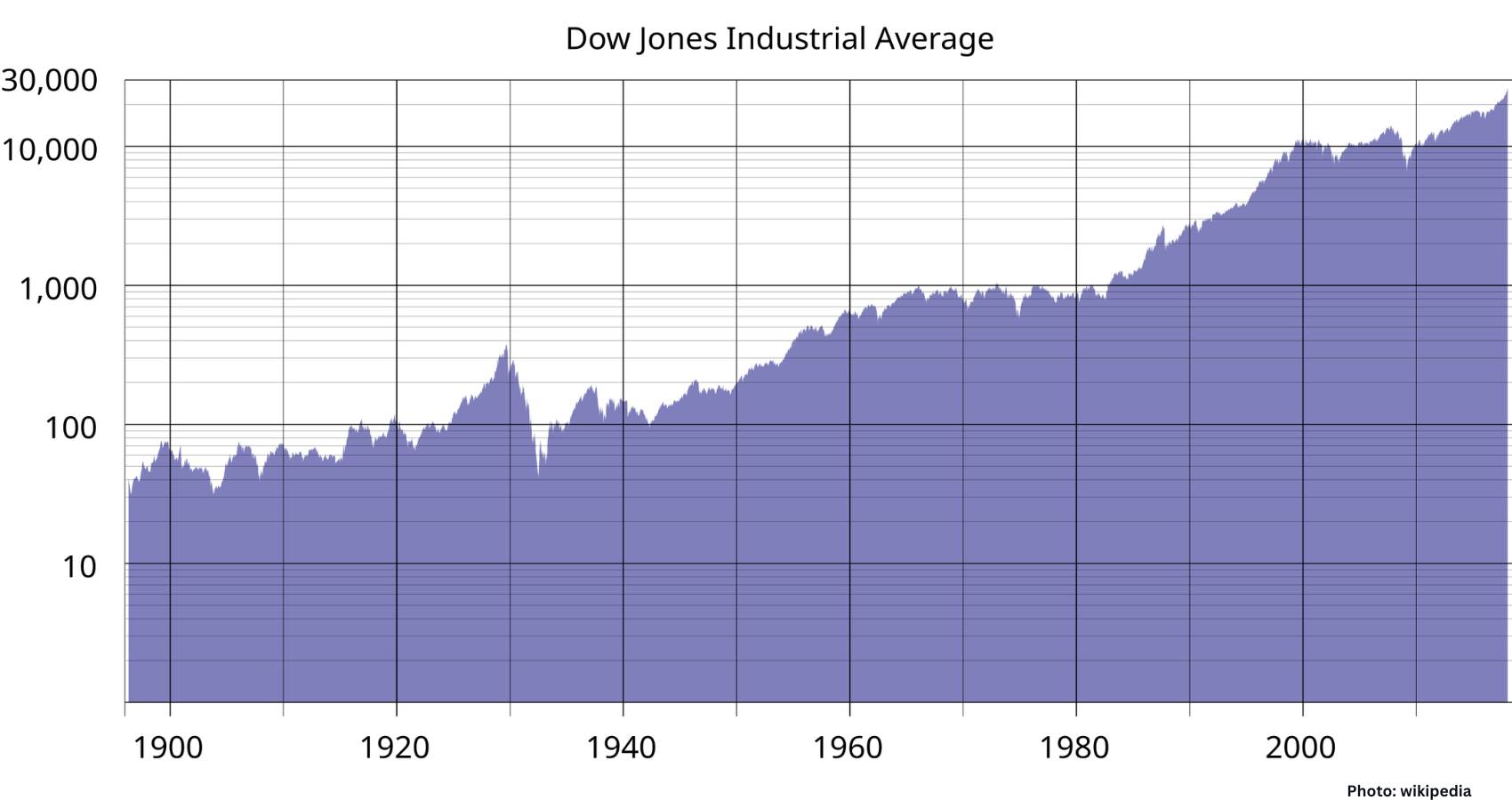

The Dow Jones Industrial Average closed above 50,000 points for the first time in history, marking a significant milestone amid a broader market rally.

