In cities across China, the country’s central bank has begun rolling out the e-renminbi—an all-digital version of its paper currency that can be accessed and accepted by merchants and consumers without an internet connection, credit or even a bank account. Already having conducted more than $5 billion in e-renminbi transactions, China has opened its digital currency up to foreigners. Next year, when Beijing hosts the Winter Olympic Games, authorities are expecting to let the world test drive its technological achievement.

The U.S., by contrast, is having trouble even concluding its multi-year exploration into the possibility of an e-dollar. In fact, an upcoming Federal Reserve paper on a potential U.S. digital currency won’t take a position on whether the central bank of the United States will, or even should, create one. Instead, Federal Reserve Chair Jerome Powell said in recent testimony to Congress, this paper will “begin a major public consultation on central bank digital currencies…” (Once planned for July, the paper’s release has since been moved to September.)

The U.S., by contrast, is having trouble even concluding its multi-year exploration into the possibility of an e-dollar. In fact, an upcoming Federal Reserve paper on a potential U.S. digital currency won’t take a position on whether the central bank of the United States will, or even should, create one. Instead, Federal Reserve Chair Jerome Powell said in recent testimony to Congress, this paper will “begin a major public consultation on central bank digital currencies…” (Once planned for July, the paper’s release has since been moved to September.)

Once the world leader in digital payments and technological innovation, the U.S. is being outpaced by its top global adversary as well as much of the industrialized and the developing world. The Bahamas recently announced the integration of its digital Sand Dollar into a stock exchange, while Australia, Malaysia, Singapore and South Africa are moving forward with the world’s first cross-border central bank digital currency exchange program led by the Bank for International Settlements (BIS), which is known as the central bank of central banks.

Such developments have been somewhat outshined by El Salvador’s recent decision to make bitcoin a legally accepted currency, which few expect to make significant impact in the payment space. But outside of the cryptocurrency space, nations around the globe are making significant strides in the development of the digital future of money — supported by governments and backed by powerful central banks. Leadership in this space will have implications for more than just payments: geopolitical ambitions, economic growth, financial inclusion and the very nature of money could all be dictated by who leads the charge and how.

“I don’t think the U.S. is aware there is a race”

Digital currencies are the next wave in the “evolution of the nature of money in the digital economy,” Hyun Song Shin, economic adviser and co-leader of the Monetary and Economic Department at the Bank for International Settlements, tells TIME. As more of our world migrates from physical brick-and-mortar to wireless and cloud-based, the way we pay for things is changing as well. A central bank digital currency would operate just like cash, but instead of having to carry it in a physical wallet or put it into a bank account, it would be stored and accessed digitally. Not only could U.S.-backed digital currency facilitate easier, modern banking, it could prove vital in protecting American international influence.

Late to the party, the U.S. is “stepping up its research and public engagement” on digital currencies, the Federal Reserve says, including forming working groups on cryptocurrency and other kinds of digital money, and experimenting with technology that would be central to producing a digital dollar. The Fed’s regional Boston branch is overseeing these efforts with the Massachusetts Institute of Technology on what’s known as Project Hamilton. But the path towards a digital U.S. dollar has met many challenges, skeptics and outright opponents. All while China, and other countries, push forward.

Lagging behind the world

Just how far behind is the U.S. in the development of a central bank-issued digital currency (CBDC)? According to global accounting firm PwC’s inaugural CBDC global index, which tracks various CBDCs’ project status from research to development and production, the U.S. ranks 18th in the world. America’s potential efforts trail countries like Sweden, South Korea and China but also countries like the Bahamas, Ecuador, Eastern Caribbean and Turkey. China, with its government’s hyperfocus on maintaining control and overseeing data, has been working to develop a CBDC for almost a decade.

And the U.S. is probably not close to catching up. Analysts like Harvard economics professor Kenneth Rogoff, who study monetary policy and digital currencies, estimate that the U.S. could be at least a decade away from issuing a digital dollar backed by the Fed. In that time, Rogoff argued in an op-ed earlier this year, the modernization of China’s financial markets and reduction or removal of its currency controls “could deal the dollar’s status a painful blow.”

China has already largely moved away from coin and paper currency; Chinese consumers have racked up more than $41 trillion in mobile transactions, according to a recent research paper from the Brookings Institution, with the lion’s share (92%) going through digital payment processors WeChat Pay and Alipay.

“The reason you could say the U.S. is behind in the digital currency race is I don’t think the U.S. is aware there is a race,” Yaya Fanusie, an Adjunct Senior Fellow at the Center for a New American Security, and a former CIA analyst, tells TIME in an interview. “A lot of policymakers are looking at it and concerned…but even with that I just don’t think there’s this sense of urgency because the risk from China is not an immediate threat.” Not only is the U.S. running significantly behind in the development of a CBDC, we are trailing the rest of the world in digital payments broadly.

Kenya, for example, has almost fully digitized its economy through its digital currency and payment system MPESA, making transactions free and almost instantaneous. India’s Unified Payments Interface (UPI) allows users to transfer money instantly between bank accounts with no cost. Brazil’s PIX facilitates the transfer of money between people and companies in up to 10 seconds. All of these programs work through and are overseen by the countries’ central banks rather than commercial banks or other private companies.

What’s holding the U.S. back?

Critics argue CBDCs are simply a solution in search of a problem and potentially harmful. Many see support from the banking sector as vital to the success of a digital U.S. dollar, however commercial banks in the U.S. have taken a largely adversarial stance. “The proposed benefits of CBDCs to international competitiveness and financial inclusion are theoretical, difficult to measure and may be elusive,” the American Bankers Association said in a statement at a recent congressional hearing on digital currencies. “While the negative consequences for monetary policy, financial stability, financial intermediation, the payments system, and the customers and communities that banks serve could be severe.”

The Bank Policy Institute, which lobbies on behalf of the country’s largest banks, went so far as to argue that neither the Fed nor the U.S. Treasury even has the constitutional authority to issue a digital currency. Commercial banks dominate the U.S. financial system to such a degree that unraveling them would be ostensibly impossible, experts say, they also would be a powerful adversary. Former Goldman Sachs managing director Nomi Prins notes banks have clearly seen the writing on the wall.

