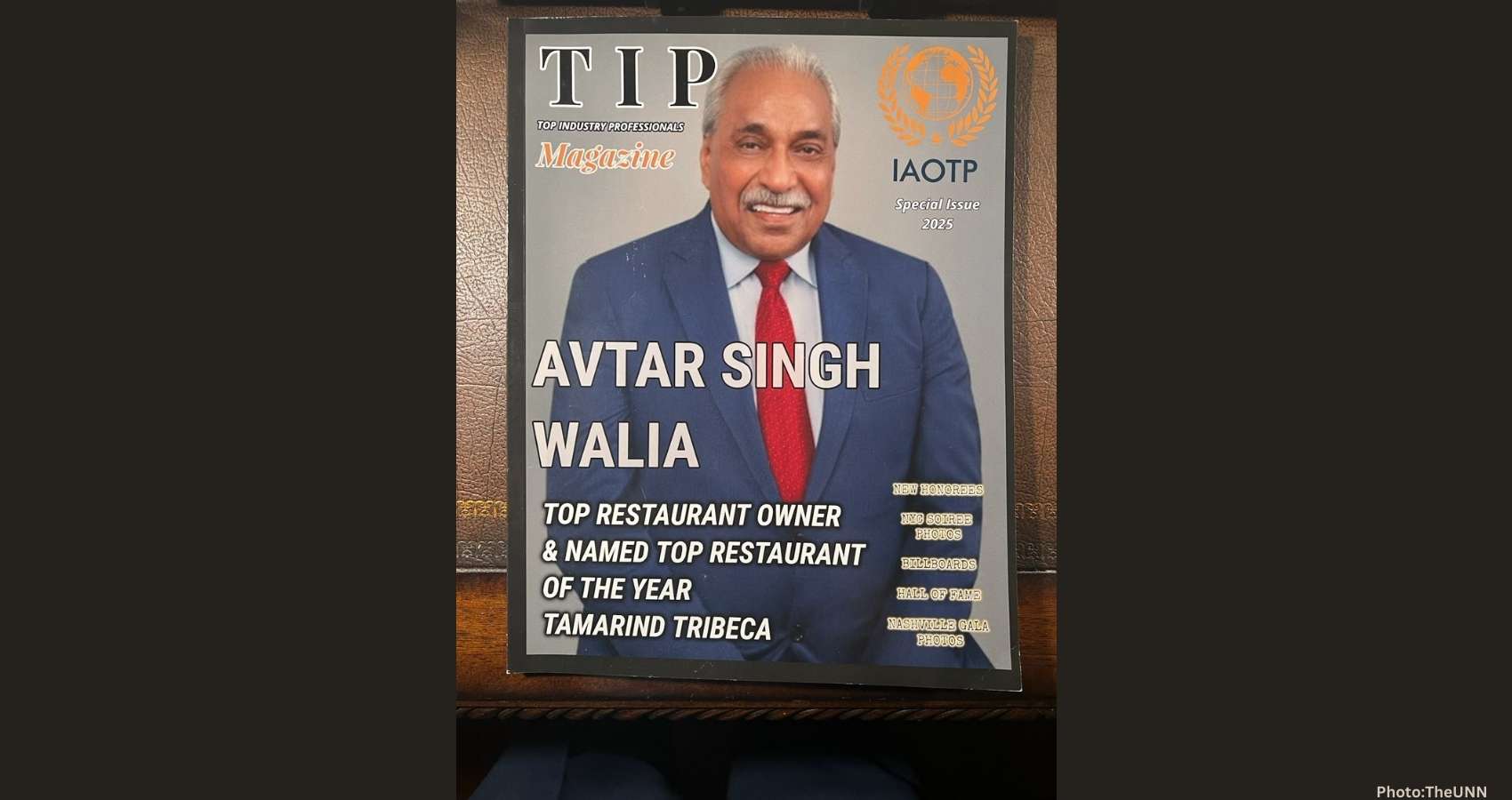

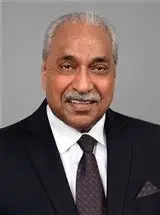

Michelin-Starred Restaurateur Honored for Transforming Indian Fine Dining in America

Las Vegas, NV —In a glittering ceremony at the Bellagio Hotel in Las Vegas, Avtar Singh Walia, renowned for his transformative impact on Indian cuisine in America, was honored as a Top Restaurant Owner of the Year by the International Association of Top Professionals (IAOTP).

