics—expanding their operations in the state. Moreover, Bharat FIH, a subsidiary of Foxconn, is set to begin assembling Pixel phones and drones for Google, further boosting the state’s profile in the global tech industry.

During his U.S. trip, CM Stalin is also likely to meet Sundar Pichai, the Chief Executive Officer (CEO) of Google, along with the heads of several other Fortune 500 companies. These meetings are expected to open up further avenues for collaboration and investment, reinforcing Tamil Nadu’s status as a global industrial powerhouse.

The Chief Minister’s concerted efforts to attract high-tech industries and foster innovation underscore his vision for Tamil Nadu’s future—a state that is not only a manufacturing hub but also a leader in research and development, particularly in emerging technologies. As the state continues to forge international partnerships, the benefits of these initiatives are expected to ripple through the local economy, creating jobs and driving sustainable growth.

By securing these MoUs and engaging with global technology leaders, CM Stalin is setting the stage for Tamil Nadu to become a critical player in the global technology and manufacturing sectors, ensuring long-term economic prosperity for the state and its people.

Synergy is ITServe Alliance’s flagship Annual Conference, which began in 2015 with the objective of providing business owners, entrepreneurs, and executives with strategies and solutions that address the unique needs of the IT Solution & Services Industry.

Synergy is ITServe Alliance’s flagship Annual Conference, which began in 2015 with the objective of providing business owners, entrepreneurs, and executives with strategies and solutions that address the unique needs of the IT Solution & Services Industry. Vinay Mahajan, President & CEO of NAM Info Inc., emphasized the significance of this collaboration, stating, “Our investment in Inferyx is a critical step in enhancing data-driven decision-making through innovation and delivering exceptional outcomes.” This partnership represents a strategic move by NAM to bolster its capabilities in delivering cutting-edge data solutions that drive business success.

Vinay Mahajan, President & CEO of NAM Info Inc., emphasized the significance of this collaboration, stating, “Our investment in Inferyx is a critical step in enhancing data-driven decision-making through innovation and delivering exceptional outcomes.” This partnership represents a strategic move by NAM to bolster its capabilities in delivering cutting-edge data solutions that drive business success.

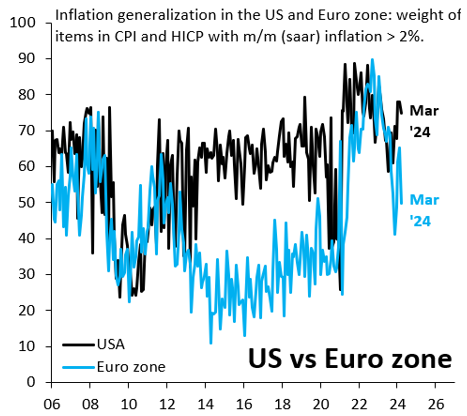

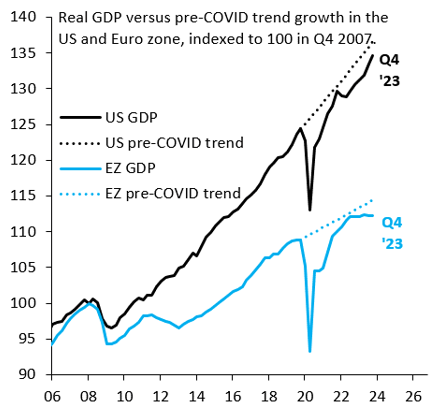

A stylized fact following the 2008 crisis is that U.S. growth substantially outperformed the rest of the advanced world. This again looks to be true in the aftermath of COVID-19 (Figure 1), with lots of debate on the underlying drivers. Some argue that this outperformance reflects loose fiscal policy and rapid immigration, while others see a productivity boom linked to tight labor markets. Whatever the source, cyclical outperformance may keep U.S. inflation stickier than elsewhere. There are some signs of this. Figure 2 shows the combined weight of items in the U.S. consumer price index (CPI) with month-over-month inflation above 2% (on a seasonally adjusted, annualized basis), alongside the same measure for the eurozone’s harmonized index of consumer prices (HICP). This metric is noisier than if we used year-over-year inflation, but it has the advantage of focusing on recent inflation dynamics, since there are no base effects to muddy the picture. Elevated inflation remains relatively broad-based in the U.S., consistent with strong growth, while inflation momentum is clearly fading in the eurozone.

A stylized fact following the 2008 crisis is that U.S. growth substantially outperformed the rest of the advanced world. This again looks to be true in the aftermath of COVID-19 (Figure 1), with lots of debate on the underlying drivers. Some argue that this outperformance reflects loose fiscal policy and rapid immigration, while others see a productivity boom linked to tight labor markets. Whatever the source, cyclical outperformance may keep U.S. inflation stickier than elsewhere. There are some signs of this. Figure 2 shows the combined weight of items in the U.S. consumer price index (CPI) with month-over-month inflation above 2% (on a seasonally adjusted, annualized basis), alongside the same measure for the eurozone’s harmonized index of consumer prices (HICP). This metric is noisier than if we used year-over-year inflation, but it has the advantage of focusing on recent inflation dynamics, since there are no base effects to muddy the picture. Elevated inflation remains relatively broad-based in the U.S., consistent with strong growth, while inflation momentum is clearly fading in the eurozone.