President Donald Trump’s “ratepayer protection pledge” aims to shift the financial burden of electricity costs from consumers to tech companies operating energy-intensive AI data centers.

Under a new initiative introduced by President Donald Trump, technology firms may be required to finance additional power generation to alleviate pressure on public energy grids. This initiative, known as the “ratepayer protection pledge,” was announced during Trump’s recent State of the Union address.

As consumers engage with chatbots, stream shows, or back up photos to the cloud, they rely on a vast network of data centers. These facilities are essential for powering artificial intelligence, search engines, and various online services. However, a growing debate has emerged regarding who should bear the costs of the electricity consumed by these data centers.

The core concept of the ratepayer protection pledge is straightforward: tech companies that operate energy-intensive AI data centers should absorb the costs associated with the additional electricity they require, rather than passing those costs onto consumers through increased utility rates.

While the idea appears simple, the implementation poses significant challenges. AI systems demand substantial computing power, which in turn requires considerable amounts of electricity. Today’s data centers can consume as much power as a small city, and as AI technologies expand across sectors such as business, healthcare, and finance, energy demand has surged in specific regions.

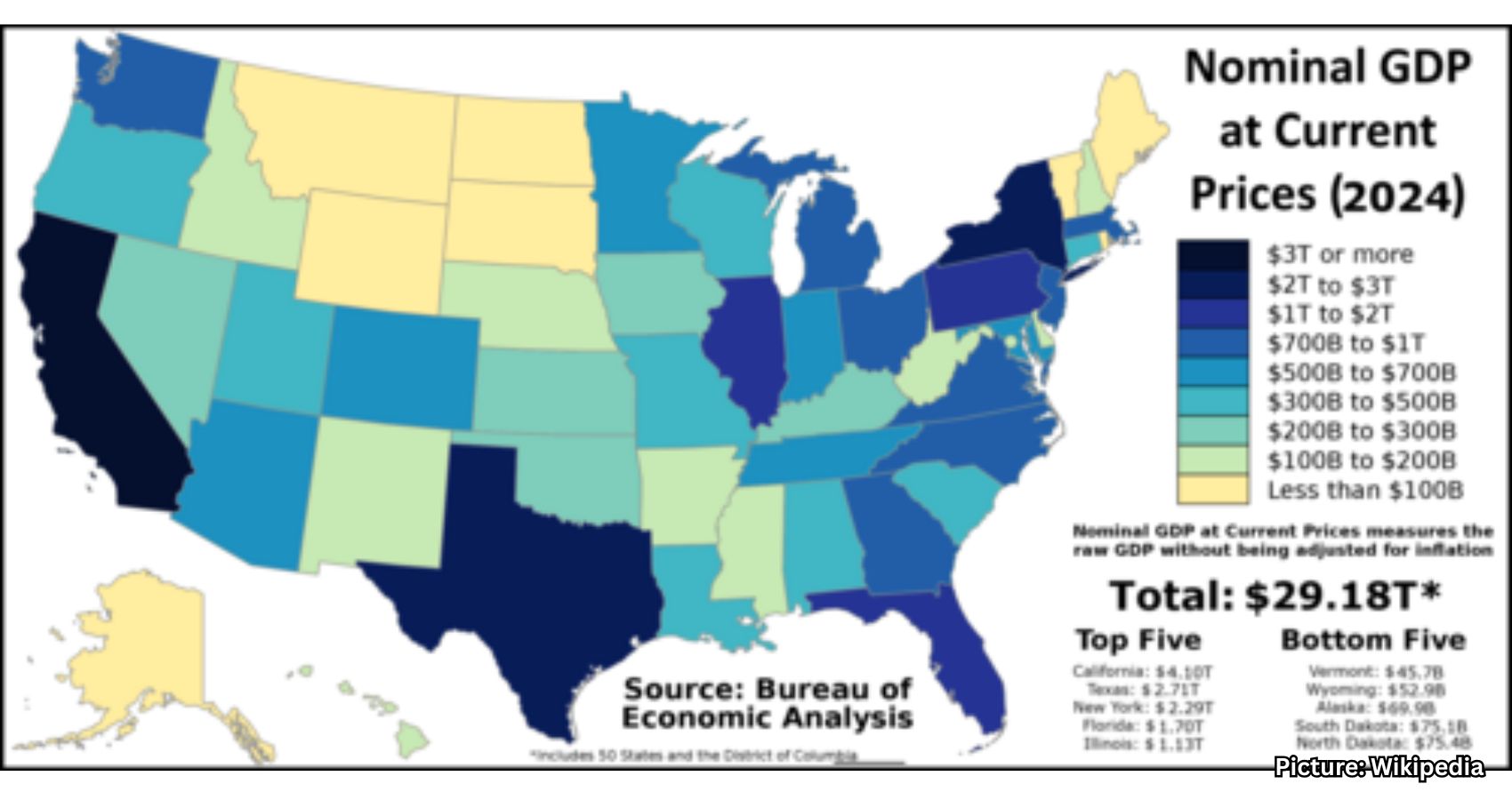

Utilities have raised concerns that many parts of the country lack the infrastructure to support this level of concentrated energy demand. Upgrading substations, transmission lines, and generation capacity incurs significant costs, which traditionally influence the rates paid by households and small businesses. This is where the ratepayer protection pledge comes into play.

Under this pledge, large technology companies would be responsible for covering the costs associated with their energy consumption. Proponents argue that this approach effectively separates residential energy costs from the expansion of AI. In essence, households should not see their utility bills increase simply because a new AI data center opens nearby.

Anthropic, a prominent AI company, has emerged as a key supporter of the pledge. A spokesperson from the company referred to a tweet by Sarah Heck, Anthropic’s Head of External Affairs, stating, “American families shouldn’t pick up the tab for AI. In support of the White House ratepayer protection pledge, Anthropic has committed to covering 100% of electricity price increases that consumers face from our data centers.” This commitment positions Anthropic as one of the first major AI firms to publicly declare its intention to absorb consumer electricity price increases linked to its operations.

Other major tech firms, including Microsoft, have also expressed support for the initiative. Brad Smith, Microsoft’s vice chair and president, stated, “The ratepayer protection pledge is an important step. We appreciate the administration’s work to ensure that data centers don’t contribute to higher electricity prices for consumers.” The White House reportedly plans to convene with Microsoft, Meta, and Anthropic in early March to discuss formalizing a broader agreement, although attendance and final terms have yet to be confirmed.