“Banks are centralized middlemen with respect to financial transactions,” Prins, author of Collusion: How Central Bankers Rigged The World, tells TIME. “The more popular cryptocurrency or digital currency becomes, the fewer profits the banking system can reap from traditional services and verification methods that allow them to hold, take or use their customers’ money, and the more financial power they stand to lose as a result.” Even disruptive financial technologies like PayPal, Venmo and Zelle work through the banking system, rather than around it, thanks in large part to the banks’ power.

Central bankers also generally have concluded that commercial banks are a necessary piece of a potential CBDC ecosystem, thanks to their pre-existing regulatory guardrails and ability to move money. Top policymakers at the Fed, including influential Vice Chair for Supervision Randal Quarles, have joined the banking industry in arguing that a digital dollar “could pose significant and concrete risks” and that the potential benefits “are unclear.” Fed Governor Christopher Waller said in August he was “skeptical that a Federal Reserve CBDC would solve any major problem confronting the U.S. payment system,” in a recent speech he titled “CBDC: A Solution in Search of a Problem?” Further, there’s no central U.S. authority with direct oversight or responsibility for any of this.

In addition to the Fed, the Office of the Comptroller of the Currency, the Securities and Exchange Commission, the Federal Trade Commission, the Consumer Financial Protection Bureau, the Federal Deposit Insurance Corporation, Office of Thrift Supervision, Financial Stability Oversight Council, Federal Financial Institutions Examination Council and the Office of Financial Research would all have some stake in the development of a digital currency backed by the central bank, to say nothing of state and regional authorities.

“The U.S. has an active congressional debate, which is beneficial and very important,” Federal Reserve Governor Lael Brainard tells TIME in an interview. “But the U.S. also has a diffusion of regulatory responsibility with no single payments regulator at the federal level, which is not as helpful. That diffusion of responsibility is part of what creates the lags that our system is working through.” None of this exists in China where the Chinese Communist Party oversees the central bank, commercial banks and their regulators and is unconcerned with privacy.

How a downgraded dollar could hamstring U.S. influence

An American CBDC could have lasting geopolitical impact and curb a longstanding international effort to reduce reliance on the mighty U.S. dollar. “Why we should care about this is that the U.S. financial system is not intrinsically dominant,” Fanusie says. “Other countries, both allies and adversaries, are sincerely interested in finding ways to decrease their dependence on the dollar.” With the U.S. dollar as the world’s reserve and primary funding currency, the U.S. can restrict access to funding from financial markets, limit countries’ ability to sell their natural resources and hinder or block individuals’ access to the banking sector.

“Other countries, both allies and adversaries, are sincerely interested in finding ways to decrease their dependence on the dollar”

While dollar dominance has rankled much of the world for decades, there has been no suitable replacement for the U.S., with its massive economy, sophisticated banking system and sprawling international presence. China is in the midst of a long-term push to simultaneously grow its financial markets and internationalize its currency. Both have the end goal of allowing China and its allies to limit the ability of the U.S. to enforce its will through economic actions like sanctions. Fanusie wrote in a January report that being the first major economy to roll out a digital currency is “part of China’s geopolitical ambitions.”

However, the renminbi will not become the world’s reserve currency — at least, not any time soon. But what China has done by being in the forefront of CBDC development is put itself in position to take the lead on development and implementation of rules and regulations for digital currencies on a global scale. “While America led the global revolution in payments half a century ago with magnetic striped credit and debit cards, China is leading the new revolution in digital payments,” writes Brookings’ economic studies fellow Aaron Klein.

Why should central banks offer digital currencies?

Over the past decade, digital currencies, including cryptocurrency and “stablecoins,” have sprung up like weeds. Some purport to be just as safe as dollars, but are backed by questionable assets. In a crisis regulators worry they could fluctuate wildly in value or lose their value altogether. Having central banks, which are responsible for the printing and circulation of coins and paper money, issue digital currencies is in part a reaction to this private sector activity, Shin says, “accelerated by the potential encroachment of private digital currencies, and the need to preserve the role of money as a public good.”

“The status quo is not an option”

Notably, a U.S. digital currency could provide benefits to everyday people. It could increase financial inclusion and fix flaws in current payments systems, Shin adds, citing findings of a recent BIS study.

For example, transferring money between U.S.-based bank accounts, even those held by the same person, can take days. The process can be even longer when crossing international borders. Credit and debit card transactions similarly don’t settle for days and come with significant fees for merchants, who sometimes pass them on to customers. CBDCs could grant universal access to the banking sector and quickly facilitate the distribution of paychecks and government funds, reducing the need for costly bank workarounds like check cashing and payday loans.

Championing CBDCs

Brainard has been pushing the Fed to move on a digital currency for years, but there was little urgency from others at the Fed or in Congress. Companies developing their own currencies, consumers investing in cryptocurrency and the COVID-19 pandemic making paper notes anathema to many Americans changed that. Before COVID-19, Facebook’s Libra project (now known as Diem) showed lawmakers and central bankers the potential for a private company to step in and fill the void by effectively minting its own currency that could be spent by users around the world.

“The status quo is not an option,” Diem co-creator David Marcus said at the International Monetary Fund’s 2019 fall meeting. “Whether it’s Libra or something else, the world is going to change in a profound way.” Brainard, for one, has taken notice. “My own thinking is that stablecoins and related private sector initiatives are moving very rapidly, which makes it incumbent on us to move more rapidly,” she tells TIME. “That is why I have been pushing to advance outreach, cross-border engagement, and policy and technology research for several years now.” So-called stablecoins — unregulated digital currencies created by private companies that purport to represent dollars but are completely unregulated — have become a significant worry for lawmakers and shown the importance of considering tying currency to a central bank.

“It’s getting harder and harder for community banks to compete for new customers when big tech companies can afford to spend billions on marketing and technology,” Sen. Sherrod Brown, who chairs the Senate Banking Committee, tells TIME. “But many of these new ‘fintech’ products don’t come with the consumer protections, federal backing or customer service and relationships with the community that small banks and credit unions provide.”

