The rapid expansion of AI infrastructure is raising concerns about a potential credit crunch as companies increasingly rely on debt to fund their initiatives.

The race to build artificial intelligence (AI) infrastructure is accelerating at an unprecedented pace, but beneath the surface of this optimism lies a growing financial risk that has largely gone unnoticed outside of Wall Street. At the recent WSJ Tech Live conference in Laguna Beach, OpenAI CFO Sarah Friar suggested that the U.S. government may eventually need to intervene to support the massive wave of debt being utilized to fund AI expansion.

Friar’s comment hinted at a possible future bailout that would protect corporations and investors while shifting part of the financial burden onto taxpayers. Although she later clarified on LinkedIn that she meant partnership rather than a government guarantee, her statement exposed a stark reality: while the bond market is large enough to absorb AI-related borrowing, its appetite for risk may not align with the scale of the current AI spending frenzy.

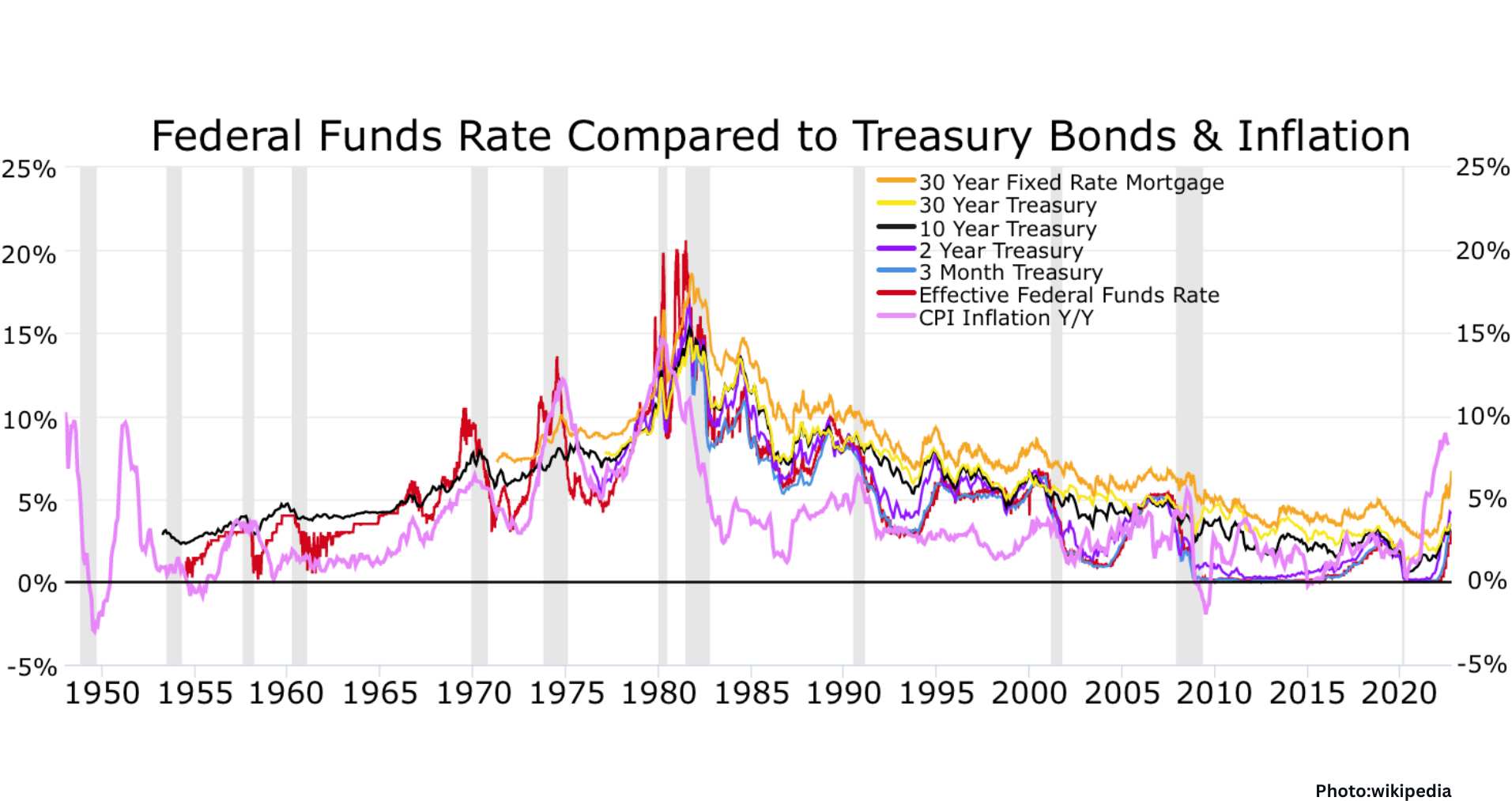

The scale of this spending is indeed staggering. Analysts at JPMorgan estimate that AI-related investment-grade corporate bond issuance could reach $1.5 trillion by 2030. This figure is enormous when compared to the approximately $1.9 trillion in total U.S. corporate bonds issued annually since 2020.

