Andrew Sherman emphasizes the importance of recognizing internal intangible assets during organizational inflection points, urging leaders to look inward rather than chase external trends.

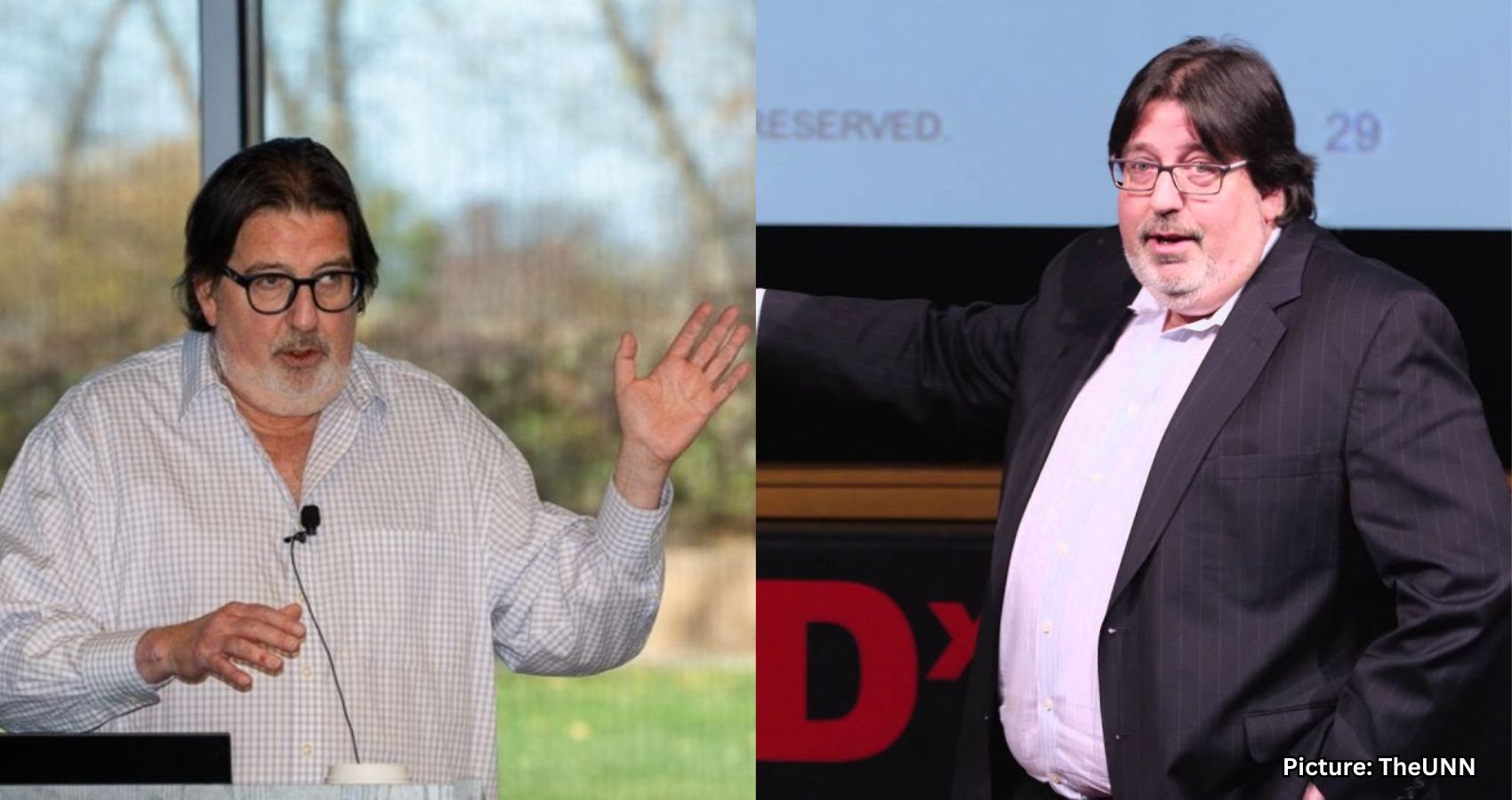

At the American Bazaar’s Leadership @ Inflection Points conference held in Vienna, Virginia, on November 14, attorney and strategist Andrew J. Sherman challenged business leaders to shift their focus from external trends to the hidden assets within their organizations.

In his keynote address, Sherman, a partner at Brown Rudnick LLP and a noted expert on business growth and intellectual property, warned against the tendency to pursue “bright shiny objects” instead of recognizing the inherent value already present in their enterprises.

“An inflection point,” Sherman explained to an audience of executives and entrepreneurs, “is not a time to freeze, or to chase the next shiny thing. It’s a time to look within—to lift up the sofa cushion, and see what hidden coins you already have.”

This metaphor succinctly encapsulated Sherman’s message: organizations frequently overlook their most valuable assets precisely when they need clarity the most.

According to Sherman, every organization—be it a Fortune 500 company, a university, or even a sports team—will encounter a turning point. “It’s a natural evolution,” he stated. “The question is not if the inflection point comes, but how leaders respond when it does.”