During a hearing on digital currencies in June, Sen. Elizabeth Warren, the ranking member of the Subcommittee on Financial Institutions and Consumer Protection, compared stablecoins to worthless “wildcat notes” that were issued by speculators in the 19th century. Her expert at that hearing, Lev Menand, an Academic Fellow and Lecturer in Law at Columbia Law School, went further in his testimony, calling stablecoins “dangerous to both their users and … to the broader financial system.”

With private companies pushing deeper into the digital currency space, rival countries seeking to seize leadership and a public that is moving further away from physical currency, the U.S. is facing a world in which it may not control or even lead the world’s payment systems. That would make the future of money look very different from the past.

The

The  Although planners are still scouting for locations, possible targets include Nevada, Utah, Idaho, Arizona, Texas and the Appalachian region, according to the project’s official website. The announcement was accompanied by a series of digital renderings by Bjarke Ingels Group (BIG), the architecture firm hired to bring Lore’s utopian dream to life. The images show residential buildings covered with greenery and imagined residents enjoying abundant open space. With fossil-fuel-powered vehicles banned in the city, autonomous vehicles are pictured traveling down sun-lit streets alongside scooters and pedestrians.

Although planners are still scouting for locations, possible targets include Nevada, Utah, Idaho, Arizona, Texas and the Appalachian region, according to the project’s official website. The announcement was accompanied by a series of digital renderings by Bjarke Ingels Group (BIG), the architecture firm hired to bring Lore’s utopian dream to life. The images show residential buildings covered with greenery and imagined residents enjoying abundant open space. With fossil-fuel-powered vehicles banned in the city, autonomous vehicles are pictured traveling down sun-lit streets alongside scooters and pedestrians. The U.S. Federal Reserve, by contrast, has largely stayed on the sidelines. This could be a lost opportunity. The United States should develop a digital dollar, not because of what other countries are doing, but because the benefits of a digital currency far outweigh the costs. One benefit is security. Cash is vulnerable to loss and theft, a problem for both individuals and businesses, whereas digital currencies are relatively secure. Electronic hacking does pose a risk, but one that can be managed with new technologies. (As it happens, offshoots of Bitcoin’s technology

The U.S. Federal Reserve, by contrast, has largely stayed on the sidelines. This could be a lost opportunity. The United States should develop a digital dollar, not because of what other countries are doing, but because the benefits of a digital currency far outweigh the costs. One benefit is security. Cash is vulnerable to loss and theft, a problem for both individuals and businesses, whereas digital currencies are relatively secure. Electronic hacking does pose a risk, but one that can be managed with new technologies. (As it happens, offshoots of Bitcoin’s technology  This is the first such attempt in the state where expatriates, and returnees, of a village have come together and mobilized capital for a business enterprise of this kind. The total investment of Rs 18 crore was raised from 207 people. Of these, 147 invested only Rs 1 lakh each. The price of a share was fixed at Rs 50,000, and an individual had to invest in at least two shares. There was a cap on the maximum investment as well – Rs 40 lakh per person. “The major highlight of the venture is that a large section of investors are ordinary people who have some small savings, a few lakh rupees, after years of toil in the Gulf. But for an initiative of this type, they would not have been able to be a part of a professional business venture,” said GTF Steels Chairman Mohammed Basheer Nadammal.

This is the first such attempt in the state where expatriates, and returnees, of a village have come together and mobilized capital for a business enterprise of this kind. The total investment of Rs 18 crore was raised from 207 people. Of these, 147 invested only Rs 1 lakh each. The price of a share was fixed at Rs 50,000, and an individual had to invest in at least two shares. There was a cap on the maximum investment as well – Rs 40 lakh per person. “The major highlight of the venture is that a large section of investors are ordinary people who have some small savings, a few lakh rupees, after years of toil in the Gulf. But for an initiative of this type, they would not have been able to be a part of a professional business venture,” said GTF Steels Chairman Mohammed Basheer Nadammal. “United continues on its trajectory to build a more innovative, sustainable airline and today’s advancements in technology are making it more viable to include supersonic planes,” said United CEO Scott Kirby. “Boom’s vision for the future of commercial aviation, combined with the industry’s most robust route network in the world, will give business and leisure travelers access to a stellar flight experience.” The announcement is not the first of an intended partnership between a supersonic firm and a large aviation company.

“United continues on its trajectory to build a more innovative, sustainable airline and today’s advancements in technology are making it more viable to include supersonic planes,” said United CEO Scott Kirby. “Boom’s vision for the future of commercial aviation, combined with the industry’s most robust route network in the world, will give business and leisure travelers access to a stellar flight experience.” The announcement is not the first of an intended partnership between a supersonic firm and a large aviation company. For many crypto enthusiasts, the decentralized nature of digital currencies — which, unlike traditional currencies, aren’t backed by any institution or government authority — is a big draw. But regulatory guidance can help protect investors. “As much as I like the decentralization and the lack of government [involvement], I am glad that they are paying attention because unfortunately with cryptocurrency, there are a lot of scams,” says

For many crypto enthusiasts, the decentralized nature of digital currencies — which, unlike traditional currencies, aren’t backed by any institution or government authority — is a big draw. But regulatory guidance can help protect investors. “As much as I like the decentralization and the lack of government [involvement], I am glad that they are paying attention because unfortunately with cryptocurrency, there are a lot of scams,” says  According to the report, it rose from 7.2% in the previous quarter—ending on March 31, 2021 – even the attrition rate is pegged to be the lowest in the county. IT companies such as Accenture announced their attrition rate for the first quarter of 2021-22 fiscal at 17% against 11% in the year-ago quarter., while Infosys and Wipro’s attrition rates were reported to be 15.2% and 12.1% in the fourth quarter of 2020-21 financial year.

