American tourists in Puerto Vallarta found themselves caught in violent chaos following the reported death of cartel leader El Mencho, leading to widespread unrest and travel disruptions.

American tourists vacationing in Puerto Vallarta were thrust into a chaotic situation following the reported killing of notorious cartel leader Nemesio Oseguera, commonly known as El Mencho. The violence that erupted in the wake of his death led to burning cars, blocked roads, and looting, leaving many visitors feeling trapped and anxious.

As airlines canceled flights and local authorities issued shelter-in-place orders, stranded tourists described scenes reminiscent of a war zone. Witnesses reported seeing cars set ablaze, suspected cartel members obstructing major thoroughfares, and stores being ransacked by looters. Many visitors found themselves evacuating their accommodations and relying on limited hotel food while waiting for Mexican authorities to restore order.

Eugene Marchenko, a 37-year-old from Charleston, South Carolina, recounted his experience while staying at an Airbnb near a main road. He woke up to the sound of blaring horns and witnessed six cars engulfed in flames just outside his balcony. Marchenko and his wife, who had only arrived in Mexico a day earlier, were forced to evacuate for several hours due to fears that a nearby fuel tanker, also on fire, could explode.

“I looked down and they’re completely engulfed in flames,” Marchenko said. “It was six cars in total that burned and one fuel tanker.” He described a video he saw from a neighbor showing men he believed to be cartel members forcing people out of their vehicles before setting them on fire. “They told the people to leave,” he explained. “Then they were taking the gas and pouring the gas on the vehicle and waiting until everybody was clear before they were setting it on fire.”

Later that afternoon, Marchenko ventured outside in search of food and observed pharmacies and corner stores that had been completely burned down. He noted that younger crowds had broken into nearby buildings to loot beer and cigarettes.

Videos obtained by Fox News Digital showed a helicopter hovering above Marchenko’s building, seemingly searching for someone, while Mexican armed forces and armored vehicles patrolled the streets below. Public transportation and ride-sharing services had come to a standstill, and Marchenko expressed uncertainty about how he and other tourists would reach the airport even if flights resumed.

Despite the turmoil, Marchenko remarked that there was a surprising lack of panic among the tourists. “There’s definitely not any panic from almost nobody here,” he said. “I think it’s interesting; almost everybody was just annoyed more than anything.”

Adriana Belli, a 49-year-old visitor from Miami, shared her own experience. She had planned to spend over a week in Mexico for a wedding in Guadalajara and a friend’s birthday celebration in Mexico City. Belli found the sudden outbreak of violence particularly shocking, especially after hearing from other American tourists at her Marriott resort that the area had been considered extremely safe for years.

<p”A lot of the other tourists who had early morning flights were actually able to get to the airport, but they are now locked down in the airport and unable to leave,” she said. “So what we heard from other guests is they are just sort of surviving off of granola bars.”

Another tourist staying at a different resort reported that restaurants and room service had been shut down. Guests were gathered in the lobby for what was described as “the last bit of food.” He mentioned that this trip was the first time he and his wife had been away from their 4-year-old son, prompting him to call home to inform family members about the location of their will. “This is the first time we’ve ever been away from him. My wife was saying, ‘We’re never leaving him again,’” he said. “I had to call my mom today and, you know, just tell her, ‘Look, here’s where my will is. We just created this. I don’t want you to panic, but I may need you to stay a couple days extra with my son.’”

