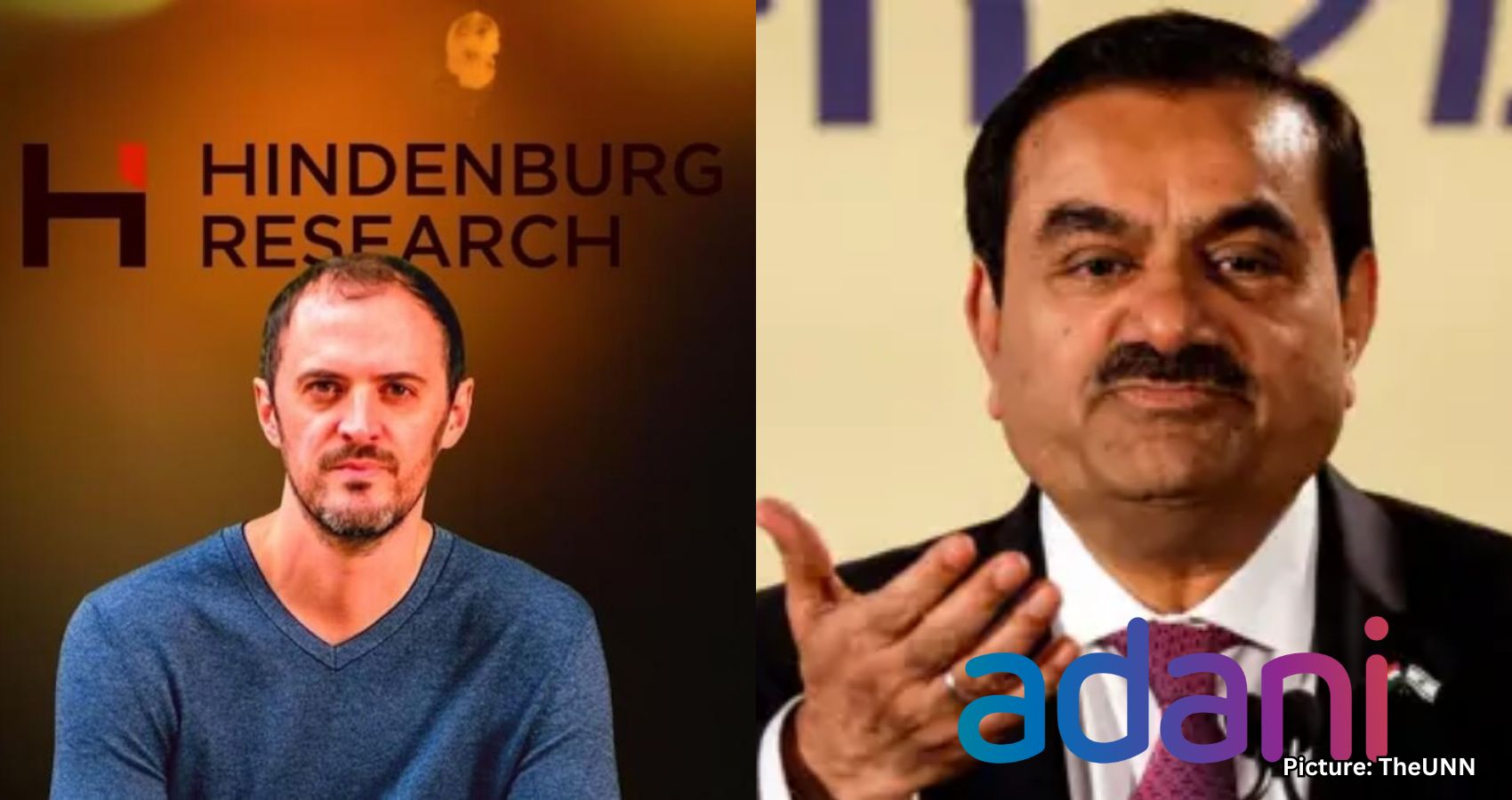

Adani Group Chairman Gautam Adani celebrates the Securities and Exchange Board of India’s dismissal of Hindenburg Research’s allegations, asserting that the truth has prevailed and reaffirming the company’s commitment to transparency and resilience.

Gautam Adani, Chairman of the Adani Group, expressed his satisfaction with the Securities and Exchange Board of India (SEBI) for rejecting significant claims made by the short-seller Hindenburg Research. In a letter to shareholders, Adani characterized the regulator’s decision as a powerful affirmation of the company’s governance standards and declared that “truth has prevailed.”

The SEBI’s ruling marks the conclusion of a tumultuous chapter that began over two years ago when Hindenburg Research published a report that wiped out $150 billion in market value for the conglomerate and subjected it to intense scrutiny. Adani emphasized that the outcome highlights the resilience of the group, which has been tested on “every dimension.”

Reflecting on the January 2023 report from Hindenburg Research, Adani described it as a moment that shook India’s financial markets. He noted that the allegations were not only an attack on his conglomerate but also “a direct challenge to the audacity of Indian enterprises to dream on a global scale.” Just last week, SEBI dismissed the market manipulation charges that Hindenburg had leveled against the Adani Group.

According to SEBI, the claims of fraud related to alleged related-party dealings within the Adani Group were “not established.” The regulator found no evidence of violations by the Adani Group, which operates across various sectors including ports, coal, renewable energy, media, and airports.

Adani remarked, “What was meant to weaken us has instead strengthened the very core of our foundations.” He emphasized that this moment represents more than just regulatory clearance; it serves as a validation of the transparency, governance, and purpose with which the company has always operated.

While the group’s market value has not yet returned to pre-Hindenburg levels, Adani noted that its operations have significantly strengthened. Over the past two years, the portfolio EBITDA surged by 57% to ₹89,806 crore (approximately $10.8 billion), alongside a 48% increase in gross block assets, which now stand at ₹6.1 lakh crore.

Adani highlighted several key infrastructure achievements during this period, including the launch of India’s first container transshipment port at Vizhinjam in Kerala, the addition of 6 GW of renewable energy capacity through the Khavda project—recognized as the world’s largest single-site renewable installation—and the commencement of operations at the world’s largest copper smelter and metallurgical complex. Additionally, the group rolled out 4 GW of new thermal power capacity and established 7,000 circuit kilometers of transmission lines across India and abroad.

Looking ahead, Adani outlined the group’s priorities, which include enhancing governance, driving innovation, and expanding infrastructure investments. “We will double down on nation building,” he stated, acknowledging the stress experienced by investors, lenders, and partners during the recent crisis. He promised to enhance governance, accelerate innovation and sustainability efforts, and increase investments in the country’s infrastructure.

In closing, Adani urged a recommitment to the company’s core principles: resilience in adversity, integrity in action, and an unwavering commitment to building a brighter future for India and the world. He concluded his letter with lines from poet Sohan Lal Dwivedi, likening the group’s journey to a boat navigating turbulent waters: “The boat that fears the waves can never reach the shore, But those who keep on trying will win forevermore…”

Source: Original article