In an alarming revelation, a nefarious blackmail scheme has emerged, employing instant loan applications to ensnare and disgrace individuals across India, as well as in various Asian, African, and Latin American nations. A heart-wrenching report has exposed the grave consequences of this perilous extortion racket, with at least 60 Indian citizens resorting to suicide after enduring relentless abuse and threats. The BBC’s undercover investigation has shone a light on those profiting from this deadly deception, which has proliferated in India and China.

Astha Sinhaa’s world was abruptly upended when her aunt, in a state of panic, urgently contacted her. “Don’t allow your mother to leave the house,” she implored. Still half-asleep, the 17-year-old was gripped with fear as she discovered her mother, Bhoomi Sinhaa, in the adjacent room, distraught and agitated.

Bhoomi, a vibrant and fearless Mumbai-based property lawyer, had, as a widowed single mother, earned respect for her dedication to her daughter. However, on this fateful day, she was reduced to a state of chaos.

Bhoomi, a vibrant and fearless Mumbai-based property lawyer, had, as a widowed single mother, earned respect for her dedication to her daughter. However, on this fateful day, she was reduced to a state of chaos.

Astha recalls, “She was breaking apart.” Bhoomi urgently began to provide her daughter with instructions on the whereabouts of important documents and contacts, a palpable desperation to exit the premises. Her aunt’s admonition resonated in Astha’s mind: “Don’t let her out of your sight, because she will end her life.”

Little did Astha know the extent of her mother’s torment, who had become a victim of a global scam that had ensnared individuals in at least 14 countries, wielding shame and extortion as its weapons.

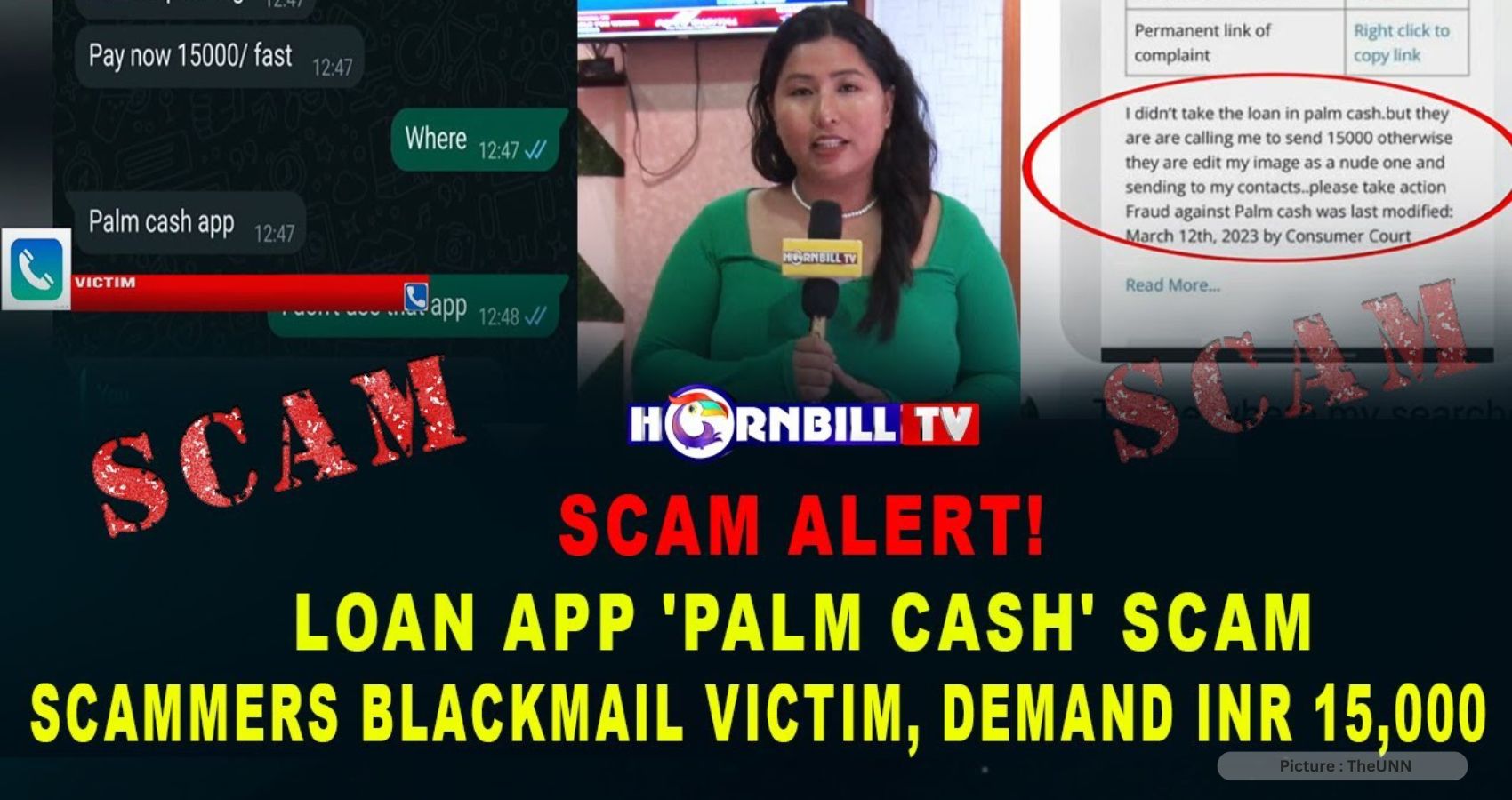

The sinister modus operandi of this scam is uncompromising yet straightforward. Numerous apps promise rapid, hassle-free loans. While not all of them operate maliciously, many, once downloaded, surreptitiously harvest users’ contacts, photos, and identification documents, employing this sensitive data as leverage for future extortion.

