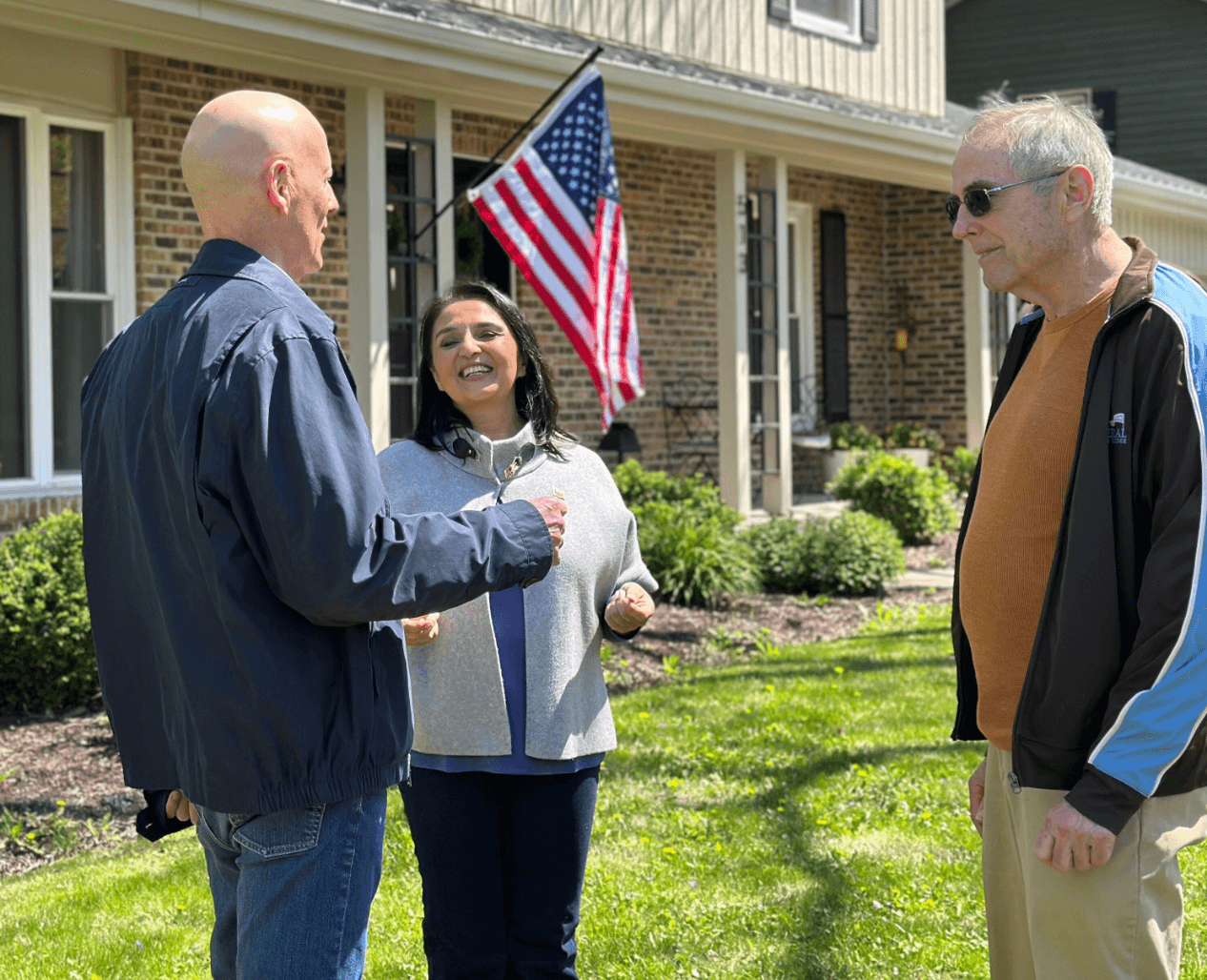

Dr. Bharat Barai, a distinguished Indian American physician and community leader, was honored with the first ever Dr. Sampat Shivangi Legacy Award for his leadership, contributions to the society and close association with Dr. Shivangi, during the 43rd annual American Association of Physicians of Indian Origin (AAPI) Convention in Cincinnati on July 26, 2025.