The Dow Jones Industrial Average reached a historic milestone on Friday, closing above the 50,000-point threshold for the first time in its 140-year history. The index surged more than 1,200 points during the trading session, representing a 2.5 percent increase to settle at a record-breaking 50,115 points. This landmark achievement reflects a wave of optimism across Wall Street, as the S&P 500 climbed 2 percent and the tech-heavy Nasdaq Composite rose 2.2 percent by the end of the day.

This ascent to 50,000 marks a sharp reversal from recent market anxieties. For several weeks, the broader market had been mired in a period of sustained losses, primarily driven by investor uncertainty regarding the long-term impact of generative artificial intelligence on the software development sector. Analysts had previously expressed concern that the rapid integration of AI might disrupt traditional revenue models for established tech giants, leading to a cooling period for the indices. However, Friday’s performance suggests that these fears may be receding in light of more immediate economic indicators and strong corporate earnings.

Technology bellwether Nvidia played a pivotal role in the Dow’s upward trajectory on Friday, ending the session with an 8 percent gain. The semiconductor giant continues to serve as a primary engine for market growth, benefiting from sustained demand for the hardware necessary to power complex computing tasks. The rally was not confined to the technology sector; gains were distributed across a diverse range of industries. Construction and manufacturing stalwarts, including Caterpillar and 3M, were among the index’s top performers, signaling a robust outlook for the industrial and infrastructure segments of the economy.

Financial institutions also contributed significantly to the day’s record-setting performance. Shares of Goldman Sachs and JPMorgan Chase saw substantial appreciation, buoyed by the prospect of a stabilizing interest rate environment. The healthcare and retail sectors added to the momentum, with Amgen and Walmart posting notable gains. Even the entertainment sector experienced a boost, as the Walt Disney Co. joined the ranks of the day’s best-performing stocks. This broad-based participation indicates a diversification of the rally beyond the narrow tech leadership that dominated much of the previous year.

Economists pointed to a shift in consumer and investor sentiment as the primary catalyst for the day’s movement. Data released by the University of Michigan indicated a slight increase in the consumer sentiment index, providing a much-needed boost to market confidence. Jeffrey Roach, chief economist for LPL Financial, noted that median one-year inflation expectations have reached their lowest levels since January 2025. This improvement in inflation metrics has offered considerable comfort to investors who have navigated the complexities of a high-interest-rate environment and persistent price pressures over the past two years.

The Federal Reserve remains a central focus for market participants as they look toward the remainder of the year. While the transition to a new Federal Reserve chair has introduced a degree of uncertainty and temporary jitters in the trading pits, many analysts remain optimistic about the central bank’s trajectory. There is a growing consensus among institutional investors that the Fed may initiate rate cuts later this year. Such a move would likely lower borrowing costs for corporations and consumers alike, effectively providing the liquidity necessary to support further market appreciation and economic expansion.

Political figures were quick to acknowledge the market’s historic performance. President Trump, whose administration has closely monitored economic approval ratings amidst fluctuating data, celebrated the milestone via social media. In a post on Truth Social, the President extended his congratulations to the country, framing the 50,000-point mark as a validation of broader economic policies. The intersection of political rhetoric and market performance continues to be a focal point for analysts assessing the impact of fiscal policy on investor behavior and corporate confidence.

The ascent to 50,000 highlights the accelerating pace of growth within the Dow Jones Industrial Average over the last decade. The index has more than doubled in value in less than ten years, crossing several major milestones in quick succession. The Dow first reached 20,000 points in January 2017 and climbed to 30,000 by November 2020. It subsequently broke the 40,000-point barrier in May 2024. The transition from 40,000 to 50,000 took only 630 days, a remarkably brief period compared to the 1,270 days required to bridge the gap between 30,000 and 40,000.