Industry groups have pointed to companies like Google and utilities such as Duke Energy and Georgia Power as making consumer-focused commitments related to data center growth. However, the enforcement mechanisms and long-term regulatory details surrounding the pledge remain unclear.

The infrastructure required for AI is already one of the most expensive technology buildouts in history, with companies investing billions in chips, servers, and real estate. If these firms are also required to finance dedicated power plants or pay premium rates for grid upgrades, the costs associated with running AI systems could escalate further. This situation may necessitate a shift in energy strategy, making it just as critical as computing strategy.

For consumers, this initiative signals that electricity is now a fundamental aspect of the AI conversation. AI is no longer solely about software; it also encompasses the infrastructure needed to support it. As AI becomes integrated into smartphones, search engines, office software, and home devices, the hidden infrastructure supporting these technologies continues to grow. Every AI-generated image, voice command, or cloud backup relies on a power-hungry network of servers.

By asking companies to take greater responsibility for their electricity consumption, policymakers are acknowledging a new reality: the digital world relies heavily on tangible resources. For consumers, this shift could lead to increased transparency regarding energy costs, while also raising important questions about sustainability, local impact, and long-term expenses.

For homeowners and renters, the pressing question remains: Will this initiative protect my electric bill? In theory, by separating the energy costs associated with data centers from residential rates, the risk of price spikes linked to AI growth could diminish. If companies fund their own power generation or grid upgrades, utilities may have less incentive to distribute those costs across all customers.

However, utility pricing is inherently complex, influenced by state regulators, long-term planning, and local energy markets. Even if individuals rarely use AI tools, their communities could still feel the impact of nearby data centers. The pledge aims to prevent the large-scale power demands of these facilities from affecting monthly utility bills.

The ratepayer protection pledge marks a significant turning point in the relationship between technology and energy consumption. As AI continues to evolve, it is crucial for tech companies to absorb the costs associated with their expanding power needs. If they succeed, households may avoid some of the financial burdens associated with rapid AI growth. Conversely, failure to do so could result in utility bills becoming an unexpected challenge in the AI era.

As AI tools increasingly become part of daily life, consumers must consider how much additional power they are willing to support to keep these technologies operational. For further insights, readers can visit CyberGuy.com.