In addition, Tamarind Tribeca, owned by Avtar Singh Walia, was chosenas Top Restaurant of the Year for 2025 by IAOTP.

The annual gala in December 2025, which brought together global industry leaders, celebrated Mr. Walia’s decades-long dedication, vision, and leadership in the culinary world. “It was truly humbling for me and my beloved Restaurant, Tamarind to be chosen as the top in the world from among the hundreds that were considered for this great honor,” said Mr. Walia. “I want to thank the International Association of Top Professionals for bestowing this honor on me and Tamarind. The honor is a testament to Indian cuisine gpoing mainstream across the globe.”

The IAOTP recognition is reserved for a select few in each discipline, chosen for their outstanding achievements, leadership abilities, and community contributions. This year, Walia’s name rose to the top, a testament to his perseverance, innovative approach, and the enduring legacy he has built over nearly forty years.

The President of the International Association of Top Professionals (IAOTP), Stephanie Cirami, stated: “Choosing Mr. Walia for this honor was an easy decision for our panel to make. He is inspirational, influential, and a true visionary and thought leader. We cannot wait to meet him and celebrate his accomplishments at this year’s gala.”

Decades of Dedication and Innovation

Looking back, Mr. Walia attributes his success to his perseverance, work ethic, and the mentors he has had along the way.

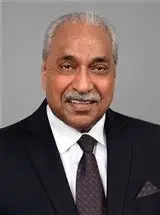

Mr. Walia’s journey began in the late 1970s after immigrating from Punjab, India. Starting as a warehouse manager for Gucci and later working at New York’s Tandoor restaurant, he quickly discovered his true passion lay in the world of food. His first major role in hospitality came at Akbar restaurant on Park Avenue, where, as manager, he cultivated his dream of opening a fine dining establishment that would showcase the flavors and elegance of Indian cuisine.

That dream came to fruition in 1986 when he co-founded Dawat, partnering with celebrity chef Madhur Jaffrey. Dawat quickly gained a reputation for introducing New Yorkers to a refined, authentic take on Indian food. “We wanted to show people that Indian cuisine could be sophisticated, nuanced, and worthy of the city’s culinary spotlight,” Walia recalls. “It was about changing perceptions and celebrating the richness of our culture.”

Building a Culinary Empire

Walia’s commitment to excellence and authenticity led him to open Tamarind on East 22nd Street in the Flatiron District in 2001, this time as the sole proprietor. Working alongside acclaimed chefs like Raj Jallepalli and Durga Prasad, he elevated the restaurant to Michelin-star status, a first for Indian cuisine in New York City. “A Michelin star isn’t just a personal achievement — it’s a recognition of my team’s relentless pursuit of perfection,” Walia says. “It affirms that Indian food has a rightful place among the world’s greatest cuisines.”

In 2010, Walia launched Tamarind Tribeca at 99 Hudson Street, a sprawling 11,000-square-foot institution that has become synonymous with luxury, hospitality, and world-class Indian dining. The restaurant seats 175 across two levels, featuring a main dining room, a windowed cocktail lounge, and a mezzanine for private events. Under his guidance, Tamarind Tribeca earned Michelin stars in 2013 and 2014, cementing its status as one of New York’s premier culinary destinations.

Tamarind Tribeca, formally known as the Tamarind, a Michelin–starred fine dining restaurant, was located in the Flatiron Section of Manhattan. The new Tamarind in Tribeca is synonymous with exceptionally well crafted Indian fine dining. Carefully set up by Avtar Walia, the restaurant aims to amalgamate the mysteries and joys of the flavors from the India sub-continent with the elan and panache of Tribeca, New York.

