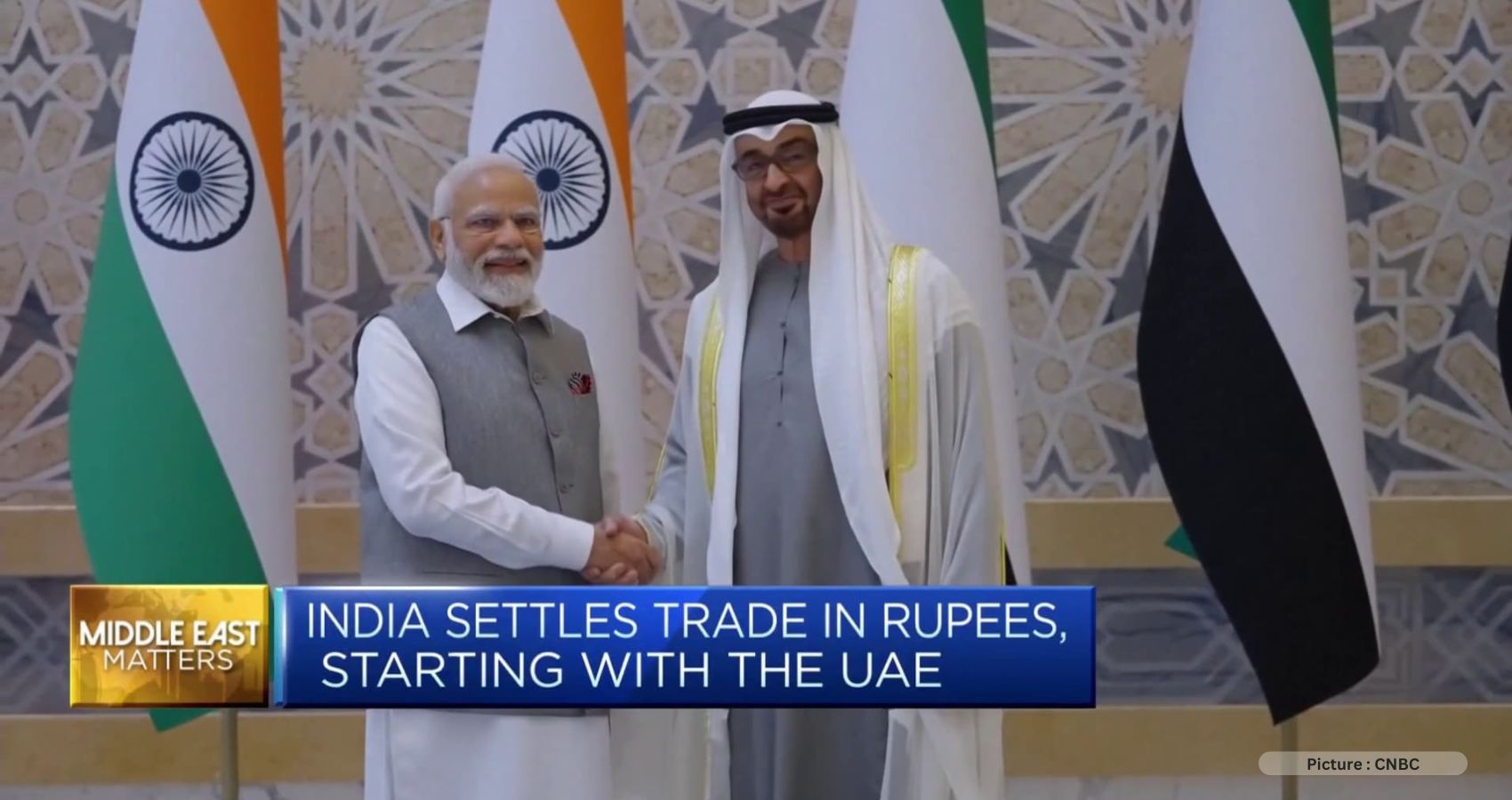

In a significant move, India and the United Arab Emirates (UAE) have officially commenced trading in their respective local currencies, marking a departure from the traditional reliance on the U.S. dollar for international transactions.

The Indian government made an announcement on Monday, revealing that Indian Oil Corp., a major petroleum refiner in the country, had used the Indian rupee to purchase one million barrels of oil from the Abu Dhabi National Oil Company, instead of using the U.S. dollar as the standard transaction currency. This landmark transaction underscores the growing trend towards local currency trade arrangements.

This development follows another noteworthy transaction involving the sale of 25 kilograms of gold from a UAE-based gold exporter to an Indian buyer for approximately 128.4 million rupees (equivalent to $1.54 million), as reported by Reuters. These two transactions serve as prime examples of the increasing shift towards conducting trade using local currencies.

The implications of this trend for the role of the U.S. dollar on the global stage are worth exploring. As these nations forge ahead with local currency trade agreements, questions arise about the potential impact on the U.S. dollar’s status as the dominant international currency.

India’s central bank laid the groundwork for this shift by introducing a new framework aimed at settling global trade using the rupee. This framework materialized last month when India, a significant oil importer and consumer on the global stage, entered into two agreements with the UAE. The primary objective of these agreements is to streamline cross-border transactions and payments by conducting trade in their respective local currencies. This move is anticipated to reduce transaction costs and eliminate the need for dollar conversions. In addition to local currency trade, both countries have also committed to establishing a real-time payment link, further simplifying cross-border money transfers. The Reserve Bank of India elucidated that these agreements will facilitate “seamless cross-border transactions and payments, and foster greater economic cooperation.”

While India and the UAE are at the forefront of this local currency trade trend, they are not alone in their efforts to reduce reliance on the U.S. dollar. Several influential countries worldwide, including China and Russia, have been exploring avenues to diminish the dollar’s prominence due to concerns over aggressive U.S. sanctions and foreign policy maneuvers. This global trend, often referred to as “de-dollarization,” has gained momentum, raising discussions about the future dominance of the U.S. dollar in international trade.

Janet Yellen, the Treasury Secretary, sought to address these concerns by emphasizing that no currency currently possesses the capacity to replace the U.S. dollar. Yellen’s assertion followed an 8% decrease in the dollar’s share of global reserves in the previous year. In response to this trend, central banks around the world have been diversifying their reserves, transitioning away from the dollar and towards other assets such as gold.

India and the UAE have embarked on a path of local currency trade, signaling a shift away from the traditional reliance on the U.S. dollar in international transactions. This move, driven by the desire to streamline cross-border trade and payments, highlights a broader trend of “de-dollarization” observed in various countries, including China and Russia. While these developments raise questions about the future status of the U.S. dollar, experts, including Janet Yellen, maintain that no currency currently possesses the necessary attributes to fully replace the greenback. As central banks diversify their reserves in response to this evolving landscape, the dynamics of global trade and finance continue to undergo transformation.