Congressman Jonathan Jacson, representing District 1 in Illinois presented the award to Dr. Barai. The award ceremony attended by nearly 1,000 physicians, and community was a tribute to Dr. Shivangi, remembering his impactful work in healthcare, politics, and US – India relations. In him, the Indian American community has lost a great leader and friend whose contributions will continue to resonate for generations.

Dr. Sampat Shivangi, a physician, philanthropist, influential Indian American community leader, and veteran leader of AAPI for several decades, suddenly passed away due to health reasons in his hometown, Jackson, Mississippi, on February 10, 2025.

Dr. Sampat Shivangi, a physician, philanthropist, influential Indian American community leader, and veteran leader of AAPI for several decades, suddenly passed away due to health reasons in his hometown, Jackson, Mississippi, on February 10, 2025.

In his address, Dr. Barai shared with the audience, his close association with Dr. Shivangi and how both of them have strived to enhance the Ino-US relationship to the next level.

Born in Mumbai, Dr Barai is a distinguished physician, a respected leader of the Indian American community. He currently serves as the Medical Director of the Cancer Institute, Methodist Hospitals, Clinical Asst. Professor of Medicine at Indiana University Medical School, Secretary and former President of the Medical Licensing Board of the State of Indiana (since year 2000).

Dr. Barai obtained his MD in Medicine (University of Illinois), MD in Medical Oncology (Northwestern University Med School), and MD in Hematology (Rush University Medical School). He has been the President of the Medical Staff, Chairman of the Medical Executive Committee, and serves on the Board of Directors of the Methodist Hospitals. He also serves on the advisory board of the Indiana University School of Business. He also serves on the Medical Advisory Panels for US Senators and Congressmen.

In his address, Congressman Jonathan Jackson said, “Let us not forget, the path of honor in this country was never laid smooth. Just as black Americans marched from Selma to Montgomery demanding dignity and the franchise for the right to vote that came to the Civil Rights Act of 1965, so too have the Indian Americans journey with courage, discipline and ancestral wisdom to etch their names into the bedrock of the American Congress.”

Drawing parallel between the Indian American Diaspora and the African American community in the US, Rep. Jackson said, ‘We are linked, you and I, bound by histories, tied together by history and a common destiny, both ancient and recent, yours, rooted in the Vedas and the teachings of the Mahatma Gandhi, while mine in the sorrow of the songs of the plantations and the sermons of Reverend Martin Luther King, both people are marked as outsiders now shaping the very center of our great democracy.:

Jackson said, ‘We are linked, you and I, bound by histories, tied together by history and a common destiny, both ancient and recent, yours, rooted in the Vedas and the teachings of the Mahatma Gandhi, while mine in the sorrow of the songs of the plantations and the sermons of Reverend Martin Luther King, both people are marked as outsiders now shaping the very center of our great democracy.:

Rep. Jacson reminded the Indian American physicians, that Liberty demands not only resistance but resilience. So, I honor you today for having gone into the parts of this nation to heal the sick and care for those that have been distressed.”

Dr. Shivangi’s wife, Dr. Udaya Shivangi, and their two daughters, Priya Kurup and Pooja Shivangi Amin, vowed to continue his noble mission. “His dream did not end with him—it lives on. I will carry forward his mission through education, philanthropy, and strengthening U.S.-India ties. I plan to write a book, make a film, expand charitable initiatives, and actively work to strengthen the relationship between the U.S. and India, ensuring that his contributions inspire generations to come. Most importantly, along with our daughters, I will raise our grandchildren the way he wanted—to be idealists, to serve, and to give back to the world,” Dr. Udaya Shivangi said.

