The S&P 500, a renowned benchmark index in the U.S. stock market, hosts some of the world’s most valuable companies. Naturally, the CEOs of these firms command substantial compensation packages. But what exactly do these packages consist of? And do these CEOs consistently receive the compensation they are promised, or does it fluctuate with the stock market’s ups and downs?

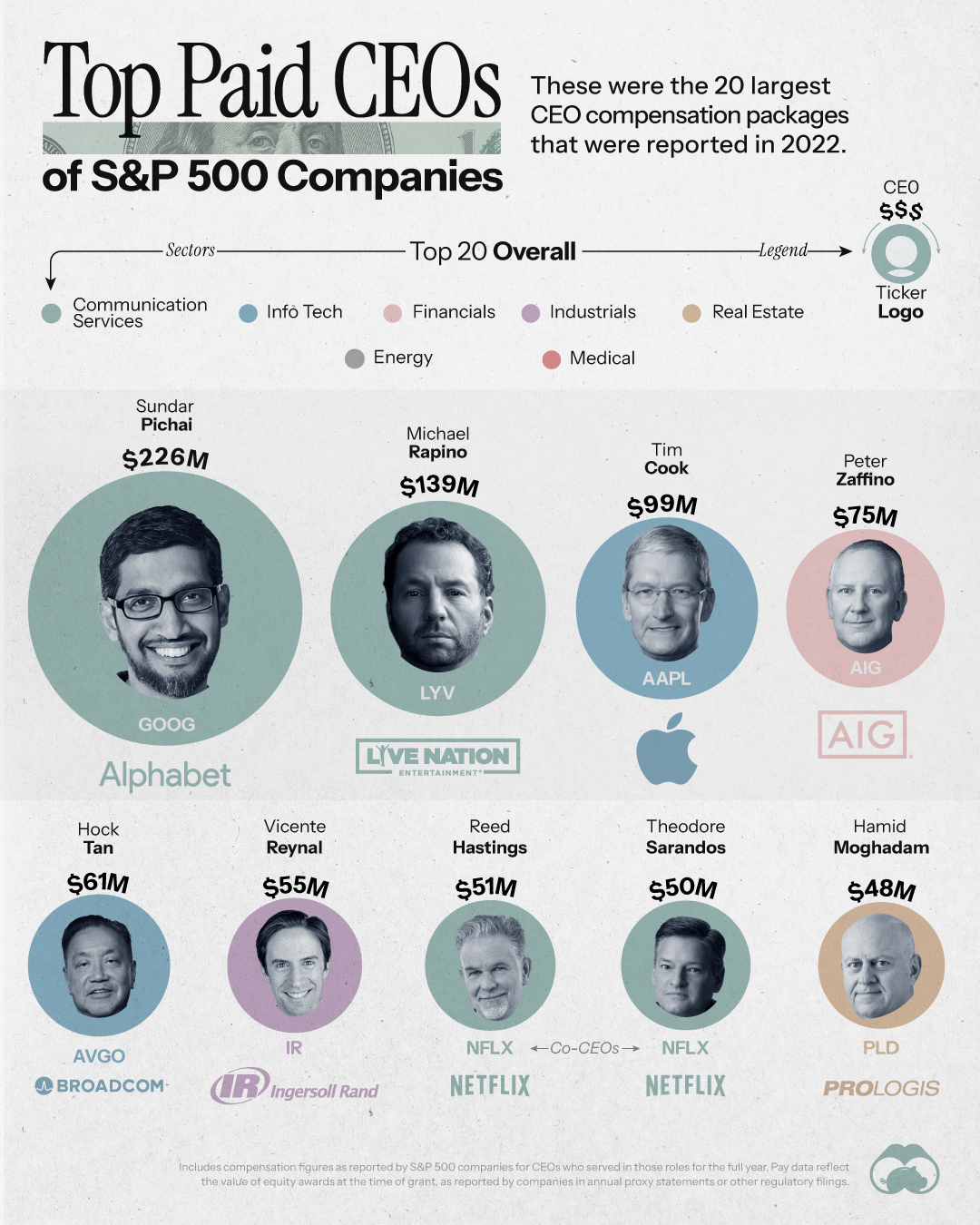

Today, we present an infographic based on data sourced from The Wall Street Journal. It highlights the top-earning CEOs of S&P 500 companies in 2022 and delves into the components of their compensation.

The 20 CEOs with the Highest Compensation

The compensation packages for CEOs of S&P 500 companies encompass more than just base salaries. They typically include bonuses, stock awards, and various incentives. Let’s take a look at the highest-paid CEOs of S&P 500 companies in 2022, along with the sectors they represent.

- Sundar Pichai, CEO of Alphabet (Google’s parent company), led the pack with an impressive compensation package valued at approximately $226 million. This staggering sum exceeded Google’s median employee compensation by over 800 times. Pichai’s package comprised an annual salary of $2 million, a $6 million security allowance, and stock awards valued at $218 million.

- Michael Rapino, CEO of Live Nation Entertainment, saw his awarded pay package soar to $139 million in 2022, up from nearly $14 million the previous year. This substantial increase included stock awards initially valued at $116 million.

- Tech giants Apple and Broadcom also featured prominently. Tim Cook, Apple’s CEO, received a compensation package worth $99 million in 2022, while Hock Tan, President and CEO of Broadcom, was awarded $61 million.

Other notable CEOs on the list included Peter Zaffino of global insurance giant AIG and Netflix’s co-CEOs, Ted Sarandos and Reed Hastings. Hastings experienced a $10 million increase in his compensation in the preceding year but stepped down from his role in January 2023.

A Halt in the Rise of Median CEO Income

Over the past decade, the median pay for CEOs across S&P 500 companies has doubled. In 2021, this figure reached a peak of $14.7 million. However, in 2022, the median CEO compensation package plateaued for the first time in ten years, dipping slightly to $14.5 million.

Compensation That Reflects Market Performance

Compensation packages linked to market valuations mean that these CEOs may receive more or less than their designated pay. This discrepancy arises because most stock awards are not immediately granted upon announcement; rather, they vest over time, making them susceptible to fluctuations in share prices.

In 2022, the Securities and Exchange Commission (SEC) introduced new disclosure regulations, requiring companies to report the realized value of executive pay packages, aptly named “compensation actually paid.” According to The Wall Street Journal’s report, many of the highest-paid S&P 500 CEOs in 2022 received considerably smaller pay packages due to market swings.

For instance, Sundar Pichai ultimately received approximately $116 million as the value of Alphabet’s stock decreased when his grants vested. Similarly, Michael Rapino received nearly $36 million, even though his stock awards will continue vesting over the next five years.

It’s worth noting that, in 2022, several CEOs of energy companies, including Exxon Mobil and Chevron, outshone many of the top-paid S&P 500 CEOs. This was largely due to the surge in their companies’ stock prices during that year.

Conclusion

The compensation of CEOs at S&P 500 companies is a subject of great interest and scrutiny. While these executives command significant pay packages, the actual amounts they receive can fluctuate substantially based on market conditions. The introduction of new disclosure rules by the SEC sheds light on the realized value of executive pay, highlighting the impact of market dynamics on CEO compensation. As we move forward, it will be interesting to see how these trends evolve and whether CEOs’ earnings continue to mirror the performance of their companies’ stock.