According to the report, it rose from 7.2% in the previous quarter—ending on March 31, 2021 – even the attrition rate is pegged to be the lowest in the county. IT companies such as Accenture announced their attrition rate for the first quarter of 2021-22 fiscal at 17% against 11% in the year-ago quarter., while Infosys and Wipro’s attrition rates were reported to be 15.2% and 12.1% in the fourth quarter of 2020-21 financial year. Lawmakers approved Democrats’ budget resolution on a party-line 50-49 vote, a crucial step for a president and party set on training the government’s fiscal might at assisting families, creating jobs and fighting climate change. Higher taxes on the wealthy and corporations would pay for much of it. Passage came despite an avalanche of Republican amendments intended to make their rivals pay a price in next year’s elections for control of Congress.

Lawmakers approved Democrats’ budget resolution on a party-line 50-49 vote, a crucial step for a president and party set on training the government’s fiscal might at assisting families, creating jobs and fighting climate change. Higher taxes on the wealthy and corporations would pay for much of it. Passage came despite an avalanche of Republican amendments intended to make their rivals pay a price in next year’s elections for control of Congress. Soon after he unfurled the national flag to mark nation’s 75th Independence Day at the historic Red Fort here, Modi addressed the nation, saying the infrastructure plan will create job opportunities for millions of Indian youth. “It will help local manufacturers turn globally competitive and also develop possibilities of new future economic zones in the country,” he said.

Soon after he unfurled the national flag to mark nation’s 75th Independence Day at the historic Red Fort here, Modi addressed the nation, saying the infrastructure plan will create job opportunities for millions of Indian youth. “It will help local manufacturers turn globally competitive and also develop possibilities of new future economic zones in the country,” he said. Rangan will officially take over the role from September 7 onwards. “Yamini has been overseeing day to day operations at HubSpot since March, managing Board meetings, the HubSpot earnings call, and key hiring and growth initiatives, working closely with Dharmesh and the rest of the leadership team. She’s made HubSpot better by being here, and I know that trend will continue with her as CEO,” Halligan wrote.

Rangan will officially take over the role from September 7 onwards. “Yamini has been overseeing day to day operations at HubSpot since March, managing Board meetings, the HubSpot earnings call, and key hiring and growth initiatives, working closely with Dharmesh and the rest of the leadership team. She’s made HubSpot better by being here, and I know that trend will continue with her as CEO,” Halligan wrote. A record 26 are now billionaires, including pop star mogul Rihanna and 23andMe’s Anne Wojcicki. The Indian Americans on the list include Neha Narkhede, co-founder and former chief technology officer of Confluent; PepsiCo’s former chair and CEO Indra Nooyi; Neerja Sethi, co-founder of Syntel; Reshma Shetty, co-founder of Gingko Bioworks; and Jayshree Ullal, president and CEO of Arista Networks.

A record 26 are now billionaires, including pop star mogul Rihanna and 23andMe’s Anne Wojcicki. The Indian Americans on the list include Neha Narkhede, co-founder and former chief technology officer of Confluent; PepsiCo’s former chair and CEO Indra Nooyi; Neerja Sethi, co-founder of Syntel; Reshma Shetty, co-founder of Gingko Bioworks; and Jayshree Ullal, president and CEO of Arista Networks. Since the issue relating to the Farmer’s plight was central to the concerns of the Indian diaspora which had gathered, this prohibition would prevent them from venting their sentiments and showing support to the cause of the farmers, as a result of which it left them no choice but to stay put at the location and voice their bitter disappointment over the unfair and undemocratic imposition of conditions which prevented them from participating in celebrating the joyous occasion of the Independence Day of India while at the same time expressing serious concern on the inaction of the sitting government to resolve the issue.

Since the issue relating to the Farmer’s plight was central to the concerns of the Indian diaspora which had gathered, this prohibition would prevent them from venting their sentiments and showing support to the cause of the farmers, as a result of which it left them no choice but to stay put at the location and voice their bitter disappointment over the unfair and undemocratic imposition of conditions which prevented them from participating in celebrating the joyous occasion of the Independence Day of India while at the same time expressing serious concern on the inaction of the sitting government to resolve the issue. In all Indian Americans own and operate 3.1 million guestrooms, and 2.2 million direct impact jobs. The study’s topline results were presented to AAHOA Members during the general session on the first day of the 2021 AAHOA Convention & Trade Show at the Kay Bailey Hutchison Convention Center Dallas on August 3rd.

In all Indian Americans own and operate 3.1 million guestrooms, and 2.2 million direct impact jobs. The study’s topline results were presented to AAHOA Members during the general session on the first day of the 2021 AAHOA Convention & Trade Show at the Kay Bailey Hutchison Convention Center Dallas on August 3rd. With the ownership of the majority hotel industry, the economic impact and industry influence of AAHOA’s nearly 20,000 Members, is very impressive. “This study gives us the clearest picture to date about the scale, reach, and economic impact that AAHOA Members have in the United States,” said AAHOA Chairman Biran Patel. “It is remarkable how far AAHOA Members have come since the association’s founding in 1989 when a small group of hoteliers banded together to fight discrimination. That commitment to helping hoteliers grow their businesses and realize the American Dream is reflected in the impressive numbers revealed today. We are proud of what our Members have accomplished and remain committed to being the foremost resource and advocate for America’s hotel owners.”

With the ownership of the majority hotel industry, the economic impact and industry influence of AAHOA’s nearly 20,000 Members, is very impressive. “This study gives us the clearest picture to date about the scale, reach, and economic impact that AAHOA Members have in the United States,” said AAHOA Chairman Biran Patel. “It is remarkable how far AAHOA Members have come since the association’s founding in 1989 when a small group of hoteliers banded together to fight discrimination. That commitment to helping hoteliers grow their businesses and realize the American Dream is reflected in the impressive numbers revealed today. We are proud of what our Members have accomplished and remain committed to being the foremost resource and advocate for America’s hotel owners.” Biden signed the executive order at the White House alongside representatives from Ford, GM and Stellantis, and members of the United Auto Workers Union. The automakers are supporting Biden’s new target, announcing their “shared aspiration” that 40-50% of their cars sold by 2030 to be electric vehicles, according to a joint statement from the three automakers.

