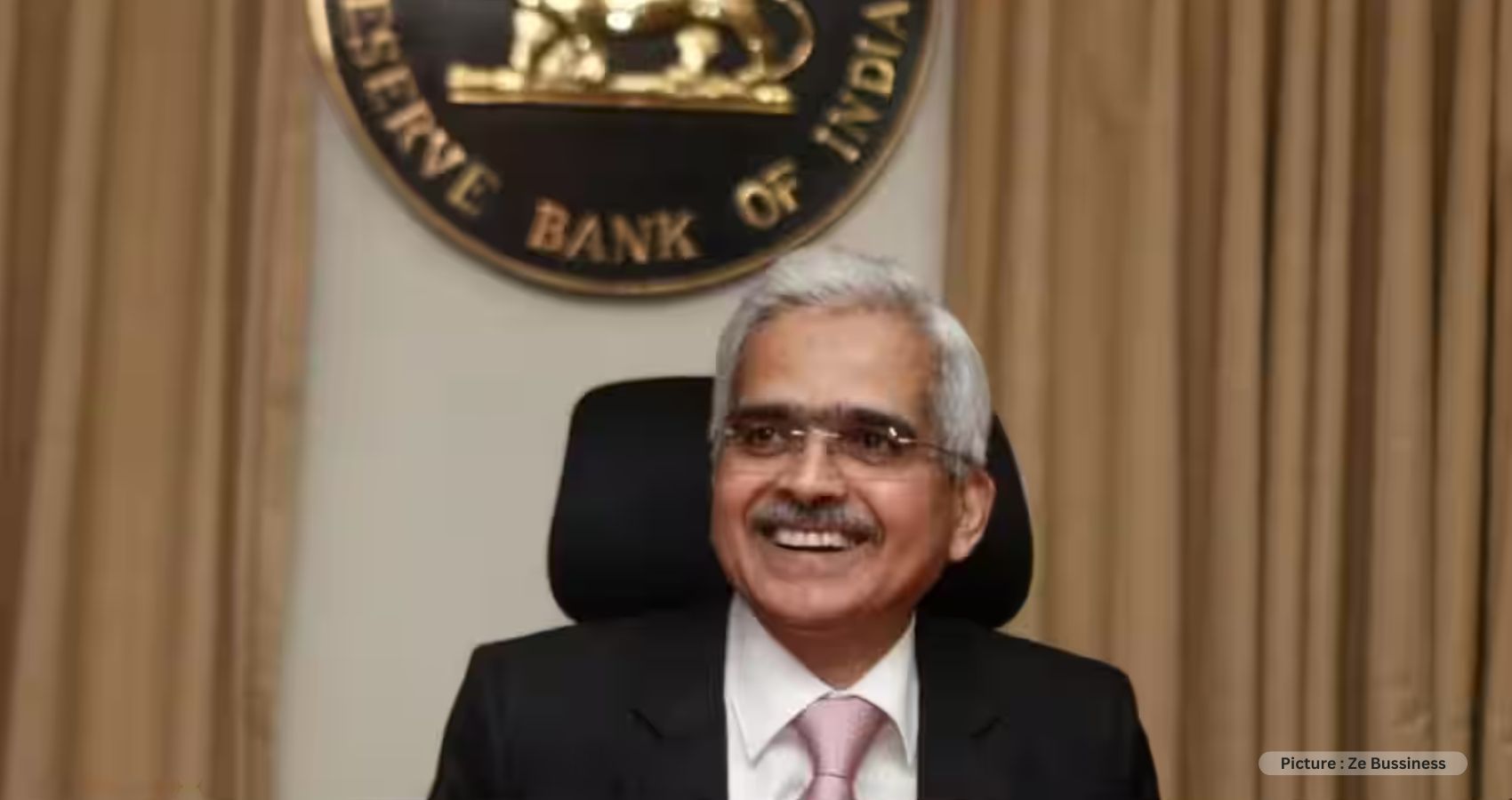

Shaktikanta Das, the Governor of the Reserve Bank of India (RBI), has achieved global recognition by securing the top spot in the prestigious Global Finance Central Banker Report Cards for 2023. In this authoritative ranking, he was bestowed with an ‘A+’ rating, placing him at the pinnacle of central bank governors worldwide. This distinguished evaluation was conducted by the esteemed US-based Global Finance Magazine.

Das has garnered accolades for his adept stewardship of the Indian economy, particularly during a turbulent period of global economic uncertainty. His remarkable achievements include maintaining a firm grip on inflation and providing crucial support for economic growth.

As of December 12, 2018, Shaktikanta Das assumed office as the 25th Governor of the RBI, succeeding Urjit Patel. His tenure is marked by a string of influential roles, including serving as the Secretary of the Department of Revenue and the Department of Economic Affairs within the finance ministry.

Prime Minister Narendra Modi expressed his heartfelt congratulations to Shaktikanta Das for attaining the coveted ‘A+’ rating in the Global Finance Central Banker Report Cards for 2023. He underscored the significance of this achievement, stating, “Congratulations to RBI Governor Shri Shaktikanta Das. This is a proud moment for India, reflecting our financial leadership on the global stage. His dedication and vision continue to strengthen our nation’s growth trajectory.”

In the Global Finance grading system, an ‘A’ signifies an exceptional performance, while an ‘F’ represents a clear failure. In this regard, Shaktikanta Das’s ‘A+’ rating underscores his outstanding contributions to the central banking sphere.

Trailing behind Das in the rankings are Switzerland’s Governor Thomas J. Jordan and Nguyen Thi Hong, the central bank chief of Vietnam, both of whom also received ‘A’ ratings.

The report emphasized the global reliance on central bankers in the fight against inflation, which has surged due to pent-up demand and disrupted supply chains. Central bankers are increasingly called upon to address these economic challenges.

Global Finance’s annual Central Banker Report Cards are a platform to honor bank governors whose innovative ideas, originality, ingenuity, and tenacity have set them apart from their peers.

Joining Shaktikanta Das in the ‘A’ grade category are notable central bank governors like Roberto Campos Neto of Brazil, Amir Yaron of Israel, Harvesh Kumar Seegolam of Mauritius, and Adrian Orr of New Zealand, all of whom have been recognized for their remarkable performance.

Additionally, several governors received an ‘A-‘ rating in the report, including Leonardo Villar of Colombia, Hector Valdez Albizu of the Dominican Republic, Asgeir Jonsson of Iceland, and Perry Warjiyo of Indonesia.

It’s worth noting that Global Finance has been evaluating central bank governors from 101 countries, territories, and districts, including prominent institutions such as the European Union, the Eastern Caribbean Central Bank, the Bank of Central African States, and the Central Bank of West African States since 1994.

Shaktikanta Das’s ascendancy to the top of the Global Finance Central Banker Report Cards for 2023 is not an isolated recognition of his excellence. In June of the same year, he was honored with the title of ‘Governor of the Year’ at the Central Banking Awards 2023 held in London. This further underscores his exceptional contributions to the field of central banking.

Shaktikanta Das has emerged as the preeminent central banker globally, earning an ‘A+’ rating in the esteemed Global Finance Central Banker Report Cards for 2023. His adept management of India’s economy, particularly during times of global economic uncertainty, has earned him widespread acclaim. This recognition not only reflects his dedication and vision but also positions India as a leader on the international financial stage. Additionally, his ‘Governor of the Year’ accolade at the Central Banking Awards 2023 in London underscores the enduring impact of his contributions to central banking.