Dr. Udaya Shivangi told Rep. Jacson, “You have been a great help, not only to me, but to all our Indian doctors. Thank you.” She went on to thank others, saying, “I would like to join my daughters Priya and Pooja, in acknowledging and expressing our gratitude to my husband and a good friend, Dr Vijay Prabhakar from Chicago, curating a historical congressional salute on March 36th at a US Capitol Hill and for his continued efforts to my husband’s legacy alive across America. Thank you, Dr Prabhakar for being a co chair of this award. Thank you.”

“A trailblazer of the Indian Diaspora, Dr. Shivangi has left an indelible mark on the Indian American community. Throughout the decades, he committed his time, resources, and efforts to serving AAPI and various other Indian American organizations. His leadership, vision, and tireless commitment to advocating for the community set him apart as a pillar of strength and guidance,” Dr. Udaya Shivangi said.

“A trailblazer of the Indian Diaspora, Dr. Shivangi has left an indelible mark on the Indian American community. Throughout the decades, he committed his time, resources, and efforts to serving AAPI and various other Indian American organizations. His leadership, vision, and tireless commitment to advocating for the community set him apart as a pillar of strength and guidance,” Dr. Udaya Shivangi said.

It was only about a month prior to his sudden death that the President of India, Droupadi Murmu, inaugurated the newly built Dr. Sampat Kumar S. Shivangi Cancer Hospital in Belagavi, Karnataka. Spanning 1,75,000 square feet with a capacity of 300 beds, the hospital was built with cutting-edge technology with funds donated and raised by Dr. Sampat Shivangi, she pointed out.

“Dr. Shivangi believed that success is measured not by what we accumulate but by the lives we touch. That is the legacy I promise to uphold. Sampat, you are not gone—you are here, in the walls of the hospital you built, in the halls of the school you founded, and in the hearts of those who loved you. And I will honor you every day of my life,” Dr. Udaya Shivangi assured.

Dr. Satheesh Kathula acknowledged Dr. Shivangi’s selfless service to AAPI. “There was no committee he didn’t serve on, and he was present at every convention and global health summit,” he noted. Recalling their friendship, Dr. Kathula said, “He would call me, advise me, and even scold me when I was wrong. He was like a father figure and a true role model.”

Dr. Shivangi has been actively involved in several philanthropic activities, serving with Blind Foundation of MS, Diabetic, Cancer and Heart Associations of America. Dr. Shivangi has a number of philanthropic works in India including Primary & middle schools, Cultural Center, and IMA Centers that he opened and helped to obtain the first ever US Congressional grant to AAPI to study Diabetes Mellitus amongst Indian Americans.

In addition to establishing the Dr. Sampat Kumar S. Shivangi Cancer Hospital in Karnataka, through the Dr. Sampat Shivangi Foundation, Dr. Shivangi has established multiple charitable institutions in India, including primary and middle schools, community halls, and healthcare facilities, greatly enhancing educational and healthcare access for underserved communities.

In the U.S., Dr. Shivangi has contributed to establishing a Hindu Temple in Jackson, Mississippi, providing a cultural and spiritual hub for the Hindu community and beyond. Recognized for his exemplary service, a street in Mississippi bears his name, a testament to his contributions to healthcare and community welfare.

Over the years, in the pursuit of its vision, the Dr. Sampat Shivangi Foundation has come to be known for its belief and tireless efforts that every individual deserves an opportunity to thrive, and is a beacon of hope, fostering resilience and building a more inclusive and harmonious world for all.

At the heart of societal transformation, the Dr. Sampat Shivangi Foundation stands as a testament to unwavering commitment and compassion. The foundation is built upon the pillars of education, healthcare, mental well-being, tribal support, women’s empowerment, and sports development. With a profound understanding of the multifaceted needs of underprivileged communities, we have designed a range of initiatives that address these vital aspects of human well-being.