This acceleration is particularly noteworthy given the global economic headwinds faced during this period, including supply chain disruptions, geopolitical tensions, and ongoing inflationary pressures. The fact that the index could gain 10,000 points in less than two years suggests a high level of liquidity and a concentrated surge in the valuation of the 30 blue-chip companies that comprise the Dow. Critics of the index often point out its price-weighted nature, yet it remains one of the most cited barometers of the overall health and direction of the United States economy.

Looking ahead, the sustainability of the 50,000-point level will depend on several key factors, including the upcoming quarterly earnings season and the Federal Reserve’s next policy meeting. While the psychological impact of the 50,000 milestone is significant, seasoned traders often look for support levels to solidify after such a rapid climb. If the Dow can maintain its position above this threshold, it may signal the start of a new era of market growth; conversely, any sign of renewed inflation or a shift in the Fed’s dovish stance could lead to a period of consolidation or a technical pullback.

The strength of the manufacturing sector, as evidenced by Caterpillar and 3M’s performance, provides a glimmer of hope for a soft landing or continued growth in the real economy. These companies are often viewed as proxies for global economic activity, and their upward movement suggests that industrial demand remains resilient despite higher costs. Similarly, the performance of retail giants like Walmart indicates that the American consumer remains a potent force, capable of driving corporate profits even as household budgets are scrutinized. These underlying fundamentals will be essential in determining if the Dow can reach its next major milestone in a similarly shortened timeframe.

As the trading week concludes, the 50,115-point close stands as a significant marker in financial history. It represents both the culmination of years of industrial and technological evolution and a snapshot of current investor confidence in the face of rapid AI-driven change and shifting monetary policies. While the road to 50,000 was marked by periods of intense speculation and concern, the record set on Friday provides a moment of clarity for a market that continues to defy long-term bearish projections and set new standards for growth in the 21st century, according to GlobalNetNews.

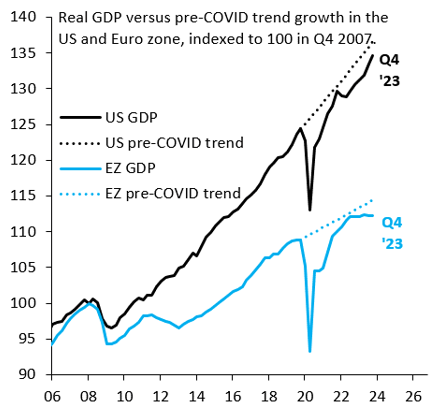

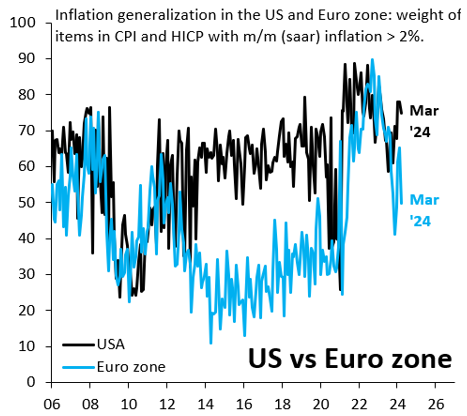

A stylized fact following the 2008 crisis is that U.S. growth substantially outperformed the rest of the advanced world. This again looks to be true in the aftermath of COVID-19 (Figure 1), with lots of debate on the underlying drivers. Some argue that this outperformance reflects loose fiscal policy and rapid immigration, while others see a productivity boom linked to tight labor markets. Whatever the source, cyclical outperformance may keep U.S. inflation stickier than elsewhere. There are some signs of this. Figure 2 shows the combined weight of items in the U.S. consumer price index (CPI) with month-over-month inflation above 2% (on a seasonally adjusted, annualized basis), alongside the same measure for the eurozone’s harmonized index of consumer prices (HICP). This metric is noisier than if we used year-over-year inflation, but it has the advantage of focusing on recent inflation dynamics, since there are no base effects to muddy the picture. Elevated inflation remains relatively broad-based in the U.S., consistent with strong growth, while inflation momentum is clearly fading in the eurozone.