“Dining at Tamarind Tribeca isn’t just a meal — it’s a journey through the best of Indian cuisine,” says food critic and longtime patron, Susan Feldman. “Mr. Walia has redefined the experience, blending authenticity with innovation in every dish.”

A Philosophy of Hospitality

Central to Walia’s approach is the Indian ethos of “Atithi Devo Bhava” — the guest is god. This philosophy is evident in every aspect of Tamarind Tribeca, from the meticulously curated menu to the warm, attentive service. Walia is a constant presence in the restaurant, greeting guests, overseeing the kitchen, and ensuring that every dish meets his high standards, especially during festive occasions like Diwali.

“Success comes from honesty, sincerity, and putting forth one’s best efforts,” Walia says, reflecting on his work ethic. “I believe in leading by example, and that means being present, listening to guests, and never settling for less than excellence.”

His hands-on leadership and tireless commitment have cultivated a loyal clientele. Tamarind Tribeca has become a destination for diners seeking not just exquisite food, but also an experience marked by gracious hospitality and attention to detail. The restaurant’s acclaimed wine selection and inventive cocktails, crafted by a team of expert mixologists, further enhance the dining experience.

Recognition and Impact

Walia’s influence extends beyond his own establishments. He is recognized as a mentor to aspiring chefs, a supporter of local communities, and a consistent advocate for raising the profile of Indian cuisine in America. Over the years, he has received numerous awards, including Top Business Owners by Marquis Who’s Who and a Lifetime Achievement Award. His story has been featured in publications such as The New York Times Magazine and Forbes, and on “Good Morning America.”

\In February 2025, Walia was also featured in the New York Edition of The Wall Street Journal, reflecting the growing national recognition of his contributions. Forbes has called him the “godfather of high-end Indian cuisine in America.” His peers refer to him as “a pioneer of Indian gastronomy in America,” and his restaurants have been described as “a masterclass in Indian fine dining.”

Giving Back and Looking Forward

Walia’s journey from his hometown of Abheypur, India, to the heights of New York’s restaurant scene is a story of hard work and the pursuit of the American dream. After earning his bachelor’s degree from Punjab University in 1974, he initially considered a career in the army, but ultimately followed his passion for hospitality, bringing the flavors of his heritage to a new audience.

Beyond his culinary achievements, Walia is known for his philanthropic efforts, supporting civic organizations and mentoring the next generation of chefs. “I want to encourage more people to enter this industry and to show them that with dedication and integrity, success is possible,” he says. Among his future aspirations is to write a memoir, capturing the lessons and stories from his remarkable career.

About IAOTP

The International Association of Top Professionals is an exclusive boutique networking organization that handpicks top leaders from across industries. Membership is by invitation only, with nominees selected based on professional accomplishments and contributions to their fields. IAOTP provides a platform for collaboration, keynote speaking, and the exchange of ideas among the world’s most distinguished professionals.

“IAOTP prides itself on creating a community where the best of the best can connect and inspire one another,” says Cirami. “Mr. Walia exemplifies the spirit of excellence and leadership we seek to recognize.”

A Lasting Legacy

As Walia looks back on his journey, he credits his mentors, family, and relentless work ethic for his continued success. “Perseverance is everything,” he asserts. “I’m grateful for every challenge and every opportunity. My hope is that by sharing my story, I can inspire others to pursue their passions wholeheartedly.”

With Tamarind Tribeca firmly established as a beacon of Indian fine dining, and with continued accolades from industry peers and patrons alike, Avtar Singh Walia’s legacy is secure — not just as a restaurateur, but as a visionary who has forever changed the culinary landscape of America.

For more information about the IAOTP Awards Gala, visit www.iaotp.com/award-gala. To learn more about Tamarind Tribeca, visit the restaurant’s official website: Tamarind Tribeca – The Finest Indian Restaurant in NYC.