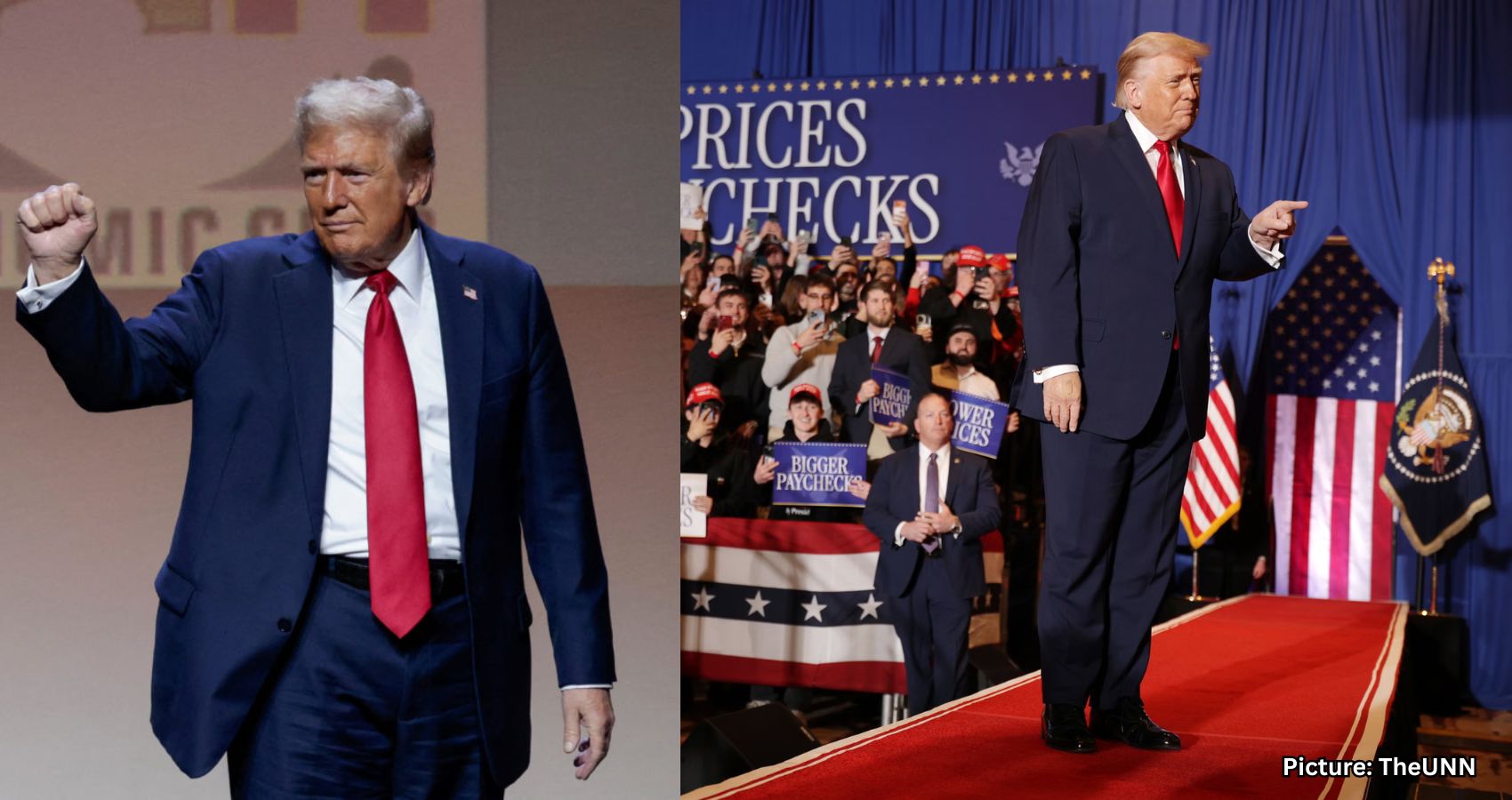

As the first Indian American to serve on the Board of the Mississippi State Department of Mental Health, Dr. Shivangi has made significant strides in mental health advocacy. His leadership extends to national positions, serving on the National Board of Directors for the Substance Abuse and Mental Health Services Administration (SAMHSA), appointed by Presidents Donald Trump and Joe Biden.