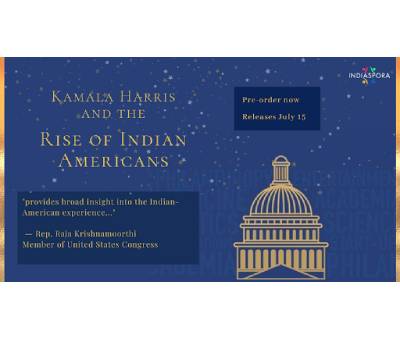

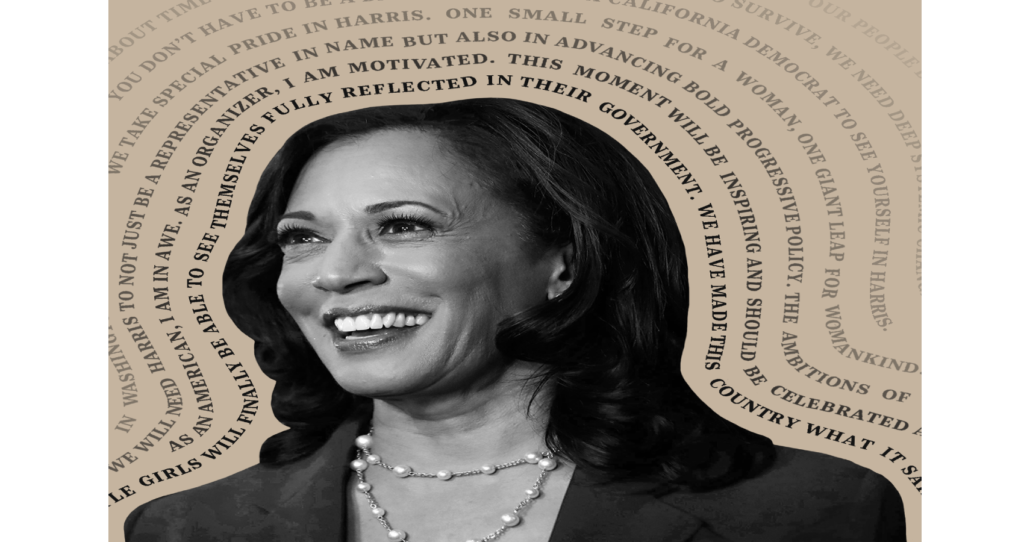

Biden signed the executive order at the White House alongside representatives from Ford, GM and Stellantis, and members of the United Auto Workers Union. The automakers are supporting Biden’s new target, announcing their “shared aspiration” that 40-50% of their cars sold by 2030 to be electric vehicles, according to a joint statement from the three automakers. Edited by the Delhi-based veteran journalist and foreign policy analystTarunBasu, the evocative collection titled, “Kamala Harris and the Rise of Indian Americans,” captures the rise of the Indians in the US across domains by exceptional achievers like Shashi Tharoor, a former UN public servant-turned Indian politician, and top diplomats like TP Sreenivasan and Arun K Singh. Sixteen eminent journalists, business leaders and scholars have contributed essays to the timely and priceless volume, which charts the community’s growing and influential political engagement. The book was released July 15 by New Delhi-based publisher Wisdom Tree and is available in the U.S. via Amazon. Basu describes the book as an “eclectic amalgam of perspectives on the emerging Indian-American story.”

Edited by the Delhi-based veteran journalist and foreign policy analystTarunBasu, the evocative collection titled, “Kamala Harris and the Rise of Indian Americans,” captures the rise of the Indians in the US across domains by exceptional achievers like Shashi Tharoor, a former UN public servant-turned Indian politician, and top diplomats like TP Sreenivasan and Arun K Singh. Sixteen eminent journalists, business leaders and scholars have contributed essays to the timely and priceless volume, which charts the community’s growing and influential political engagement. The book was released July 15 by New Delhi-based publisher Wisdom Tree and is available in the U.S. via Amazon. Basu describes the book as an “eclectic amalgam of perspectives on the emerging Indian-American story.” Basu has maintained a keen interest in the accomplishments of Indians abroad and has kept close touch with the community. The purpose of this anthology of essays edited by him is to bring to the global eye the unfolding saga of four million Indians in the United States. Indian Americans currently are just 1% of the US population but are expected to rise to 2% by 2030. Portraying the rise of the Indian American physicians as a strong and influential force in the United States, Ajay Ghosh chronicling their long journey to the United States and their success story, in a Chapter titled, “Physicians of Indian Heritage: America’s Healers” takes the readers to the times of Dr. AnandibaiJoshi, the first documented physician of Indian origin who had landed on the shores of the United States in 1883.

Basu has maintained a keen interest in the accomplishments of Indians abroad and has kept close touch with the community. The purpose of this anthology of essays edited by him is to bring to the global eye the unfolding saga of four million Indians in the United States. Indian Americans currently are just 1% of the US population but are expected to rise to 2% by 2030. Portraying the rise of the Indian American physicians as a strong and influential force in the United States, Ajay Ghosh chronicling their long journey to the United States and their success story, in a Chapter titled, “Physicians of Indian Heritage: America’s Healers” takes the readers to the times of Dr. AnandibaiJoshi, the first documented physician of Indian origin who had landed on the shores of the United States in 1883. “The nomination — and subsequent election — of the U.S.-born Indian origin Kamala Harris put the media spotlight on the small, but respected and high-achieving Indian American community,” writes Basu in his preface. “It is a fascinating and inspiring story of how an immigrant population from a developing country, with low education levels, became the most educated, highest-earning ethnic community in the world’s most advanced nation in almost a single generation,” he said, noting that Indian Americans have made their mark in almost every field, from the traditional trifecta of science, engineering and medicine, to the arts, academia, philanthropy, and, increasingly, politics.

“The nomination — and subsequent election — of the U.S.-born Indian origin Kamala Harris put the media spotlight on the small, but respected and high-achieving Indian American community,” writes Basu in his preface. “It is a fascinating and inspiring story of how an immigrant population from a developing country, with low education levels, became the most educated, highest-earning ethnic community in the world’s most advanced nation in almost a single generation,” he said, noting that Indian Americans have made their mark in almost every field, from the traditional trifecta of science, engineering and medicine, to the arts, academia, philanthropy, and, increasingly, politics. Last year, a report said that India has taken a slew of measures to promote the use of electric cars in the country. The government slashed Goods and Services Tax (GST) on electric vehicles to five per cent from earlier 12 per cent but to protect domestic automakers, it levies 125 per cent duty on imported vehicles.

