A recent report reveals that the Trump administration’s immigration detention system has expanded significantly, targeting individuals without criminal records and creating harsh conditions that undermine due process.

Washington, D.C., January 14 — A new report from the American Immigration Council highlights the troubling expansion of the immigration detention system under the Trump administration. The report indicates that the administration is detaining hundreds of thousands of individuals, most of whom have no criminal record, in a system that makes it nearly impossible for them to contest their cases or secure their release.

The report, titled *Immigration Detention Expansion in Trump’s Second Term*, outlines how historic funding increases and aggressive enforcement tactics have led to the highest levels of immigration detention in U.S. history. Instead of addressing genuine public safety concerns, the government is allocating billions of dollars towards mass detention, pressuring individuals who pose no threat to abandon their cases and accept deportation.

The consequences of the Trump administration’s mass deportation agenda extend beyond detention centers. The Department of Homeland Security (DHS) has employed aggressive tactics during large-scale enforcement actions in neighborhoods across the country, resulting in tragic, preventable deaths. This underscores the human cost of an immigration enforcement system that operates with minimal oversight and accountability.

“This has absolutely nothing to do with law and order,” said Aaron Reichlin-Melnick, senior fellow at the American Immigration Council. “Under mass deportation, we’re witnessing the construction of a mass immigration detention system on an unprecedented scale, where individuals with no criminal record are routinely imprisoned without a clear path to release. Over the next three years, billions more dollars will be funneled into a detention system that is on track to rival the entire federal criminal prison system. The goal is not public safety, but to pressure individuals into relinquishing their rights and accepting deportation.”

According to the report, the number of individuals held in U.S. Immigration and Customs Enforcement (ICE) detention surged nearly 75 percent in 2025, rising from approximately 40,000 at the beginning of the year to 66,000 by December, marking the highest level ever recorded. With Congress authorizing $45 billion in new detention funding, the report warns that the system could more than triple in size over the next four years.

Key findings from the report reveal a significant shift in the demographics of those being detained. Arrests of individuals with no criminal record increased by 2,450 percent in the first year of the Trump administration, driven by tactics such as “at-large” arrests, roving patrols, worksite raids, and re-arrests of individuals attending immigration court hearings or ICE check-ins. The percentage of individuals arrested by ICE and held in detention without a criminal record rose from 6 percent in January to 41 percent by December.

The rapid expansion of the detention system has exacerbated already poor conditions. By December, ICE was utilizing over 100 more facilities to detain immigrants than at the start of the year. For the first time, thousands of immigrants arrested in the interior are being held in hastily constructed tent camps, where conditions are reported to be brutal. More individuals died in ICE detention in 2025 than in the previous four years combined.

Moreover, individuals are increasingly stripped of their opportunity to request release from a judge. New policies have normalized prolonged, indefinite detention. The Trump administration is pursuing measures that deny millions of detained individuals the right to a bond hearing, where they could argue for their release while their immigration cases are pending, including those who have lived in the United States for decades.

The administration is also using detention as a means to increase deportations. By November 2025, for every individual released from ICE detention, more than fourteen were deported directly from custody, a stark contrast to the one-to-two ratio from the previous year.

As the administration expands detention, it simultaneously undermines oversight. The rapid growth of the detention system has coincided with significant cuts to internal watchdogs and new restrictions on congressional inspections. This erosion of oversight has far-reaching consequences, as ICE operates with fewer checks on its authority, leading to aggressive enforcement in cities that has resulted in preventable harm and deaths.

“The Trump administration continues to falsely claim it’s going after the ‘worst of the worst,’ but public safety is merely a pretext for detaining immigrants and coercing them to abandon their cases,” said Nayna Gupta, policy director at the American Immigration Council. “Horrific conditions inside detention facilities compel individuals to accept deportation, thereby fueling the administration’s inhumane deportation quotas and objectives.”