When borrowers fail to meet repayment deadlines – and sometimes even when they do – these apps transmit user information to a call center. There, young agents in the gig economy, equipped with laptops and smartphones, are trained to relentlessly harass and demean individuals until they comply with demands for repayment.

By the end of 2021, Bhoomi had borrowed roughly 47,000 rupees ($565; £463) from several loan apps, expecting that her work-related expenses would soon be covered. While the funds arrived promptly, a substantial portion was deducted in fees. A week later, her expenses remained unpaid, compelling her to borrow from other apps, creating a spiraling debt that ultimately reached two million rupees ($24,000; £19,655).

Subsequently, the recovery agents commenced their relentless calls, which swiftly devolved into a barrage of insults and abuse directed at Bhoomi. Even after making payments, she was accused of dishonesty. The agents phoned her up to 200 times daily, asserting knowledge of her residence and even sending gruesome images as threats.

As the abuse escalated, Bhoomi’s tormentors threatened to expose her as a thief and a prostitute to all 486 contacts in her phone. When her daughter’s reputation became a target, Bhoomi found herself unable to sleep.

In a desperate attempt to repay her mounting debts, she borrowed from friends, family, and additional apps, eventually totaling 69 in all. Every night, she hoped the morning would never come. However, at 7:00 a.m., her phone would start buzzing relentlessly.

Although Bhoomi eventually managed to repay all the money, one app, in particular, Asan Loan, persisted in its harassment. Overwhelmed and emotionally drained, Bhoomi’s ability to concentrate at work waned, and panic attacks became a daily occurrence.

One day, a colleague showed her a disturbing image on his phone – a lewd, pornographic picture of herself. The photograph had been crudely manipulated, superimposing Bhoomi’s head onto another person’s body. However, it filled her with revulsion and humiliation. The image had been disseminated to every contact in her phone book by Asan Loan, pushing Bhoomi to contemplate suicide.

Disturbingly, this devastating scam has affected numerous lives across the world. However, in India alone, the BBC’s investigation has uncovered that at least 60 individuals have taken their own lives after enduring harassment from loan apps.

These victims, mostly in their 20s and 30s, include a firefighter, an award-winning musician, a young couple leaving behind their three- and five-year-old daughters, and even a grandfather and grandson who were both ensnared in the clutches of loan apps. Shockingly, four of the victims were teenagers.

Regrettably, many of the victims are too ashamed to discuss their ordeal, while the perpetrators, for the most part, remain anonymous and concealed. After a months-long search for an insider, the BBC managed to locate a former debt recovery agent who had worked for call centers associated with multiple loan apps.

This informant, referred to as Rohan (a pseudonym), was deeply troubled by the abuse he witnessed. He recounted customers’ tears and their threats of self-harm, admitting, “It would haunt me all night.” Eventually, Rohan agreed to assist the BBC in exposing the scam.

He successfully secured employment at two separate call centers, Majesty Legal Services and Callflex Corporation, and spent weeks covertly recording their activities. His recordings captured young agents mercilessly harassing clients, issuing threats and profanities. In one incident, a woman resorted to threats of violence. She accused a client of committing incest and, upon their disconnection, callously laughed.

Rohan managed to document over 100 instances of harassment and abuse, thus providing the first tangible evidence of this systemic extortion.

The most egregious instances of abuse occurred at Callflex Corporation, located just outside Delhi. At this call center, agents routinely employed obscene language to degrade and threaten clients. Notably, these agents were not acting independently but rather under the supervision and direction of call center managers, including one named Vishal Chaurasia.

Rohan succeeded in gaining Chaurasia’s trust and, alongside a journalist posing as an investor, arranged a meeting during which they pressured him to elucidate the intricacies of the scam.

Chaurasia revealed that when a customer acquires a loan, the app gains access to their contact list. Callflex Corporation is then contracted to recover the funds, resorting to relentless harassment if a client misses a payment, targeting both the client and their contacts. According to Chaurasia, the agents can say anything, as long as it secures repayment.

“The customer then pays because of the shame,” Chaurasia divulged. “You’ll find at least one person in his contact list who can destroy his life.”

The BBC approached Chaurasia for direct comment, but he declined to provide a statement. Regrettably, Callflex Corporation also failed to respond to the BBC’s outreach efforts.

One of the countless lives torn apart by this scam was that of Kirni Mounika, a 24-year-old civil servant. She was the pride of her family, the only student at her school to secure a government job, and a devoted sister to her three brothers.