A stylized fact following the 2008 crisis is that U.S. growth substantially outperformed the rest of the advanced world. This again looks to be true in the aftermath of COVID-19 (Figure 1), with lots of debate on the underlying drivers. Some argue that this outperformance reflects loose fiscal policy and rapid immigration, while others see a productivity boom linked to tight labor markets. Whatever the source, cyclical outperformance may keep U.S. inflation stickier than elsewhere. There are some signs of this. Figure 2 shows the combined weight of items in the U.S. consumer price index (CPI) with month-over-month inflation above 2% (on a seasonally adjusted, annualized basis), alongside the same measure for the eurozone’s harmonized index of consumer prices (HICP). This metric is noisier than if we used year-over-year inflation, but it has the advantage of focusing on recent inflation dynamics, since there are no base effects to muddy the picture. Elevated inflation remains relatively broad-based in the U.S., consistent with strong growth, while inflation momentum is clearly fading in the eurozone.

The Sixteenth Finance Commission has been requested to make its recommendations available by October 31, 2025, covering an award period of 5 years commencing 1st April, 2026. The Finance Commission usually takes about two years to consult stakeholders in the States and Centre and arrive at their conclusions.

The Sixteenth Finance Commission has been requested to make its recommendations available by October 31, 2025, covering an award period of 5 years commencing 1st April, 2026. The Finance Commission usually takes about two years to consult stakeholders in the States and Centre and arrive at their conclusions. The SEC’s complaint, unsealed on Monday in the Eastern District of Texas, alleged that the defendants raised more than $89 million from over 350 investors for investments in purported venture capital funds that the founders managed via Nanban Ventures and more than $39 million from 10 investors that invested directly in the three other entities.

The SEC’s complaint, unsealed on Monday in the Eastern District of Texas, alleged that the defendants raised more than $89 million from over 350 investors for investments in purported venture capital funds that the founders managed via Nanban Ventures and more than $39 million from 10 investors that invested directly in the three other entities. Bhoomi, a vibrant and fearless Mumbai-based property lawyer, had, as a widowed single mother, earned respect for her dedication to her daughter. However, on this fateful day, she was reduced to a state of chaos.

Bhoomi, a vibrant and fearless Mumbai-based property lawyer, had, as a widowed single mother, earned respect for her dedication to her daughter. However, on this fateful day, she was reduced to a state of chaos.

Many of the laborers who participated in the temple’s construction arrived in New Jersey from India on religious visas and belonged to the Dalit community, historically marginalized groups in South Asia’s caste system. The lawsuit claimed that temple leadership enforced the caste hierarchy at work.

Many of the laborers who participated in the temple’s construction arrived in New Jersey from India on religious visas and belonged to the Dalit community, historically marginalized groups in South Asia’s caste system. The lawsuit claimed that temple leadership enforced the caste hierarchy at work. The RBI museum website shares insights from that era, noting that there were deliberations about selecting symbols for independent India. Initially, the idea was to replace the King’s portrait with that of Mahatma Gandhi. Design proposals were even prepared for this purpose. However, the consensus eventually shifted towards choosing the Lion Capital at Sarnath in place of Gandhi’s portrait. The new banknote designs largely followed the earlier patterns.

The RBI museum website shares insights from that era, noting that there were deliberations about selecting symbols for independent India. Initially, the idea was to replace the King’s portrait with that of Mahatma Gandhi. Design proposals were even prepared for this purpose. However, the consensus eventually shifted towards choosing the Lion Capital at Sarnath in place of Gandhi’s portrait. The new banknote designs largely followed the earlier patterns.