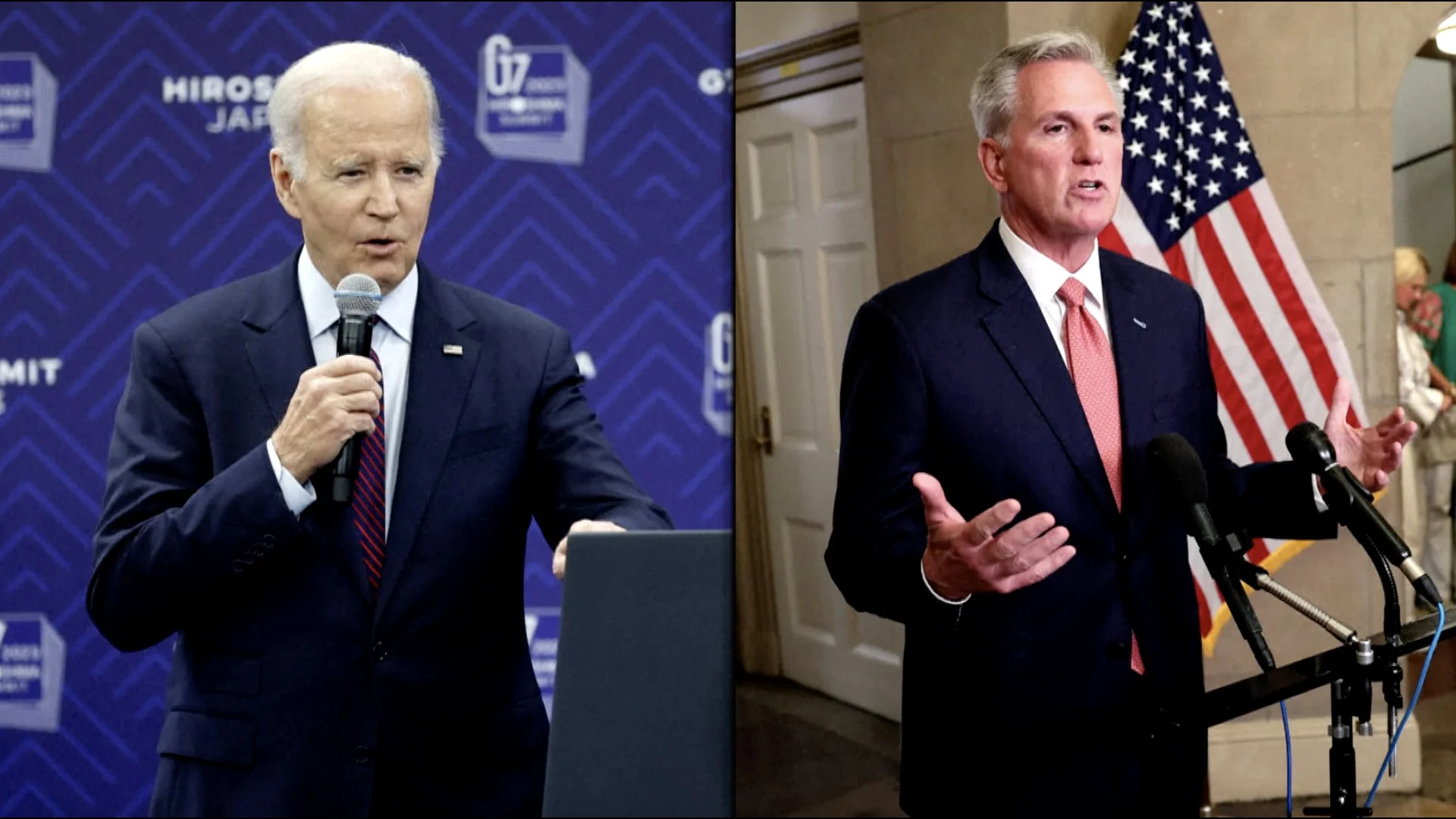

The US federal government is on the brink of being unable to make debt payments, and it’s up to Congress to vote on raising the nation’s borrowing cap, also known as the debt limit. However, House Speaker Kevin McCarthy (R-Calif.) and President Biden are currently at odds over Republican demands to link the debt limit to spending caps and other policy requirements. Treasury Secretary Janet Yellen has cautioned that the country could exhaust its borrowing authority by June 1, leaving little time for negotiators to reach a consensus.

In a recent meeting with McCarthy, House Democratic Leader Hakeem Jeffries (D-N.Y.), Senate Majority Leader Chuck Schumer (D-N.Y.), and Senate Minority Leader Mitch McConnell (R-Ky.), Biden aimed to find a way forward. Although they didn’t reach an agreement, staff-level discussions continue in an attempt to avert default.

Debt ceiling

You might have some questions about the debt ceiling and the ongoing debate. The debt ceiling, or debt limit, is a restriction on the amount of debt the federal government can accumulate. As Jason Furman, a former economic advisor to President Obama and current economics professor at Harvard, explains, “It used to be that every time you did a Treasury auction where you borrowed, Congress would pass a new law just for that one auction.” However, in 1917, during World War I, Congress opted for a more streamlined approach, allowing the government to borrow up to a specified amount before needing to request an increase. Since 1960, Congress has raised or suspended the debt limit 78 times, according to the Treasury Department.

How do experts know when the government has really run out of funds?