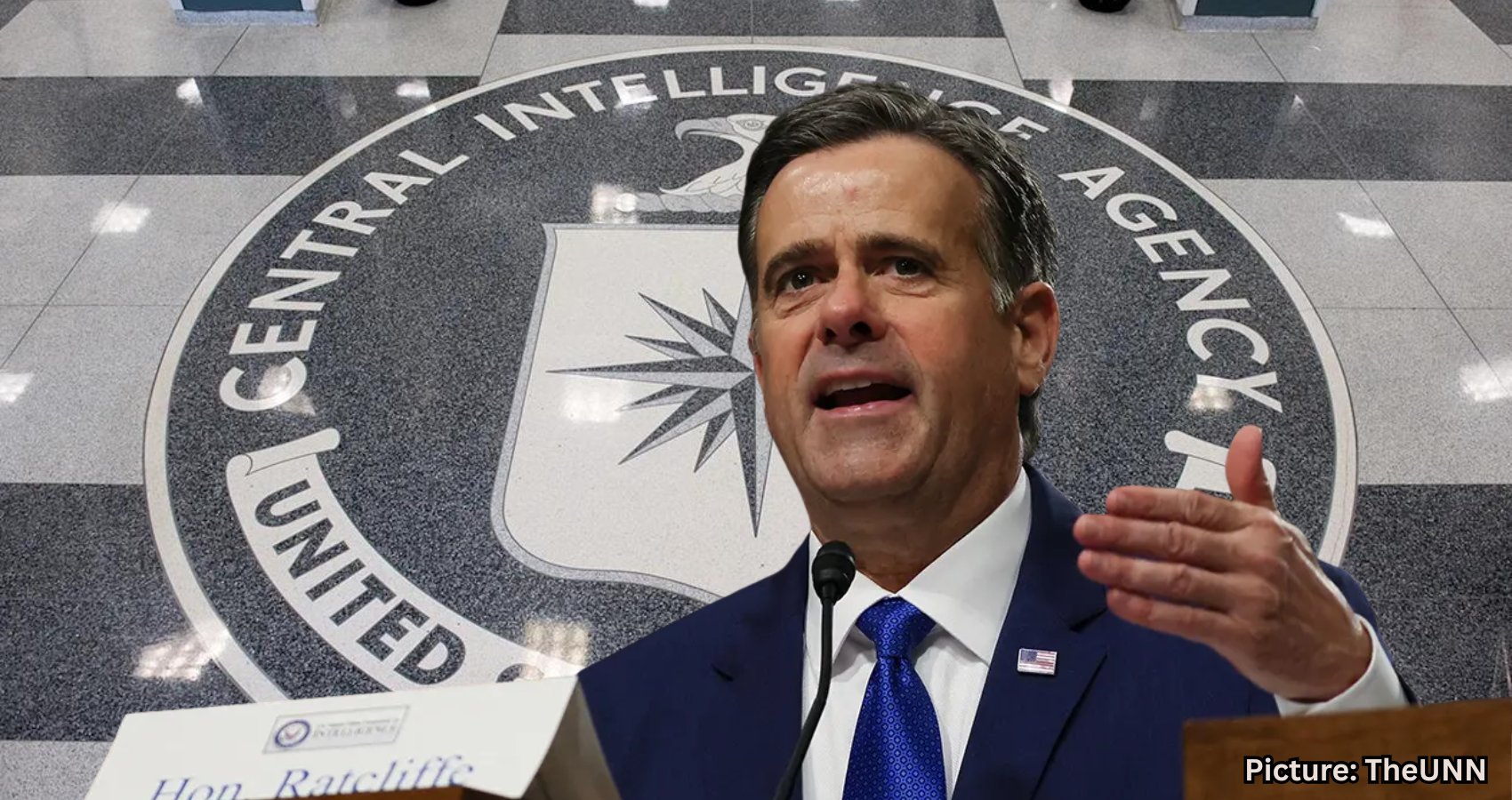

Despite the chaos, he remained hopeful that authorities would restore order in the coming days. The Mexican Defense Department confirmed on Sunday that Oseguera was killed in a military operation, a development that reportedly triggered widespread unrest and uncertainty across multiple states as officials worked to stabilize the region.

As the situation unfolds, many tourists are left grappling with the unexpected turn of events, hoping for a swift resolution to the violence that has disrupted their vacations.

According to Fox News Digital, the aftermath of El Mencho’s death continues to impact the safety and security of visitors in Puerto Vallarta.