He noted that many leaders fall victim to what he termed “deer-in-the-headlights syndrome,” becoming paralyzed by indecision until opportunities slip away. Others mistakenly equate activity with progress, spending resources on consultants and transformation plans without making meaningful advancements.

Instead, Sherman advocated for a more introspective approach, encouraging leaders to take stock of their internal strengths—a practice that many organizations neglect.

In his talk, Sherman referenced his influential book, *Harvesting Intangible Assets*, which delves into how companies can unlock the unseen value embedded in their intellectual property, systems, and organizational culture.

He pointed out that while most companies can accurately account for their physical assets, such as desks and computers, few can effectively quantify their intangible assets, which include data, processes, customer relationships, distribution networks, and brand equity.

“We’re still living in the 1950s when it comes to accounting,” Sherman remarked. “Look at public companies today. The physical assets on their balance sheets are a fraction of their market value.”

He cited Nvidia as a prime example, noting that the chipmaker’s market capitalization recently exceeded $4 trillion, yet only about half a trillion of that is tied to physical assets. “That means three and a half trillion dollars of value isn’t accounted for on the balance sheet—except under ‘goodwill,’” he explained.

Historically, intangible assets have grown to represent a significant portion of corporate value. In 1975, tangible assets made up approximately 83 percent of corporate value; today, intangible assets account for nearly 90 percent.

Sherman cautioned that organizations often pursue new ventures or technologies—what he referred to as “bright shiny objects”—instead of examining their existing resources. He recalled advice from a fishing guide during a trip to Canada with his son: “Don’t leave fish to find fish.”

“In business,” Sherman said, “leaders leave what’s working to chase the next big thing—when the real opportunities are right there under their nose.”

He humorously reiterated the couch-cushion metaphor, stating, “Yes, when you lift it up, you’ll find some Cheerios and dust. But you’ll also find coins. Those coins are your hidden assets—things you already own but haven’t leveraged.”

For Sherman, the issue isn’t a lack of innovation but rather a lack of awareness. “Too many leaders are surrounded by people saying, ‘We’re great, we just need small changes.’ But what if the assets you need are already there—you’re just not managing them?”

He shared a personal anecdote from his early legal career in the 1980s, recounting a $500,000 business acquisition where the tangible assets only totaled $490,000. In a moment of panic, he approached his senior partner, who simply advised him to “add a line item called goodwill.”

This experience underscored Sherman’s message at the conference: in an era fixated on disruption, true innovation may not stem from seeking the next big thing but from recognizing the quiet power of existing resources.

As a seasoned advisor to Fortune 500 companies, Sherman provided insights from his work with Walmart, highlighting the company’s supply chain and distribution system as a “treasure chest of intangible value.”

“I once showed them how they could create $50 or $100 million in new revenue through underutilized assets,” he said. “They told me, ‘That’s like a fly on an elephant’s rear end—we only get excited when the number starts with a B.’ But from a shareholder perspective, that’s still real value. If you don’t use it, someone else will.”

To illustrate how overlooked ideas can yield significant returns, Sherman recounted the story of Dunkin’ Donuts’ “Munchkins.” Initially, the holes from the doughnut machine were discarded, but someone proposed selling them, turning what was once waste into a profitable product.

He challenged the audience to consider, “What’s the ‘Dunkin’ Munchkin’ in your organization? I guarantee you have one—probably several.”

Sherman argued that the mismanagement of intangible assets represents a global issue that squanders vast potential wealth. He cited estimates suggesting that $40 trillion worth of unused or underutilized intangible assets exists worldwide—ideas, technologies, and systems languishing in archives and corporate backrooms.

“Whether you’re in government, academia, or the private sector,” he stated, “we waste resources and innovation because we don’t know what we have.”

He highlighted the inefficiencies in universities and research institutions, noting that Stanford converts only about 5% of its R&D spending into income, while the University of Maryland achieves a mere 0.75% return. “That means for every $100 spent, the return is 75 cents. That’s embarrassing,” he remarked.

Sherman called for stronger partnerships between entrepreneurs and academics to commercialize discoveries that would otherwise remain dormant. “If professors are too busy being academics, that’s fine,” he said, “but let entrepreneurs in to build something with those ideas.”

Throughout his address, Sherman reiterated a central theme: inflection points should not provoke panic or reckless reinvention but should be seen as opportunities for reflection and internal innovation.

“Inflection points,” he concluded, “are not a time for the deer-in-the-headlights syndrome, or for the hamster-on-a-wheel response, or to spend a fortune on consultants. They’re a time to ask: What assets do we already have that could create new revenue, new markets, new opportunities?”

His message resonated with the audience of founders, executives, and innovators, many of whom are navigating their own organizational crossroads in a rapidly changing economy.

“The assets already exist,” Sherman emphasized. “They’re just under your seat, under the sofa cushion. The question is: are you willing to look?”

Source: Original article