As the Supreme Court prepares to rule on Trump’s tariff authority, the White House is set to announce the next Federal Reserve chair, both decisions poised to significantly impact the U.S. economy.

Two pivotal economic policy decisions are approaching in Washington: a Supreme Court ruling regarding tariffs and the anticipated announcement of the next Federal Reserve chair. Both developments carry substantial implications for trade, financial markets, and the future of U.S. monetary policy.

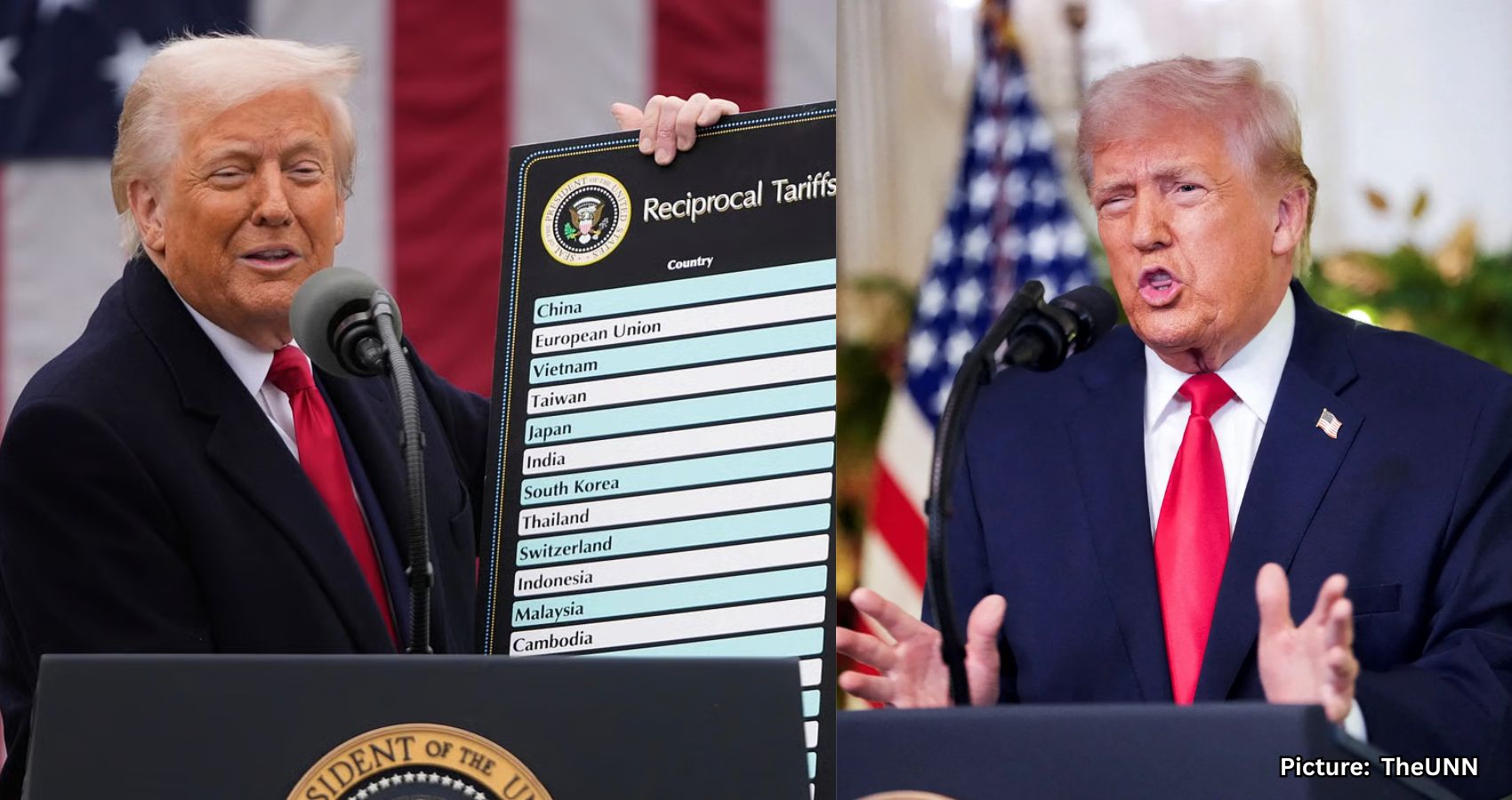

At the Supreme Court, two cases have emerged that President Donald Trump has described as “life or death” for the country. These cases compel the nation’s highest court to examine the extent of presidential power in reshaping U.S. trade policy. The lawsuits—Learning Resources Inc. v. Trump and Trump v. V.O.S. Selections Inc.—were filed by an educational toy manufacturer and a family-owned wine and spirits importer, both challenging Trump’s tariffs.

Central to both cases is a critical question: does the International Emergency Economic Powers Act (IEEPA) grant the president the authority to impose tariffs, or does such action overstep constitutional boundaries?

Tariffs are taxes imposed by the government on imported goods. While companies pay these taxes at the border, they often pass the additional costs onto consumers, meaning that the public ultimately bears much of the financial burden. Since Trump announced sweeping “Liberation Day” tariffs in April, total duty revenue has surged to $215.2 billion for fiscal year 2025, which concluded on September 30, according to the Treasury Department’s Customs and Certain Excise Taxes report. This revenue trend has continued into the new fiscal year, with the government collecting $96.5 billion in duties since October 1, as per the latest statement from the Treasury.

In the meantime, two candidates are competing for the influential role of Federal Reserve chair: Kevin Hassett and Kevin Warsh. The appointment to lead the world’s most powerful central bank comes at a time when persistently high living costs are testing Trump’s economic agenda. The Federal Reserve, responsible for setting borrowing costs and influencing inflation, plays a crucial role in Americans’ daily financial realities.

The next Fed chair will oversee significant interest-rate decisions and efforts to manage inflation, making the position one of the most consequential in U.S. economic policymaking.

Warsh, a former Morgan Stanley banker, has positioned himself as a vocal critic of the current Fed leadership, intensifying his critiques as he seeks to replace Chair Jerome Powell. He previously made history as the youngest person to serve on the Federal Reserve Board of Governors in 2006.

Hassett, on the other hand, is Trump’s chief economic adviser and a staunch supporter of the administration’s policies. He currently directs the White House’s National Economic Council and has held two senior roles during Trump’s first term, advising the president on economic policy throughout the 2024 campaign.

Treasury Secretary Scott Bessent, who has been instrumental in shaping Trump’s shortlist for the Fed’s top position, has known both Warsh and Hassett for over 20 years and considers them equally qualified for the role.

Trump has advocated for significant rate cuts, urging the Federal Reserve to reduce its benchmark interest rate to 1% to stimulate economic growth. His criticism of Federal Reserve Chairman Jerome Powell, whom he appointed in 2017, has at times taken on a personal tone, with Trump assigning the Fed chair various mocking nicknames.

Powell is expected to complete his term in May 2026, at which point the next chair will assume leadership of the Federal Reserve.

These developments underscore the ongoing tension between trade policy and monetary policy, as both the Supreme Court and the White House prepare to make decisions that could reshape the economic landscape in the United States.

As the nation awaits these crucial rulings and appointments, the implications for American consumers and the broader economy remain significant, with many looking to see how these changes will affect their financial futures.

According to Fox News, the outcomes of these cases and appointments will be closely monitored as they unfold.