Experts determine when the government is nearing its funding limit by examining expected tax revenue, the timing of those payments arriving in Treasury accounts, and scheduled debt payments. This analysis helps establish a timeframe, referred to as an X-Date, when the debt authority might be depleted.

Nonetheless, the Treasury Department has several options, known as extraordinary measures, to prevent default. These measures involve reallocating investments and using accounting techniques to redistribute funds. The federal government technically reached the debt limit in January, but these extraordinary measures have maintained payment flows since then. While experts cannot pinpoint an exact date for when funds will be exhausted, they can estimate a general range, which currently falls between early June and potentially as late as July or August.

Why is there a fight over it?

Debt has generally been viewed unfavorably in American politics, and lawmakers often hesitate to be seen as endorsing more federal borrowing or spending. Additionally, they tend to attach unrelated priorities to must-pass legislation, making the debt limit a prime target for political disputes.

As Maya MacGuineas, president of the Committee for a Responsible Federal Budget, explains, “Everybody uses [bills to increase] the debt ceiling for their favorite policies.” The real issue arises when discussions about defaulting become more serious. Historically, votes to raise the debt limit were relatively uneventful; however, the situation changed in 2011 when the US came dangerously close to default.

Mark Zandi, an analyst at Moody’s Analytics, notes that while there have been previous political battles over the debt, none were as risky or significant as the 2011 conflict. At that time, Republican House Speaker John Boehner (R-Ohio) and President Obama were in a standoff over spending. Republicans demanded deep spending cuts and caps on future spending growth, while Obama insisted on raising the debt limit without any extraneous policies – a clean increase.

Ultimately, Congress reached an agreement to increase the debt limit along with caps on future spending, but not before Standard & Poor’s downgraded the nation’s debt for the first time in history. Today’s situation bears a striking resemblance to the 2011 political struggle, raising serious concerns about the possibility of a default.

What could happen if it’s not raised?

If the debt ceiling is not raised, the Treasury Department would be unable to fulfill its due payments, resulting in a default. This would occur regardless of the type or size of the missed payment.

Some Republicans have proposed a system called payment prioritization, in which certain debts are selected for repayment. However, this would require Congress to pass new legislation, which is politically improbable. Moreover, most experts believe that implementing such a system could be practically unfeasible, and it is not currently being considered as a serious solution.

Has the U.S. ever failed to make these debt payments?

No, the U.S. has never failed to make its debt payments. This reliability is a significant reason why the federal government can easily sell Treasury bonds to investors worldwide and why the U.S. dollar is one of the most trusted currencies.

As MacGuineas points out, “Treasuries are the debt vehicle that are most trusted in the entire world, even if there is an economic crisis that originated in the U.S., people come and buy treasuries because they trust them.” If that trust is jeopardized due to a default or missed interest payment, the U.S. would likely struggle to regain its previous status as the world’s most trusted debtor.

Would capping or cutting spending now resolve the problem?

No, capping or cutting spending now would not resolve the problem, as the debt limit pertains to money already spent due to laws previously passed by Congress. Furman emphasizes that “this borrowing isn’t some unilateral thing that President Biden wants to do… It is in order to accomplish what Congress told him to accomplish.”

Some of the current debt accumulation even results from laws enacted under former presidents, such as Donald Trump. Spending caps and other changes proposed by House Republicans are separate policies designed to address future debt accumulation rather than the immediate need to raise the debt limit.

What else could be affected by a default?

The possibility of a U.S. default may result in a domino effect of negative outcomes across the worldwide financial landscape. The nation’s credit rating could suffer long-term damage, diminishing the value of U.S. treasuries and making it a less attractive investment destination. MacGuineas expressed deep concern, stating, “I am truly concerned there is an actual chance of default and that is so dangerous and such a sign that the U.S. is not able to govern itself in a way that is functioning.”

Zandi cautioned that the fallout might extend beyond merely investment and borrowing rates. He advised, “Don’t worry about your stock portfolio, worry about your job,” emphasizing the potential loss of employment and increased unemployment rates. He added, “This will certainly push us and, you know, it’s going to be about layoffs. Stock portfolios will be the least of people’s worries.”

Furman compared the potential crisis to the 2008 financial meltdown caused by Lehman Brothers Bank’s collapse, suggesting it could be even more severe. “It could be worse than Lehman Brothers, where everyone basically demands their money back because they don’t believe the collateral anymore,” he explained. “And you have the equivalent of a run on the global financial system.”

Is default the same thing as a shutdown?

Default and shutdown are not the same thing. A government shutdown transpires when Congress does not pass annual spending bills before the fiscal year concludes on September 30. Although these two matters may be connected at times, this is because legislators have, on occasion, deliberately synchronized the debt limit extension with the end of the fiscal year to prompt more comprehensive spending debates in conjunction with debt authorization.

Are there other ways this problem could be fixed, aside from just increasing the debt limit?

Apart from merely raising the debt limit, there are alternative solutions to address the issue, as the existing process is widely considered ineffective. MacGuineas from the Committee for a Responsible Federal Budget believes that while Congress should reassess debt and spending priorities, the current debt limit mechanism fails to compel them to make decisions. She stated, “The debt ceiling is a terrible way to try to impose fiscal responsibility,” describing it as a “dumb approach.”

Instead, MacGuineas proposes a system where the debt limit is increased in line with the passage of legislation by Congress. Some economists have even suggested eliminating the debt limit entirely.

Other less conventional ideas involve minting a $1 trillion platinum coin to cover the debt or elevating the limit to such an extent that subsequent debates would be postponed for years or even decades.