Last year, a report said that India has taken a slew of measures to promote the use of electric cars in the country. The government slashed Goods and Services Tax (GST) on electric vehicles to five per cent from earlier 12 per cent but to protect domestic automakers, it levies 125 per cent duty on imported vehicles. In terms of the origin of patent applications in the pharma sector globally, India is among the top 10 countries, followed by Italy, Australia, Taiwan and Sweden. The applications originating from India are majorly filed in the US, European Parliament and APAC region. The top Indian filers who filed patents in India during the last five years (2015-2020) include the Council of Scientific and Industrial Research (CSIR), ITC Life Sciences, Lovely Professional University, Colgate Palmolive (India), Tata Consultancy Services (TCS) Limited, IIT Bombay, Cadila Healthcare, Lupin, Amity University, and Wockhardt Limited, the report said.

In terms of the origin of patent applications in the pharma sector globally, India is among the top 10 countries, followed by Italy, Australia, Taiwan and Sweden. The applications originating from India are majorly filed in the US, European Parliament and APAC region. The top Indian filers who filed patents in India during the last five years (2015-2020) include the Council of Scientific and Industrial Research (CSIR), ITC Life Sciences, Lovely Professional University, Colgate Palmolive (India), Tata Consultancy Services (TCS) Limited, IIT Bombay, Cadila Healthcare, Lupin, Amity University, and Wockhardt Limited, the report said. Moreover, it has become clear that Bitcoin does not offer true anonymity. The government’s success in

Moreover, it has become clear that Bitcoin does not offer true anonymity. The government’s success in  This is indeed a very proud and emotional moment for me. I am very happy to receive Abu Dhabi’s highest civilian award from the blessed hands of HH Sheikh

This is indeed a very proud and emotional moment for me. I am very happy to receive Abu Dhabi’s highest civilian award from the blessed hands of HH Sheikh  Experts are saying

Experts are saying Globally, 2.4 billion people did not have access to sufficiently nutritious food in 2020 – an increase of nearly 320 million people in one year. The report also highlights how climate change has left communities in developing countries most exposed to hunger – despite the fact that they contribute little to global CO2 emissions. These poorer nations are also the least prepared to withstand or respond to climate change, said WFP’s Gernot Laganda, who added that weather-related shocks and stresses were “driving hunger like never before”.

Globally, 2.4 billion people did not have access to sufficiently nutritious food in 2020 – an increase of nearly 320 million people in one year. The report also highlights how climate change has left communities in developing countries most exposed to hunger – despite the fact that they contribute little to global CO2 emissions. These poorer nations are also the least prepared to withstand or respond to climate change, said WFP’s Gernot Laganda, who added that weather-related shocks and stresses were “driving hunger like never before”. India’s strong external settings help to buffer the risks associated with the government’s high deficits and debt stock. India’s economy is recovering from a deep contraction in FY21 and a subsequent severe second wave of Covid. “We expect real

India’s strong external settings help to buffer the risks associated with the government’s high deficits and debt stock. India’s economy is recovering from a deep contraction in FY21 and a subsequent severe second wave of Covid. “We expect real  Bitcoin had fallen below $30,000 for the first time in more than five months, hit by China’s crackdown on the world’s most popular cryptocurrency on June 21st. The digital currency slipped to about $28,890, and has lost about 50% of its value since reaching an all-time high of $64,870 in April. China has told banks and payments platforms to stop supporting digital currency transactions. It follows an order on Friday to stop Bitcoin mining in Sichuan province.

Bitcoin had fallen below $30,000 for the first time in more than five months, hit by China’s crackdown on the world’s most popular cryptocurrency on June 21st. The digital currency slipped to about $28,890, and has lost about 50% of its value since reaching an all-time high of $64,870 in April. China has told banks and payments platforms to stop supporting digital currency transactions. It follows an order on Friday to stop Bitcoin mining in Sichuan province. “Over the last 15 years, the Conrad 30 program has brought more than 15,000 physicians to underserved areas, filling a critical need for quality care in our rural communities – a need that was highlighted during the coronavirus pandemic,” Klobuchar said in a statement. “Our bipartisan legislation would allow doctors to remain in the areas they serve, improving health care for families across the nation while retaining talent trained and educated here in the United States,” she added.

“Over the last 15 years, the Conrad 30 program has brought more than 15,000 physicians to underserved areas, filling a critical need for quality care in our rural communities – a need that was highlighted during the coronavirus pandemic,” Klobuchar said in a statement. “Our bipartisan legislation would allow doctors to remain in the areas they serve, improving health care for families across the nation while retaining talent trained and educated here in the United States,” she added. San Francisco Bay Area-based Prashant Prasad, a volunteer for Immigration Voice, a grass roots organization representing the high skilled immigrants in the US, explains why the current bill may be good news. He says, “We started advocating for a simple bill which would remove the per country caps for employment based green cards many years ago. The primary purpose of this was to ensure that employment based green cards are given on a first come first served basis.

San Francisco Bay Area-based Prashant Prasad, a volunteer for Immigration Voice, a grass roots organization representing the high skilled immigrants in the US, explains why the current bill may be good news. He says, “We started advocating for a simple bill which would remove the per country caps for employment based green cards many years ago. The primary purpose of this was to ensure that employment based green cards are given on a first come first served basis. BR will serve as THE ONLY tech platform on which smaller retailers can personally select products from verified suppliers across various categories with minimum MOQs (in most cases, just ONE product per style). Since most sellers and buyers are unable to produce or procure volumes during these uncertain times, BR serves as the perfect matchmaking service for these small-to-mid-size businesses looking for alternative avenues.