Her father, a successful farmer, was ready to support her to do a masters in Australia. The Monday she took her own life, three years ago, she had hopped on her scooter to go to work as usual. “She was all smiles,” her father, Kirni Bhoopani, says. It was only when police reviewed Mounika’s phone and bank statements that they found out she had borrowed from 55 different loan apps. It started with a loan of 10,000 rupees ($120; £100) and spiralled to more than 30 times that. By the time she decided to kill herself, she had paid back more than 300,000 rupees ($3,600; £2,960).

Police reports indicate that Mounika’s ordeal involved incessant calls and vulgar messages from the loan apps, which had escalated to messaging her contacts.

Mounika’s room has now been transformed into a makeshift memorial. Her government ID card hangs near the door, and her mother’s wedding bag remains untouched. What pains her father most is that she never confided in him about her predicament. “We could have easily arranged the money,” he laments, wiping tears from his eyes. His anger is directed toward those responsible for his daughter’s suffering.

As he was accompanying his daughter’s body from the hospital, her phone rang, and he answered to a torrent of obscenities. “They told us she has to pay,” he recalls. “We told them she was dead.” He wondered who these heartless tormentors could be.

Hari, a former employee at a call center tasked with loan recovery for one of the apps Mounika had borrowed from, shares a grim perspective. While he claims not to have personally made abusive calls, he was part of the team responsible for initial, more polite interactions. Hari reveals that managers instructed staff to employ abuse and threats.

Agents routinely sent messages to victims’ contacts, portraying the victims as fraudsters and thieves. Hari emphasizes the importance of maintaining a reputation in front of one’s family, stating, “No one is going to spoil that reputation for the measly sum of 5,000 rupees.” Once a payment was secured, the system signaled “Success!” and they moved on to the next client.

When clients began to threaten self-harm, nobody took these threats seriously until the suicides began. Faced with this grim reality, the staff contacted their boss, Parshuram Takve, to inquire whether they should cease their relentless tactics.

Upon Takve’s appearance at the office, he was notably furious. “He said, ‘Do what you’re told and make recoveries,'” Hari recalls. And so they did.

A few months later, Mounika tragically took her own life. Takve, a ruthless figure, wasn’t the sole mastermind behind this operation. Occasionally, Hari notes, the software interface would inexplicably switch to Chinese.

Takve was married to a Chinese woman named Liang Tian Tian. Together, they established Jiyaliang, a loan recovery business located in Pune, where Hari was employed. In December 2020, Indian authorities arrested Takve and Liang while investigating harassment related to loan apps. However, they were released on bail a few months later.

By April 2022, they faced charges of extortion, intimidation, and abetment of suicide. By the year’s end, they were fugitives from justice.

Takve proved to be a formidable figure, but he did not operate in isolation. At times, the software interface switched to Chinese, suggesting a broader connection. Our investigation led us to a Chinese businessman named Li Xiang, who has little online presence. However, we identified a phone number associated with one of his employees and, posing as investors, arranged a meeting with Li.

During this meeting, Li boasted about his business ventures in India. He disclosed that his companies had been subject to police raids in 2021 in relation to loan apps’ harassment, leading to frozen bank accounts. Li explained that his companies run loan apps in India, Mexico, and Colombia, and he asserted himself as an industry leader in risk control and debt collection services in Southeast Asia. He further revealed plans to expand into Latin America and Africa, employing over 3,000 staff in Pakistan, Bangladesh, and India to provide “post-loan services.”

Li went on to detail his company’s debt recovery methods, explaining, “If you don’t repay, we may add you on WhatsApp, and on the third day, we will call and message you on WhatsApp at the same time, and call your contacts. Then, on the fourth day, if your contacts don’t pay, we have specific detailed procedures. We access his call records and capture a lot of his information. Basically, it’s like he’s naked in front of us.”

For Bhoomi Sinha, the relentless harassment, threats, and abuse were bearable, but the shame of being linked to that pornographic image shattered her. She describes the message as stripping her bare in front of the entire world, causing her to lose her self-respect, morality, and dignity in an instant.

This image was shared with lawyers, architects, government officials, elderly relatives, and friends of her parents – individuals who would never view her the same way again. She explains that it tainted her essence, leaving her with emotional scars akin to mending a broken glass with persistent cracks.

Her community of 40 years has ostracized her, and she reveals that she no longer has friends. However, her daughter’s unwavering support became a source of strength. Bhoomi resolved to fight back, filing a police report, changing her number, and instructing friends, family, and colleagues to ignore calls and messages.

Although her ordeal has been harrowing, Bhoomi found solace in her sisters, her boss, and an online community of others abused by loan apps. Above all, her daughter’s unwavering support has been her greatest source of strength.

The BBC presented these allegations to Asan Loan, Liang Tian Tian, and Parshuram Takve, but neither the company nor the couple responded. Li Xiang asserted that his companies adhere to local laws and regulations, denying any involvement in predatory loan apps and emphasizing their compliance with strict standards for loan recovery call centers. Majesty Legal Services denied the use of customers’ contacts for loan recovery and assured that their agents are instructed to avoid abusive or threatening calls, with violations resulting in dismissal.