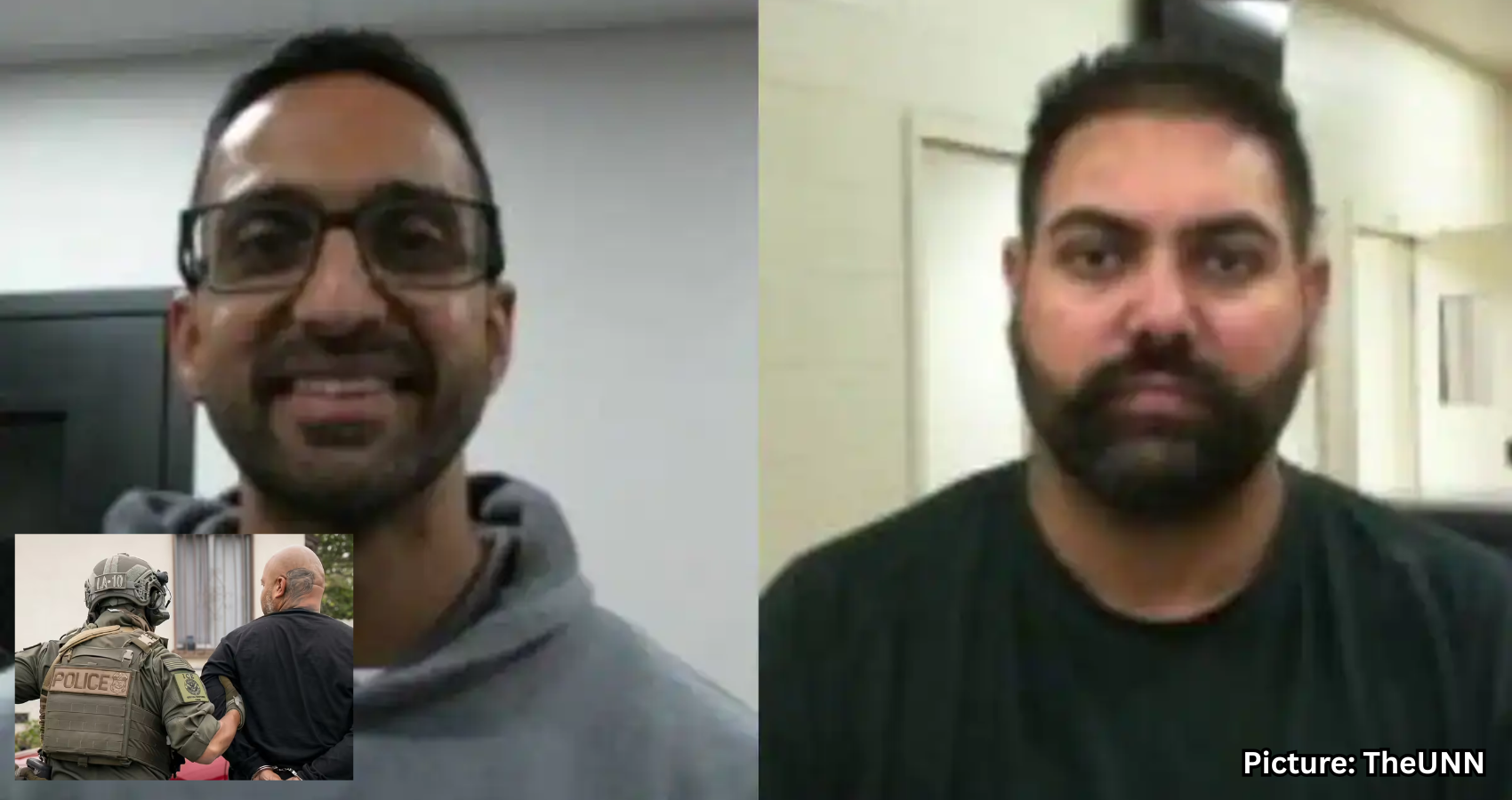

The report profiles the experiences of three individuals that illustrate the real-world impact of this historic expansion of detention. One case involves a green card holder and father of two, who was detained by ICE at an airport due to a past conviction that he was assured would not jeopardize his legal status. During his detention, ICE neglected his medical issues for months.

Another case features an asylum seeker granted humanitarian protection by an immigration judge, yet remains detained months later without explanation, as ICE seeks to deport her to a third country. She reported being treated better in federal prison while serving time for an immigration offense.

Lastly, a DACA recipient was detained following a criminal arrest and transferred repeatedly across the country as ICE searched for available bed space, witnessing consistently poor conditions across various detention centers.

With billions of additional dollars already approved, the report warns that immigration detention is poised to grow even larger, exacerbating the human, legal, and financial costs for families, communities, and the nation as a whole.

“This is a system built to produce deportations, not justice,” Reichlin-Melnick stated. “When detention becomes the default response to immigration cases, the costs are borne by everyone. Families are torn apart, due process is set aside, and billions of taxpayer dollars are wasted on these unnecessary and cruel policies that do nothing to enhance public safety,” according to the American Immigration Council.