BR will serve as THE ONLY tech platform on which smaller retailers can personally select products from verified suppliers across various categories with minimum MOQs (in most cases, just ONE product per style). Since most sellers and buyers are unable to produce or procure volumes during these uncertain times, BR serves as the perfect matchmaking service for these small-to-mid-size businesses looking for alternative avenues. In fact, it has become very expensive and slow to conduct transactions using cryptocurrencies. It takes about

In fact, it has become very expensive and slow to conduct transactions using cryptocurrencies. It takes about  Companies are searching for workers as growing numbers of vaccinated Americans head back to stores. There were 878,000 job openings in the US retail sector in March, a 53% increase from the same month last year, according to the latest

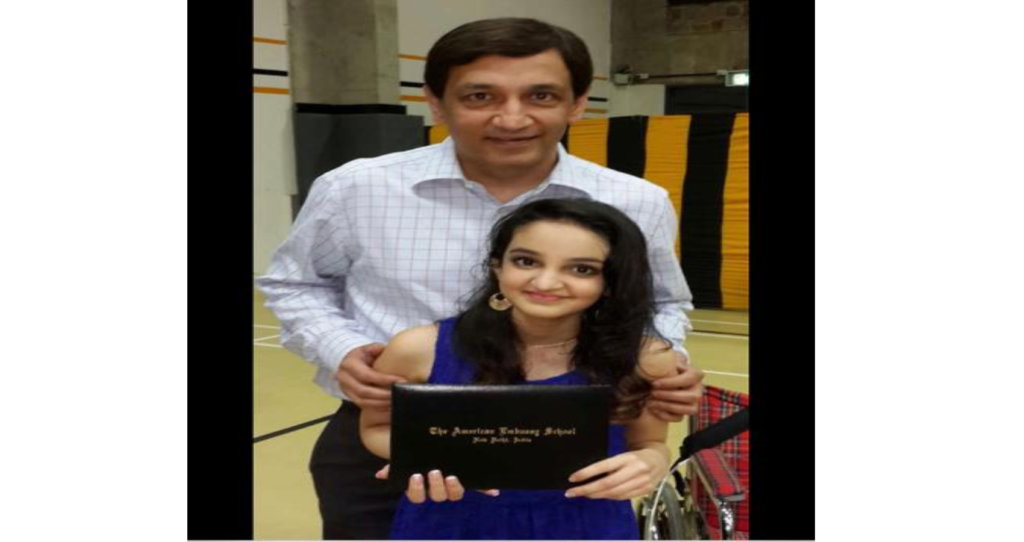

Companies are searching for workers as growing numbers of vaccinated Americans head back to stores. There were 878,000 job openings in the US retail sector in March, a 53% increase from the same month last year, according to the latest Her life has been made into a powerful movie called ‘Sky is Pink’ with Priyanka Chopra Jonas , Farhan Akhtar and ZairaWasim playing lead roles. The movie is now streaming on Netflix. It was inspiring to share Niren’s journey on Chai with Manju. His input in the food and hospitality industry were very insightful including leading Panera profitably in tough Covid times. His advice to those looking to invest in India is worth a watch. His emotional appeal to donate bone marrow to save lives is important as Indian lag behind and his daughter’s life would have been saved with a timely bone marrow donation I loved his three step recipe to make dreams come true and to live life fully describing life as an unfinished painting.

Her life has been made into a powerful movie called ‘Sky is Pink’ with Priyanka Chopra Jonas , Farhan Akhtar and ZairaWasim playing lead roles. The movie is now streaming on Netflix. It was inspiring to share Niren’s journey on Chai with Manju. His input in the food and hospitality industry were very insightful including leading Panera profitably in tough Covid times. His advice to those looking to invest in India is worth a watch. His emotional appeal to donate bone marrow to save lives is important as Indian lag behind and his daughter’s life would have been saved with a timely bone marrow donation I loved his three step recipe to make dreams come true and to live life fully describing life as an unfinished painting. He holds a bachelor’s degree in Economics from St. Stephen’s College in Delhi, an MBA in marketing from the University of Delhi, and also completed the Advanced Management Program at Harvard Business School.One of the best parts of the interview with Dr. Manju Shethwas to watch him sing. Music plays a huge role in his life. Indeed, he is a rockstar CEO.

He holds a bachelor’s degree in Economics from St. Stephen’s College in Delhi, an MBA in marketing from the University of Delhi, and also completed the Advanced Management Program at Harvard Business School.One of the best parts of the interview with Dr. Manju Shethwas to watch him sing. Music plays a huge role in his life. Indeed, he is a rockstar CEO. Sonal Shah, the foundation’s president, and TAAF board members were at the White House, where they briefed administration officials, including domestic policy adviser Susan Rice. They discussed how the foundation plans to spend the $1.1 billion in donations to fight back against hate crimes directed at these communities, according to a statement from the foundation. Biden and Vice President Kamala Harris dropped by the meeting to express their support, the foundation said.

Sonal Shah, the foundation’s president, and TAAF board members were at the White House, where they briefed administration officials, including domestic policy adviser Susan Rice. They discussed how the foundation plans to spend the $1.1 billion in donations to fight back against hate crimes directed at these communities, according to a statement from the foundation. Biden and Vice President Kamala Harris dropped by the meeting to express their support, the foundation said. BAPS has been accused of human trafficking and wage law violations. An FBI spokesperson confirmed that agents were at the temple on “court-authorized law enforcement activity,” but wouldn’t elaborate. One of the attorneys who filed the suit said some workers had been removed from the site May 11.The lawsuit has been filed a month after New Jersey labor authorities halted work by a contractor at the Robbinsville temple and at a BAPS temple in Edison. The new lawsuit is a proposed class action complaint, alleging around 200 workers on religious immigration visas endured forced manual labor for the ongoing construction and expansion of the religious property on the 100-acre site.