In the current year alone, U.S. companies have already issued over $200 billion in AI-linked bonds, accounting for about 10% of the entire corporate bond market. Major tech giants are spearheading this charge, with notable bond sales including:

Amazon, which filed a $15 billion bond sale in November; Alphabet, which raised $25 billion earlier in the month with bonds maturing up to 50 years; Meta, which brought in $30 billion in October; and Oracle, which issued $18 billion in September.

Interestingly, these companies do not require the cash, as they are sitting on substantial reserves. For instance, Meta has $44.5 billion in cash and equivalents, while Alphabet and Amazon each have nearly $100 billion.

This is precisely why Friar’s remark unsettled markets. If investor enthusiasm begins to wane, even these blue-chip borrowers may find themselves needing to offer higher yields or more attractive deal terms, which would drive borrowing costs up across the market.

Evidence of this trend is already surfacing. Analysts at Janus Henderson have noted that Alphabet and Meta had to pay 10 to 15 basis points more on recent bond deals compared to earlier issuances. Following Meta’s bond sale, demand for Oracle’s new bonds dropped significantly, with its 2055 bonds experiencing an 11 basis point widening in spreads within just a week.

What appears to be an AI financing boom could easily lead to a broader credit tightening.

The risk of a concentrated debt market is becoming increasingly apparent. Gil Luria, head of tech research at D.A. Davidson, believes that while tens of billions in AI-related borrowing is manageable, hundreds of billions could crowd out other companies that need to raise funds.

Investors typically rely on diversification to mitigate major losses. However, when numerous companies depend on the same AI-driven spending model, diversification becomes ineffective. Analysts at S&P Global Ratings warn that if demand for AI computing slows, tech, media, and telecom issuers could all face simultaneous stress.

Todd Czachor of Columbia Threadneedle draws a parallel to the shale boom, which funneled $600 billion into a single sector and reshaped global credit markets. He estimates that AI infrastructure spending could reach $5.7 trillion, an expansion he describes as being “on a different planet.”

With such a significant amount of debt entering the market simultaneously, even financially robust corporations could inadvertently increase spreads across entire sectors, tightening credit conditions for all.

Portfolio rules further exacerbate the issue. Bond funds, pensions, and insurers often have strict limits on how much exposure they can take to a single issuer or sector. While these constraints are designed to protect investors, they also hinder new entrants when one industry dominates issuance.

Index rules reflect this reality as well. For instance, MSCI and Fidelity cap any single issuer at approximately 3%, while MarketAxess employs a 4% limit. iShares corporate bond ETFs follow similar 3% issuer caps. Currently, these ceilings have not been breached—Oracle sits at 2% of the main iShares fund, and Meta is just above 1%. However, AI-related issuance is accelerating rapidly.

Private credit was initially expected to absorb a portion of the AI buildout, but early defaults in unrelated sectors have made lenders more cautious. Private credit managers cite diversification limits as a significant barrier, as funds cannot allocate too much capital to data center or AI infrastructure deals.

Wellington Management estimates that private markets may only absorb $200 to $300 billion of total AI funding, which falls far short of what is needed. This situation shifts the burden back to the public bond market, where spreads are already widening.

Portfolio guidelines often track issuer exposure rather than thematic exposure, meaning funds can legally hold multiple 3% allocations across companies like Alphabet, Meta, Microsoft, and Oracle—while unknowingly concentrating all their risk in a single theme: the AI megacycle. “This is one huge bet,” warns Khurana.

Khurana argues that the surge in debt from big tech has already pushed spreads higher, and if another high-quality AI borrower offers an unusually attractive yield, it could reset the entire corporate bond market. Investors would flock to safer AI issuers and abandon lower-quality names.

Who stands to be most exposed in this scenario? Telecom giants such as AT&T (BBB) with $150 billion in outstanding debt, Comcast (A-) with $100 billion, and Verizon (BBB+) with $120 billion are among the largest and most frequent issuers. If forced to compete with high-yielding AI bonds, they may face soaring borrowing costs or even lose access to funding altogether.

The risk does not end there. If AI borrowers continue to dominate issuance, liquidity could drain from other sectors, yields could spike, and diversification screens could exclude entire industries. What seems to be a financing boom for the future of computing may ultimately become the catalyst for the next major credit crunch.

Source: Original article

Synergy 2025, the flagship annual conference of ITServe Alliance, is set to convene more than 2,000 CEOs and executives from across the globe at the Puerto Rico Convention Center from December 4–5, 2025. Building on a legacy of excellence, this year’s event promises to deliver unparalleled insights from world-renowned speakers, dynamic panel discussions, and networking opportunities designed to inspire, educate, and empower leaders in the IT services industry.

Synergy 2025, the flagship annual conference of ITServe Alliance, is set to convene more than 2,000 CEOs and executives from across the globe at the Puerto Rico Convention Center from December 4–5, 2025. Building on a legacy of excellence, this year’s event promises to deliver unparalleled insights from world-renowned speakers, dynamic panel discussions, and networking opportunities designed to inspire, educate, and empower leaders in the IT services industry.