A dedicated advocate for Indo-U.S. relations, Dr. Shivangi has contributed to key initiatives, including the Indo-U.S. Civil Nuclear Agreement, collaborating with President George W. Bush to strengthen ties between the two nations. His commitment to India is further reflected in his coordination efforts with the White House to lift sanctions against India during President Bill Clinton’s administration.

A recipient of numerous awards, including the Pravasi Bharatiya Samman Award, The US Congressional Recognition Award, the Ellis Medal of Honor Award, Lifetime Achievement Award by the Indo-American Press Club, Dr. Shivangi’s legacy reflects a lifelong dedication to improving lives through healthcare, philanthropy, and international diplomacy.

Dr. Shivangi had said, he always thought about why the Indian Americans especially the Physician fraternity, consisting of more than 100,000 physicians in the United States, are not willing to undertake philanthropy in their homeland or in USA. “My hope and prayers is that many more will follow me just as my dream has come true today. I urge my fellow Indo-American physicians to join this movement and help change the world for the better. My humble request is that let us be the change and bring this movement to make our world different tomorrow. I hope my prayers will be answered one day and all humanity lives in a better world.”

Dr. Sampat Shivangi, a physician, philanthropist, influential Indian American community leader, and veteran leader of AAPI for several decades, suddenly passed away due to health reasons in his hometown, Jackson, Mississippi, on February 10, 2025.

Dr. Sampat Shivangi, a physician, philanthropist, influential Indian American community leader, and veteran leader of AAPI for several decades, suddenly passed away due to health reasons in his hometown, Jackson, Mississippi, on February 10, 2025. Jackson said, ‘We are linked, you and I, bound by histories, tied together by history and a common destiny, both ancient and recent, yours, rooted in the Vedas and the teachings of the Mahatma Gandhi, while mine in the sorrow of the songs of the plantations and the sermons of Reverend Martin Luther King, both people are marked as outsiders now shaping the very center of our great democracy.:

Jackson said, ‘We are linked, you and I, bound by histories, tied together by history and a common destiny, both ancient and recent, yours, rooted in the Vedas and the teachings of the Mahatma Gandhi, while mine in the sorrow of the songs of the plantations and the sermons of Reverend Martin Luther King, both people are marked as outsiders now shaping the very center of our great democracy.: “A trailblazer of the Indian Diaspora, Dr. Shivangi has left an indelible mark on the Indian American community. Throughout the decades, he committed his time, resources, and efforts to serving AAPI and various other Indian American organizations. His leadership, vision, and tireless commitment to advocating for the community set him apart as a pillar of strength and guidance,” Dr. Udaya Shivangi said.

“A trailblazer of the Indian Diaspora, Dr. Shivangi has left an indelible mark on the Indian American community. Throughout the decades, he committed his time, resources, and efforts to serving AAPI and various other Indian American organizations. His leadership, vision, and tireless commitment to advocating for the community set him apart as a pillar of strength and guidance,” Dr. Udaya Shivangi said. Her work ethic carried into her college years at Northwestern University, where she juggled studies with a daily paper route. As an adult, she balanced the demands of single motherhood, running a small business, and caring for her ailing parents. These life experiences have given her firsthand insight into the everyday struggles facing working families. “My life was Made in America. This campaign was Made in America. It could not have happened anywhere else,” she declared. “Now, I’m committed to making sure that the same American Dream is alive and well now, and for generations to come.”

Her work ethic carried into her college years at Northwestern University, where she juggled studies with a daily paper route. As an adult, she balanced the demands of single motherhood, running a small business, and caring for her ailing parents. These life experiences have given her firsthand insight into the everyday struggles facing working families. “My life was Made in America. This campaign was Made in America. It could not have happened anywhere else,” she declared. “Now, I’m committed to making sure that the same American Dream is alive and well now, and for generations to come.”