BAPS has been accused of human trafficking and wage law violations. An FBI spokesperson confirmed that agents were at the temple on “court-authorized law enforcement activity,” but wouldn’t elaborate. One of the attorneys who filed the suit said some workers had been removed from the site May 11.The lawsuit has been filed a month after New Jersey labor authorities halted work by a contractor at the Robbinsville temple and at a BAPS temple in Edison. The new lawsuit is a proposed class action complaint, alleging around 200 workers on religious immigration visas endured forced manual labor for the ongoing construction and expansion of the religious property on the 100-acre site. BAPS is a global sect of Hinduism founded in the early 20th century and aims to “preserve Indian culture and the Hindu ideals of faith, unity, and selfless service,” according to its website. The organization says it has built more than 1,100 mandirs — often large complexes that essentially function as community centers. BAPS is known for community service and philanthropy, taking an active role in the diaspora’s initiative to help India amid the current COVID-19 surge. According to the website for the Robbinsville mandir, its construction “is the epitome of volunteerism.”“Volunteers of all ages have devoted their time and resources from the beginning: assisting in the construction work, cleaning up around the site, preparing food for all the artisans on a daily basis and helping with other tasks,” the website says. “A total of 4.7 million man hours were required by craftsman and volunteers to complete the Mandir.”

BAPS is a global sect of Hinduism founded in the early 20th century and aims to “preserve Indian culture and the Hindu ideals of faith, unity, and selfless service,” according to its website. The organization says it has built more than 1,100 mandirs — often large complexes that essentially function as community centers. BAPS is known for community service and philanthropy, taking an active role in the diaspora’s initiative to help India amid the current COVID-19 surge. According to the website for the Robbinsville mandir, its construction “is the epitome of volunteerism.”“Volunteers of all ages have devoted their time and resources from the beginning: assisting in the construction work, cleaning up around the site, preparing food for all the artisans on a daily basis and helping with other tasks,” the website says. “A total of 4.7 million man hours were required by craftsman and volunteers to complete the Mandir.” The National Catholic Register writes: “These gifts have been blamed for contributing to corruption in the Church when they were used between high-level Church officials to seek favors, most notably in cases like that of ex-cardinal Theodore McCarrick.”

The National Catholic Register writes: “These gifts have been blamed for contributing to corruption in the Church when they were used between high-level Church officials to seek favors, most notably in cases like that of ex-cardinal Theodore McCarrick.” Harris has become increasingly involved in promoting the Biden administration’s infrastructure proposal currently being considered by Congress, known as the American Jobs Plan. She’s taken part in meetings with the Congressional Black Caucus as well as

Harris has become increasingly involved in promoting the Biden administration’s infrastructure proposal currently being considered by Congress, known as the American Jobs Plan. She’s taken part in meetings with the Congressional Black Caucus as well as  “We will invest significant resources into toppling those who seek to destroy our families, communities, and identity. The senseless gun violence that we’re seeing in this country is reflective of all of the spineless politicians who are beholden to the gun lobby. Period. End of story,” said Nikore. “They will be hearing from us — instead of offering thoughts and prayers, it’s time to mobilize for direct action and vote them out. That is what we’re doing today. We will end the violence, only when we have leaders who have the guts to do so.”

“We will invest significant resources into toppling those who seek to destroy our families, communities, and identity. The senseless gun violence that we’re seeing in this country is reflective of all of the spineless politicians who are beholden to the gun lobby. Period. End of story,” said Nikore. “They will be hearing from us — instead of offering thoughts and prayers, it’s time to mobilize for direct action and vote them out. That is what we’re doing today. We will end the violence, only when we have leaders who have the guts to do so.” Bills using reconciliation in the Senate can advance with just a simple majority, rather than 60 votes. With an evenly divided Senate, liberal lawmakers’ hope of passing gun control and voting rights were dashed last week when a key Democrat, Sen. Joe Manchin of West Virginia, said he would oppose the changes to the filibuster, which creates a 60-vote threshold.

Bills using reconciliation in the Senate can advance with just a simple majority, rather than 60 votes. With an evenly divided Senate, liberal lawmakers’ hope of passing gun control and voting rights were dashed last week when a key Democrat, Sen. Joe Manchin of West Virginia, said he would oppose the changes to the filibuster, which creates a 60-vote threshold.

Indian government sources said the South Asian country was unlikely to bind itself to the 2050 goal as its energy demand was projected to grow more than that of any other country over the next two decades.

Indian government sources said the South Asian country was unlikely to bind itself to the 2050 goal as its energy demand was projected to grow more than that of any other country over the next two decades. Governor McMaster presented the proclamation to KV Kumar, President & CEO of IAICC at the inauguration and appreciated the work of IAICC. While speaking at the event, Governor McMaster welcomed IAICC to South Carolina and said his administration will work with IAICC and support its initiatives in the State.

Governor McMaster presented the proclamation to KV Kumar, President & CEO of IAICC at the inauguration and appreciated the work of IAICC. While speaking at the event, Governor McMaster welcomed IAICC to South Carolina and said his administration will work with IAICC and support its initiatives in the State. Welcoming the gathering, KV Kumar appreciated Governor McMaster’s efforts in the State and thanked him and the First Lady Peggy McMaster for graciously hosting the IAICC inauguration and the reception at the Governor’s Mansion. He also thanked the Indian Ambassador to the US, Mr. Taranjit Singh Sandhu, and the Consul General of India in Atlanta, Dr. Swati Kulkarni for their continued support to IAICC. Kumar said he missed the Ambassador at the event, and congratulated him for bringing several key initiatives to strengthen India-US relations. During her address,

Welcoming the gathering, KV Kumar appreciated Governor McMaster’s efforts in the State and thanked him and the First Lady Peggy McMaster for graciously hosting the IAICC inauguration and the reception at the Governor’s Mansion. He also thanked the Indian Ambassador to the US, Mr. Taranjit Singh Sandhu, and the Consul General of India in Atlanta, Dr. Swati Kulkarni for their continued support to IAICC. Kumar said he missed the Ambassador at the event, and congratulated him for bringing several key initiatives to strengthen India-US relations. During her address, IAICC SE Regional Chairman, Dr. Narasimhulu Neelagaru also thanked Governor McMaster for his support and said he looked forward to working him and the State of South Carolina. At the event, Mr. Kumar introduced Ms. Bhavna Vasudeva, President of IAICC-SC Chapter.

IAICC SE Regional Chairman, Dr. Narasimhulu Neelagaru also thanked Governor McMaster for his support and said he looked forward to working him and the State of South Carolina. At the event, Mr. Kumar introduced Ms. Bhavna Vasudeva, President of IAICC-SC Chapter.